April 2025

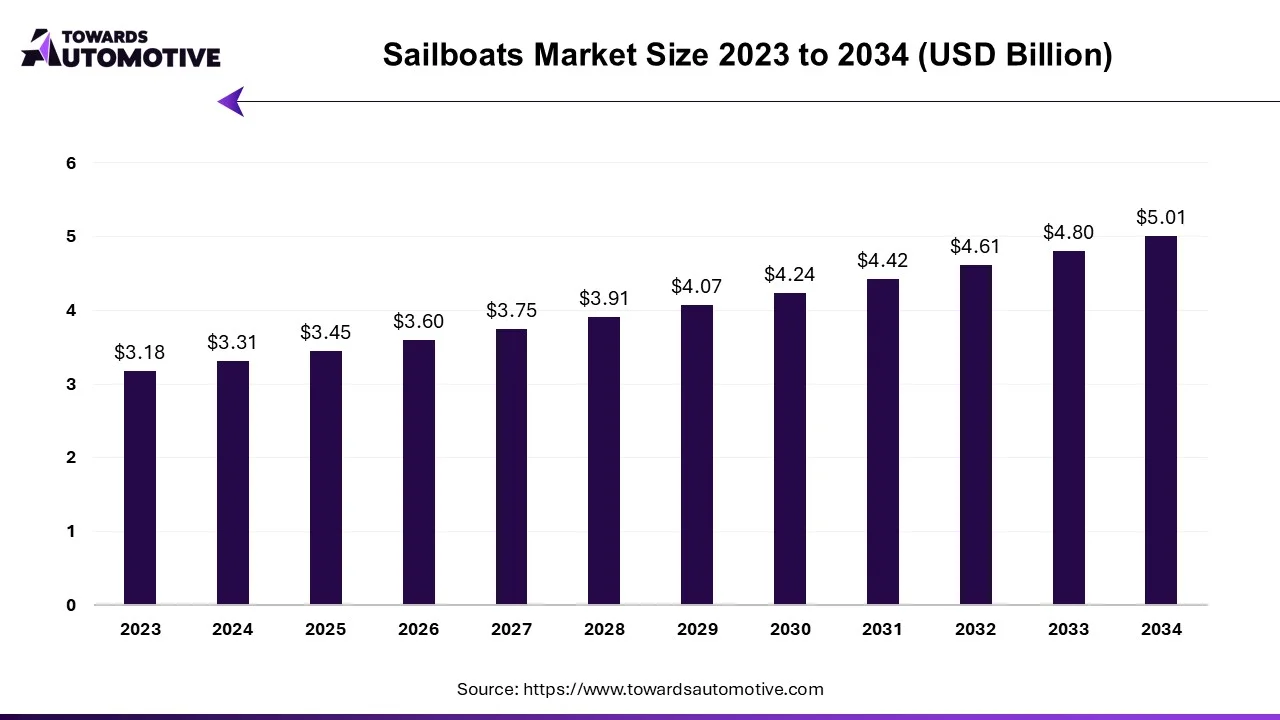

The global sailboats market is forecast to grow at a CAGR of 4.21%, from USD 3.45 billion in 2025 to USD 5.01 billion by 2034, over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The global sailboats market includes a broad spectrum of products, ranging from small dinghies and day sailors to luxury yachts and performance racing boats. With a rich history dating back centuries, sailing remains a popular activity worldwide, attracting enthusiast of all ages and backgrounds. In recent years, the sailboats market has witnessed notable shifts.

The increasing technological advancements including lightweight materials, advanced sail designs, and navigation systems, are enhancing performance and efficiency, attracting both seasoned sailors and newcomers to the sport. Furthermore, the increasing emphasis on sustainability and eco-friendly practices is driving demand for sailboats equipped with environmentally conscious features such as electric propulsion systems and solar panels. Additionally, the growing popularity of recreational boating, fueled by urbanization and a desire for outdoor leisure activities, is expanding the market's consumer base.

