April 2025

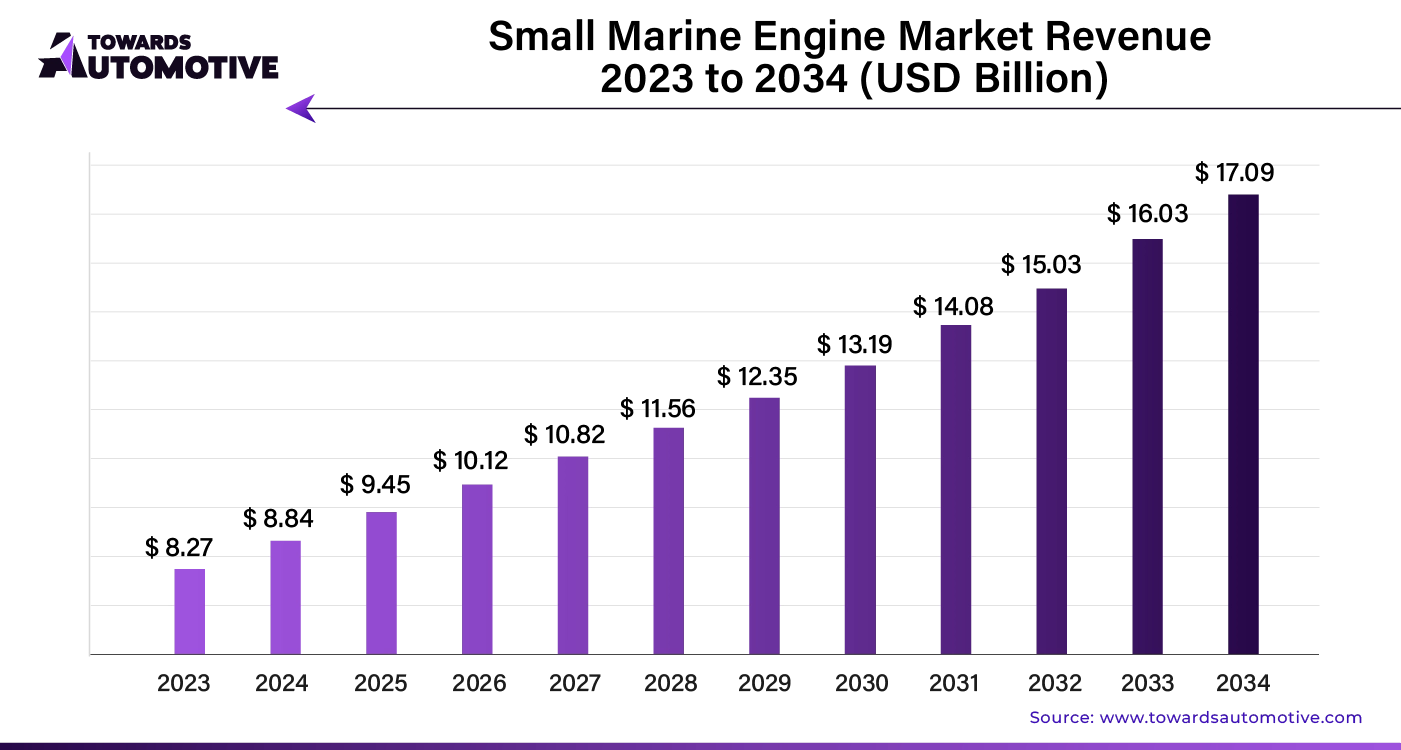

The global small marine engine market size is calculated at USD 8.84 billion in 2024 and is expected to be worth USD 17.09 billion by 2034, expanding at a CAGR of 6.93% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The small marine engine market is expanding due to the growing popularity of recreational boating activities such as fishing, water sports, and leisure cruising. These engines are essential for various commercial applications, including small fishing vessels, ferries, and water taxis, driven by increased maritime trade, tourism, and transportation.

Innovations in engine technology, such as enhanced fuel efficiency, emission control, and noise reduction, attract consumers seeking environmentally friendly and efficient propulsion systems. Rising disposable incomes and improved living standards in emerging economies are boosting demand for recreational boating, further fueling industry growth.

