March 2025

Senior Research Analyst

Reviewed By

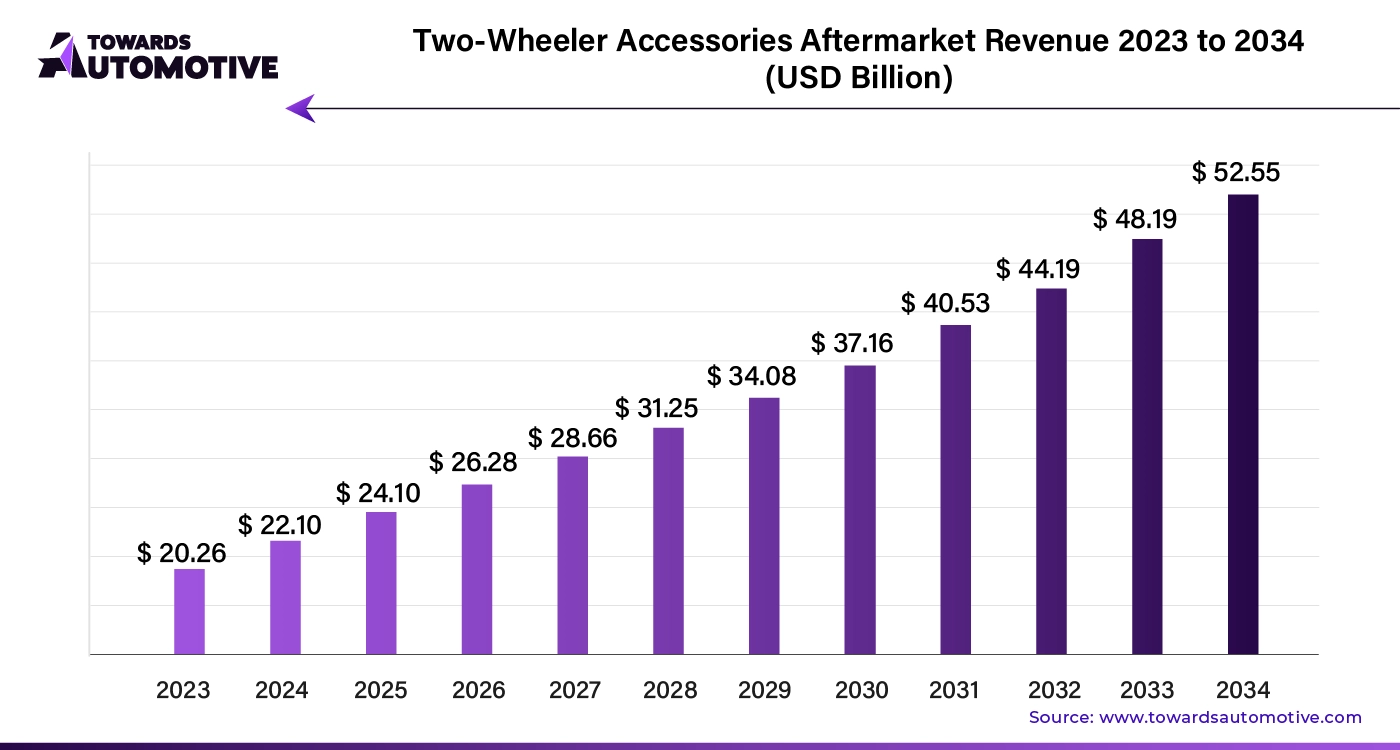

The global two-wheeler accessories aftermarket size is calculated at USD 22.10 billion in 2024 and is expected to be worth USD 52.55 million by 2034, expanding at a CAGR of 9.05% from 2024to 2034.

Riders are increasingly customizing their bikes with unique accessories, boosting demand for one-of-a-kind options. High-tech additions like smartphone mounts and GPS systems are becoming popular, enhancing both safety and convenience. Eco-conscious riders are favoring environmentally friendly accessories, such as LED lights and energy-efficient upgrades. There's also a noticeable rise in demand for safety gear, including helmets, gloves, and armored jackets, highlighting the focus on rider well-being. Additionally, online platforms are transforming the aftermarket industry by offering a wide range of choices, easy comparisons, and convenient purchasing options.

