December 2025

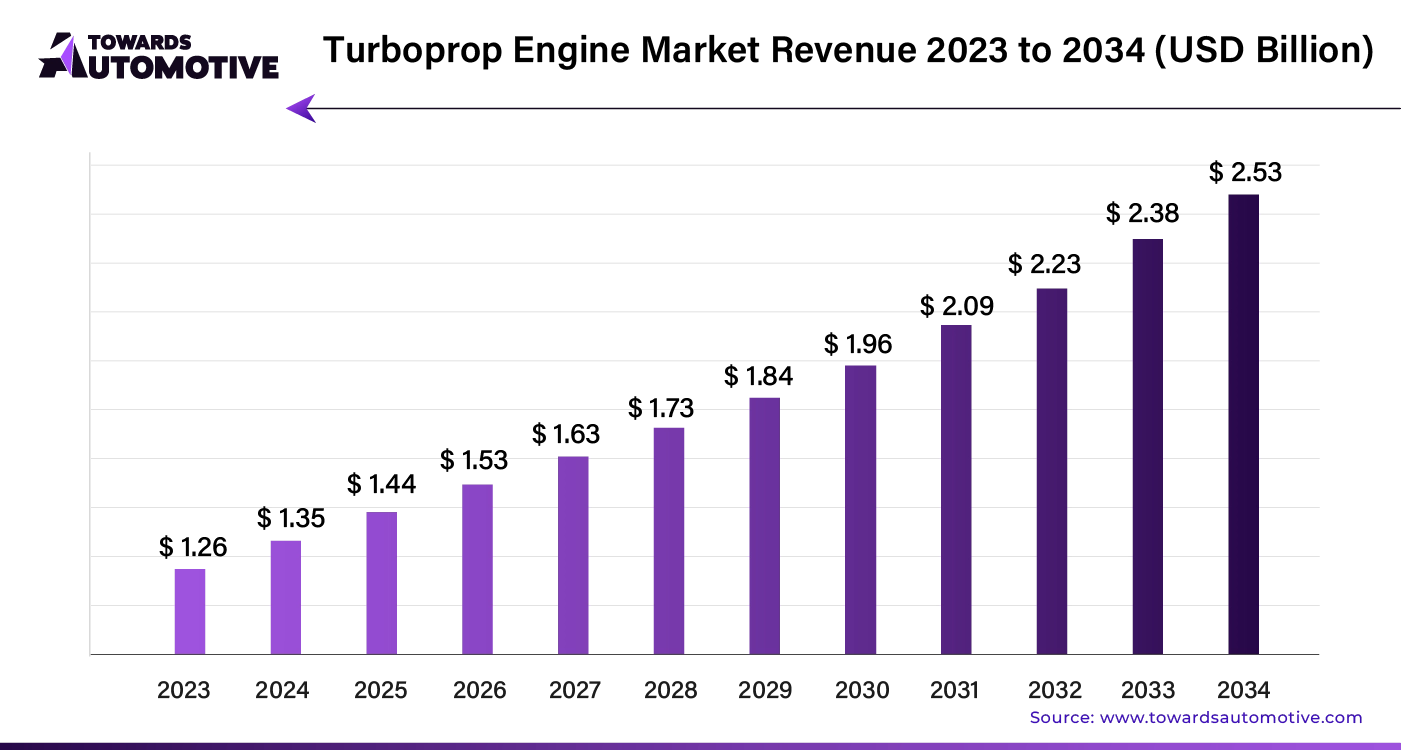

The global turboprop engine market is forecast to grow at a CAGR of 6.5%, from USD 1.44 billion in 2025 to USD 2.53 billion by 2034, over the forecast period from 2025 to 2034.

