April 2025

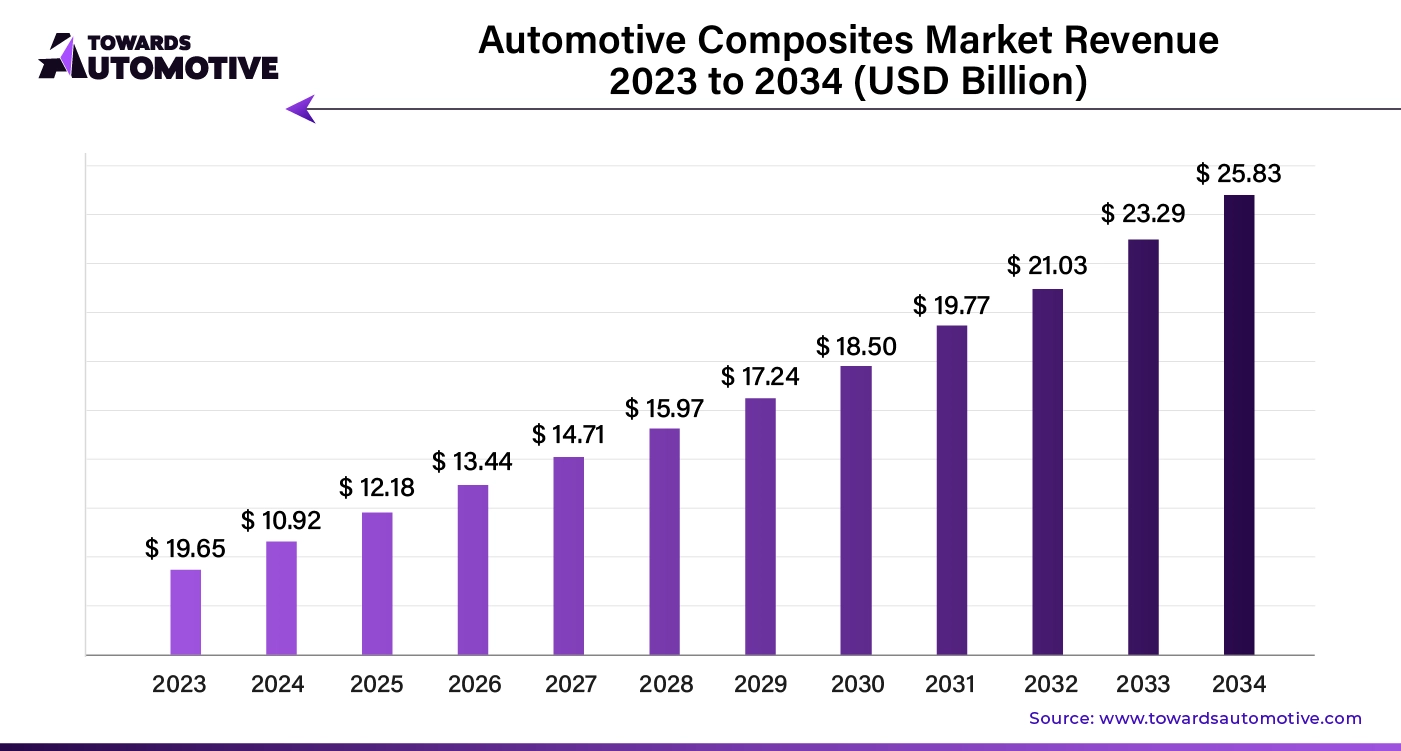

The global automotive composites market is expected to increase from USD 12.18 billion in 2025 to USD 25.83 billion by 2034, growing at a CAGR of 10.76% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Automotive Composites Market is witnessing rapid growth as the automotive industry increasingly adopts lightweight, durable materials to enhance vehicle performance, fuel efficiency, and sustainability. Composites, which include materials such as carbon fiber, fiberglass, and natural fibers, offer a superior strength-to-weight ratio compared to traditional materials like steel and aluminum. This advantage makes them highly sought after in the manufacturing of automotive components, particularly in the production of electric vehicles (EVs) and high-performance cars, where weight reduction is crucial for improving energy efficiency and overall driving dynamics.

As automakers strive to meet stringent emission standards and fuel efficiency targets, the demand for lightweight materials is accelerating. Composites play a key role in reducing vehicle weight, which directly contributes to lower fuel consumption and reduced CO2 emissions. Additionally, their versatility allows for innovative designs and structural components that can withstand harsh conditions, further boosting their appeal in the automotive sector.

