October 2025

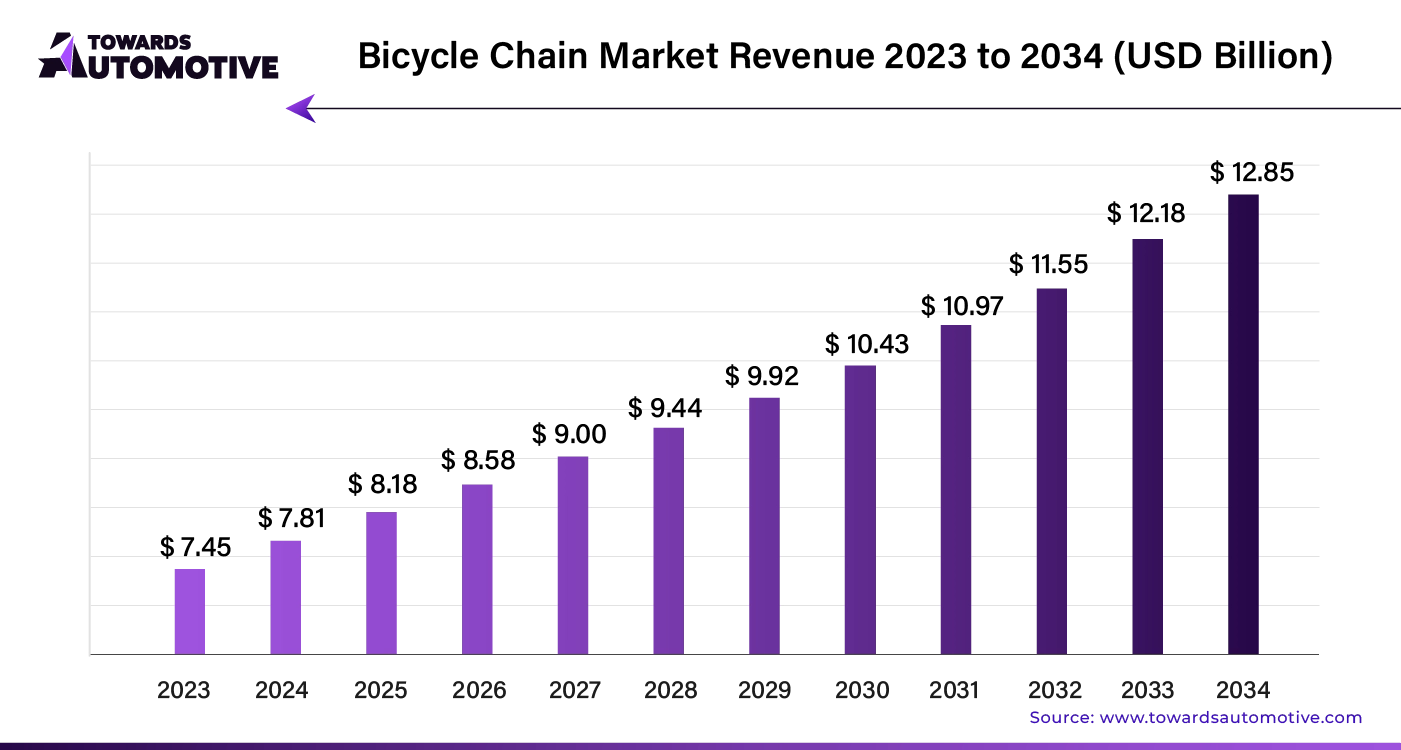

The bicycle chain market is forecasted to expand from USD 8.18 billion in 2025 to USD 12.85 billion by 2034, growing at a CAGR of 4.9% from 2025 to 2034.

As environmental awareness grows, individuals in developed countries are increasingly choosing bicycles over fuel-powered cars. This shift is boosting the demand for high-quality bicycle parts, particularly bicycle chains. Urbanization has spurred investments in cycling infrastructure, further driving the expansion of bicycle usage and the need for essential components.

Innovative advancements in bicycle technology, including the use of strong and lightweight materials, are enhancing performance and attracting cycling enthusiasts. The rise of e-commerce platforms has made it easier for consumers to access a wide range of bicycle chains, contributing to market growth.

