April 2025

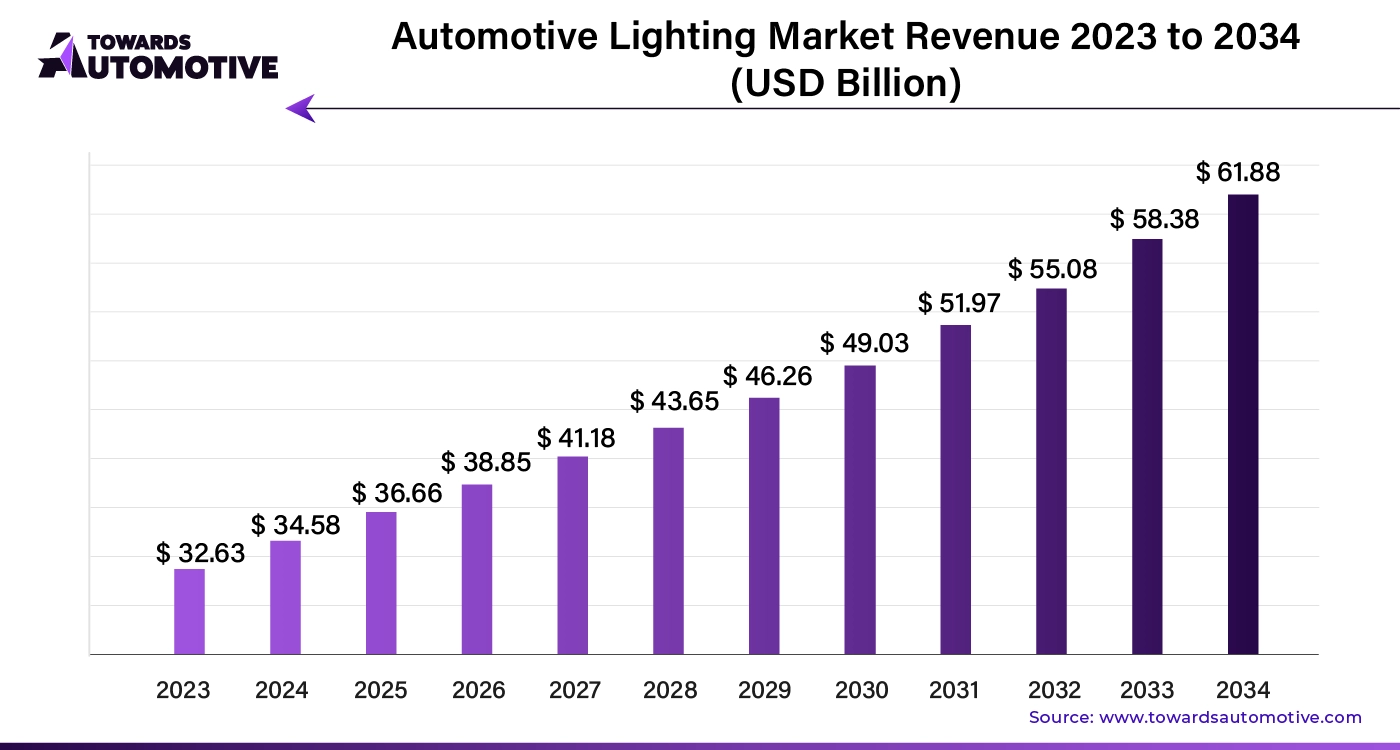

The global automotive lighting market is anticipated to grow from USD 36.66 billion in 2025 to USD 61.88 billion by 2034, with a compound annual growth rate (CAGR) of 5.99% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive lighting market is rapidly evolving as advancements in vehicle technology and growing consumer demand for safety and aesthetics drive innovation. Automotive lighting systems, which include headlights, taillights, interior lighting, and indicator lights, play a crucial role in enhancing visibility, safety, and the overall driving experience. The increasing adoption of LED and OLED technologies is transforming the market, offering energy-efficient, long-lasting, and customizable lighting solutions. These modern lighting systems not only improve visibility for drivers in low-light conditions but also add a distinct, stylish element to vehicle design.

Moreover, stringent government regulations aimed at improving road safety are pushing automakers to integrate advanced lighting systems into their vehicles. Innovations like adaptive lighting, automatic high beams, and matrix LED headlights are gaining traction as they enhance driver visibility and reduce the risk of accidents. The growing popularity of electric vehicles (EVs) is also contributing to the demand for more energy-efficient lighting solutions that align with the overall sustainability goals of the automotive industry.