The rise in urbanization is boosting the demand for practical two-wheeler accessories, particularly for storage and commuting gear. In developing countries, increasing disposable incomes are fueling accessory sales as more people rely on two-wheelers for daily transportation. Strict safety and emission regulations are also driving the adoption of compliant aftermarket accessories. Additionally, the growing popularity of adventure and off-road biking is creating a strong demand for durable accessories like crash protection, off-road tires, and navigation tools. Collaborations between accessory manufacturers and motorcycle brands are further enhancing market diversity by offering exclusive, brand-specific products that appeal to brand loyalists. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The two-wheeler accessories aftermarket faces significant challenges, particularly from counterfeit and low-quality products that jeopardize rider safety. Price-sensitive customers often choose cheaper options, reducing demand for higher-quality accessories. Adapting to evolving safety and environmental regulations requires ongoing R&D, which increases costs and delays time to market. Ensuring efficient distribution, especially in remote areas, is difficult and impacts product availability. In mature markets, intense competition and product saturation lead to price wars and lower profit margins for manufacturers.

AI is set to revolutionize the two-wheeler accessories market, enhancing both product development and customer experience. By leveraging AI, manufacturers can analyze vast amounts of data to predict consumer preferences, enabling the design of more personalized and innovative accessories. This targeted approach reduces time-to-market and aligns products closely with consumer demands.

AI also plays a critical role in optimizing supply chains, ensuring that inventory levels match market needs, thereby minimizing overproduction and reducing costs. Additionally, AI-driven predictive maintenance tools for accessories like smart helmets and GPS systems can improve safety and performance, further driving consumer interest.

Moreover, AI enhances customer service through chatbots and virtual assistants, offering real-time support and personalized recommendations. This improves customer satisfaction and boosts sales, ultimately fueling market growth. As AI continues to evolve, its integration into the two-wheeler accessories market will become a key driver of innovation and expansion.

The supply chain in the two-wheeler accessories aftermarket operates with precision to meet rising consumer demand. Manufacturers source raw materials directly from suppliers, ensuring quality and cost efficiency. Once the materials arrive, production processes kick into gear, transforming raw inputs into finished accessories.

These finished products then move to distributors and wholesalers, who manage inventory and facilitate the distribution to retail outlets. Retailers, both online and offline, play a crucial role in delivering these accessories to the end customers, offering a range of options that cater to diverse consumer preferences.

Efficient logistics and transportation networks ensure timely delivery, reducing lead times and enhancing customer satisfaction. Technology integration, such as real-time tracking and inventory management systems, further streamlines operations, minimizing delays and optimizing the supply chain's performance. This well-oiled system supports market growth, allowing the two-wheeler accessories industry to adapt quickly to market fluctuations and consumer trends.

The two-wheeler accessories aftermarket thrives on contributions from various companies that specialize in essential components like protective gear, performance parts, and maintenance products. Leading manufacturers produce helmets, riding gloves, and jackets, ensuring rider safety and comfort. Companies like Alpinestars and Dainese dominate this segment with innovative, high-quality gear.

Performance parts manufacturers, such as AkrapoviÄ and Yoshimura, enhance vehicle performance through exhaust systems, air filters, and suspension upgrades. These components are vital for riders seeking to optimize their bikes' power and efficiency.

Additionally, companies like Motul and Castrol contribute to the ecosystem by providing top-tier lubricants and maintenance products, ensuring longevity and smooth operation of two-wheelers.

This collaborative ecosystem, driven by innovation and specialization, caters to diverse rider needs, enhancing both safety and performance in the two-wheeler market.

India Leads the Charge: Two-Wheeler Accessories Aftermarket's Fastest-Growing Powerhouse

India is making waves as the fastest-growing market in the two-wheeler accessories aftermarket, with a remarkable forecasted CAGR of 9.75% from 2023 to 2033. This impressive growth underscores India’s rising importance in the global two-wheeler industry. Several factors drive this expansion, including the country’s increasing urban population, rising disposable incomes, and a strong preference for two-wheelers as a primary transportation mode. The heightened demand for accessories such as safety gear and advanced navigation systems reflects the evolving needs of Indian riders. Government initiatives, shifting consumer preferences, and the growth of e-commerce platforms further boost this trend, positioning India as a key player in the global market.