The increasing focus on sustainability is also driving the growth of natural fiber composites, as automakers look for eco-friendly alternatives to traditional materials. Moreover, advancements in manufacturing processes, such as automated production techniques and recycling technologies, are making composites more cost-effective, leading to broader adoption in mass-market vehicles.

Overall, the Automotive Composites Market is set to expand as the industry embraces lightweight, high-strength materials to address the growing demands for energy efficiency, sustainability, and improved vehicle performance.

AI plays a transformative role in the Automotive Composites Market, driving advancements in materials development, manufacturing efficiency, and product design. One of the key contributions of AI is its ability to optimize the selection and composition of composite materials. Through advanced data analytics and machine learning algorithms, AI helps engineers and researchers identify the best combination of materials, such as carbon fiber and resin, to achieve the desired balance of strength, weight, and cost. This accelerates the innovation process and allows for the creation of highly customized, high-performance composites tailored to specific automotive applications.

In manufacturing, AI enhances process automation, improving production efficiency and reducing errors. AI-driven systems can monitor and control composite manufacturing processes, ensuring precision and consistency in tasks like molding, layering, and curing. This not only increases output but also minimizes material waste, contributing to more sustainable production practices. Predictive maintenance enabled by AI further optimizes machinery performance, reducing downtime and improving overall factory efficiency.

Additionally, AI enables more sophisticated simulations and predictive modeling in the design phase. By simulating the behavior of composites under various conditions, AI helps manufacturers evaluate the performance of materials before physical testing, accelerating product development cycles. This reduces costs and time-to-market, while also enhancing safety and durability in automotive applications.

Overall, AI plays a pivotal role in advancing the automotive composites industry by improving material innovation, manufacturing precision, and product design efficiency.

The growing demand for lightweight materials is a key driver of the Automotive Composites Market, as automakers increasingly prioritize fuel efficiency, performance, and sustainability. Lightweight composites, such as carbon fiber and fiberglass, offer significant advantages over traditional materials like steel and aluminum, particularly in terms of strength-to-weight ratio. As vehicle weight reduction becomes critical for improving fuel economy and reducing emissions, the demand for composites in automotive manufacturing is on the rise.

One of the primary motivations behind this shift is the need to meet stringent environmental regulations and fuel efficiency standards set by governments worldwide. Lightweight materials help reduce the overall mass of vehicles, leading to lower fuel consumption and decreased greenhouse gas emissions. This is particularly crucial for electric vehicles (EVs), where reducing weight extends battery range and enhances overall vehicle performance. Composites also offer the flexibility to create innovative, aerodynamic designs that further improve energy efficiency.

Additionally, the push for high-performance and luxury vehicles has intensified the demand for composites due to their durability, strength, and lightweight properties. These materials enable manufacturers to develop safer, faster, and more efficient vehicles without compromising structural integrity.

As automakers continue to focus on sustainability, fuel efficiency, and performance, the demand for lightweight composites is expected to surge, propelling the growth of the Automotive Composites Market and driving innovation across the industry.

The Automotive Composites Market faces several restraints that hinder its growth, primarily due to high production costs and complex manufacturing processes. The use of advanced composites like carbon fiber remains expensive, limiting their adoption in mass-market vehicles. Additionally, the longer production times required for composite manufacturing, compared to traditional materials like steel or aluminum, present challenges in scaling up for large-volume automotive production. Furthermore, the recyclability and repairability of certain composite materials remain concerns, creating obstacles for widespread implementation in the automotive sector.

Hybrid composites are creating significant opportunities in the Automotive Composites Market by combining the strengths of different materials to deliver enhanced performance and versatility. These composites, often made by blending fibers like carbon, glass, or aramid with thermoplastics or other resins, offer superior mechanical properties such as improved strength, durability, and weight reduction. For automakers, this innovation enables the production of components that are not only lighter but also stronger and more resilient than traditional materials, boosting vehicle efficiency and performance.

The versatility of hybrid composites allows for their application across various automotive parts, from structural components to interior finishes. Their lightweight nature is particularly advantageous in the production of electric vehicles (EVs), where reducing weight directly impacts battery efficiency and range. Hybrid composites are also more cost-effective and easier to process than pure carbon fiber, making them accessible for mass-market vehicles, not just high-end models.

Moreover, hybrid composites offer better recyclability and customization options, aligning with the industry’s increasing focus on sustainability and innovative design. As automakers strive to meet stricter environmental regulations and consumer demands for high-performance vehicles, hybrid composites are opening new pathways for growth in the automotive industry.

