March 2025

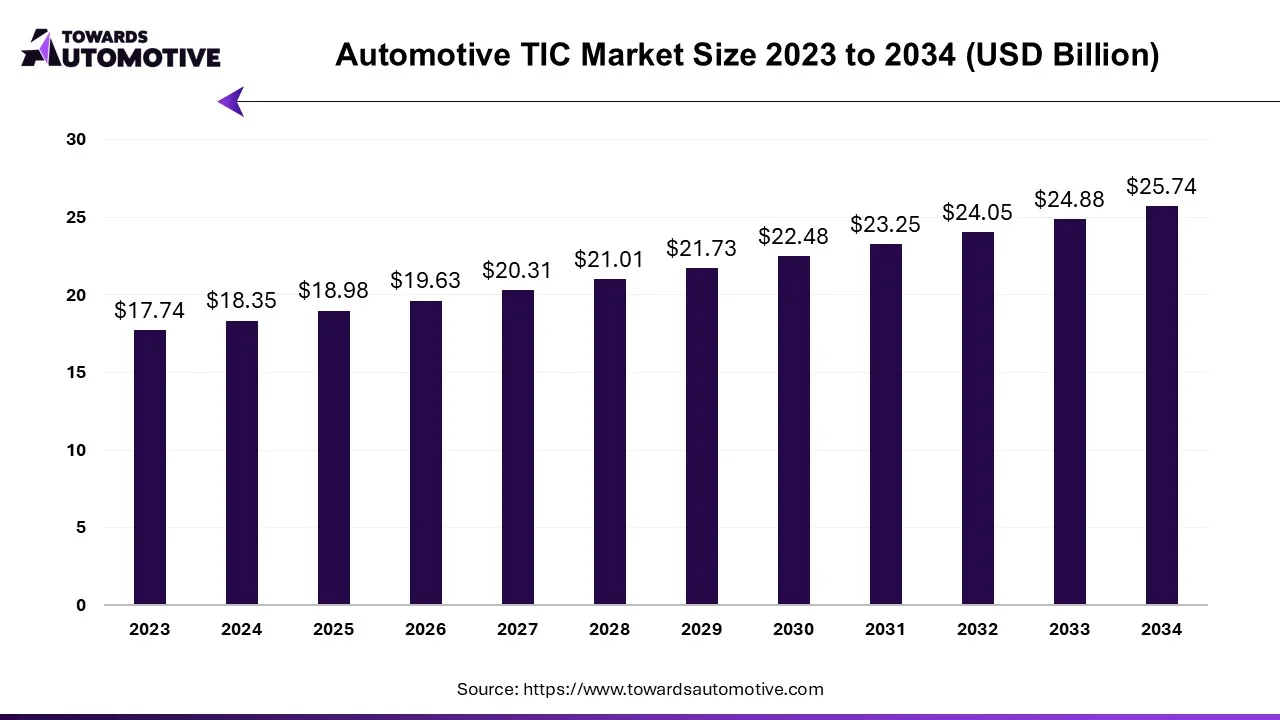

The automotive TIC market is projected to reach USD 25.74 billion by 2034, growing from USD 18.98 billion in 2025, at a CAGR of 3.44% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