The surge in interest in recreational boating reflects a broader cultural shift towards outdoor leisure pursuits, due to rising disposable incomes and a desire for experiential activities. As individuals seek to escape the confines of urban living and embrace nature, sailing presents an appealing avenue for adventure and relaxation. Novice sailors are drawn to the accessible entry point provided by smaller sailboats, which offer an opportunity to learn the ropes and embark on leisurely excursions.

In November 2022, Navigare Yachting unveiled a strategic alliance with Tezmarin. Tezmarin has been designated as the sole agent for Navigare in selling new yachts for charter, as well as managing charter bookings within the local Turkish market. Additionally, a new charter base is scheduled to open in Marmaris, a picturesque sailing hotspot situated in Southwest Turkey.

Meanwhile, experienced enthusiasts are enticed by the thrill of mastering the wind and waves, whether through competitive racing or leisure cruising. This diversification of the consumer base underscores the democratization of sailing, as it becomes more accessible to individuals across different demographics and skill levels. Moreover, the timeless allure of the sea, coupled with advancements in boat design and technology, further amplifies the appeal of recreational boating, driving sustained demand for sailboats in the market.

The demographic shifts present a notable restraint in the sailboats market, primarily due to aging demographics and evolving consumer preferences among younger generations. With an increasing proportion of the population entering older age brackets, there's a decline in the traditional consumer base for sailboats, affecting market growth. Moreover, younger demographics, influenced by changing lifestyles and digital distractions, exhibit less interest in traditional recreational pursuits like sailing. This shift in preferences necessitates innovative approaches to attract and engage new demographics to sailing.

Manufacturers and industry stakeholders must adapt their marketing strategies and product offerings to resonate with the interests and values of younger generations, leveraging digital platforms, experiential events, and community-building initiatives. Embracing trends such as adventure tourism and experiential travel can also help rejuvenate interest in sailing among younger consumers, mitigating the impact of demographic shifts on market growth. Ultimately, addressing these demographic challenges requires on-going innovation and adaptation to meet the evolving needs and preferences of the changing consumer landscape.

The increasing emphasis on sustainability presents a significant opportunity for the sailboats market, as consumers prioritize environmentally conscious choices. This shift in consumer preferences towards eco-friendly practices is driving demand for sailboats equipped with sustainable features, such as electric propulsion systems and solar panels. Electric propulsion systems offer quieter operation, reduced emissions, and lower operating costs compared to traditional diesel engines, appealing to environmentally conscious sailors seeking cleaner alternatives.

Additionally, solar panels provide renewable energy sources, reducing reliance on fossil fuels and minimizing environmental impact. Sailboat manufacturers that prioritize sustainability and integrate eco-friendly technologies into their products stand to benefit from a competitive advantage in the market. Moreover, as environmental awareness continues to grow, sailboats with sustainable features are likely to attract a broader customer base, including environmentally conscious consumers seeking to minimize their carbon footprint while enjoying the pleasures of sailing. This presents an opportunity for market expansion and differentiation for manufacturers committed to sustainability.

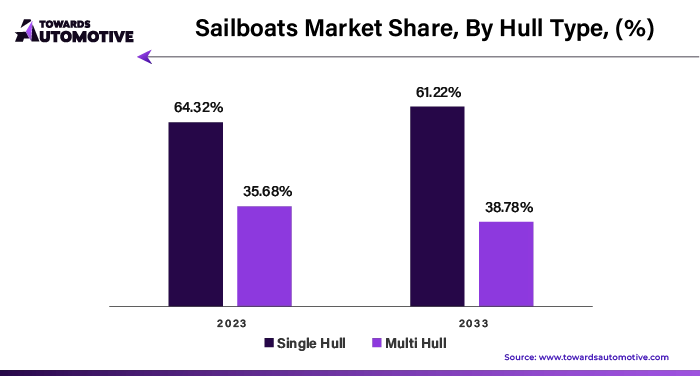

The single hull segment captured a substantial market share of 64.32% in 2023. The simplicity of single hull sailboats appeals to a wide range of consumers, including both novice sailors and experienced enthusiasts. These vessels are easier to handle and maintain compared to multihull counterparts, making them accessible to individuals with varying skill levels. Additionally, their exceptional mobility enhances the overall sailing experience, allowing sailors to navigate through different water conditions with ease and precision.

