February 2025

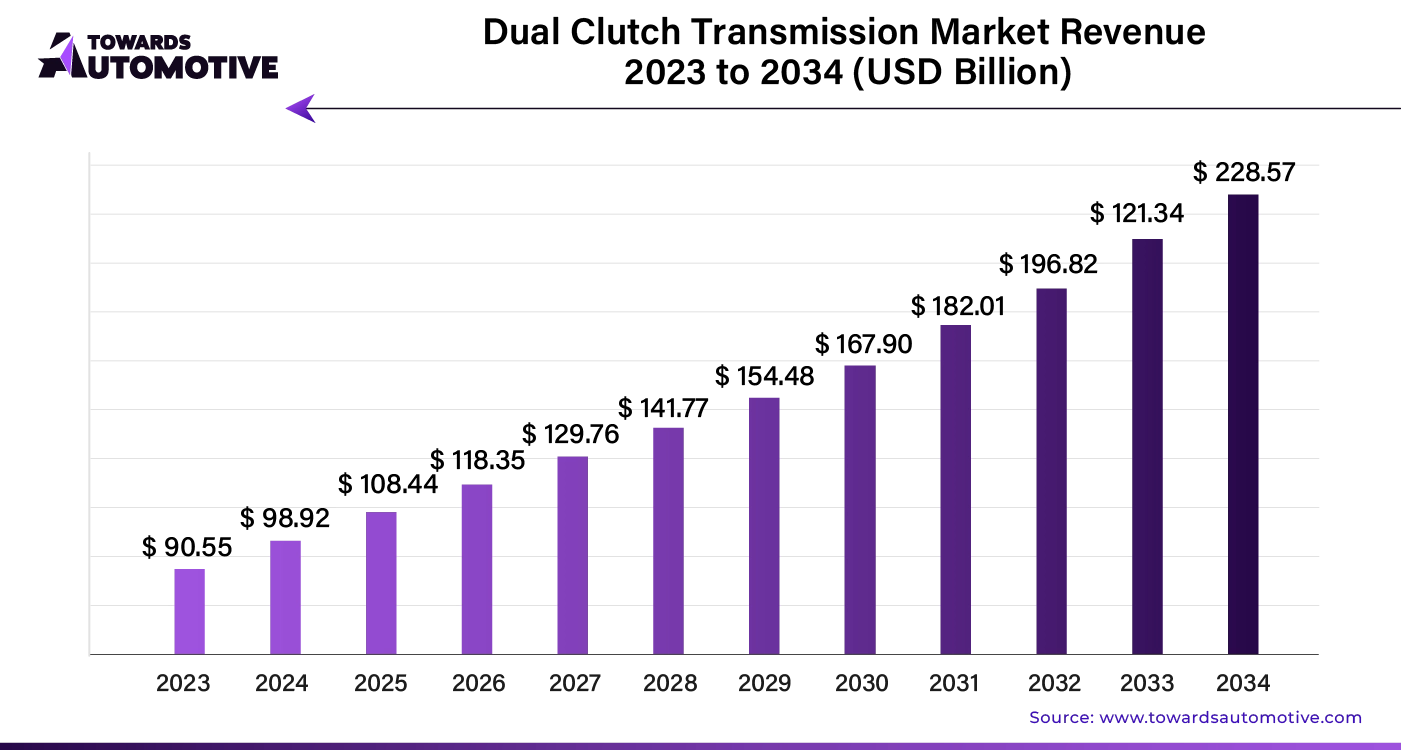

The global dual clutch transmission market is projected to reach USD 228.57 billion by 2034, expanding from USD 108.44 billion in 2025, at an annual growth rate of 9.23% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Dual Clutch Transmission (DCT) offers significant benefits over traditional manual transmissions. It provides rapid gear shifts and a smoother driving experience. DCT minimizes power loss and enhances acceleration, driving high demand. Additionally, it requires less maintenance and lowers long-term costs, resulting in improved vehicle performance.

Wet plate dual-clutch transmissions (DCTs) are increasingly favored over dry plate systems due to their higher durability and performance. Lubricated with oil, these clutches minimize friction and enhance gear shifts, leading to smoother operation and improved reliability.

