April 2025

Senior Research Analyst

Reviewed By

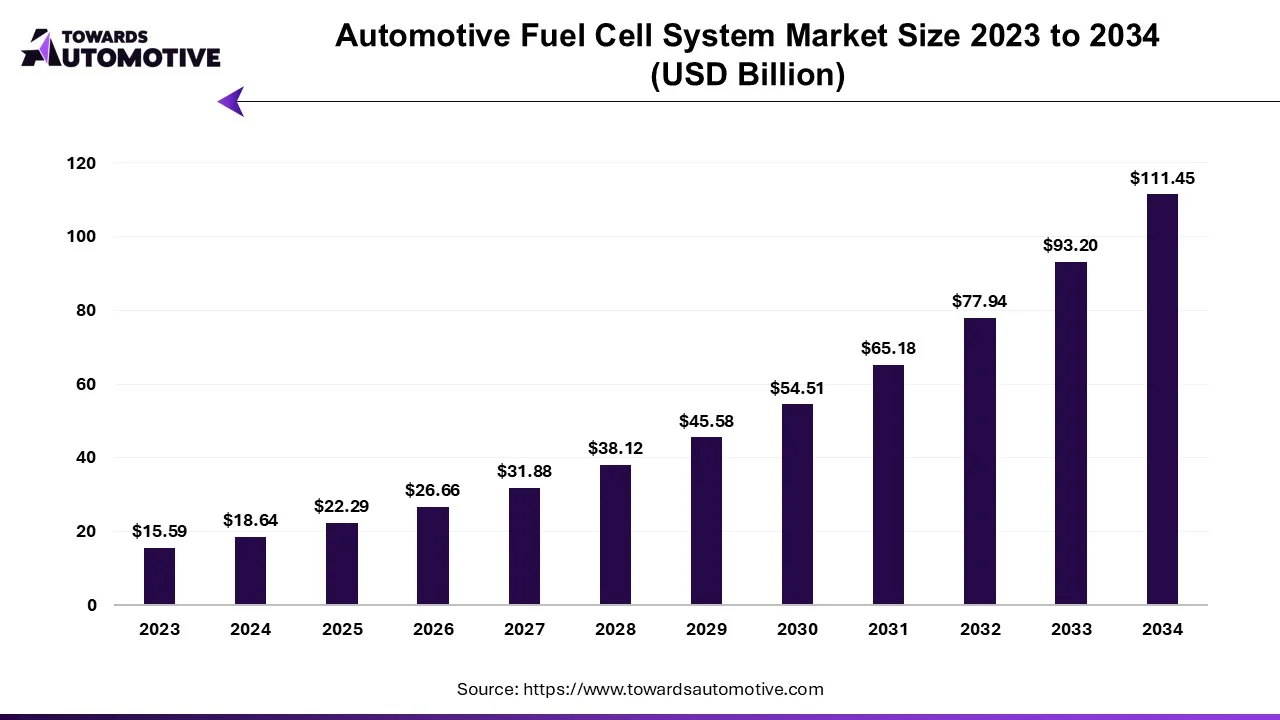

The global automotive fuel cell system market is predicted to expand from USD 22.29 billion in 2025 to USD 111.45 billion by 2034, growing at a CAGR of 19.58% during the forecast period from 2025 to 2034.

The automotive fuel cell system is a clean energy solution revolutionizing the transportation sector by offering an efficient and sustainable alternative to traditional internal combustion engines. It operates by converting hydrogen gas into electricity through an electrochemical process, producing only water and heat as byproducts. This makes fuel cell vehicles (FCVs) environmentally friendly, as they generate zero emissions while delivering long driving ranges and quick refueling times compared to battery electric vehicles (BEVs). The system typically consists of components such as a fuel cell stack, hydrogen storage tanks, and power electronics that work in synergy to provide seamless energy to the vehicle's motor. Increasing concerns over greenhouse gas emissions, rising fossil fuel prices, and global initiatives to curb air pollution have accelerated the adoption of automotive fuel cell technology.

Moreover, advancements in hydrogen production, storage, and refueling infrastructure are addressing key challenges in scaling up this technology. Automakers, including Toyota, Hyundai, and Honda, are spearheading the development of FCVs, driving innovation and market growth. With its potential to combine clean energy with high performance, the automotive fuel cell system is poised to play a pivotal role in achieving a carbon-neutral future in the global automotive industry.

The role of AI in automotive fuel cell systems is highly significant. AI algorithms optimize the fuel cell's operation by predicting energy demand, managing hydrogen consumption, and improving overall power distribution. This ensures the fuel cell stack operates at its peak efficiency, reducing energy losses and extending the system’s lifespan. AI-driven predictive maintenance plays a crucial role by analyzing real-time data from sensors to detect anomalies, predict failures, and schedule proactive maintenance, minimizing downtime and repair costs.