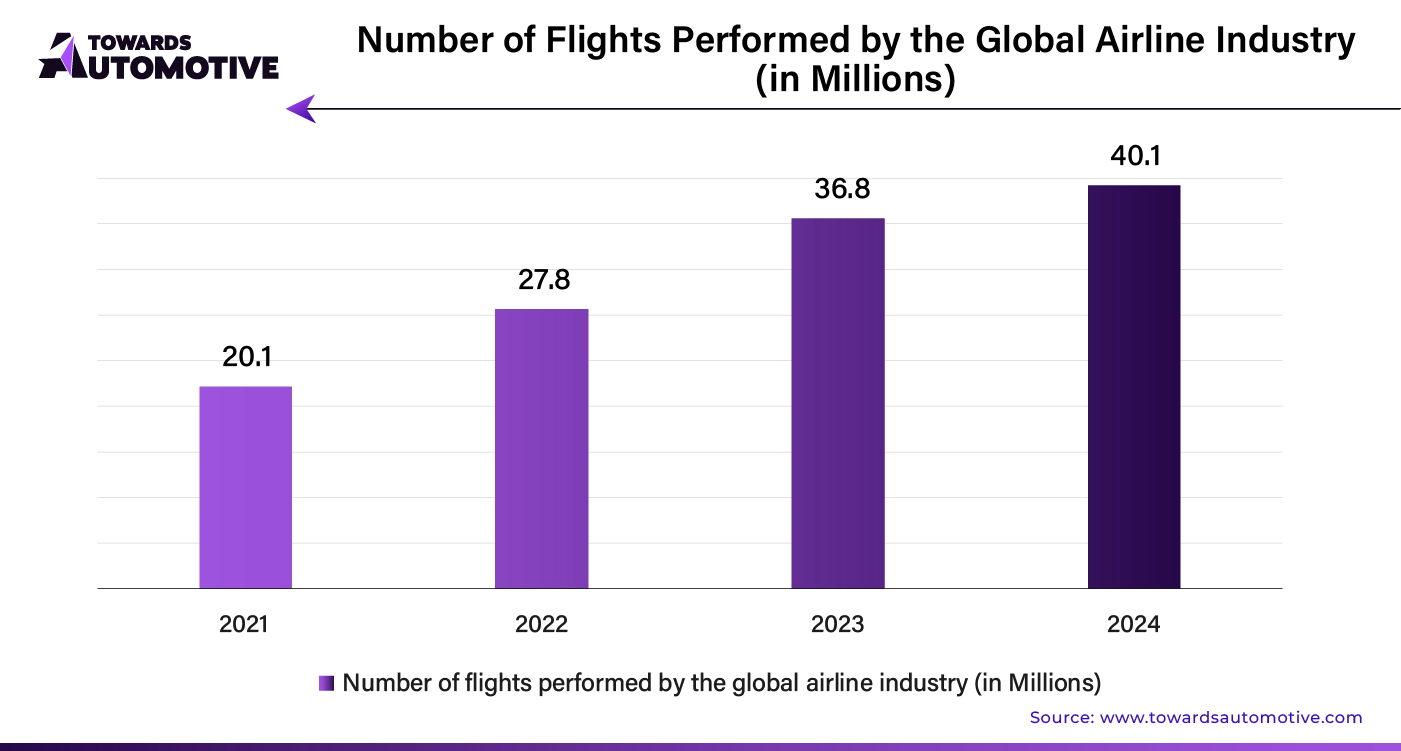

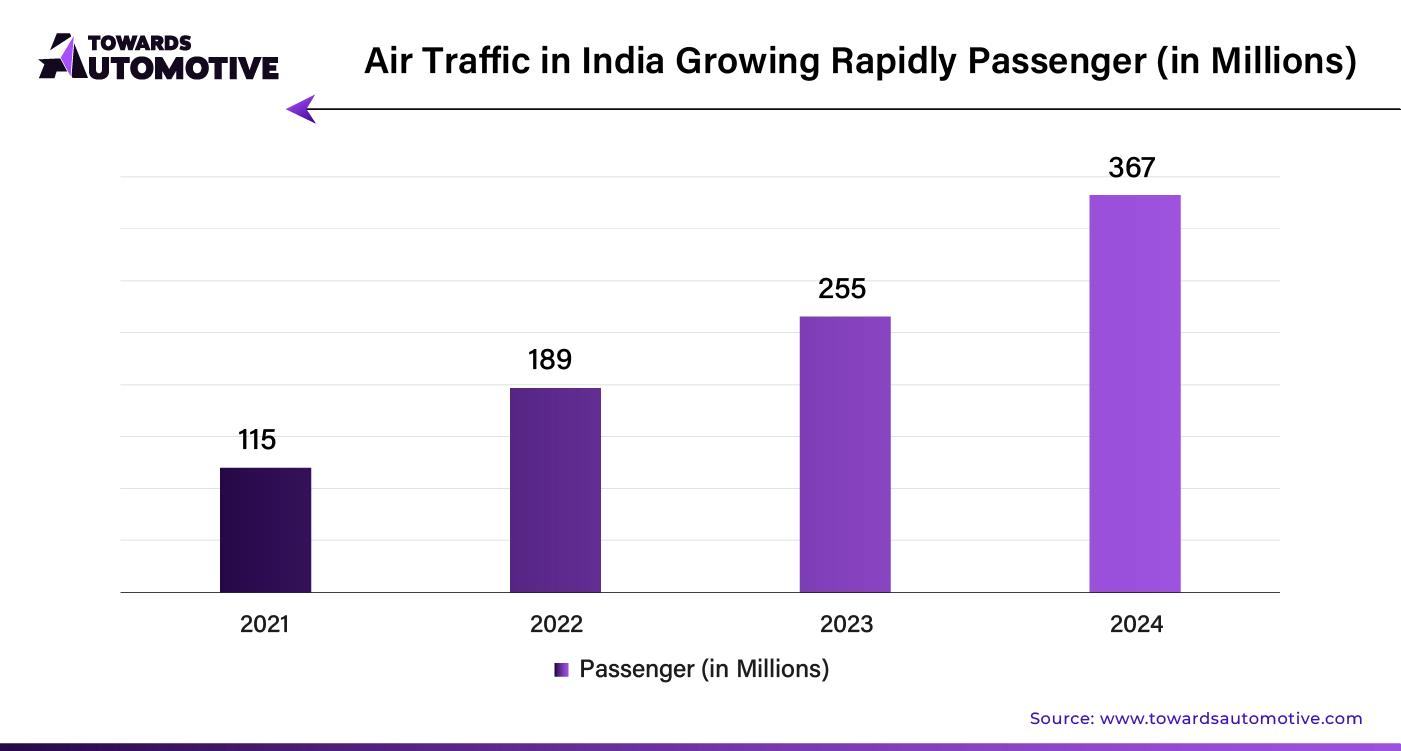

The airline sector is experiencing rapid growth, driven by rising urbanization and increasing passenger traffic. As air travel becomes an increasingly efficient mode of transportation, the industry is poised for significant expansion by 2034.

In parallel, the military sector is seeing a surge in demand for advanced engines and cutting-edge technology. Turboprop engines, known for their efficiency in low-altitude flying and short-distance travel, are particularly valuable because they require minimal space for takeoff and landing. This efficiency makes them an attractive option for both military and civilian applications.