Among the various types of bicycles, city bikes are expected to lead in market share, while 12-speed chains are emerging as the dominant choice. E-bikes are also gaining popularity due to their efficiency in quick transportation. City bikes, designed for daily urban commuting, and e-bikes, which benefit from electric assistance, both require durable chains capable of withstanding frequent use and strain. Leading companies such as Shimano and SRAM are responding to this demand by offering customized chain options tailored to different cycling needs.

In the realm of mountain biking, 11-speed and 12-speed chains are prevalent. These chains are increasingly sought after in upscale urban areas due to their precise shifting capabilities and enhanced driving performance, making them highly desirable among professional cyclists. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The industry is witnessing a growing demand for versatile gear options. For instance, the 3/32” chain variant is commonly used in single-speed and internal hub bikes. This chain size strikes an ideal balance between strength and weight, making it suitable for everyday cycling, especially in city environments.

Bicycle chains are typically madesfrom alloy steel or carbon steel. Carbon steel chains are valued for their cost-effectiveness and rust resistance, while alloy steel chains are preferred for their superior strength and durability. These materials cater to a range of consumer preferences, from performance-focused to budget-conscious options.

Increasing Adoption of Lightweight Materials

Technological advancements in bicycle materials are revolutionizing the bicycle chain market. Leading companies like KMC and SRAM are incorporating lightweight materials such as carbon fiber and composites into their chains. These materials enhance bicycle performance, particularly for professional cyclists who demand top-tier efficiency and speed. Shimano, another major player, uses high-strength alloys and stainless steel for its commuter chains. This choice not only boosts durability but also ensures that the chains perform well in urban environments.

In addition to lightweight materials, manufacturers are turning to innovative coatings like ceramic and titanium. These coatings, commonly found on speed chains, reduce friction, extend the lifespan of the chains, and minimize maintenance needs. As environmental consciousness grows, there is a noticeable shift towards sustainable and recyclable materials. Companies like Campagnolo are leading efforts in adopting eco-friendly practices, aligning with both regulatory standards and consumer expectations. This commitment to sustainability is expected to drive continued growth in the industry.

Shift Toward Zero-Emission Transportation

The trend towards zero-emission transportation is creating new opportunities for the bicycle chain market. In developed countries, an increasing number of people are choosing bicycles over public transport and private vehicles due to the environmental benefits and sustainability of cycling. Bicycles, being a zero-emission mode of transport, are becoming more popular as cities grapple with climate change and overcrowding.

Governments worldwide are investing in better cycling infrastructure and encouraging bicycle use for both commuting and recreation. Cities like Amsterdam and Copenhagen have significantly enhanced their cycling infrastructure, leading to greater bicycle usage. This increased popularity directly boosts the demand for bicycle chains, which are crucial for transferring power from the pedals to the wheels.

Growing Collaborations Between Municipalities and City Planners

Governments and city planners are increasingly focusing on developing cycling infrastructure to promote eco-friendly transportation. For example, Paris has allocated USD 250 million for new bike lanes under its “Plan Vélo,” while Oregon has approved USD 55 million for improving walking and bicycle infrastructure in its Statewide Transportation Improvement Program (STIP) for 2024 to 2027.

Amsterdam continues to expand its bicycle network by adding new bike bridges and car-free zones. Such investments in cycling infrastructure support the growth of the bicycle chain market, as these components are essential for bicycle functionality. Manufacturers are responding to these developments by collaborating with municipal authorities and city planners, driving innovation and aligning with global trends towards sustainable urban transportation.

Rise of Bike-Sharing Initiatives

The proliferation of bike-sharing programs is opening up lucrative opportunities for manufacturers. These programs provide a convenient, sustainable alternative for short urban trips. Successful examples include Beijing’s Mobike and Ofo, and Paris’ Vélib, which address the last-mile connectivity issue effectively.

To support these programs, cities are investing in infrastructure such as docking stations, specialized bike lanes, and maintenance facilities. Frequent use of shared bikes necessitates durable and low-maintenance bicycle chains. Manufacturers can leverage this trend by focusing on the development of robust chains that meet the demanding conditions of bike-sharing fleets. By engaging with bike-sharing programs and innovating product offerings, companies can capture a significant share of the urban transportation market.

