March 2025

Senior Research Analyst

Reviewed By

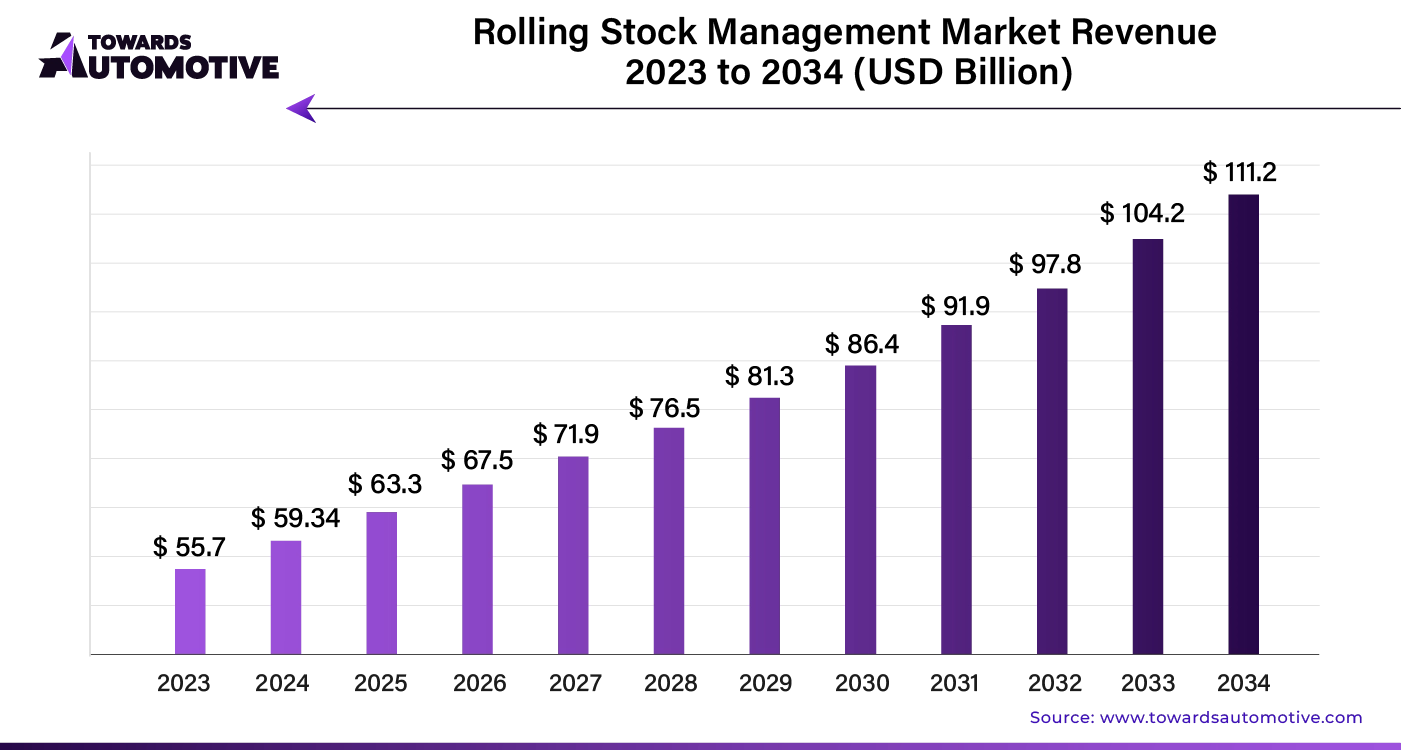

The global rolling stock management market is anticipated to grow from USD 63.3 billion in 2025 to USD 111.2 billion by 2034, with a compound annual growth rate (CAGR) of 6.57% during the forecast period from 2025 to 2034.

Predictive maintenance technologies are being widely adopted to boost operational efficiency and reduce downtime in rolling stock management. Real-time monitoring, powered by IoT sensors and data analytics, is enabling proactive maintenance of train components. Fleet modernization programs are improving passenger experience, safety, and energy efficiency. Asset management solutions are also gaining attention for optimizing resource use, minimizing lifecycle costs, and extending equipment lifespan. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Market Drivers:

Market Challenges:

Artificial Intelligence (AI) is poised to significantly enhance the Rolling Stock Management market. By leveraging AI, operators can optimize maintenance schedules, predict equipment failures, and streamline operations. AI-driven predictive maintenance helps anticipate component wear and tear, reducing unplanned downtime and extending the lifespan of rolling stock. This proactive approach minimizes disruptions and lowers maintenance costs.