Government initiatives that promote maritime tourism, support the fishing industry, and enhance waterway infrastructure are creating favorable conditions for market expansion. Additionally, the development of nautical tourism, including cruising and island hopping, is driving demand for small marine engines in regions with scenic coastlines, such as Japan and the Middle East.

The need for engine replacements and upgrades in existing boats also contributes to market growth, as boat owners seek to modernize their propulsion systems with more efficient and reliable engines. Outboard engines, valued for their ease of use and versatility, are particularly popular for operating in shallow waters. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The increasing interest in water-based leisure activities is driving up the demand for small marine engines across various watercraft. Advances in engine technology have significantly improved performance, fuel efficiency, and environmental sustainability, making these engines more attractive to consumers. Manufacturers are enhancing engine capabilities and expanding their product lines, contributing to robust market growth.

Lightweight and compact models have increased the versatility and reliability of small marine engines. With options such as outboard, inboard, and sterndrive configurations, consumers can choose engines tailored to their boating needs. The growing popularity of water sports, fishing, and coastal tourism is expected to sustain this upward trend in small marine engine consumption.

Small marine engine manufacturers grapple with several challenges that impact their market. Stringent environmental regulations aimed at reducing emissions require costly investments in research and development, which can drive up production costs and consumer prices. Economic fluctuations and downturns also affect demand, as individuals and businesses may delay or reduce investments in new boats or engine upgrades.

Technological advancements in alternative propulsion systems, like electric and hybrid engines, pose competition to traditional internal combustion engine manufacturers. Additionally, geopolitical tensions, trade disputes, and supply chain disruptions can impact the availability and cost of essential raw materials and components.

Changing consumer preferences, especially among younger generations, may shift the demand for recreational boating and small marine engines. To remain competitive and sustain growth, manufacturers must navigate these regulatory, economic, technological and consumer dynamics.

AI integration is transforming the small marine engine market by enhancing operational efficiency and boosting growth. Advanced AI algorithms optimize engine performance through real-time data analysis, leading to significant improvements in fuel efficiency and reduced emissions. By predicting maintenance needs and detecting potential failures early, AI minimizes downtime and extends engine lifespan, offering substantial cost savings for operators.

AI-driven analytics facilitate smarter design and manufacturing processes. Manufacturers leverage AI to simulate various engine conditions, refining designs for better performance and reliability. This innovation not only accelerates development but also meets the increasing demand for eco-friendly and high-performance marine engines.

Furthermore, AI enhances customer experience by enabling predictive maintenance and personalized service recommendations. With AI-powered diagnostics, marine engine owners receive tailored insights and proactive support, enhancing overall satisfaction and loyalty.

In summary, AI integration is a game-changer in the small marine engine market. It drives growth by improving efficiency, reducing costs, and fostering innovation, positioning the industry for a more sustainable and prosperous future.

In the small marine engine market, an efficient supply chain is crucial for meeting demand and maintaining competitiveness. Manufacturers rely on a network of suppliers for key components like pistons, cylinders, and fuel systems. These suppliers must deliver high-quality parts on time to avoid production delays.

Effective inventory management is vital to ensure that components are available when needed. Just-in-time (JIT) inventory systems can reduce holding costs and minimize waste. However, they require accurate forecasting and reliable suppliers.

Logistics play a significant role in the supply chain. Efficient transportation routes and methods ensure timely delivery of components to manufacturers and finished engines to distributors. Companies often use advanced tracking systems to monitor shipments and manage potential disruptions.

Coordination between manufacturers, suppliers, and distributors is essential for optimizing the supply chain. Clear communication and strong relationships help in addressing issues promptly and adapting to market changes.

By leveraging technology and strategic planning, companies can streamline their supply chains, reduce costs, and enhance overall efficiency in the small marine engine market.

The small marine engine market thrives due to various essential components and key contributors. Core components include engines, fuel systems, cooling systems, and exhaust systems. Each plays a crucial role in ensuring efficient performance and reliability for marine vessels.

Major companies in the market, such as Yamaha Motor Co., Honda Marine, and Mercury Marine, significantly impact the ecosystem. Yamaha Motor Co. is renowned for its advanced engine technology and extensive dealer network, ensuring widespread accessibility and support. Honda Marine focuses on fuel-efficient and environmentally friendly engines, driving innovation in sustainable marine propulsion. Mercury Marine stands out with its high-performance engines and comprehensive service solutions, enhancing the overall customer experience.