Challenges from Alternative Transportation Options

Despite the growth in bicycle use, the industry faces competition from alternative transportation modes like electric scooters and ride-sharing services. Companies such as Lime and Bird offer electric scooters, while Uber and Lyft provide ride-sharing options. These alternatives cater to the demand for quick and less physically demanding urban transport, potentially diverting some consumer interest away from bicycles.

Manufacturers can address these challenges by focusing on innovation and exploring strategic partnerships. By participating in bike-sharing programs and developing cutting-edge bicycle chains designed for urban settings, they can maintain a strong market presence and adapt to evolving consumer preferences.

Artificial Intelligence (AI) is set to transform the bicycle chain market by driving innovation and enhancing overall growth. AI technologies are playing a crucial role in optimizing design, manufacturing, and maintenance processes. Through advanced data analysis and machine learning algorithms, AI can identify patterns and predict future trends, leading to more efficient production techniques and higher-quality products.

In design, AI enables the development of more durable and lightweight bicycle chains by analyzing material properties and performance metrics. This results in chains that offer improved longevity and reliability. During manufacturing, AI-driven automation streamlines production, reducing errors and increasing output efficiency. Predictive maintenance algorithms also help in foreseeing wear and tear, enabling timely replacements and minimizing downtime.

Moreover, AI enhances supply chain management by forecasting demand and optimizing inventory levels. This reduces costs and ensures that the right products are available at the right time. By leveraging AI, companies can gain a competitive edge through faster innovation cycles and improved customer satisfaction. Overall, AI integration promises to accelerate market growth and set new standards in the bicycle chain industry.

The supply chain in the bicycle chain market is designed to ensure the efficient production and delivery of high-quality chains to manufacturers and end consumers. It begins with the procurement of raw materials, such as steel and alloys, which are sourced from global suppliers. These materials are then processed in specialized manufacturing facilities where they are shaped and treated to meet industry standards.

Once the chains are produced, they undergo rigorous quality control tests to ensure durability and performance. After passing inspection, the finished chains are packaged and distributed through a network of logistics providers. This network includes warehousing facilities and transportation services that handle the movement of products from the manufacturer to wholesalers and retailers.

Retailers then make these chains available to bicycle manufacturers and directly to consumers. Effective supply chain management in this market involves close coordination between suppliers, manufacturers, and distributors to manage inventory levels, forecast demand, and minimize lead times. Leveraging advanced technologies and data analytics helps optimize these processes, ensuring that bicycle chains are delivered on time and at the right cost.

The bicycle chain market is fueled by several key components, including chains, gears, derailleurs, and chainrings. Chains, the primary component, are made from high-strength steel or alloys to withstand the forces generated while pedaling. Gears, which include cassette sprockets and chainrings, work in tandem with chains to control the bike's speed and torque. Derailleurs, both front and rear, shift the chain between gears to optimize performance and efficiency.

Various companies play pivotal roles in this ecosystem. Shimano, a leading global manufacturer, produces high-quality chains and derailleurs that enhance gear shifting and durability. SRAM is known for its innovative gear systems and chain designs, catering to both professional and amateur cyclists. Campagnolo focuses on premium components, delivering high-performance chains and gears for competitive cycling. Companies like KMC offer specialized chains that provide improved longevity and efficiency. Additionally, manufacturers such as KMC and Wippermann are recognized for their advancements in chain technology, which contribute to smoother and more reliable cycling experiences.

Together, these companies drive innovation and quality in the bicycle chain market, ensuring that cyclists enjoy improved performance and durability.

Tier 1: Industry Giants with Global Reach

Tier 1 companies dominate the global market with revenues exceeding USD 10 million. These industry leaders command a significant market share, ranging from 30% to 40%, due to their substantial production capacities and extensive product portfolios. Their success stems from a combination of advanced manufacturing expertise and a broad geographic presence, supported by a robust and diverse consumer base. Key players in this tier include:

Tier 2: Regional Influencers with Specialized Expertise

Tier 2 companies, while not as large as their Tier 1 counterparts, still play a significant role in specific regional markets. These mid-sized players typically generate revenues below USD 10 million and focus on serving local industries with modern manufacturing technologies. Although they may lack the extensive global reach and advanced technology of Tier 1 companies, their specialized expertise and regional impact are notable. Prominent Tier 2 companies include:

These Tier 2 companies, while not as expansive as their Tier 1 counterparts, contribute significantly to the regional markets with their specialized products and technological advancements.

