April 2025

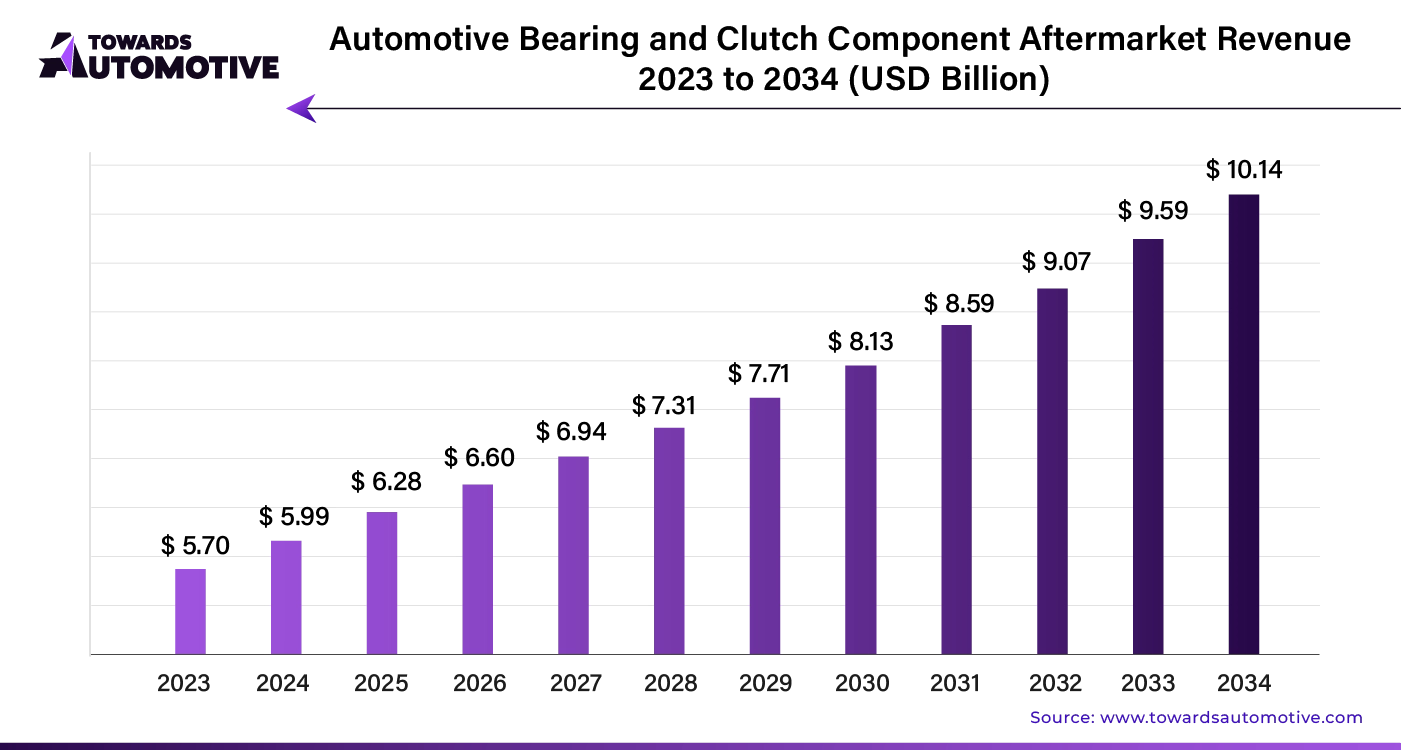

The global automotive bearing and clutch component aftermarket size is calculated at USD 5.99 billion in 2024 and is expected to be worth USD 10.14 billion by 2034, expanding at a CAGR of 5% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive bearing and clutch component aftermarket is experiencing significant growth due to several key factors:

Vehicle Customization Drives Market Growth: Vehicle owners increasingly seek personalized modifications, boosting demand for aftermarket bearings and clutch components.

3D Printing Revolutionizes Production: The integration of 3D printing and additive manufacturing is transforming how bearings and clutches are produced, enabling rapid prototyping and customized solutions.

Electric and Hybrid Vehicles Create New Opportunities: The rising popularity of electric and hybrid vehicles is fueling demand for specialized bearings and clutch components designed for these advanced powertrains.