The compression molding segment held the largest share of the market. Compression molding is a key driver in the growth of the Automotive Composites Market, offering a cost-effective and efficient manufacturing process for producing high-strength, lightweight components. This technique, which involves molding composite materials under heat and pressure, allows for the mass production of complex automotive parts with high precision and consistency. The process is particularly well-suited for creating large, intricate structures like bumpers, hoods, and interior panels, making it a valuable tool for automakers looking to reduce vehicle weight and enhance fuel efficiency.

One of the main advantages of compression molding is its ability to accommodate a wide variety of composite materials, such as carbon fiber, glass fiber, and thermoplastic composites. This flexibility enables manufacturers to choose the ideal material for specific automotive applications, balancing cost, strength, and weight reduction. Additionally, the short cycle times and lower material waste associated with compression molding help to drive down production costs, making composite components more accessible for mass-market vehicles.

As automakers continue to focus on lightweighting and sustainability, the use of compression molding is expected to expand, supporting the broader adoption of composites and fueling growth in the automotive composites market.

The exterior segment is anticipated to grow with fastest growth rate during the forecast period. The exterior segment plays a crucial role in driving the growth of the Automotive Composites Market, as automakers increasingly adopt composite materials for vehicle exteriors to achieve better performance, aesthetics, and fuel efficiency. Exterior components like bumpers, hoods, doors, and panels benefit greatly from the use of composites due to their lightweight nature, which significantly reduces overall vehicle weight. This reduction contributes to improved fuel economy and lower emissions, aligning with stringent environmental regulations and the rising demand for sustainable vehicles.

Composites also offer superior design flexibility, enabling manufacturers to create more aerodynamic and aesthetically appealing exterior parts without compromising on strength or durability. Their resistance to corrosion and ability to absorb energy in the event of a collision further enhance vehicle safety and longevity, making them an attractive option for both high-performance and mass-market vehicles.

In addition to performance advantages, the cost-effectiveness of composite materials, particularly in terms of long-term durability and reduced maintenance, makes them ideal for automotive exteriors. As manufacturers continue to prioritize fuel efficiency, safety, and design, the growing use of composites in the exterior segment is expected to accelerate, driving the broader adoption of composite materials across the automotive industry.

The glass fiber segment is likely to grow with fastest growth rate during the forecast period. The glass fiber segment is a key contributor to the growth of the Automotive Composites Market, owing to its versatility, cost-effectiveness, and strong mechanical properties. Glass fiber composites are widely used in various automotive components, including structural parts, body panels, and interior elements, due to their lightweight yet durable nature. By reducing the overall weight of vehicles, glass fiber composites help improve fuel efficiency and lower emissions, meeting the increasing demand for environmentally friendly vehicles.

One of the main advantages of glass fiber is its affordability compared to other composite materials like carbon fiber, making it more accessible for mass-market vehicles. It also provides excellent strength and stiffness, ensuring the safety and reliability of automotive components while enhancing vehicle performance. Glass fiber composites are also resistant to corrosion, impact, and high temperatures, contributing to the longevity of automotive parts.

As automakers continue to focus on lightweighting and sustainability, the demand for glass fiber composites is expected to rise. Its wide-ranging applications, coupled with its cost advantages and durability, position glass fiber as a critical material in driving the expansion of the automotive composites market, particularly in mass-produced vehicles.

