April 2025

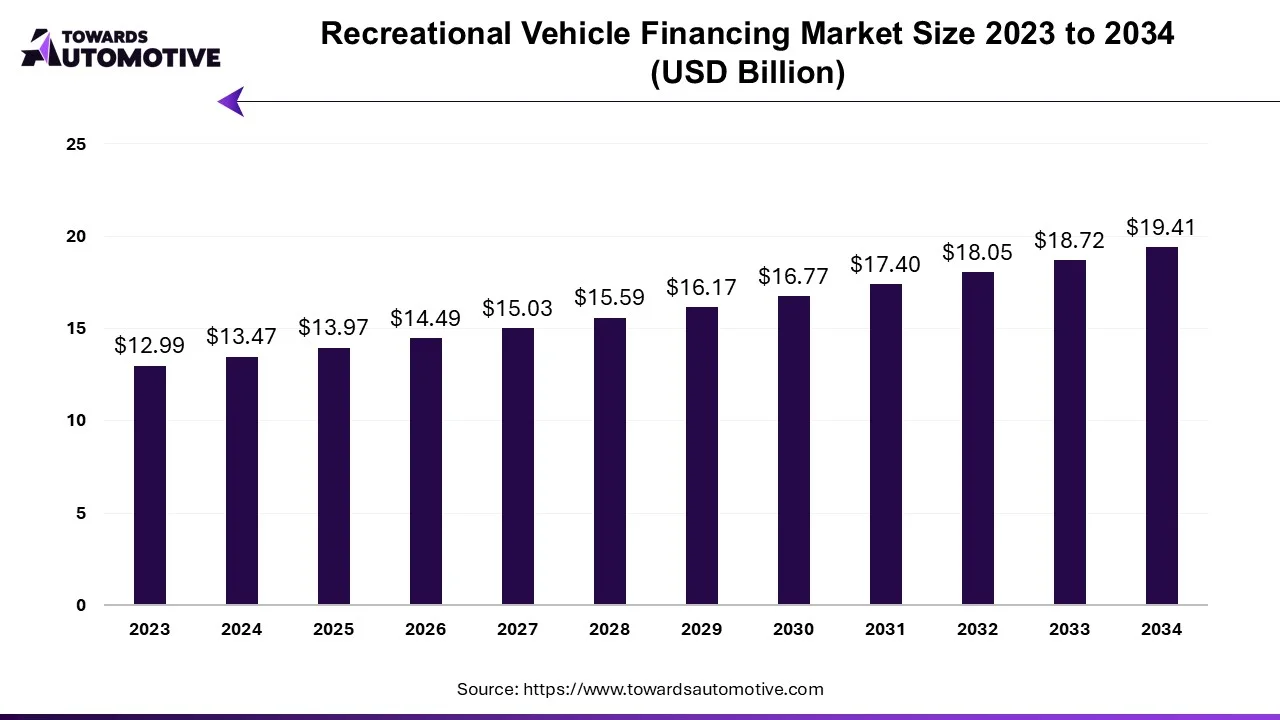

The recreational vehicle financing market is expected to increase from USD 13.97 billion in 2025 to USD 19.41 billion by 2034, growing at a CAGR of 3.72% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The recreational vehicle financing market is a prominent segment of the BFSI industry. This industry deals in providing financing services for purchasing recreational vehicles. There are several types of providers in this sector consisting of bank loans, credit unions, online lenders, manufacturing financers and some others. These financial services are launched for purchasing different vehicles comprising of motorhomes, travel trailers, fifth wheel trailers and pop-up campers. It is designed for numerous customers including individuals and businesses. The rising development in the BFSI sector along with rapid consumer interest towards recreational activities has boosted the industrial expansion. This market is projected to grow significantly with the growth of the automotive sector in different parts of the world.

In July 2023, Nick Stellman, the CEO of Finio announced that” In industries where disparate systems and manual data entry are still the norm, Finio’s digital finance hub catapults the F&I process to a whole new level, Finio saves costs and adds security”.

The recreational vehicle financing market is a highly competitive industry with the presence of several dominating players. Some of the prominent market players in this industry consists of Bank of America, Ford Credit, Toyota Financial Services, GMC Financial, Nissan Motor Acceptance Corporation, Honda Financial Services, SunTrust Banks, Ally, Citibank, JPMorgan Chase, U.S. Bank and some others. These market players are constantly engaged in providing superior financial services and adopting several strategies for maintaining their dominant position in this industry.

By Vehicle Type

By Financing Type

By Loan Purpose

By Customer Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us