AI enhances operational efficiency by analyzing vast amounts of data in real time. It enables real-time monitoring of rolling stock conditions, ensuring timely interventions and improving overall safety. Advanced algorithms can optimize routing and scheduling, leading to better resource utilization and reduced operational costs.

Additionally, AI-powered analytics facilitate more informed decision-making. It provides insights into performance trends and helps identify areas for improvement. The integration of AI in rolling stock management not only boosts efficiency but also supports sustainability goals by optimizing energy consumption and reducing emissions.

Overall, AI is driving substantial growth in the Rolling Stock Management market by enhancing reliability, efficiency, and safety. As technology advances, its role in transforming this sector will become increasingly pivotal.

In the rolling stock management market, a well-coordinated supply chain ensures smooth operations and timely delivery of components. The supply chain begins with the procurement of raw materials and components from reliable suppliers. Manufacturers then assemble these components into rolling stock units, adhering to strict quality standards.

After assembly, rolling stock undergoes rigorous testing to guarantee safety and performance. This phase is crucial for maintaining high operational standards. Once tested, the rolling stock is transported to various transit agencies and operators. Efficient logistics management is essential to avoid delays and reduce transportation costs.

Maintenance and repair services are integrated into the supply chain to address any issues promptly. This ongoing support ensures rolling stock remains in optimal condition throughout its lifecycle. Effective inventory management further enhances supply chain efficiency, preventing shortages and overstock situations.

Technological advancements, such as real-time tracking and data analytics, play a vital role in optimizing the supply chain. They provide valuable insights for forecasting demand and managing inventory. By streamlining these processes, the rolling stock management market can achieve greater reliability and cost-effectiveness.

The Rolling Stock Management market revolves around the efficient operation and maintenance of railway vehicles. Key components include rolling stock, infrastructure, and management systems. Rolling stock encompasses locomotives, passenger cars, and freight cars. Infrastructure involves tracks, signaling systems, and stations. Management systems focus on optimizing the performance and lifecycle of rolling stock.

Companies in this market play crucial roles. For example, Siemens provides advanced signaling and train control systems, enhancing operational efficiency. Bombardier, known for its rolling stock and maintenance services, ensures reliable vehicle performance. Alstom contributes with its innovative rail solutions, including high-speed trains and management systems. Hitachi Rail offers integrated systems for rolling stock management, focusing on safety and efficiency.

Additionally, firms like Thales and GE Transportation supply critical components such as train control and monitoring systems. Their technology supports real-time data analysis, helping operators make informed decisions. By integrating these components and leveraging the expertise of various companies, the Rolling Stock Management market ensures streamlined operations and enhanced safety across railway networks.