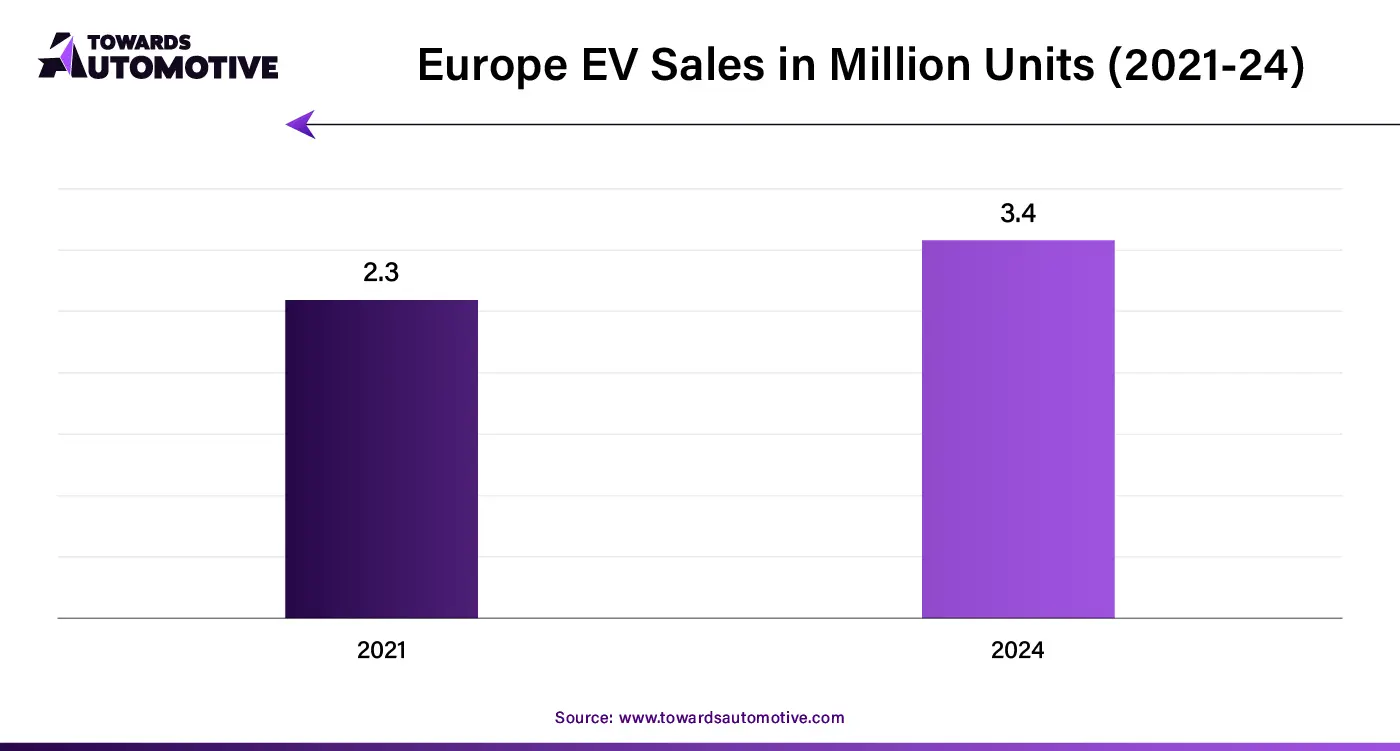

The automotive TIC market is a crucial sector of the automotive services industry. This industry deals in providing TIC services to automotive sector. There are several types of services provided by this sector comprising of testing services, inspection services and certification services. These services are used for inspecting passenger vehicles and commercial vehicles. It is highly adopted by automotive companies to ensure vehicle and component quality, performance, safety and compliance with regulations and standards. The rising sales of electric vehicles in different parts of the world has contributed to the industrial expansion. This market is expected to rise significantly with the growth of the automotive sector across the globe.

In July 2024, Shaju S, the Vice President and Head of the Transportation Business Unit at Tata Elxsi made announcement stating that, “India is emerging as a global hub for next-generation automotive development with the presence of global R&D centers of the entire mobility ecosystem from OEMs to silicon vendors. The shift in vehicle E/E architecture, electrification, and connectivity is driving the need for advanced software development and testing capabilities.”

Asia Pacific held the dominant share of the automotive TIC market. The market is generally driven by the rising investment in automotive sector coupled with the presence of numerous car manufacturing companies in this region. Moreover, the growing demand for luxury cars along with availability of cheap labor and raw materials has driven the industrial expansion. In Asia Pacific, Japan, China, South Korea and India are the major contributors of this industry. The rising sales and production of vehicles has driven the market growth in these nations.

