April 2025

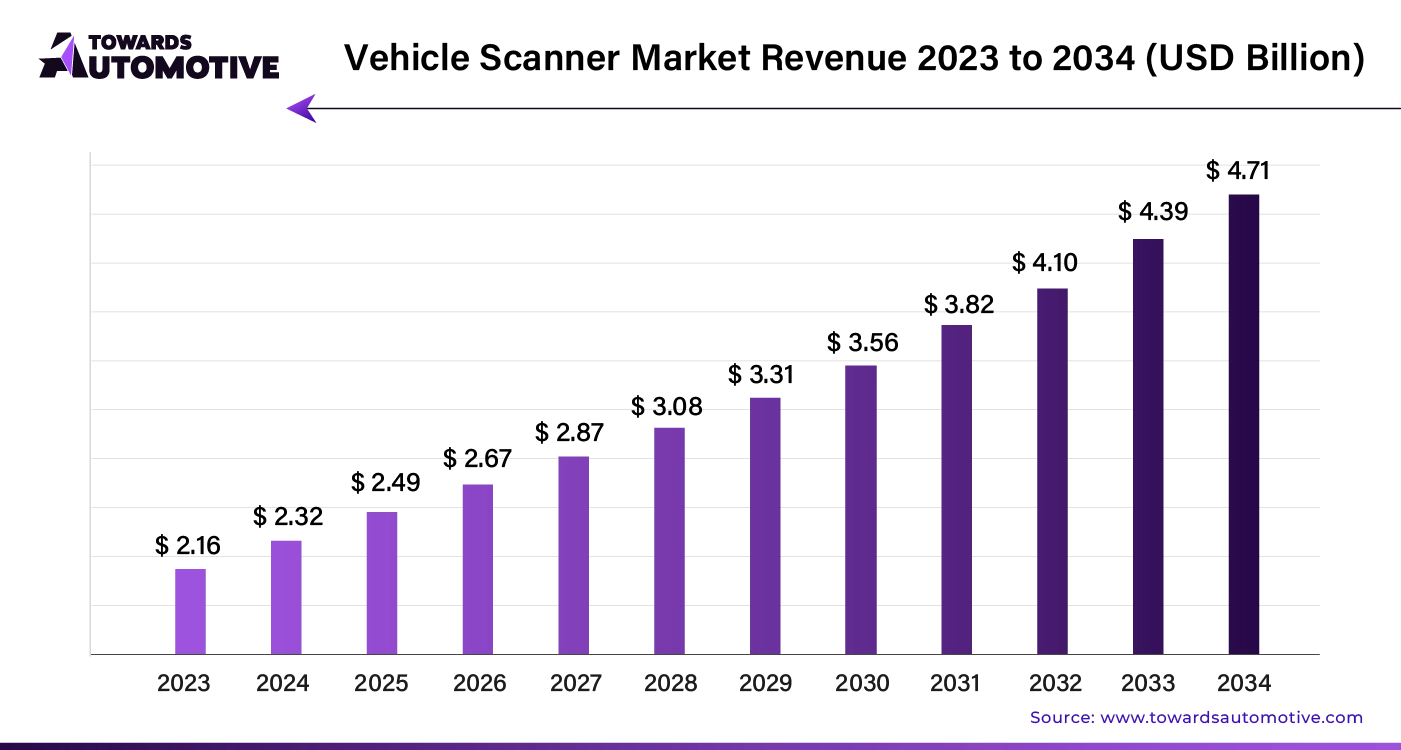

The global vehicle scanner market is forecasted to expand from USD 2.49 billion in 2025 to USD 4.71 billion by 2034, growing at a CAGR of 7.43% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The vehicle scanner industry is expanding rapidly due to several factors. Security concerns are driving the demand for advanced scanning technologies to enhance vehicle safety and performance. Effective screening methods are crucial for border crossings, airports, and other high-security areas. Increased international trade and rising regulatory requirements further boost the market. Additionally, rapid technological advancements continue to propel industry growth.

The vehicle scanner market is expanding rapidly due to the need for effective screening solutions at border crossings, airports, and other high-security areas. Technological advancements are enhancing the speed, precision, and effectiveness of vehicle screening, particularly in high-traffic locations like airports and borders.

