April 2025

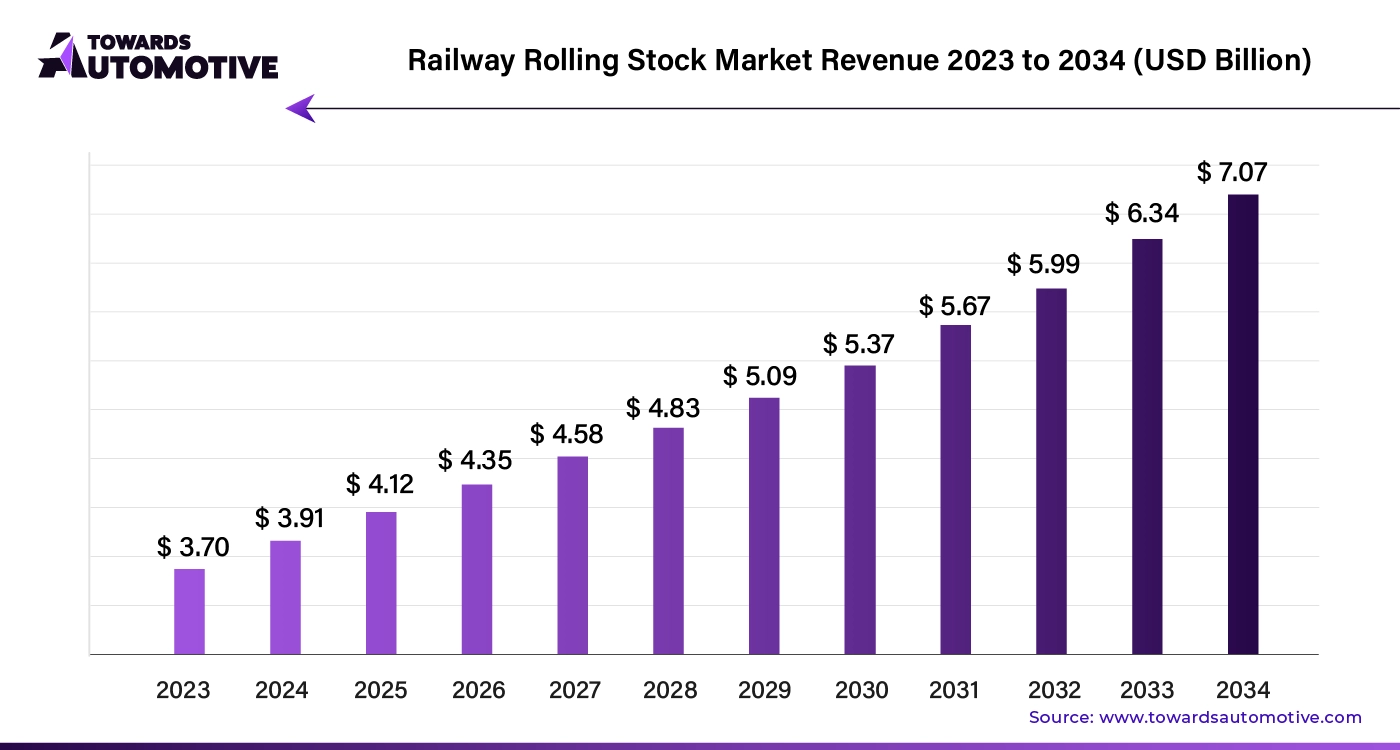

The global railway rolling stock market size is calculated at USD 3.91 billion in 2024 and is expected to be worth USD 7.07 billion by 2034, expanding at a CAGR of 5.64% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The railway rolling stock market presents several lucrative investment opportunities driven by technological advancements and evolving consumer demands. Key developments in energy-efficient rolling stock include the use of electric locomotives equipped with regenerative braking systems, computer vision technologies, and artificial intelligence. These innovations not only enhance efficiency but also improve safety, creating opportunities for market players to invest in and capitalize on these advanced technologies.

The trend towards enhancing railway transportation safety further supports investment in the sector. Many metropolitan areas have established extensive metro and subway networks that operate on a daily schedule, emphasizing the importance of well-maintained and modernized rolling stock. Investing in the development and upkeep of these systems can be highly beneficial, given their crucial role in daily commuting. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Another emerging trend is the growing demand for autonomous trains. The self-driving capabilities of these locomotives represent a novel shift in transportation technology. As the industry progresses, diversifying product portfolios to include autonomous rolling stock could provide a significant competitive edge.

The consumption of railway rolling stock is closely tied to infrastructure investments aimed at modernizing the rail network. Upgrades include installing more robust brake systems, enhancing passenger comfort, and adopting new locomotives, coaches, and wagons. These investments are crucial for supporting the increasing demand for high-capacity transportation solutions by both public and private sectors.