Additionally, AI enhances thermal management by regulating temperature fluctuations within the fuel cell stack, ensuring consistent performance and durability. In hydrogen production and refueling infrastructure, AI helps streamline operations by optimizing hydrogen supply chain logistics, monitoring fuel quality, and managing refueling station networks. Machine learning models also contribute to research and development by simulating complex chemical reactions within the fuel cell, accelerating innovation and material discovery. Automakers leverage AI to integrate fuel cell systems seamlessly with vehicle electronics, improving energy efficiency and driving experience. As AI continues to evolve, its application in automotive fuel cell systems will play a pivotal role in overcoming current limitations and driving the widespread adoption of hydrogen-powered vehicles.

Government initiatives play a pivotal role in driving the growth of the automotive fuel cell system market by providing financial support, policy frameworks, and infrastructure development. Governments across the globe are implementing stringent emission regulations to combat climate change and reduce dependency on fossil fuels. Policies such as subsidies, tax incentives, and funding for research and development encourage automakers to invest in fuel cell electric vehicles (FCEVs). Programs like Japan’s Hydrogen Society Vision and South Korea’s Hydrogen Economy Roadmap are leading examples of how governments are prioritizing hydrogen as a clean energy source. Additionally, the European Union’s Green Deal and the Hydrogen Strategy for a Climate-Neutral Europe aim to accelerate the adoption of hydrogen-based mobility solutions by supporting the development of hydrogen refueling infrastructure.

Financial incentives and investments in building hydrogen refueling stations further address a key challenge hindering FCEV adoption. In China, government-backed initiatives focus on deploying hydrogen-powered buses and trucks, while North America has seen significant funding for hydrogen research and refueling infrastructure. These efforts create a favorable environment for automakers and energy companies to scale up fuel cell technologies. By encouraging innovation, lowering production costs, and fostering partnerships, government initiatives significantly drive the growth and commercialization of automotive fuel cell systems.

The growth of the automotive fuel cell system market faces several restraints, including high production costs, limited hydrogen refueling infrastructure, and challenges in hydrogen storage and transportation. Fuel cell technology, particularly components like fuel cell stacks and hydrogen tanks, remains expensive due to the use of costly materials such as platinum-based catalysts. Additionally, the lack of a widespread hydrogen refueling network limits the adoption of fuel cell vehicles, particularly in developing regions. Hydrogen production and transportation also pose logistical and economic challenges, especially for green hydrogen. These factors, combined with competition from battery electric vehicles, hinder the large-scale commercialization of automotive fuel cell systems.

The growing adoption of Fuel Cell Electric Vehicles (FCEVs) is a key driver of opportunities in the automotive fuel cell system market. As governments worldwide impose stricter emission regulations and work towards carbon neutrality, FCEVs provide a viable solution for reducing greenhouse gas emissions while meeting the demand for longer driving ranges and shorter refueling times. Unlike traditional internal combustion engine (ICE) vehicles, FCEVs are powered by hydrogen, producing only water vapor as a byproduct, making them a clean alternative to battery electric vehicles (BEVs) in the quest for sustainable transportation.

The increasing adoption of FCEVs in both passenger and commercial segments, particularly in regions like Europe, Asia Pacific, and North America, is creating significant demand for advanced automotive fuel cell systems. Automakers such as Toyota, Hyundai, and Honda are leading the charge by introducing fuel cell-powered cars like the Mirai, Nexo, and Clarity, while also expanding their production capacity. The rise in commercial FCEV applications, including hydrogen-powered buses, trucks, and delivery vans, further fuels demand, as these vehicles require high-performance fuel cell systems capable of supporting long-range, heavy-duty operations.

Additionally, the growing adoption of FCEVs is directly associated with the development of the hydrogen refueling infrastructure. As more vehicles hit the road, the need for refueling stations increases, prompting investments in hydrogen fueling networks. This, in turn, drives innovation in hydrogen storage, transportation, and production technologies. The broadening adoption of FCEVs not only stimulates the demand for fuel cell systems but also encourages greater collaboration across industries, accelerating the growth of the automotive fuel cell system market in the coming future.