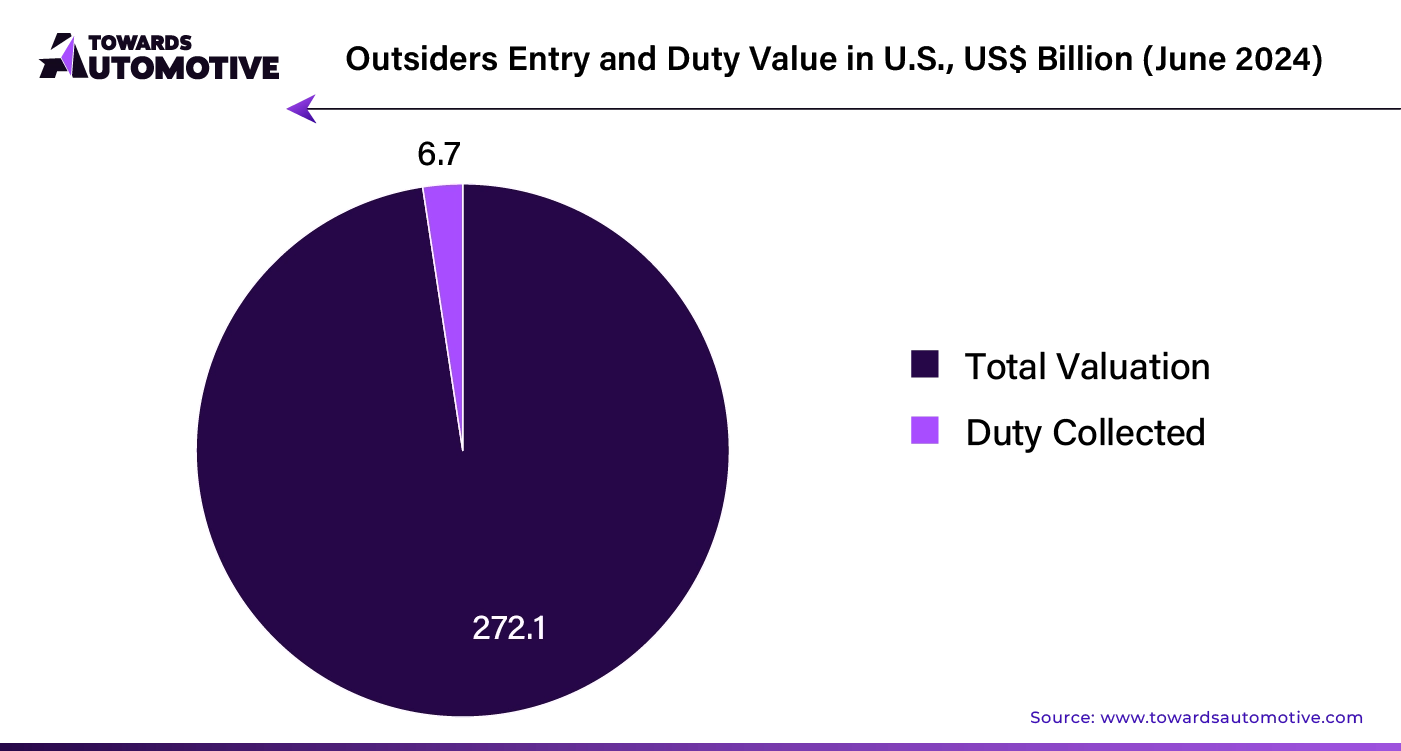

Rising global commerce demands efficient screening methods to ensure the safety of goods transported across borders. Increased regulatory requirements, especially for border security, are boosting the demand for advanced vehicle scanner technology in the fight against terrorism.

Additionally, the growing focus on vehicle safety features is driving automakers to invest in advanced vehicle scanner technology to enhance automobile security. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The automotive industry is increasingly adopting multi-modal scanning technologies, including X-ray, millimeter-wave, and terahertz systems. These technologies are essential for detecting threats such as explosives and weapons hidden in vehicles, thereby enhancing safety and meeting stringent security regulations. This growing emphasis on comprehensive threat detection drives demand for rigid vehicle scanners.

The vehicle scanner market is expanding due to the integration of scanning data into digital security systems for real-time monitoring. Advanced technologies like laser scanning, ultrasonic scanning, and MRI provide detailed vehicle information, aiding in efficient traffic management. The rise of cloud-based systems and IoT technologies further supports market growth by enabling seamless data integration and analysis across platforms.

Artificial Intelligence (AI) is transforming the vehicle scanner market by significantly boosting its growth potential. AI integration enhances scanning accuracy and efficiency, enabling quicker and more reliable detection of vehicle faults and anomalies. With AI, scanners can analyze vast amounts of data in real-time, offering precise diagnostics and predictive maintenance insights. This technology reduces human error and speeds up the scanning process, leading to faster vehicle service and repairs.