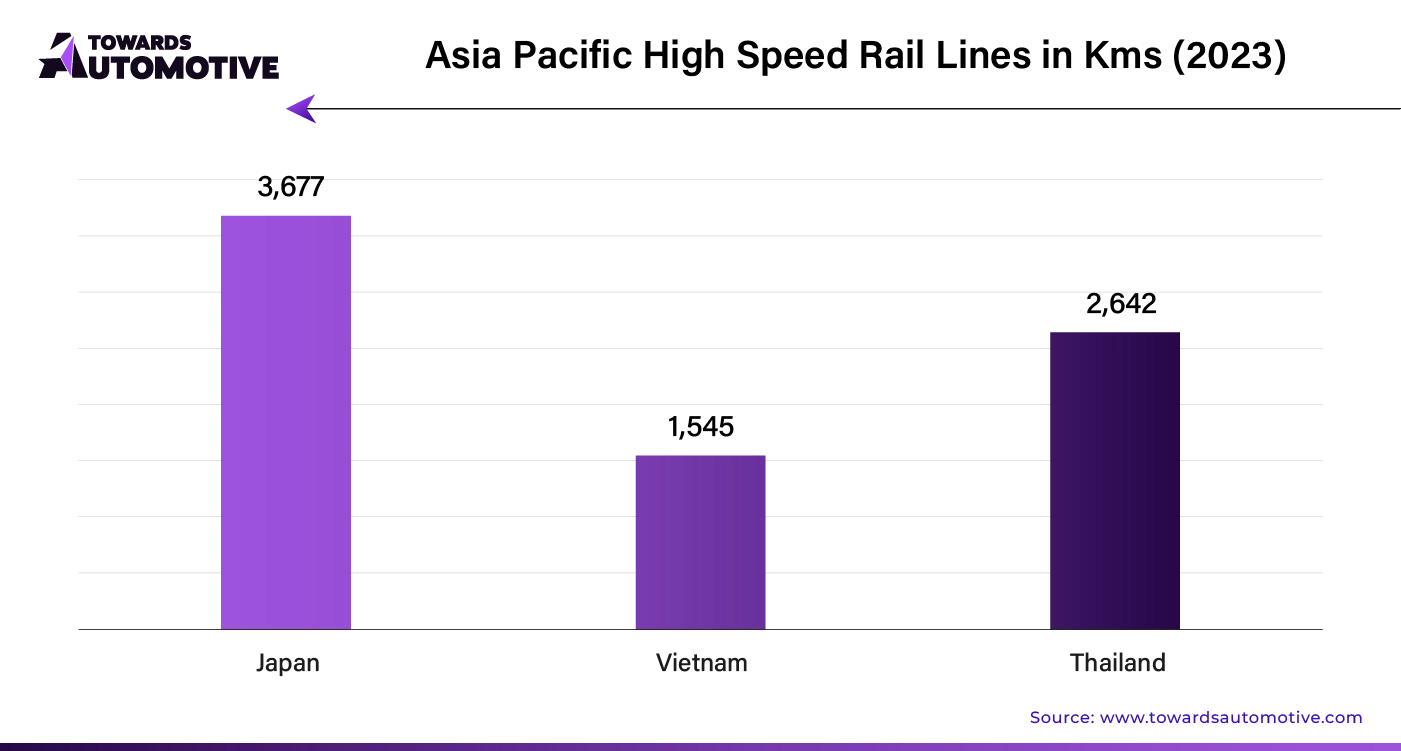

Japan: The Forefront of Rolling Stock Management

Japan leads the rolling stock management sector, thanks to its relentless pursuit of technological innovation and excellence in railway systems. The country's high-speed trains, punctuality, and safety are hallmarks of its advanced management practices. Its vast railway network, including bullet trains and urban transit, acts as a testing ground for cutting-edge technologies, solidifying its position as a global leader.

United States: Market Maturity Constraints Growth

In the United States, the expansive railway network supports both freight and passenger services. Given the high dependence on trains, maintaining efficiency, timely maintenance, and safety is crucial. However, the mature infrastructure and effective management strategies limit growth potential, leading to a projected CAGR of 6.7% from 2024 to 2034.

South Korea: Growth Driven by Technological Advances

South Korea’s focus on technological innovation and efficiency fuels its rolling stock management market. With advanced high-speed trains and urban transit systems, there is a demand for sophisticated management solutions. The market is expected to grow at a CAGR of 8.0%, driven by efforts to enhance passenger experience and operational efficiency.

China: Urban Expansion and Growth Boost Demand

China’s rapid urbanization and economic development have resulted in significant investments in railway infrastructure. With the largest high-speed rail network and extensive freight systems, rolling stock management is crucial for accommodating growing demands. The projected CAGR for China is 7.0%, reflecting its commitment to modernizing rail systems to improve connectivity and sustainability.