DTC Sales and Online Marketplaces Expand Reach: Direct-to-consumer sales and the growth of online marketplaces are reshaping the distribution landscape, making it easier for consumers to access aftermarket parts.

Technological Advancements Enhance Performance: Continuous improvements in bearing and clutch technologies are enhancing performance, durability, and efficiency. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

Smart Bearings Gain Traction: The development of smart bearings, equipped with sensors and connectivity features, is gaining popularity for their ability to provide real-time performance data and predictive maintenance.

Preventive Maintenance Interest Surges: Growing awareness of the benefits of preventive maintenance is driving interest in high-quality aftermarket components designed to extend vehicle lifespan and reliability.

North America is set to dominate the global aftermarket for automotive bearing and clutch components throughout the forecast period. By 2033, the region is projected to capture around 47.8% of the global market share. This leadership is attributed to several key factors:

Artificial Intelligence (AI) is transforming the automotive bearing and clutch component market by driving significant growth and innovation. AI technologies enhance predictive maintenance, allowing for real-time monitoring and analysis of vehicle components. This proactive approach reduces downtime and lowers maintenance costs, offering a competitive edge to manufacturers and service providers.

Advanced AI algorithms improve the precision of diagnostics, leading to better performance and longer lifespan of bearings and clutch components. By analyzing large datasets, AI helps in identifying patterns and predicting potential failures before they occur, which boosts overall vehicle reliability.

Moreover, AI-powered design tools facilitate the development of more efficient and durable components. These tools accelerate the design process, optimize material usage, and enhance product performance, catering to the growing demand for high-quality automotive parts.

In addition, AI enhances supply chain management by optimizing inventory levels and improving logistics efficiency. This results in cost savings and faster delivery times, meeting the rising expectations of the automotive industry.

Overall, AI integration in the automotive bearing and clutch component market not only enhances operational efficiency but also drives innovation and market expansion.

In the automotive bearing and clutch component market, an efficient supply chain is crucial for meeting the demands of a rapidly evolving industry. The supply chain begins with raw material suppliers, who provide essential inputs such as high-grade steel and composites. Manufacturers then utilize these materials to produce bearings and clutch components, incorporating advanced technologies to ensure high performance and durability.

Distribution centers play a pivotal role by storing finished products and managing logistics to ensure timely delivery to automotive manufacturers and aftermarket suppliers. These centers rely on real-time inventory management systems to streamline operations and reduce lead times.

Effective supply chain management also involves collaboration with logistics providers to handle transportation efficiently. Companies use data analytics to forecast demand, adjust inventory levels, and optimize routes. By implementing these strategies, the industry can minimize disruptions, reduce costs, and enhance overall supply chain resilience.

Technological advancements, such as AI-driven predictive maintenance and automated warehousing, further boost efficiency, allowing the market to adapt swiftly to changes in consumer demand and industry trends.

The Automotive Bearing and Clutch Component market thrives on contributions from major industry players and their innovative technologies. Key components in this ecosystem include bearings, clutches, and related accessories, which are essential for vehicle performance and safety.

Leading companies like SKF, NTN Corporation, and Timken Company drive market growth through advanced product designs and technology enhancements. SKF specializes in high-performance bearings and offers comprehensive solutions for automotive applications, improving reliability and efficiency. NTN Corporation focuses on high-quality, durable bearings that meet rigorous industry standards, supporting various vehicle types and driving conditions. Timken Company is renowned for its precision bearings and clutch components, enhancing vehicle handling and longevity.

Other notable contributors include Bosch and Valeo, which provide cutting-edge clutch systems and bearings with advanced features. Their products enhance the overall driving experience by ensuring smoother operation and better control.

These companies collectively push the boundaries of automotive technology, creating a competitive and dynamic market landscape. Their continuous innovations and strategic advancements play a crucial role in shaping the future of the Automotive Bearing and Clutch Component market.

Clutch kit components are set to dominate the global automotive bearing and clutch component aftermarket through 2033. These kits, which encompass crucial parts like the clutch disc, pressure plate, and release bearing, provide a comprehensive replacement solution that simplifies maintenance for both vehicle owners and mechanics.

The substantial wear on clutch components and an increasing emphasis on preventive maintenance drive robust demand for clutch kits. Known for their cost-effectiveness and ease of installation, these kits are becoming a preferred choice in the aftermarket. They currently capture a notable market share of approximately 44%.