Germany's Untapped Potential: A New Frontier in Two Wheeler Accessories

Germany, renowned for its precision engineering and strong automobile industry, is emerging as a significant force in the two-wheeler accessories aftermarket. With a projected CAGR of 8.25% by 2033, the German market presents an exciting opportunity for businesses and investors. The country’s commitment to sustainability and environmental consciousness aligns with the increasing demand for eco-friendly and energy-efficient accessories. Germany’s enthusiasm for innovation and technology provides fertile ground for developing smart accessories, safety gear, and connectivity solutions. This trend highlights the untapped potential in Germany’s market, offering a lucrative avenue for those looking to capitalize on the growing demand for high-quality two-wheeler accessories.

United States: Riding the Wave of Growth in Two Wheeler Accessories

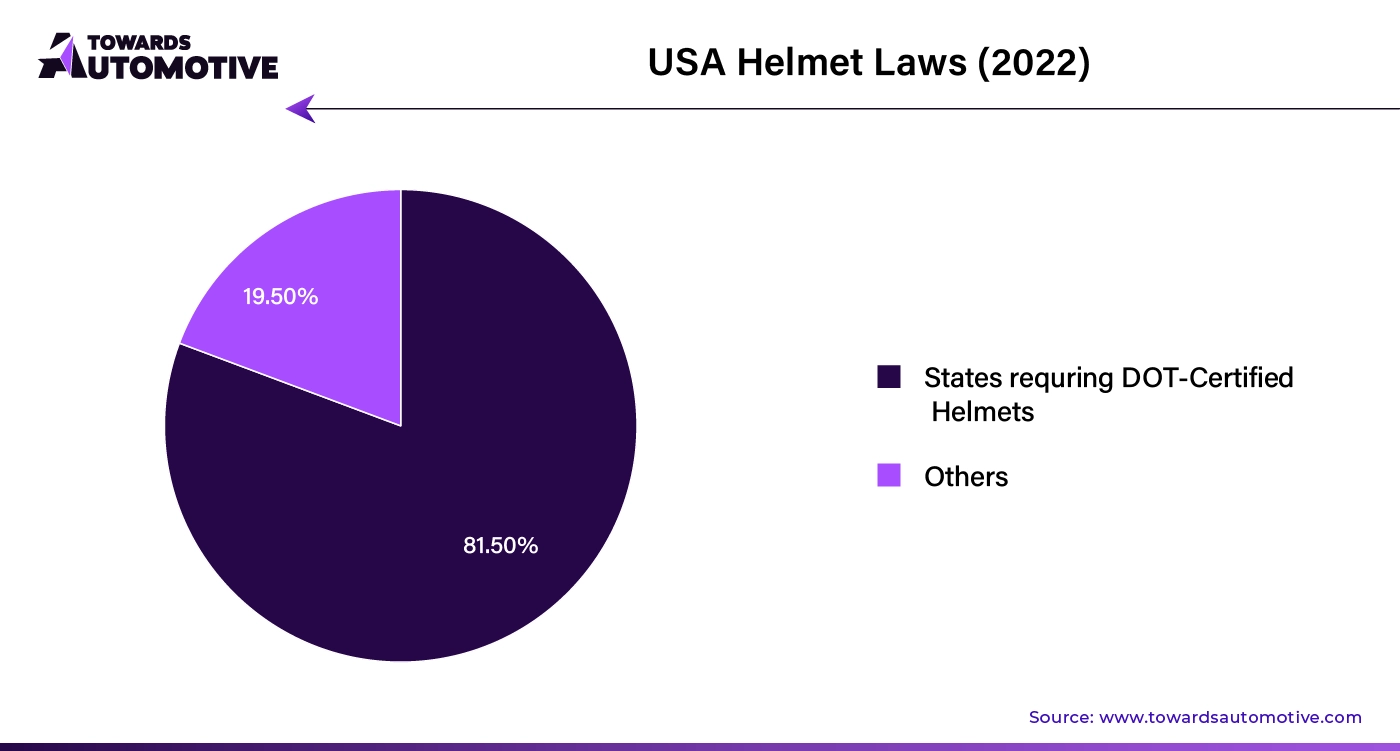

The United States is solidifying its position as a major player in the two-wheeler accessories aftermarket, with a forecasted CAGR of 8.10% by 2033. Urbanization and an increasing focus on eco-friendly transportation are driving the demand for two-wheelers, which in turn boosts the market for related accessories. Businesses should focus on adapting their products to meet the needs of eco-conscious consumers, including enhancements for safety, sustainability, and innovative technology. As the U.S. continues to embrace these trends, it presents a significant yet relatively unexplored market opportunity for those prepared to align their strategies with the evolving landscape.

China: Accelerating Towards a Sustainable Two Wheeler Accessories Market

China, with its growing middle class and increasing disposable incomes, is rapidly emerging as a dominant player in the two-wheeler accessories aftermarket. The country is expected to experience a CAGR of 9.55% by 2033, driven by urbanization and a rising preference for motorcycles and scooters as primary modes of transportation. China’s focus on green technology and sustainability is also boosting demand for eco-friendly accessories, such as energy-efficient modifications and electric enhancements. As China continues to lead in technological advancements, the two-wheeler accessories market presents a promising landscape for businesses and investors looking to tap into this dynamic growth.

Japan: Navigating Challenges in a Growing Two Wheeler Accessories Market

Japan faces a unique challenge in the two-wheeler accessories aftermarket, with a forecasted CAGR of 8.00% by 2033. Despite this potential for growth, the country’s aging population and declining birth rate present risks to long-term economic progress. To address these challenges, Japan must explore strategies such as increasing workforce participation, revising immigration policies, and investing in automation and AI to enhance productivity. By tackling these demographic shifts, Japan can continue to leverage its growth potential and secure its position in the global two-wheeler accessories market, ensuring a prosperous future for the industry.