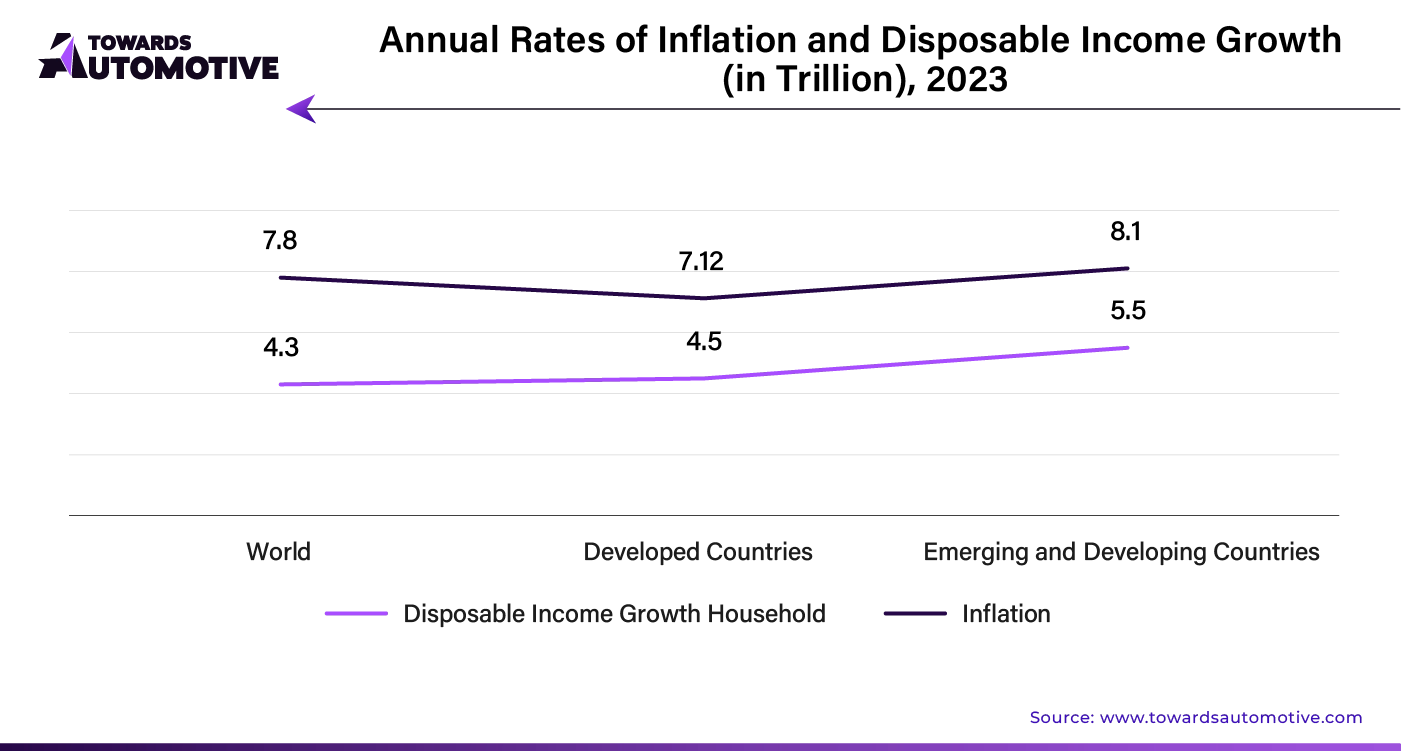

Manufacturers of turboprop aircraft are responding to the growing demand by developing new models equipped with innovative avionics and performance technologies. The rising disposable income among consumers is driving interest in private travel, which in turn is boosting the procurement of turboprop aircraft. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

A notable example of this trend is Diamond Aircraft's selection of the PT6A-25C engine for its new DART-750 aircraft, a cutting-edge all-carbon fiber tandem turboprop trainer announced by Pratt & Whitney Canada in January 2023. This choice highlights the increasing demand for new turboprop aircraft, particularly within the general aviation segment, and underscores the drive for innovation in turboprop engines.

Operators are also seeking cost-effective solutions due to rising fuel prices and environmental concerns. Turboprop engines offer a practical answer, delivering both operational efficiency and lower emissions. Additionally, these engines are extensively used in military aircraft for roles such as transport, surveillance, and maritime patrol, further fueling demand. The defense sector’s investment in upgrading fleets to enhance capabilities and performance is driving this trend.

Sustainability is a key priority for the aviation industry, with turboprop engines offering low carbon emissions and reduced noise levels. The International Air Transport Association (IATA) has set ambitious goals, with member airlines committed to achieving net-zero carbon emissions by 2050. This commitment to sustainable aviation presents a significant opportunity for turboprop engines, positioning them as a green alternative and appealing to environmentally conscious consumers.