AI-powered vehicle scanners also contribute to improved safety standards. They can identify potential issues before they become critical, thus preventing accidents and reducing repair costs. The capability to analyze historical data and recognize patterns further refines the accuracy of diagnostics.

Moreover, AI enhances user experience through intuitive interfaces and personalized recommendations. By leveraging machine learning algorithms, these scanners adapt to various vehicle models and user preferences, providing tailored solutions.

Overall, AI integration in vehicle scanners drives market growth by elevating diagnostic accuracy, operational efficiency, and user satisfaction. This innovation not only meets the increasing demand for advanced vehicle maintenance solutions but also sets a new standard for the industry.

In the vehicle scanner market, an efficient supply chain ensures timely availability and delivery of products. Manufacturers start by sourcing high-quality components from reliable suppliers. These components are then transported to assembly plants, where skilled technicians assemble them into finished scanners. After assembly, the products undergo rigorous quality checks to ensure they meet industry standards.

Once quality assurance is complete, finished scanners are shipped to distribution centers. These centers play a crucial role in managing inventory and facilitating quick responses to market demands. Distribution centers use advanced logistics systems to track inventory levels, predict demand, and streamline order fulfillment.

Retailers and resellers receive the scanners from distribution centers and offer them to end-users. Throughout this process, effective communication and coordination among all parties—manufacturers, suppliers, distribution centers, and retailers—are vital for maintaining smooth operations. Additionally, integrating real-time data analytics helps in anticipating supply chain disruptions and adapting strategies accordingly.

By focusing on these elements, the vehicle scanner market can achieve a responsive and agile supply chain, meeting customer needs efficiently while minimizing delays and costs.

The vehicle scanner market thrives on essential components and the contributions of leading companies. The core elements of vehicle scanners include sensors, cameras, and software systems. Sensors detect various vehicle parameters, while cameras capture detailed images of vehicles. Software systems analyze this data to provide actionable insights, such as vehicle condition or security alerts.

Companies like Bosch, Continental, and Denso play pivotal roles in this ecosystem. Bosch’s advanced sensor technologies enhance vehicle safety and diagnostics. Continental integrates sophisticated imaging and sensor technologies to improve vehicle detection and monitoring systems. Denso contributes with its innovative software solutions, enabling efficient data processing and analysis.

Emerging players like Raspbery Pi and Arduino also impact the market by offering cost-effective, customizable scanning solutions for specific applications. These companies provide platforms for developing and deploying specialized vehicle scanners.

Overall, the vehicle scanner market benefits from a synergy between sensor manufacturers, software developers, and system integrators, each bringing unique technologies to the table. This collaboration drives advancements in vehicle safety, diagnostics, and security.

Portable Vehicle Scanners

Portable vehicle scanners have become the leading choice in the vehicle scanner industry, projected to grow at a CAGR of 7.1% from 2024 to 2034. This is a slight decrease from the 8.7% growth rate observed between 2019 and 2023.

Key factors driving this growth include:

Drive-Through Vehicle Scanners

Drive-through vehicle scanning structures dominate the market, with an expected CAGR of 7.1% from 2024 to 2034. This is slightly lower than the 8.5% growth rate recorded from 2019 to 2023.

Reasons for their prominence include:

This analysis delves into vehicle scanner markets in the United States, China, Japan, South Korea, and the United Kingdom, highlighting factors driving demand and growth projections over the next decade.

United States: Slower Growth Amid Rising Demand

In the United States, the vehicle scanner market is projected to grow at a CAGR of 7.6% through 2034, reaching approximately US$ 825 million. This represents a decrease from the 9.7% CAGR observed from 2019 to 2023, yet the market remains strong. Key drivers include:

United Kingdom: Surge in Fixed Static Vehicle Scanners

The UK vehicle scanner market is expected to expand at a CAGR of 8.4% until 2034, with a projected market value of around US$ 188 million. This follows a robust 12.8% CAGR between 2019 and 2023. Key growth factors include:

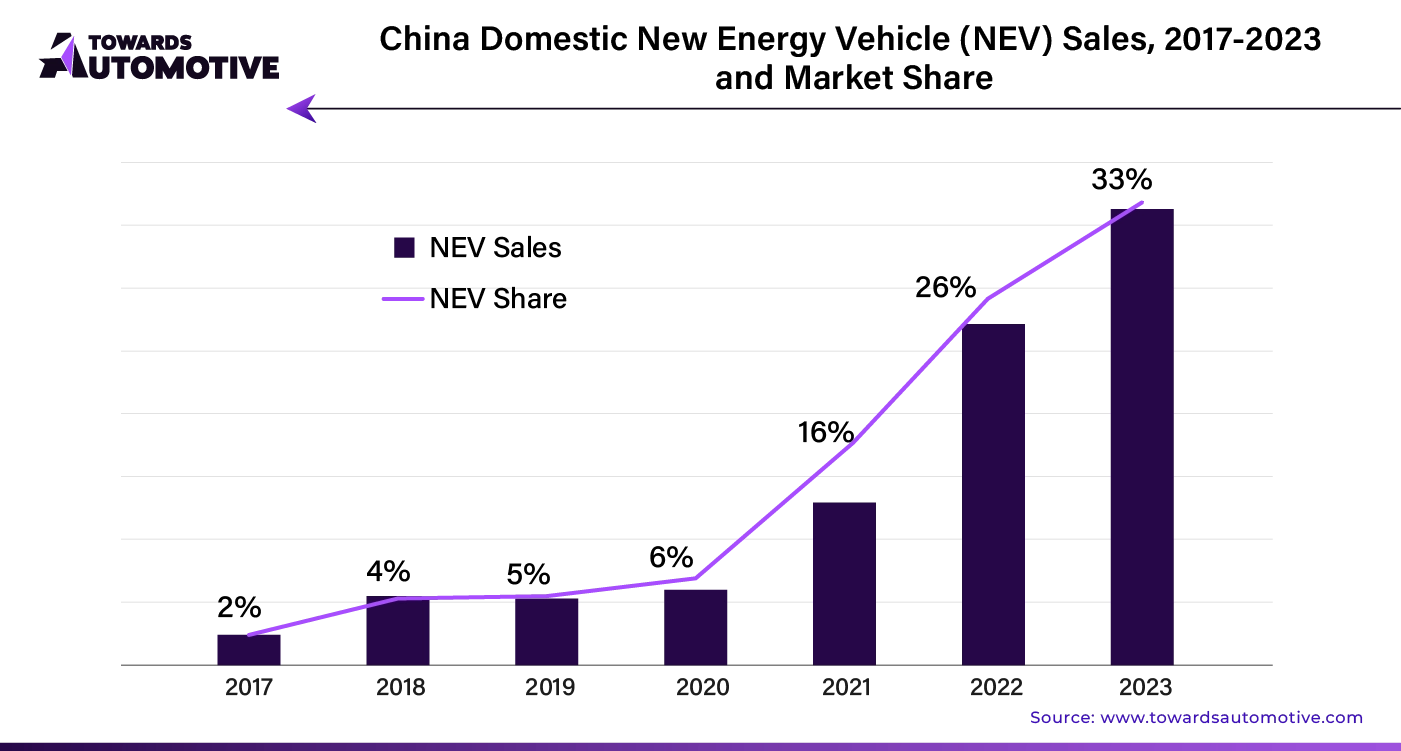

China: Technological Advancements Drive Market Growth

China’s vehicle scanner market is set to grow at a CAGR of 8.0%, reaching approximately US$ 715 million by 2034. This is a slight slowdown from the 11.2% CAGR from 2019 to 2023. Key trends include:

Japan: Rapid Expansion in Advanced Scanning Technologies

Japan’s vehicle scanner market is forecasted to grow at a CAGR of 8.3%, reaching around US$ 485 million by 2034. This follows a 12.7% CAGR from 2019 to 2023. Key drivers include:

South Korea: Accelerated Growth Driven by Technology and Regulation

South Korea’s vehicle scanner market is anticipated to grow at a CAGR of 8.9%, reaching an estimated US$ 290 million by 2034. This is a decrease from the 15.5% CAGR from 2019 to 2023. Key factors include:

The vehicle scanner industry is poised for significant growth over the next decade due to advances in technology, including sensor innovations, artificial intelligence, and machine learning. These advancements will enable the development of more sophisticated and accurate scanning systems.

Manufacturers are focusing on creating scalable and modular systems that seamlessly integrate with existing security infrastructure. Increased collaboration among industry players, research institutions, and government agencies will drive innovation and address new challenges in vehicle scanning technology. Additionally, there is a strong emphasis on sustainability, with a push towards eco-friendly and energy-efficient solutions.

To stay competitive and meet the evolving security demands of the automotive sector, vehicle scanner companies must adapt to technological advancements and changing market needs.

By Scanner Type

By Structure Type

By Application

By Component

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us