In the two-wheeler accessories aftermarket, protective gear and standard motorcycles stand out as key segments. The protective gear segment is experiencing impressive growth, with an anticipated CAGR of 29.8% from 2023 to 2033. This upward trend is driven by a growing emphasis on rider safety and increased awareness of the importance of high-quality protective accessories. As riders focus more on safety, the demand for helmets, armored jackets, gloves, and other safety gear is rising. Manufacturers are responding with innovative designs and advanced materials, reinforcing the segment's expansion and highlighting the shift towards responsible riding.

On the other hand, the standard motorcycle segment maintains a substantial market share of 31.0% in 2023. Standard motorcycles remain highly popular due to their versatility, appealing to a broad range of riders for both daily commuting and recreational use. This consistent popularity ensures steady demand for accessories like protective gear, storage solutions, and customization options. Manufacturers are tailoring their products to meet the specific needs of standard motorcycle owners, securing this segment's position as a central component of the aftermarket industry.

The two-wheeler accessories aftermarket is fiercely competitive, with numerous manufacturers and brands constantly innovating to capture market share. This vibrant environment benefits consumers by providing a wide array of choices, driving innovation, enhancing quality, and ensuring affordability.

Motorcycle enthusiasts enjoy an extensive selection of accessories, ranging from safety gear to customization options, tailored to diverse preferences and budgets. The competition in this sector spurs continuous advancements, making the aftermarket dynamic and responsive to evolving rider needs.

Harley Davidson features a premium lineup of motorcycles, including the Street, Sportster, Softail, and Touring series. Their accessory offerings, including riding gear, apparel, and parts, reflect their commitment to quality and style.

Vega Auto Accessories Ltd. offers a broad range of products, including helmets, riding gloves, bike luggage, and safety accessories. Known for innovation, comfort, and durability, Vega caters to various rider needs with high-quality and affordable solutions.

Studds Accessories Ltd. provides a comprehensive selection of motorcycle helmets, riding gear, luggage, and accessories. Focusing on safety, design, and affordability, Studds delivers quality products that combine protective features with stylish design.

By Product

By Two Wheeler Type

By Sales Channel

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us