Türkiye Poised for Leading Growth in the Bicycle Chain Market

Türkiye is expected to lead the global bicycle chain market with a notable compound annual growth rate (CAGR) of 5.7% through 2034. This growth is driven by factors such as an expanding domestic cycling infrastructure and increasing consumer interest in bicycles. Businesses in Türkiye are well-positioned to capitalize on these trends, solidifying the country’s role as a major player in the industry.

China’s Dominance in Production and Demand

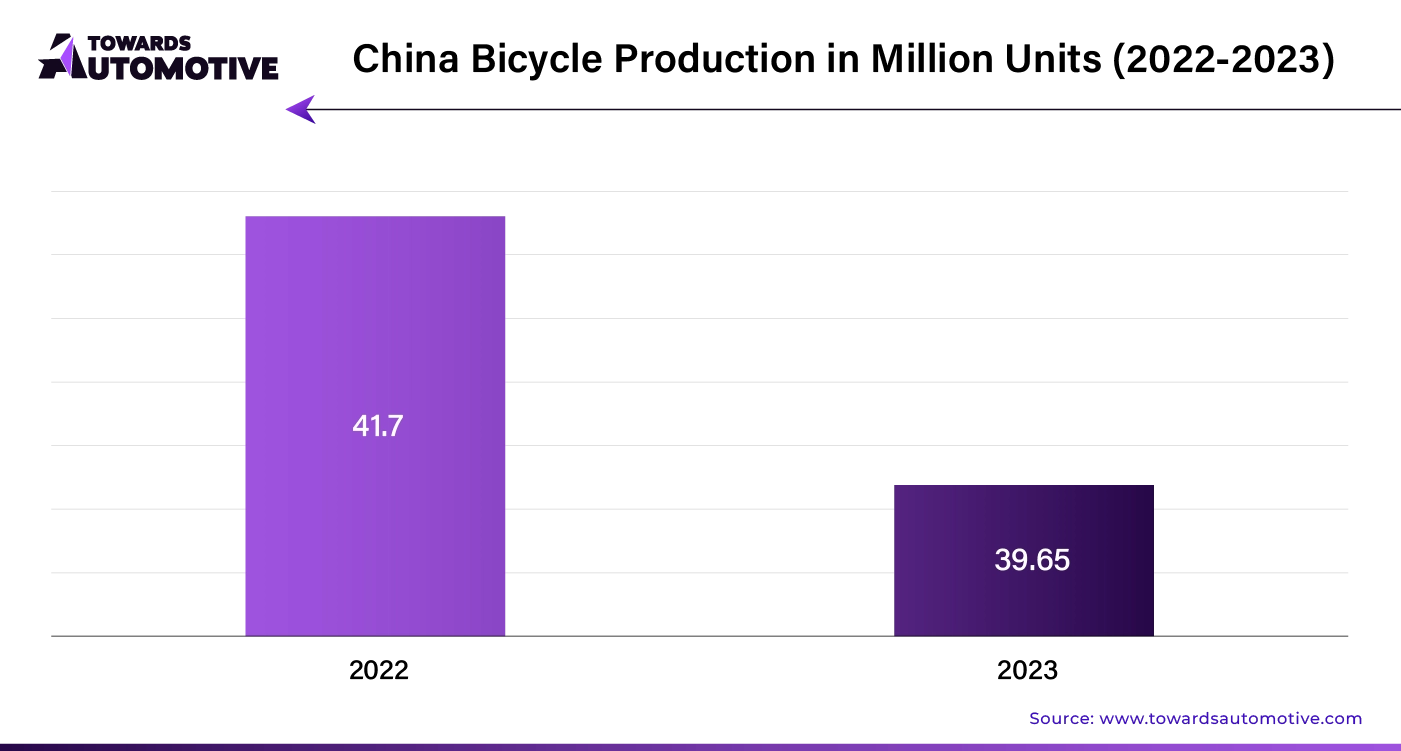

China remains a significant force in the bicycle chain industry, with a projected CAGR of 3.6%, reaching a market size of USD 2,500 million by 2034. The country commands a substantial share of global bicycle chain production, accounting for approximately 60%. This dominance is supported by strong domestic demand, extensive manufacturing capabilities, and competitive labor costs. For example, KMC operates multiple high-capacity factories in China, contributing greatly to the industry. In 2023, KMC’s annual production surpassed 115 million chains, highlighting China’s crucial role in both local and international markets.