The market growth is also driven by the need for real-time condition-based maintenance of rolling stock and infrastructure. This necessity arises from the high costs associated with railway transportation, which makes ongoing maintenance and upgrades essential for ensuring operational efficiency.

Growing Adoption of Metro and Subway Trains

The expansion of metro and subway networks is significantly boosting the demand for railway rolling stocks. Modern metro systems are increasingly incorporating high-end railcars and specialized rolling stocks designed for efficiency and safety. Innovations such as regenerative braking technology are being adopted to enhance passenger safety and operational efficiency. This trend creates opportunities for start-ups to develop cutting-edge technologies tailored to the needs of metro and subway systems.

Rise of Autonomous Trains

Autonomous trains are reshaping the railway rolling stock market with their potential for rapid transportation, increased passenger safety, and punctual scheduling. Governments and private companies are investing in infrastructure to support autonomous trains, including dedicated tracks and advanced control systems. These developments promise to improve transportation efficiency and accelerate the adoption of autonomous technology in the railway sector.

Tourism Boosts Demand for Railway Rolling Stocks

The tourism industry is increasingly leveraging railway travel to connect major tourist destinations. Train tourism offers a unique way for travelers to visit significant sites while enjoying the convenience, safety, and scenic views that trains provide. This growing interest in train travel is driving demand for various types of railway rolling stocks, as operators seek to enhance the passenger experience and accommodate the influx of tourists.

AI integration is set to revolutionize the Railway Rolling Stock market by driving growth and enhancing operational efficiency. AI technologies, including machine learning and predictive analytics, will optimize train performance, reduce maintenance costs, and improve safety. By analyzing vast amounts of data from sensors embedded in rolling stock, AI can predict potential failures before they occur, allowing for proactive maintenance and minimizing unexpected breakdowns. This not only extends the lifespan of the rolling stock but also ensures smoother and more reliable operations.

AI-powered systems will also enhance the efficiency of train schedules and routes. By processing real-time data, AI can optimize scheduling, reduce delays, and improve overall service quality. Furthermore, AI algorithms will contribute to the development of advanced autonomous trains, which will further streamline operations and reduce the need for human intervention.

As the railway industry embraces these technological advancements, the market for rolling stock will experience significant growth. AI’s ability to provide actionable insights and automation solutions will drive innovation, attract investment, and pave the way for a more efficient and modernized railway system.

In the Railway Rolling Stock market, an efficient supply chain is crucial for delivering high-quality rolling stock components and systems. The supply chain begins with suppliers who provide raw materials and parts, such as wheels, axles, and braking systems. These components are then transported to manufacturing plants where they are assembled into complete rolling stock units, including locomotives, passenger cars, and freight wagons.

Manufacturers collaborate closely with suppliers to ensure timely delivery of parts and adherence to quality standards. They employ advanced logistics and inventory management systems to optimize stock levels and reduce lead times. Once the rolling stock is manufactured, it is transported to railway operators or end-users, who then integrate it into their fleets.

Throughout the supply chain, communication and coordination between suppliers, manufacturers, and operators are essential. Implementing real-time tracking systems and predictive maintenance technologies helps anticipate and address potential disruptions, ensuring the smooth operation of the supply chain. By leveraging data analytics and automation, stakeholders can enhance efficiency, minimize delays, and improve overall performance in the railway rolling stock market.

The railway rolling stock market is a complex ecosystem supported by several key components and companies. At its core, the market comprises locomotives, passenger coaches, freight wagons, and specialized rail vehicles. These components are essential for ensuring efficient rail transportation.

Companies like Siemens and Bombardier lead in manufacturing advanced locomotives and passenger coaches, integrating cutting-edge technologies for improved performance and energy efficiency. Alstom contributes with innovative rail solutions, focusing on eco-friendly trains and digital signaling systems. Hitachi, known for its high-speed trains, emphasizes safety and comfort in passenger coaches.

In the freight segment, companies like GE Transportation and CRRC Corporation produce robust freight wagons and specialized railcars, enhancing cargo efficiency and safety. Manufacturers like Stadler prioritize modular design, allowing for customized solutions across different rail applications.

Moreover, firms such as Knorr-Bremse and Wabtec provide essential braking systems and control technologies, ensuring operational reliability and safety. Maintenance and service providers like Faiveley Transport support the longevity and performance of rolling stock through ongoing support and upgrades. Collectively, these companies drive innovation and efficiency in the railway rolling stock market, shaping its future.

The railway rolling stock market is showcasing significant trends in wheel types and train categories. Currently, monoblock wheels and freight trains are driving substantial market growth.