The PEMFC segment led the industry. The Proton Exchange Membrane Fuel Cell (PEMFC) segment plays a crucial role in driving the growth of the automotive fuel cell system market due to its high efficiency, compact design, and versatility. PEMFCs are particularly well-suited for automotive applications as they operate at relatively low temperatures, enabling quick start-up times and optimal performance in dynamic driving conditions. This makes them ideal for passenger cars, buses, and light commercial vehicles. The technology’s ability to provide high power density and consistent energy output meets the demands of modern vehicles, supporting long driving ranges and shorter refueling times compared to battery electric vehicles. Advancements in PEMFC technology, such as improved membrane durability, cost-effective catalysts, and enhanced fuel cell stack performance, are further reducing manufacturing costs, making fuel cell vehicles (FCVs) more commercially viable. Additionally, automakers like Toyota, Hyundai, and Honda are leveraging PEMFCs to develop efficient and reliable hydrogen-powered vehicles, accelerating market adoption. The growing investment in hydrogen refueling infrastructure and green hydrogen production further supports the widespread deployment of PEMFC-based systems. As governments push for zero-emission transportation solutions to meet climate goals, the PEMFC segment’s ability to deliver clean, efficient, and scalable energy solutions positions it as a key driver of automotive fuel cell system growth.

The passenger cars segment dominated the market. The passenger car segment is a significant driver of the automotive fuel cell system market, fueled by increasing demand for zero-emission vehicles and advancements in hydrogen fuel cell technology. With growing concerns about climate change and stringent emission regulations worldwide, fuel cell electric vehicles (FCEVs) offer an environmentally friendly alternative to traditional internal combustion engine (ICE) vehicles. Passenger cars powered by fuel cell systems provide long driving ranges, quick refueling times, and high energy efficiency, addressing key limitations of battery electric vehicles (BEVs). Leading automakers, such as Toyota with its Mirai and Hyundai with the Nexo, are pioneering the development and commercialization of fuel cell passenger cars, driving innovation and market adoption.

Government incentives, subsidies, and investments in hydrogen refueling infrastructure are further accelerating the growth of the passenger car segment. Countries across Europe, Asia Pacific, and North America are increasingly promoting hydrogen-powered vehicles to meet decarbonization goals. Additionally, advancements in fuel cell stack efficiency, lightweight designs, and cost reduction are enhancing the feasibility of fuel cell passenger cars for mass-market adoption. The rising consumer preference for clean, high-performance vehicles, combined with expanding hydrogen ecosystems, positions the passenger car segment as a major contributor to the growth of the automotive fuel cell system market.