Additionally, companies like Suzuki Marine and Evinrude contribute by offering a range of engine sizes and technologies, catering to various marine applications. Their innovations in engine design and reliability enhance the market's diversity and capability.

Together, these components and companies form a dynamic ecosystem that supports growth and innovation in the small marine engine market, driving advancements in technology and meeting evolving consumer demands.

Outboard Engines: Compact and Efficient

Outboard engines dominate the small marine engine market with an anticipated CAGR of 6.1% from 2024 to 2034. Their compact size and lightweight design contribute to their excellent power-to-weight ratios. Key factors driving their popularity include:

Versatility: Outboard engines are easy to mount and remove from a boat's transom, making them suitable for various watercraft, including small boats, fishing vessels, pontoon boats, and recreational cruisers.

Enhanced Performance: They offer superior performance and reliability compared to inboard engines.

Advanced Technologies: Features such as electronic fuel injection, variable valve timing, and power steering improve performance, fuel efficiency, and user experience.

Improved Cooling: The external mounting facilitates better cooling and ventilation, enhancing engine efficiency and durability.

Recreational Boats: Growing Popularity

Recreational boats represent a major segment of the small marine engine market, with a projected CAGR of 5.8% from 2024 to 2034. Factors contributing to this growth include:

Versatility and Performance: Small marine engines, particularly outboards, are favored for their adaptability and excellent performance.

Ease of Use: These engines provide straightforward installation, maneuverability, and reliable performance, making them ideal for a variety of recreational boats.

Technological Advancements: Improvements such as fuel injection and electronic controls boost performance, fuel efficiency, and reliability, making these engines a preferred choice for recreational boating.

South Korea: 7.6% CAGR

South Korea leads the small marine engine market in Asia, with a projected CAGR of 7.6% through 2034. The country’s expertise in precision engineering and manufacturing drives the demand for high-performance, reliable engines. Strong governmental support and a robust shipbuilding industry further enhance market opportunities. South Korean manufacturers continue to innovate, offering engines renowned for their exceptional performance and efficiency.

China: 6.9% CAGR

China’s small marine engine market is expected to grow at a CAGR of 6.9% by 2034. The extensive network of rivers, lakes, and coastlines boosts recreational boating and water sports, increasing engine demand. The Chinese government’s focus on domestic manufacturing and technological advancements supports industry growth. Chinese manufacturers provide competitively priced engines with improved performance and reliability.

Japan: 7.2% CAGR

Japan's small marine engine market is projected to expand at a CAGR of 7.2% through 2034. Known for its advanced engineering and high-quality products, Japan’s manufacturers produce engines that meet strict emissions standards and offer exceptional durability. The focus on marine conservation and eco-tourism drives the adoption of eco-friendly propulsion solutions.

United Kingdom: 6.7% CAGR

In Europe, the United Kingdom leads with a forecasted CAGR of 6.7% through 2034. The UK’s rich maritime heritage and strong recreational boating culture fuel market expansion. The country’s strategic location and emphasis on marine conservation drive the adoption of sustainable technologies. UK manufacturers produce engines known for their performance, reliability, and environmental sustainability.

United States: 6.2% CAGR

The United States, the largest market in North America, shows a CAGR of 6.2% through 2034. The country’s large boating community and advanced manufacturing capabilities sustain high demand for small marine engines. American manufacturers are recognized for their innovation, delivering engines with outstanding performance, efficiency, and emissions control.

The small marine engine market is rapidly expanding due to key players' strategic investments in research and development. Companies are advancing technologies like direct fuel injection, variable valve timing, and electronic controls to enhance engine performance, efficiency, and environmental sustainability. They are also broadening their product ranges and distribution networks to enter emerging markets and meet evolving customer needs. This involves introducing diverse engine models with varying power outputs, fuel options, and features to suit different boat sizes and applications.

Manufacturers are forming strategic partnerships with boat builders, dealers, and service providers to strengthen their market presence and improve customer support. Through innovation, diversification, and collaboration, these companies are driving market growth and positioning themselves for long-term success in marine propulsion.

Recent Developments:

By Placement

By Application

By Region

April 2025

April 2025

April 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us