Monoblock Wheels: Dominating with 42.8% Market Share

Monoblock wheels are a leading force in the railway rolling stock market, capturing a notable 42.8% share in 2024. Here’s why:

Freight Trains: Holding 62.5% Market Share

Freight trains are a dominant segment in the railway rolling stock market, holding a 62.5% share in 2024. Their prominence can be attributed to several key factors:

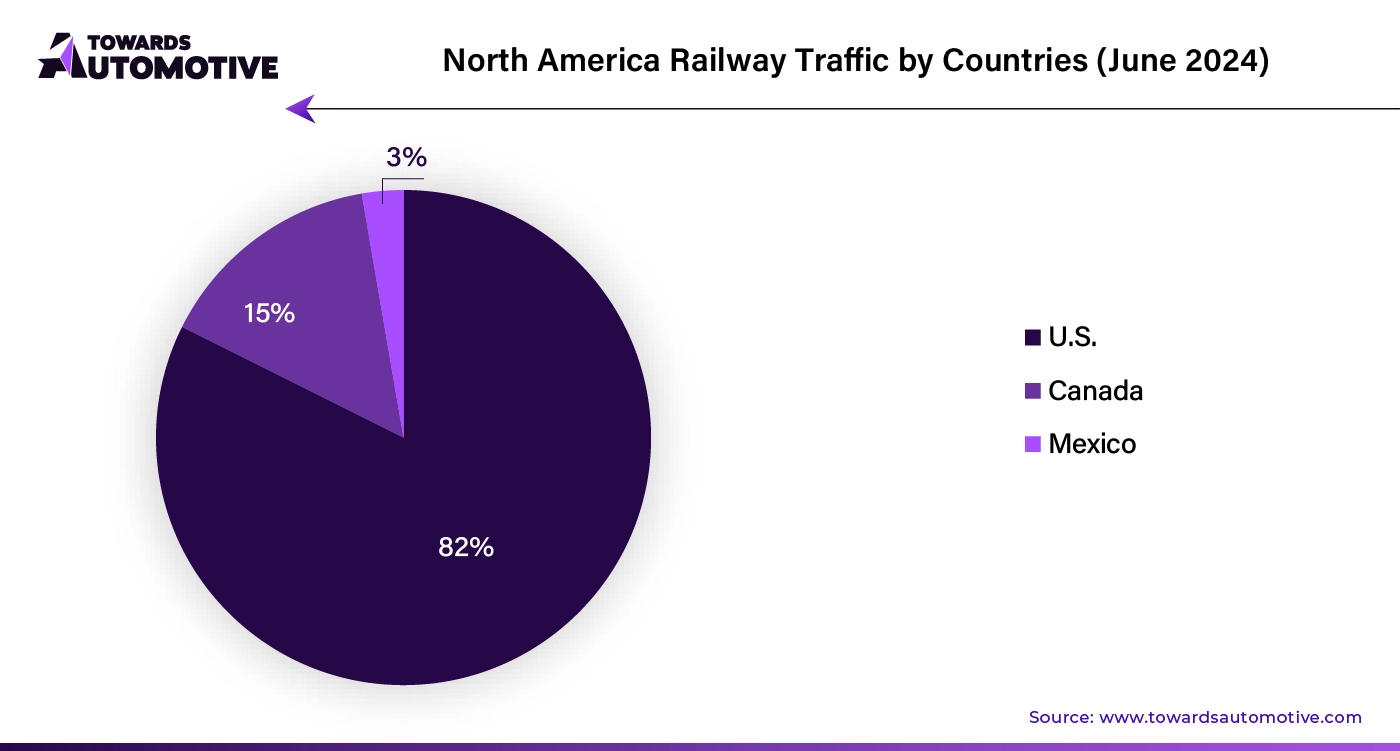

The railway rolling stock industry is experiencing diverse growth patterns across various countries. Looking ahead to the next decade, significant trends and factors are shaping the industry's development in key regions.

United States: Steady Growth with Increasing Demand

In the United States, the railway rolling stock market is projected to grow at a compound annual growth rate (CAGR) of 5.3% from 2024 to 2034. Several factors contribute to this steady growth:

Germany: Strong Growth Driven by Advanced Infrastructure

Germany's railway rolling stock market is set to expand at a CAGR of 6.6% over the next decade. Key factors fueling this growth include:

China: Technological Advancements and Bullet Trains

China’s railway rolling stock market is expected to grow at a CAGR of 4.9% from 2024 to 2034. The primary drivers of this growth are:

Japan: High-Speed and Efficient Rail Transportation

Japan’s railway rolling stock market is forecasted to grow at a CAGR of 6.6% over the next decade. Contributing factors include:

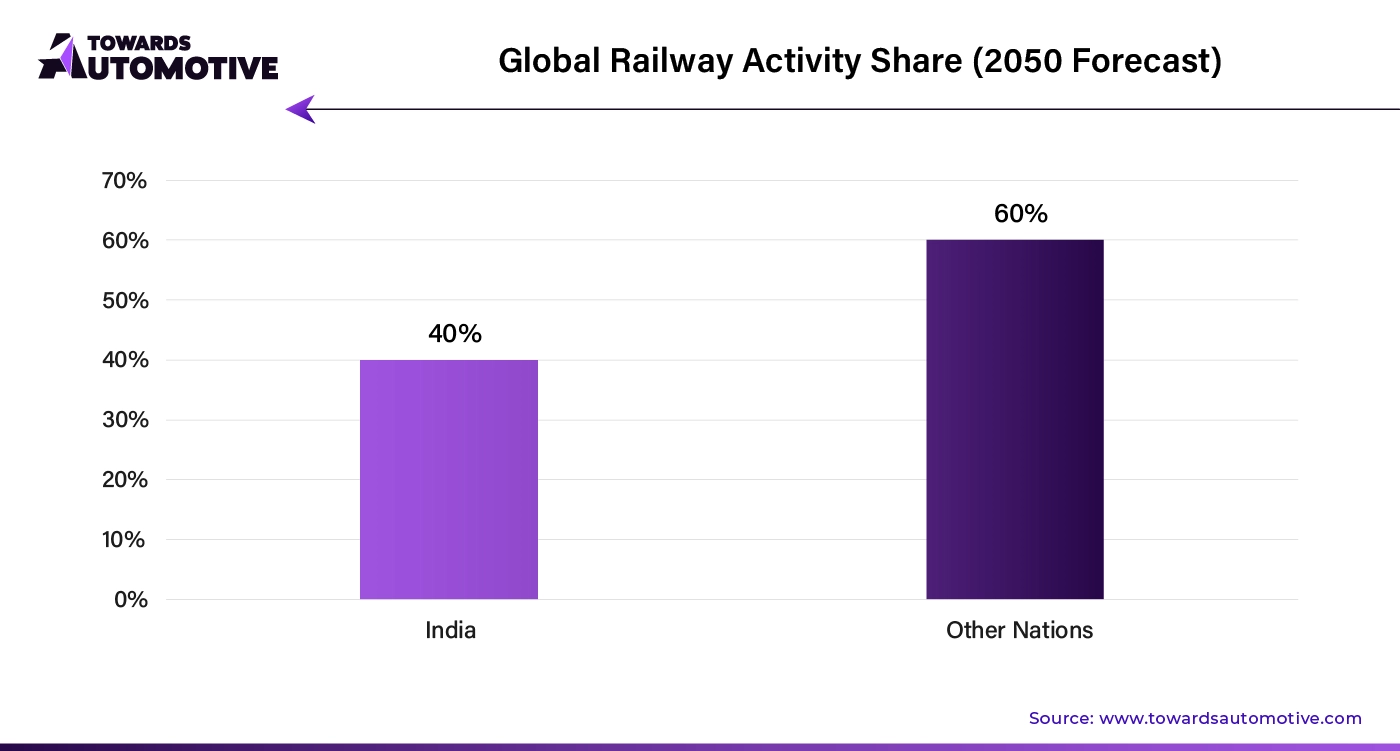

India: Expanding Network and Tourism Boost

In India, the railway rolling stock industry is anticipated to grow at a CAGR of 5.8% by 2034. Several factors contributing to this growth include:

As the global railway rolling stock market evolves, the unique trends and developments in each region shape the industry's future, presenting opportunities and challenges for market players worldwide.

The global railway rolling stock market is undergoing significant transformation, driven by a mix of strategic maneuvers and technological advancements from key players in the industry. Companies within this sector are expected to focus on several pivotal strategies to bolster their market positions and foster growth over the coming decade.

To enhance their market presence, railway companies are increasingly forming strategic alliances with prominent industry entities. These partnerships allow firms to pool resources, share expertise, and leverage combined knowledge to achieve mutual success. Collaborations are seen as essential for expanding trade networks and optimizing operations.

In a bid to gain a competitive edge, market players are prioritizing the development and launch of new, advanced products and services. This includes introducing cutting-edge rolling stock that emphasizes safety, efficiency, and comfort. Innovations such as advanced AI and IoT technologies are being integrated into rolling stock to reduce operational costs and elevate the travel experience for passengers.

Railway manufacturers are keen on advancing their technologies to enhance the performance of rolling stock. The incorporation of AI and IoT is expected to play a crucial role in driving efficiency and safety improvements. These technological enhancements are anticipated to meet the growing demand for more sophisticated and reliable railway systems.

These developments reflect a dynamic and rapidly evolving railway rolling stock market, characterized by innovation, strategic collaborations, and a focus on advancing technology to meet future demands.

By Wheel Type

By Axle Type

By Train Type

By Sales Channel

By Region

April 2025

March 2025

February 2025

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us