Germany’s Green Transportation Initiatives Boosting Bicycle Chain Demand

Germany is set to experience a 3.4% CAGR in bicycle chain demand, reaching USD 400 million by 2034. The country’s focus on electric bicycles and green transportation is a significant driver of this growth. Companies like Bosch are at the forefront, incorporating advanced chain systems into their e-bike motor technology. The popularity of e-bikes, with sales reaching 1.4 million units in 2023, underscores the increasing need for durable bicycle chains. Germany’s investments in green infrastructure, such as new bike lanes and charging stations, further reinforce its commitment to sustainable transportation and boost demand for bicycle chains.

Mexico’s Urban Cycling Boom and Manufacturing Growth

Mexico is anticipated to see a CAGR of 4.1% in the bicycle chain market, reaching a value of USD 440 million by 2034. This growth is driven by the rising popularity of urban cycling and a robust manufacturing sector. The surge in bike-sharing programs like Ecobici and the impact of trade agreements such as the United States-Mexico-Canada Agreement (USMCA) are key factors enhancing local production and market access. Additionally, the use of bicycles by companies like Grupo Bimbo for delivery purposes highlights the growing role of bicycles in various industries. Mexico’s expanding urban cycling infrastructure and emphasis on environmentally friendly transportation further strengthen its position in the global bicycle chain market.

Understanding the dynamics of leading market segments is crucial for businesses aiming to make informed decisions and invest wisely. By examining the growth trends, opportunities, and challenges in these segments, companies can navigate the market more effectively. Here's a detailed look at two significant segments in the cycling industry: the 12-speed chain type and city bicycles.

Rising Popularity of 12-Speed Chains

| Segment: | 12-Speed Chains |

| Value Share (2024): | 33.8% |

| CAGR Forecast: | 4.1% |

The 12-speed chain type is projected to lead the market with a value share of 33.8% in 2024. This segment is expected to grow at a compound annual growth rate (CAGR) of 4.1% over the forecast period. The increasing preference for 12-speed chains is attributed to their enhanced performance and versatility, making them a top choice for premium cycling setups.

High-performance systems like SRAM’s Red eTap AXS and Shimano’s 12-speed Dura-Ace are driving the demand among professional riders. These 12-speed chains offer superior handling and efficiency across various terrains, thanks to their wide gear ranges and precise shifting. The growing popularity of these chains is reflected in their rising use in both city and mountain bikes, as cyclists seek advanced gear systems for better performance.

Urbanization Driving City Bicycle Growth

| Segment: | City Bicycles |

| Value Share (2024): | 26.2% |

| CAGR Forecast: | 4.5% |

City bicycles are set to experience significant growth, capturing a value share of 26.2% in 2024 and expanding at a CAGR of 4.5%. This growth is fueled by the increasing popularity of urban cycling, influenced by rising fuel prices and the demand for cost-effective transportation solutions. The trend towards city bicycles is supported by initiatives such as Santander Cycles in London and Citi Bike in New York.

The development of urban cycling infrastructure is further encouraging the use of city bikes. As more people choose these bicycles for their daily commutes, there is a growing need for durable city bicycle chains. The demand for these robust chains is driven by the frequent use and demanding conditions typical in urban environments.

The bicycle chain industry is dominated by key players including Shimano Inc., KMC (Kuei Meng) International Inc., SRAM LLC, Izumi Chain Mfg Co. Ltd., Taya Chain Co. Ltd., and Renold PLC. These leading companies collectively hold a substantial market share of 30% to 40%. They are committed to driving technological advancements, adopting sustainable practices, and broadening their presence in regional markets. Their focus on innovation and quality ensures they remain competitive and responsive to the evolving demands of the industry.

By Chain Type

By Material Type

By Bicycle Type

By Width Type

By Sales Channel

By Region

October 2025

October 2025

September 2025

September 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us