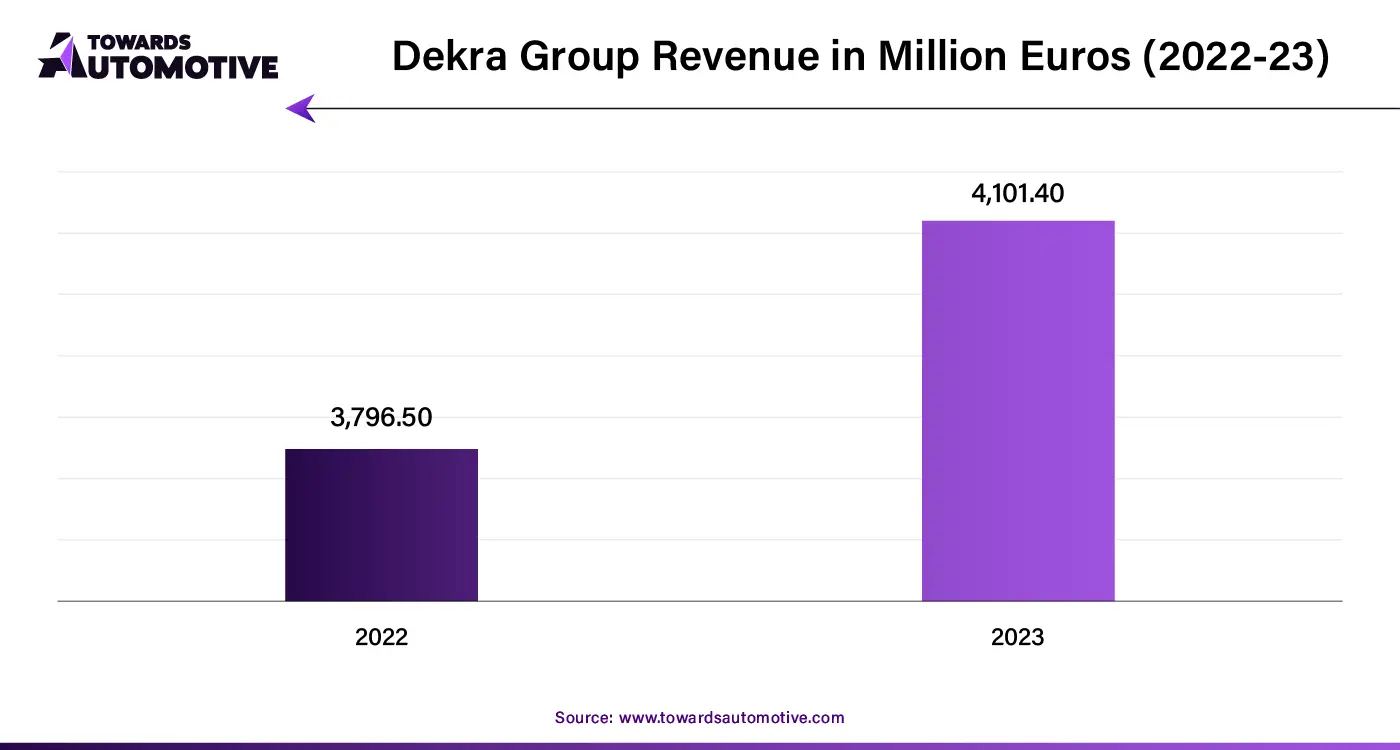

The automotive TIC market is a highly fragmented industry with the presence of several dominating players. Some of the crucial players in this industry consists of Dekra SE (Stuttgart, Germany), TÜV SÜD (Munich, Germany), Applus Services, S.A (Madrid, Spain), SGS Group (Geneva, Switzerland), Bureau Veritas Group (Neuilly-sur-Seine, France) and some others. These companies are constantly engaged in providing TIC services for automotives and adopting numerous strategies to maintain their dominant position in this industry.

By Range

By Application

By Frequency

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us