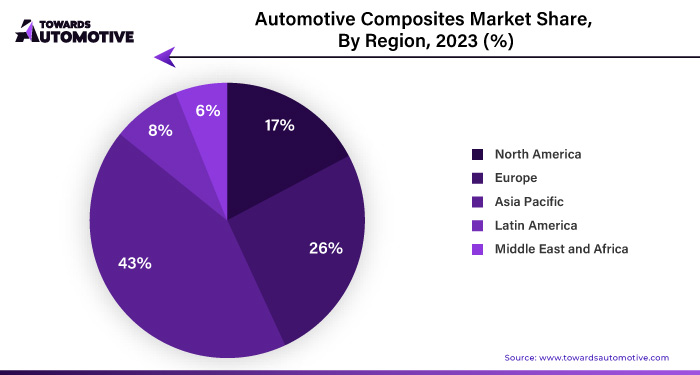

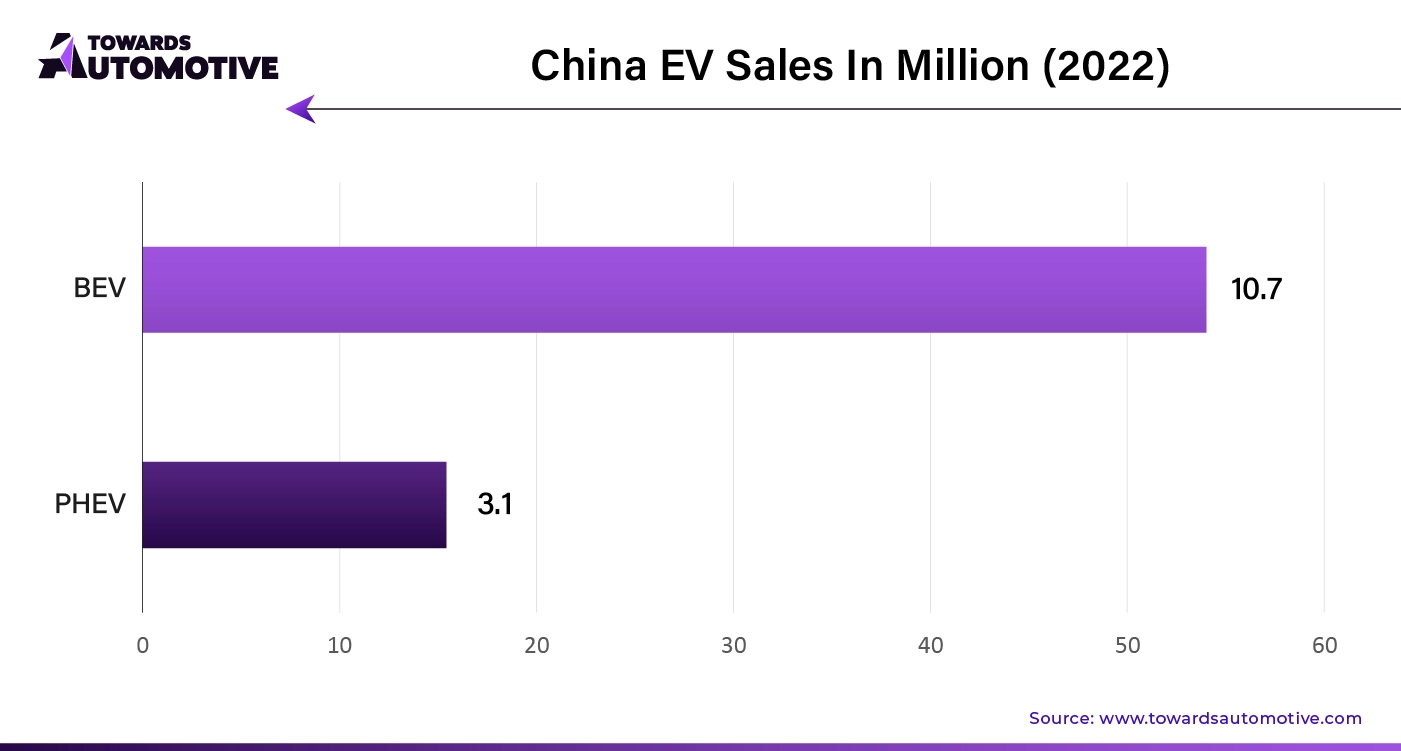

Asia Pacific dominated the automotive composites market. The growth of the Automotive Composites Market in Asia Pacific is significantly driven by increased vehicle production, rising demand for electric vehicles (EVs), and advances in composite manufacturing technologies. The rapid expansion of the automotive industry in key markets like China, India, Japan, and South Korea is creating a robust demand for lightweight, high-performance materials. Composites, such as carbon fiber and glass fiber, are increasingly used to reduce vehicle weight, which enhances fuel efficiency and meets stringent environmental regulations.

The surge in EV adoption across the region further accelerates the demand for composites. As governments implement policies and incentives to promote electric mobility, automakers are turning to composites to improve energy efficiency and extend the driving range of EVs. Lightweight composites are essential in achieving these goals, as they help offset the additional weight of batteries and electric drivetrains, thus optimizing overall vehicle performance.

Additionally, advances in composite manufacturing technologies, such as automated production processes and 3D printing, are revolutionizing the industry. These innovations make the production of composite parts more cost-effective and scalable, allowing for broader application in both high-performance and mass-market vehicles. The reduced costs and improved efficiency of composite manufacturing contribute to the widespread adoption of these materials, driving substantial growth in the automotive composites market across Asia Pacific. Collectively, these factors are shaping the region’s dynamic automotive landscape and fueling its expansion in the composites sector.