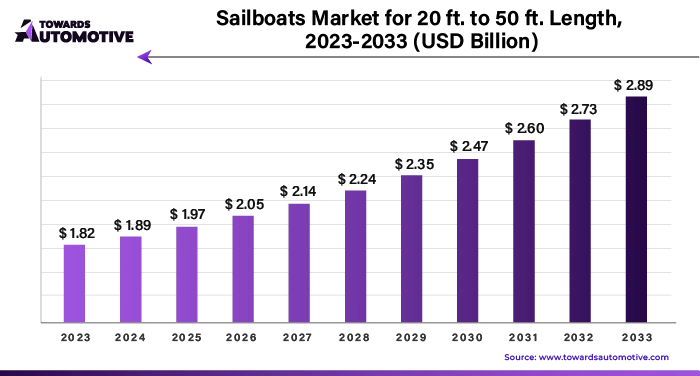

The 20 ft. to 50 ft. segment held largest market share of 57.36% in 2023. The sailboats within this length range strike a balance between affordability and performance, appealing to a broad spectrum of consumers, from recreational sailors to cruising enthusiasts. Additionally, boats in this size category offer versatility suitable for various sailing activities, including day sailing, coastal cruising, and weekend getaways. Moreover, the 20 ft. to 50 ft. segment encompasses a diverse range of sailboat types, from small day sailors to mid-sized cruising yachts, catering to different preferences and needs within the market.

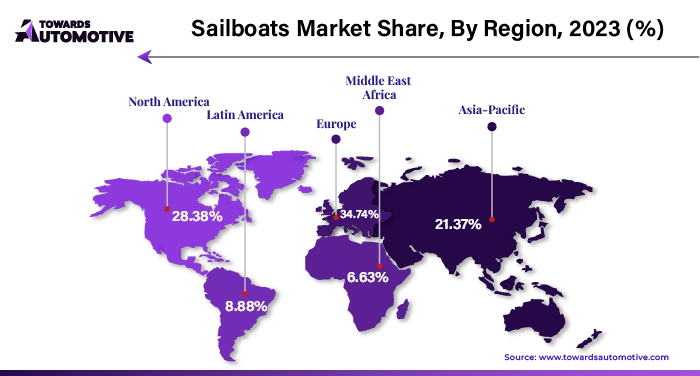

Europe dominated the market with 34.74% of shares in the global sailboats market. Europe has a rich maritime heritage and sailing tradition, with countries like Italy, France, Germany and the United Kingdom boasting strong sailing cultures. This deep-rooted connection to the sea fosters a vibrant sailing community and sustains demand for sailboats across various segments. Furthermore, the region's extensive coastline, comprising diverse landscapes and sailing destinations, provides ideal conditions for recreational boating and sailing activities. From the Mediterranean Sea to the Baltic Sea and the Atlantic Ocean, Europe offers a myriad of sailing opportunities, attracting enthusiasts from around the world.

Asia Pacific is expected to grow at a significant CAGR of 6.78% during the forecast period. The economic growth in countries across the region has led to an increase in disposable incomes. As a result, more individuals have the financial means to invest in recreational activities such as sailing, driving demand for sailboats. The region is home to numerous picturesque sailing destinations, including tropical islands, crystal-clear waters, and diverse marine ecosystems. Tourists from around the world flock to these destinations, boosting demand for sailing experiences and charters.

Some of the key players in sailboats market are The Beneteau Group, Bavaria Yachtbau GmbH, Jeanneau, Dufour Yachts, HanseYachts AG, Catalina Yachts, Hunter Marine Corporation, Lagoon Catamarans, Hylas Yachts, X-Yachts, Swan Yachts, and Grand Soleil Yachts, among others.

By Hull Type

By Length

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us