The automotive bearing and clutch component aftermarket is set for steady growth in the coming years. This market provides a range of parts, including wheel bearings, transmission bearings, and clutch actuators, used for vehicle maintenance, repair, and enhancement.

Aftermarket components offer a cost-effective alternative to original equipment manufacturer (OEM) parts, making them increasingly popular worldwide. They enable car owners to extend vehicle lifespans and enhance performance affordably. This trend is expected to drive market revenue through 2033.

A notable trend is the rising demand for specialized parts for off-road and adventure vehicles. Enthusiasts are seeking heavy-duty wheel bearings, rugged clutch kits, and durable transmission bearings designed for challenging terrains. This reflects a growing interest in off-roading and outdoor activities, prompting manufacturers to invest in robust, advanced components.

The digital transformation of the aftermarket presents significant growth opportunities. E-commerce platforms are crucial, allowing consumers and businesses to easily browse and purchase parts online. Investing in user-friendly websites and digital marketing can help businesses reach a larger audience, enhance brand visibility, and improve customer experience.

Customization and niche markets also offer lucrative opportunities. Consumers increasingly seek personalized solutions for aesthetics, performance, or unique applications. Manufacturers can capitalize on this by offering customized parts and kits for classic cars, off-road vehicles, and electric cars, boosting sales and brand loyalty.

Increasing Vehicle Ownership and Aging Fleet: The growing number of vehicle owners and the aging fleet are significant drivers for the automotive bearing and clutch component aftermarket. As more consumers purchase vehicles and keep them longer, the need for replacement parts like wheel bearings and clutch actuators rises. Older vehicles require more frequent maintenance, fueling steady demand for aftermarket components. Consumers' desire to extend their vehicle's lifespan makes aftermarket parts essential for keeping cars roadworthy and reducing overall ownership costs.

Technological Advancements and Enhanced Performance: Technological advancements and the pursuit of better vehicle performance also drive the aftermarket for automotive bearings and clutches. Modern vehicles feature sophisticated components, including advanced bearings and clutch systems. As consumers seek improved performance, fuel efficiency, and reliability, they increasingly turn to aftermarket parts that offer upgraded features and durability. This trend not only boosts replacement part sales but also opens avenues for companies to offer innovative solutions.

Increased Maintenance and Repair Awareness: Rising awareness about vehicle maintenance and repair significantly impacts the aftermarket. Car owners, fleet operators, and commercial vehicle owners are more conscious of the need for regular maintenance to ensure safety and vehicle longevity. This growing awareness drives demand for high-quality aftermarket parts as replacements for worn-out or faulty components.

Economic Factors and Cost-Effective Repairs: Economic conditions greatly influence the aftermarket for automotive bearings and clutches. During challenging economic times, consumers and businesses often prefer cost-effective repairs over purchasing new vehicles. High-quality aftermarket parts offer a budget-friendly alternative to OEM parts, driving their demand. In periods of economic uncertainty, the aftermarket parts industry tends to experience growth as consumers and businesses prioritize affordable repair solutions.

Counterfeit and Low-Quality Parts

The rise of counterfeit and low-quality automotive parts is a major challenge for the bearing and clutch component aftermarket. These parts, often cheaper, may not meet quality standards, leading to poor performance and safety risks. Counterfeits can undermine consumer trust in aftermarket products, making buyers hesitant to choose non-OEM parts. To tackle this issue, industry leaders and regulatory bodies need to collaborate on enforcing strict quality standards and developing robust detection methods for counterfeit components. Upholding the integrity of the aftermarket industry is crucial for its growth.

Technological Complexity and Diagnostic Hurdles

Modern vehicles are becoming increasingly complex, incorporating advanced technology and electronics. This complexity makes it harder for aftermarket mechanics to diagnose and repair issues effectively. The reliance on specialized diagnostic tools and expertise, often expensive and time-consuming, adds to the challenge. Additionally, some vehicle manufacturers restrict access to their diagnostic software, hindering competition for aftermarket service providers. Addressing this challenge requires investing in training and technology and fostering cooperation between vehicle manufacturers and aftermarket businesses to ensure access to necessary diagnostic resources.