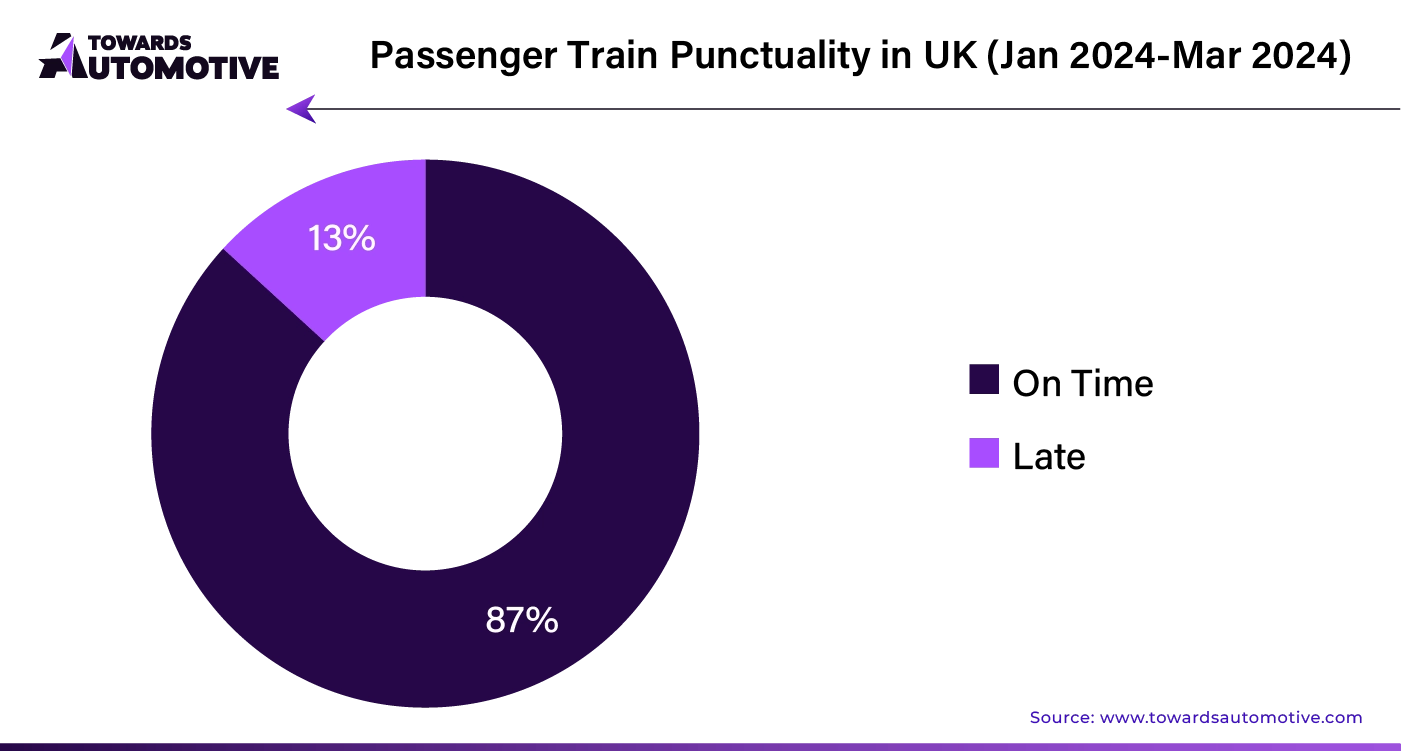

United Kingdom: Focus on Service Quality and Reliability

In the United Kingdom, rolling stock management is essential for supporting diverse railway operations, including commuter and freight services. The emphasis on safety, reliability, and customer satisfaction drives the adoption of advanced management solutions. The forecast CAGR is 7.5%, as the UK works to modernize its infrastructure and enhance service quality.

The goods carrier segment is anticipated to grow at a 6.4% CAGR by 2034, fueled by the increasing global need for efficient freight solutions. This segment plays a crucial role in transporting raw materials, finished goods, and commodities across various supply chains. Factors such as advancements in infrastructure, trade liberalization, and the rise of e-commerce are driving this growth.

In parallel, the railway management sector is projected to expand at a 6.2% CAGR by 2034. This growth is supported by continuous investments in railway infrastructure and operations. Effective management—including aspects such as scheduling, maintenance, and asset management—is essential for providing safe and efficient transportation. Key drivers of this growth include technological improvements, rising urbanization, and government efforts to modernize railway systems.

Evolving Competitive Landscape in the Rolling Stock Management Market

The rolling stock management market is dominated by key players like Siemens AG, Alstom SA, Bombardier Inc., and General Electric Company. These companies offer a range of solutions, including predictive maintenance systems, asset management software, and remote monitoring services.

Competition is fueled by technological advancements, service quality, geographic coverage, and pricing strategies. Companies frequently collaborate, form partnerships, and engage in mergers to enhance their capabilities, expand their market presence, and meet evolving customer needs.

By Application Type

By Management Type

By Maintenance

By Region

March 2025

March 2025

March 2025

February 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us