North America is expected to expected grow with the highest CAGR during the forecast period. The Automotive Composites Market in North America is experiencing robust growth driven by several interconnected factors. A primary catalyst is the increasing focus on high-performance and luxury vehicles. These segments demand advanced materials that offer superior strength, durability, and design flexibility, which are key attributes of automotive composites like carbon fiber and fiberglass. These materials enhance vehicle performance while meeting the aesthetic and functional requirements of high-end automotive applications.

Additionally, the growing emphasis on sustainability is significantly shaping the market. As environmental regulations become more stringent and consumer awareness rises, there is a strong push for eco-friendly manufacturing practices. Composites, especially those made from recyclable or bio-based materials, align with these sustainability goals, making them increasingly desirable for automotive manufacturers committed to reducing their environmental footprint.

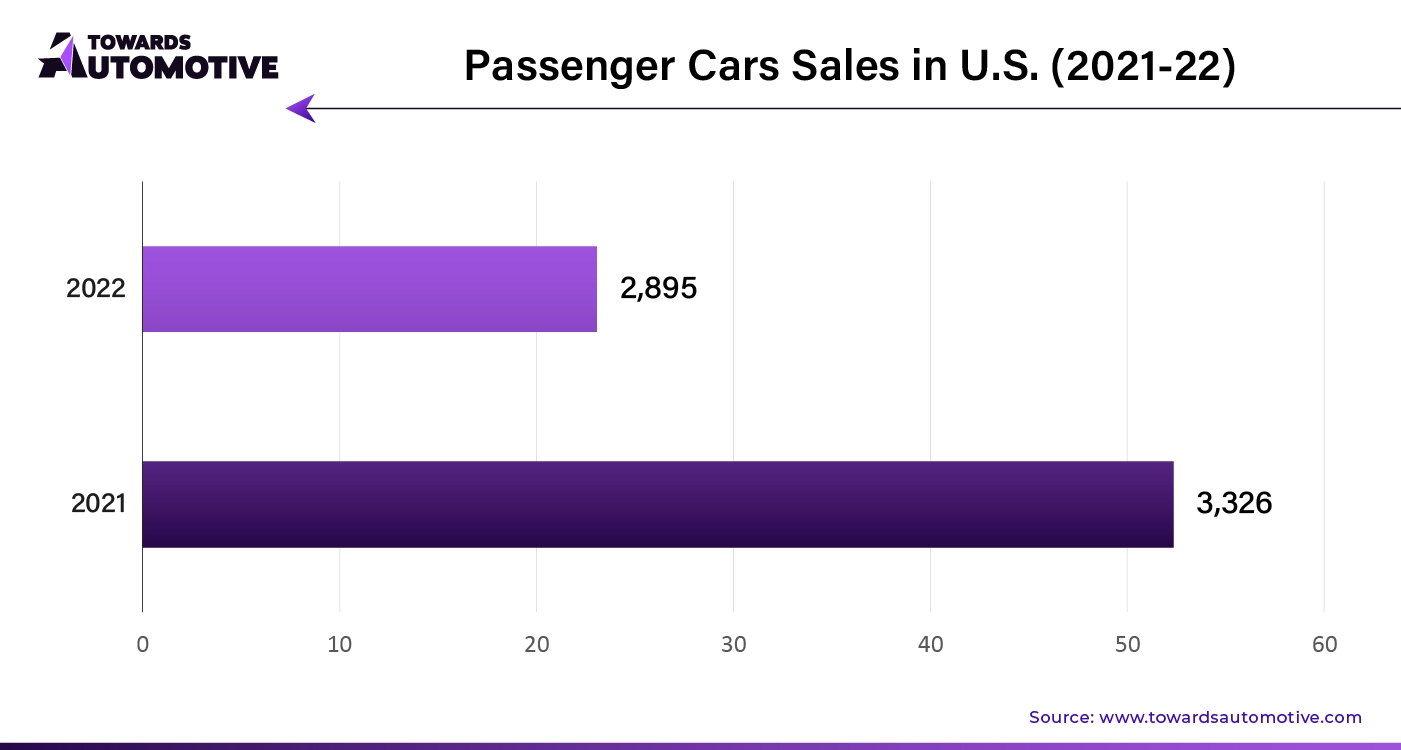

The rising demand for lightweight vehicles is another crucial driver. Lightweight composites help improve fuel efficiency and reduce emissions by lowering overall vehicle weight, which is particularly important in light of stringent fuel economy standards. This trend is further amplified by the surge in passenger car production, where composites are used to achieve weight savings and performance enhancements across a broad range of vehicle types.

By Fiber Type

By Manufacturing Process

By Application

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us