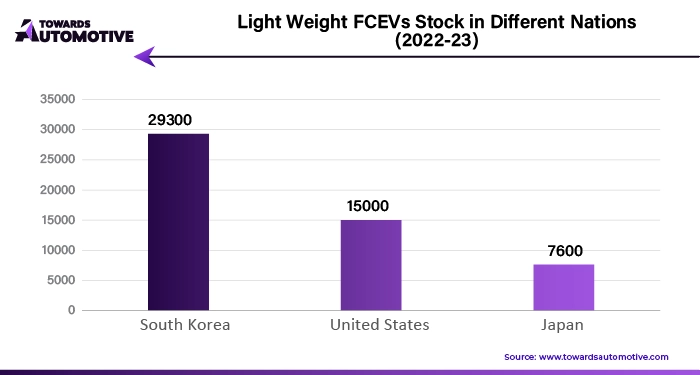

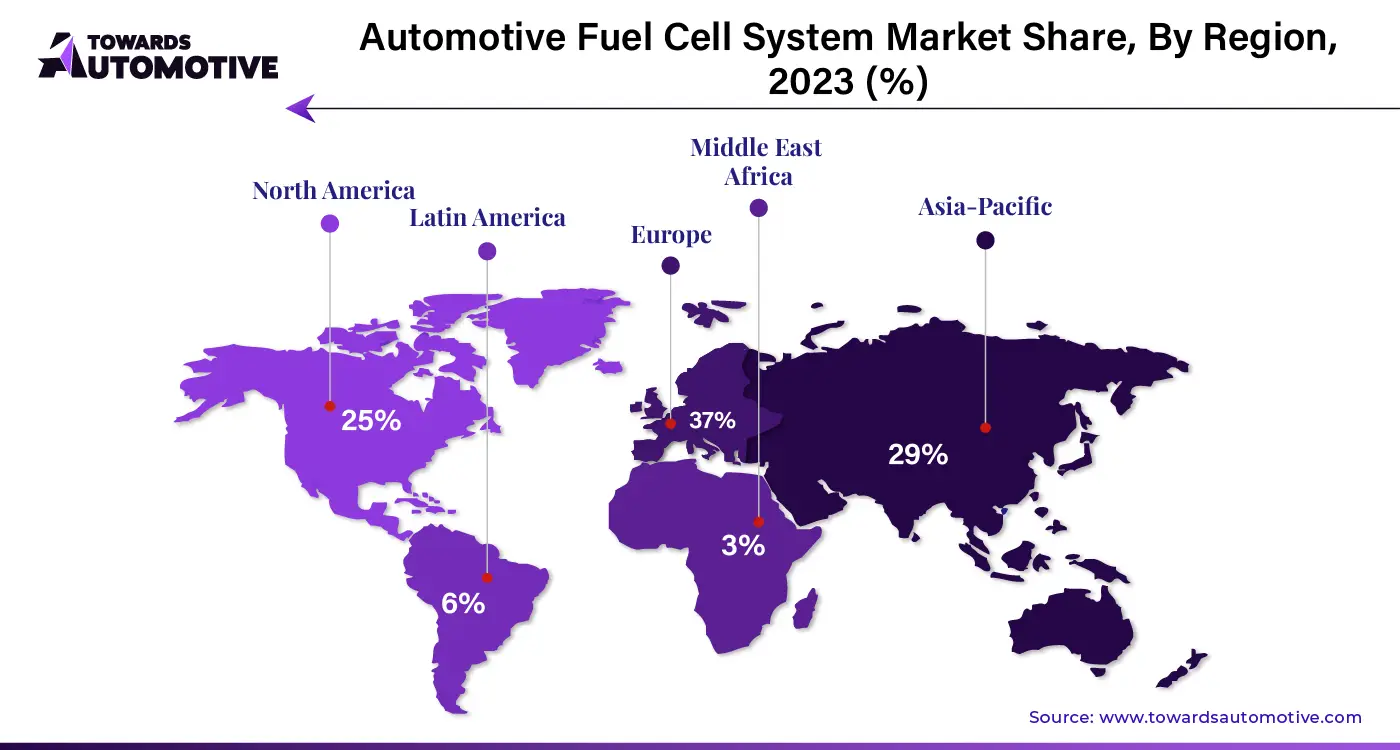

Asia Pacific dominated the automotive fuel cell system market. The growth of automotive fuel cell systems in Asia Pacific is driven by several significant factors, including strong government support, advancements in hydrogen infrastructure, and rising environmental concerns. Leading economies such as Japan, South Korea, and China are actively investing in hydrogen technologies to meet their sustainability goals and reduce carbon emissions. Government initiatives, such as Japan's Hydrogen Society Vision and South Korea's Hydrogen Economy Roadmap, offer subsidies, tax incentives, and policy frameworks to promote hydrogen-powered vehicles and establish a robust hydrogen ecosystem. In China, stringent emission regulations and targets for carbon neutrality by 2060 have encouraged widespread adoption of fuel cell vehicles (FCVs), particularly in commercial fleets like buses and trucks.

Infrastructure development is another key growth driver. Investments in hydrogen production, storage, and refueling stations are accelerating, addressing one of the main barriers to FCV adoption. For instance, South Korea aims to establish thousands of hydrogen refueling stations by 2030. Additionally, automakers such as Toyota, Hyundai, and Honda are advancing fuel cell technology by enhancing efficiency, lowering production costs, and improving performance, making FCVs more commercially viable. Rising demand for clean, long-range vehicles and the push for zero-emission transportation further fuel market growth. The combination of innovation, policy backing, and infrastructure expansion positions Asia Pacific as a leader in the adoption of automotive fuel cell systems.

Europe is expected to grow with a notable CAGR during the forecast period. The growth of automotive fuel cell systems in Europe is driven by strong government policies, investments in hydrogen infrastructure, and increasing focus on achieving carbon neutrality. The European Union (EU) has set ambitious emission reduction targets as part of the European Green Deal and aims to achieve climate neutrality by 2050. This regulatory push encourages the adoption of zero-emission vehicles, including fuel cell electric vehicles (FCEVs). Additionally, governments across Europe offer financial incentives, subsidies, and tax benefits to accelerate the development and deployment of hydrogen-powered vehicles and related infrastructure.

The expansion of hydrogen refueling infrastructure is another major factor propelling growth. Initiatives such as the Hydrogen Strategy for a Climate-Neutral Europe and projects like H2Haul aim to establish a network of hydrogen refueling stations to support FCEV adoption, particularly for heavy-duty and commercial transport. Collaboration between automakers, energy companies, and policymakers is strengthening hydrogen ecosystems, with companies like Daimler, BMW, and Renault investing in fuel cell technology and vehicle production.

Moreover, Europe’s focus on renewable hydrogen production aligns with its sustainability goals. Investments in green hydrogen, produced using renewable energy, enhance the environmental appeal of fuel cell systems. Increasing demand for clean, long-range vehicles, particularly in logistics and public transport sectors, further fuels growth. These factors collectively position Europe as a key region for automotive fuel cell system advancements.

By Type

By Power Rating

By Vehicles

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us