As automakers continue to focus on vehicle aesthetics, safety, and energy efficiency, the automotive lighting market is expected to witness significant growth. Technological advancements and the increasing integration of intelligent lighting systems are reshaping the market, offering new opportunities for manufacturers and suppliers to develop cutting-edge lighting solutions for the next generation of vehicles.

In November 2024, Didier Keskas, Head of Business Group Lighting APAC at FORVIA HELLA made an announcement stating that, “This aerodynamic rear wing lighting does not only fulfill innovative functions but also has to withstand the pressure and drag force generated by airflow during high-speed driving, posing even higher requirements to its robustness, durability, and reliability. We are consistently committed to providing high-quality products and services to the automotive market and our customers. This innovative rear lamp further demonstrates our commitment to the Chinese market, representing technological innovation and our relentless pursuit to meet the unique needs of the Chinese market and enhance customer experience."

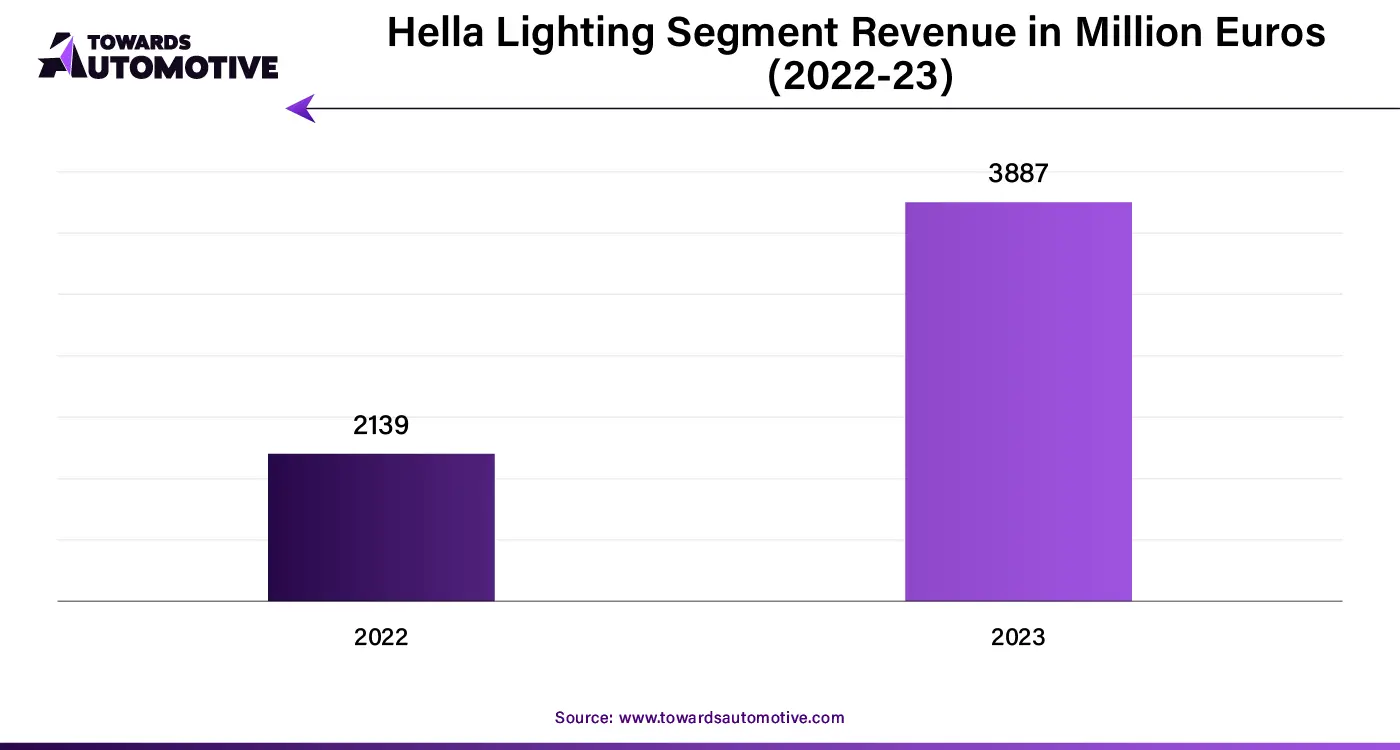

The automotive lighting market is a fragmented industry with the presence of several dominant players. Some of the prominent market players in this industry consists of Sony Corporation, Samsung Electronics, Bosch Sensortec, Texas Instruments Incorporated., Hella, STMicroelectronics and some others. These market players are constantly engaged in developing advanced lighting systems for automotives and adopting numerous strategies such as product launches, partnerships, joint ventures and some others to maintain their dominant position in this industry.

By Vehicle

By Sales Channel

By Application

By Technology

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us