April 2025

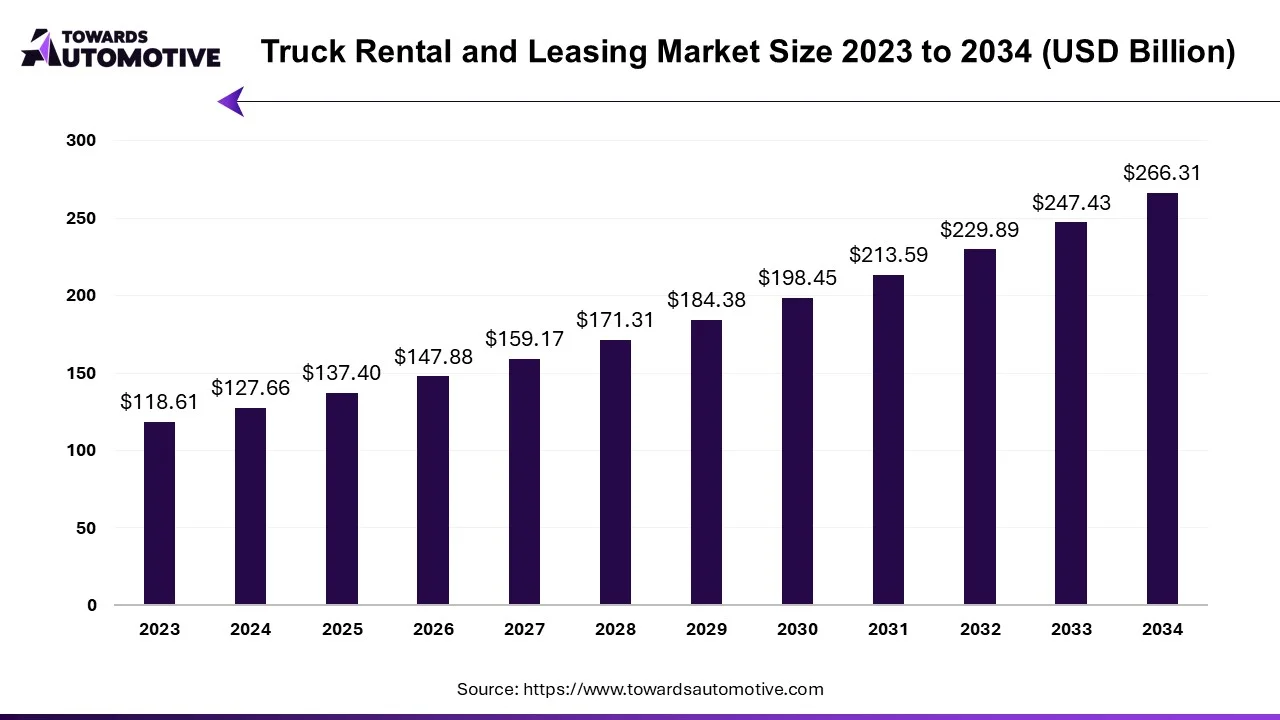

The truck rental and leasing market is expected to grow from USD 137.4 billion in 2025 to USD 266.31 billion by 2034, with a CAGR of 7.63% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