Advancements in Manufacturing Techniques Create New Opportunities

Turboprop engine manufacturers are leveraging innovative materials such as composites, titanium alloys, and ceramics to enhance performance and durability while reducing weight. These advanced materials contribute to more efficient and reliable engines. Additionally, new manufacturing techniques like additive manufacturing are allowing for the creation of complex engine components that were previously difficult or impossible to produce. The aviation industry is also seeing growing interest in hybrid-electric and all-electric propulsion systems, which combine traditional turboprop engines with electric motors or generators, offering the potential for more efficient and environmentally friendly flight options.

Regional Air Travel Expansion Fuels Demand

Turboprop aircraft are increasingly favored for regional connectivity and short-haul flights due to their low operating costs and ability to operate from smaller airports with limited infrastructure. As emerging markets experience a surge in air travel demand, there are substantial opportunities for turboprop engine manufacturers to supply engines for new aircraft and expanding fleets. This growth in regional air travel is driving increased demand for turboprop engines, as airlines seek cost-effective solutions for serving underserved routes.

Military Adoption Boosts Turboprop Engine Sales

In the military sector, turboprop engines are gaining traction due to their versatility in reconnaissance, surveillance, cargo transport, and special missions. Recent developments include the incorporation of active noise cancellation systems and redesigned engine nacelles to enhance cabin comfort and reduce noise. These advancements make turboprop engines more appealing for military applications, contributing to increased sales and investment in this segment.

Competitive Pressure from Jet Engines Challenges Growth

Despite these advancements, turboprop engines face stiff competition from jet engines, particularly in long-haul flights and high-altitude operations. Jet engines offer superior speed, performance, and efficiency at higher altitudes, making them the preferred choice for large aircraft and long-distance travel. Turboprop engines, although improving, still lag behind in power-to-weight ratio, efficiency, and operating range compared to their jet engine counterparts. This competitive pressure is expected to pose a challenge to growth in the turboprop engine sector over the forecast period.

Artificial Intelligence (AI) is set to revolutionize the turboprop engine market by significantly enhancing performance, efficiency, and safety. AI technologies enable advanced predictive maintenance, which helps identify potential issues before they become critical, reducing downtime and maintenance costs. AI-driven analytics optimize engine performance, leading to better fuel efficiency and lower emissions. With real-time data processing, AI systems enhance decision-making in flight operations, improving overall reliability and safety.

AI also facilitates the development of smarter and more adaptive engine control systems. These systems can automatically adjust parameters based on real-time flight conditions, optimizing performance and extending engine life. Additionally, AI-powered simulations and modeling tools accelerate the design and testing phases, enabling faster innovation and more cost-effective solutions.

The integration of AI in turboprop engines not only boosts operational efficiency but also drives market growth by offering enhanced value propositions to customers. As the aviation industry continues to seek advancements in technology, AI will play a crucial role in shaping the future of turboprop engines, making them more reliable, efficient, and responsive to the evolving demands of the market.

The supply chain in the turboprop engine market operates through a seamless network of stages, ensuring that components and engines reach their destinations efficiently. It begins with raw material suppliers who provide essential materials like alloys and composites. These materials are then transported to manufacturers where they are crafted into high-precision engine parts.

Next, these components are assembled into complete turboprop engines by specialized manufacturers. Quality control is a critical step, with rigorous testing ensuring that each engine meets industry standards. Once verified, the engines are distributed through a network of logistics partners who handle transportation to original equipment manufacturers (OEMs) and aftermarket suppliers.

OEMs integrate these engines into aircraft, while aftermarket suppliers focus on maintenance and repair. Throughout the process, coordination between suppliers, manufacturers, and logistics providers is crucial for timely delivery and inventory management. This dynamic system ensures that the turboprop engine market remains responsive to demand and can quickly address any disruptions. By optimizing each stage of the supply chain, the market can achieve operational efficiency and maintain high standards of performance.