Market Leaders

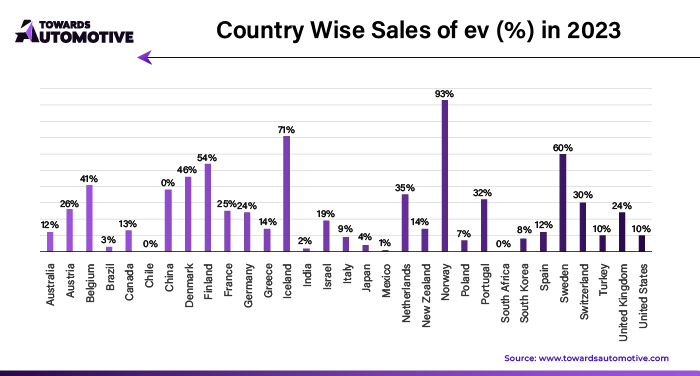

The United States, China, and India are projected to lead the automotive bearing and clutch component aftermarket by 2033. The U.S. is expected to have a market size of approximately $3.6 billion, driven by an aging vehicle fleet, ongoing technological innovations, and a rising trend in DIY repairs. China is anticipated to follow with an estimated $1.34 billion, benefiting from its strong manufacturing base and increasing vehicle ownership. India’s market is predicted to reach about $500 million, supported by the growing commercial vehicle sector and a focus on cost-effective aftermarket solutions.

Fastest-Growing Markets

Among the top markets, South Africa is forecasted to experience the highest growth rate, with a compound annual growth rate (CAGR) of 8.0% from 2023 to 2033. The Nordics will see a robust growth rate of 7.9%, while Poland is expected to grow at a rate of 7.3%. These regions are experiencing notable expansion due to rising automotive demands and technological advancements.

Innovation Driving U.S. Growth

In the United States, growth in the aftermarket sector is heavily influenced by technological innovation. The integration of advanced materials, precision engineering, and smart systems is enhancing the performance of automotive bearings and clutch components. This innovation not only boosts vehicle performance but also meets consumer demands for sustainability and efficiency. The rise of electric and hybrid vehicles is further increasing the need for specialized components.

China's Manufacturing Prowess

China’s leadership in the aftermarket sector is supported by its extensive manufacturing capabilities and growing vehicle ownership. The country’s strong presence of major automotive companies and its focus on high-quality, efficient production bolster its position as a significant player and exporter in the market.

India's Expanding Market

In India, the aftermarket sector is growing due to increased sales of commercial vehicles and the expansion of the logistics industry. Rising economic activity and trade drive the demand for reliable automotive components. Government support and cost-effective solutions further fuel market growth.

In summary, while the United States, China, and India lead the market, South Africa, the Nordics, and Poland are experiencing the fastest growth rates. The U.S. benefits from technological innovation, China excels in manufacturing, and India’s expanding commercial vehicle market drives its growth in the global automotive bearing and clutch component aftermarket.

In the automotive bearing and clutch component aftermarket, clutch kit components emerge as the leading segment. Expected to grow at a notable 5.2% CAGR from 2023 to 2033, clutch kit components are projected to achieve a valuation of USD 4,120.0 million by 2033. These components, which include the clutch disc, pressure plate, release bearing, and alignment tool, play a critical role in the smooth operation of a vehicle's transmission system. Their importance is due to their ability to ensure seamless power transmission and address wear and tear issues in clutch assemblies. The widespread use of manual transmissions worldwide drives ongoing demand for these components, resulting in a significant market share of 44.0%.

Conversely, the vans segment is anticipated to be the fastest-growing vehicle category in the aftermarket, with an estimated CAGR of 4.4% during the same period. By 2033, this segment is expected to reach a valuation of USD 2,420.0 million. The extensive use of vans for various purposes, from urban deliveries to logistics, contributes to their high sales volume and strong demand for aftermarket parts. This segment's growth is fueled by the need for dependable and efficient clutch systems to ensure optimal vehicle performance across different applications.

The global automotive bearing and clutch component aftermarket is moderately fragmented, with top players holding around 25% to 30% of the market share. Leading manufacturers include Bosch, ZF Friedrichshafen AG, AISIN, Valeo, Eaton Corporation Plc, and Aptiv.

These key companies are focusing on innovation to address the shifting demands of the automotive industry. They are developing advanced, lightweight, and high-performance bearings tailored for electric vehicles. Strategies such as mergers, partnerships, distribution agreements, acquisitions, and facility expansions are commonly used to enhance their market presence.

By Product Type

By Vehicle Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us