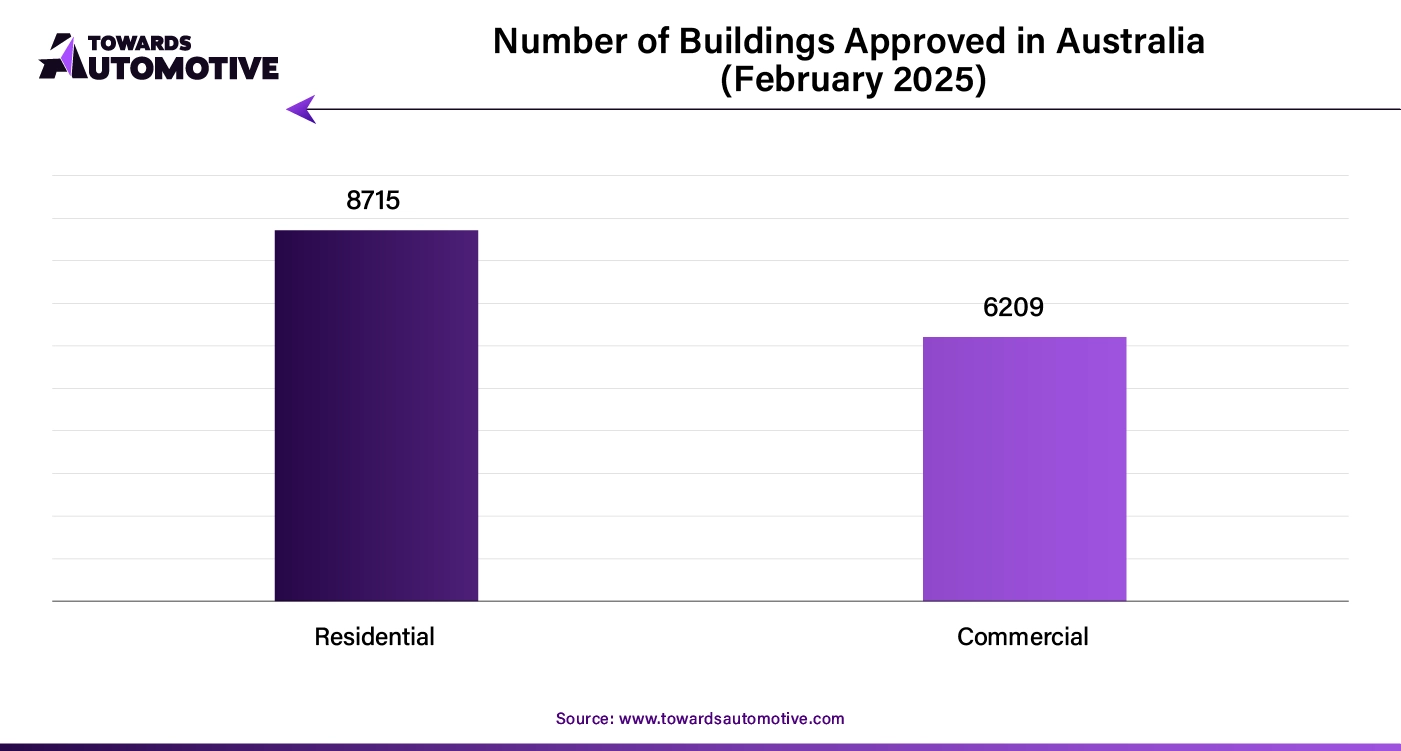

The truck rental and leasing market is a prominent segment of the automotive industry. This industry deals in providing truck rental and leasing services across the world. There are various trucks used in this industry consisting of light duty trucks, medium duty trucks and heavy-duty trucks. Some of these trucks are powered by traditional fuels while others run on electric propulsion system. These services are provided by numerous service providers consisting of rental and leasing companies, OEM captives, third-party service providers and some others. The growing number of construction activities around the world has boosted the industrial expansion. This market is expected to grow significantly with the growth of the automotive leasing sector in different parts of the globe.

In December 2024, Paul Ward, the Director of Shelbourne Motors, announced that, “This £800k investment in SVRgo underlines our commitment to innovation and excellence, enabling us to provide tailored vehicle rental solutions that cater to the diverse needs of international tourists and business clients.”

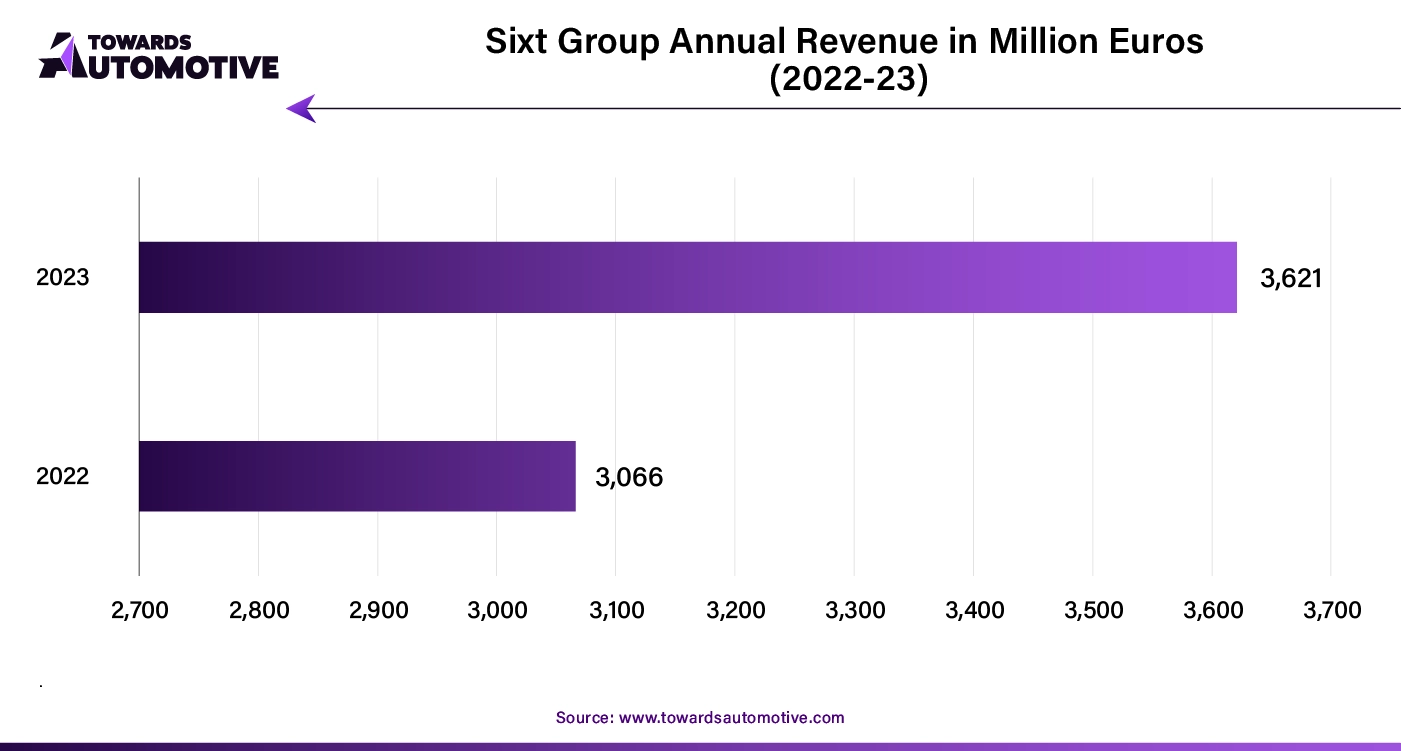

The truck rental and leasing market is a matured industry with the presence of several dominating players. Some of the prominent companies in this industry consists of U-Haul, Sixt, Idealease Inc., PACCAR Leasing Company, Amerco, Cruise America, PEMA, Ryder, Thrifty and some others. These market players are continuously engaged in providing truck rental and leasing services and adopting several strategies such as launches, collaborations, partnerships and some others to maintain their dominance in this industry.

By Truck

By Duration

By Propulsion

By Service Provider

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us