Turboprop engines are vital for efficient regional and short-haul flights, combining jet propulsion with propeller efficiency. The main components of a turboprop engine include the gas generator, which comprises the compressor, combustion chamber, and turbine; and the reduction gearbox, which converts turbine power into usable propeller thrust. Additionally, the propeller system and its control mechanisms are crucial for optimizing performance.

Various companies play pivotal roles in this market. Pratt & Whitney Canada, a leading player, is known for its innovative PW100 and PW150 series, which offer high efficiency and reliability. Rolls-Royce contributes with its AE 3007 engine, enhancing performance and fuel efficiency. General Electric’s H-series engines are recognized for their advanced technology and durability.

Other notable contributors include Safran, which provides high-performance engines like the Arriel and Ardiden series, and Honeywell, known for its HTS900 engine, offering enhanced power and fuel economy. Each company's unique technological advancements and engine designs help shape the turboprop engine market, driving growth and innovation across the aviation industry.

The global turboprop engine market is experiencing notable growth, with key players emerging from various countries. By 2034, the market is projected to be significantly influenced by South Korea and the United Kingdom, along with other leading nations. Here's a detailed look at the five top-performing countries in the sector:

Country-wise Growth Projections (2024 to 2034)

The United States is poised for significant growth in the turboprop engine sector, with a CAGR of 6.4%. The country is home to leading manufacturers such as Pratt & Whitney, General Electric, and Garrett, renowned for their reliable and innovative turboprop technologies.

Key factors contributing to this growth include:

China is emerging as a leading market for turboprop engines, with a steady CAGR of 6.8%. The country is strengthening its aviation sector through initiatives like the ‘Made in China 2025’ plan, which aims to boost domestic aerospace capabilities.

Notable factors include:

The United Kingdom is expected to hold a significant market share by 2034. The UK's growth is driven by its commitment to sustainability and collaboration with international aerospace companies.

Key drivers include:

Single Shaft Engines Lead the Charge with Growing Demand for Efficiency

In 2023, single shaft engines held a substantial 62% of the market share. This prominence reflects their notable efficiency, rapid response, and cost-effectiveness. These engines are preferred for their ability to deliver high performance through a direct mechanical connection between the gas generator and the propeller. This design reduces energy losses, converting fuel energy directly into power. Consequently, single shaft engines are highly efficient, providing better fuel economy and lower operating costs. Their swift response to throttle adjustments also enables precise control of propeller speed and thrust, enhancing their overall appeal.

Electric and Hybrid Engines Surge Ahead with the Rise of Air Taxis

The electric and hybrid engine segment, capturing 57% of the market share in 2023, is witnessing significant growth. This technology's advancement is driven by its potential to transform the aviation sector with increased efficiency and reduced emissions. Electric and hybrid engines are especially beneficial for general aviation, offering quiet operation, environmental advantages, and reduced operating costs. These engines are gaining momentum in emerging applications such as personal transportation, air taxis, and aerial photography, which are contributing to their expanding demand. The shift towards electric and hybrid technology reflects a broader trend towards sustainable and innovative aviation solutions.

Industry Insights and Recent Developments in Aircraft Engine Manufacturing

The aircraft engine manufacturing sector is currently dominated by major original equipment manufacturers (OEMs) such as Pratt & Whitney, Rolls-Royce Plc, General Electric, Honeywell International Inc., and Heron Engines. These key players hold significant sway in the industry, largely due to long-term contracts that create barriers for smaller companies and startups. The competitive landscape is heavily influenced by these industry giants, who leverage their substantial resources, research capabilities, and extensive distribution networks to maintain their market dominance.

To stay ahead, leading manufacturers are investing heavily in research and development, focusing on unique technologies, automation, and artificial intelligence (AI). These investments are expected to enhance production capacity and drive growth within the sector. Companies are also emphasizing product differentiation and technological innovation, striving to offer high-quality products that meet evolving customer demands and stringent regulatory standards. Many are forming strategic partnerships with research institutions and universities to gain a competitive edge and drive further advancements.

By Type

By Application

By Technology

By Region

December 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us