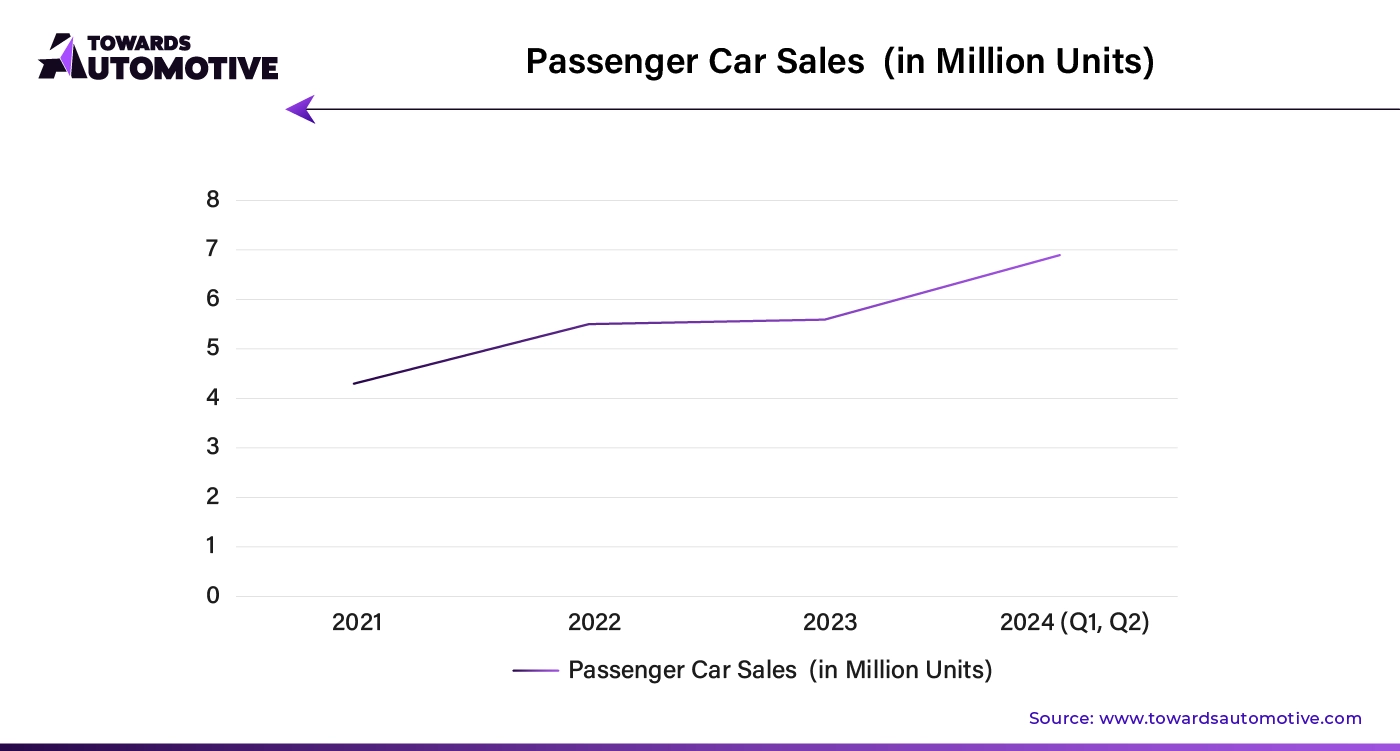

Their ability to handle high torque makes wet plate DCTs ideal for luxury and sports vehicles. For example, Porsche and Audi have integrated wet plate DCTs in models such as the Porsche 911 Carrera and Audi A4 to boost driving dynamics. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The popularity of DCTs is rising in the passenger car segment, particularly in sports and luxury vehicles, due to their improved acceleration and ride quality compared to manual transmissions. Models like the Volkswagen Golf GTI and Ford Focus ST utilize DCTs for a more responsive and enjoyable driving experience.

The demand for DCTs with over 750 Nm torque capacity is expected to grow globally. As vehicle sophistication increases, compact SUVs with high torque requirements are becoming more common, creating growth opportunities for high-torque DCTs.

For instance, the Mercedes-AMG GT features a DCT capable of handling over 750 Nm, supporting its high-performance V8 engine and enhancing both acceleration and driving dynamics.

With manufacturers pushing engine limits and adding sophistication, the need for robust transmissions that can handle high torque is becoming essential. This trend underscores the industry's commitment to high-performance vehicles and maintaining a competitive edge.

Recent advancements in dual-clutch transmissions (DCTs) are transforming the automotive industry with improved efficiency and performance. Traditionally bulky due to intricate dual-clutch mechanisms and multiple gears, DCT designs have evolved to be more compact and effective, fitting seamlessly into modern vehicles.

Modern manufacturing techniques such as precision machining, simulation software, and computer-aided design (CAD) now enable the production of smoother gear shifts. These innovations reduce energy loss, friction, and parasitic losses, enhancing vehicle performance and fuel economy.

To further cut down on weight, manufacturers are using advanced materials like composites, aluminum alloys, and high-strength steel. These materials help reduce overall weight without compromising strength, boosting fuel efficiency, handling, and vehicle dynamics.

The integration of autonomous driving technologies and advanced driver assistance systems (ADAS) with DCTs is optimizing vehicle performance and safety. These systems use real-time traffic and road condition data to enhance gear shifts, fuel economy, and driving comfort. DCTs also complement ADAS features like lane departure warning and adaptive cruise control, contributing to a safer and more efficient driving experience.

The growing demand for luxury vehicles, which emphasize performance and efficiency, is driving the adoption of DCTs. Luxury vehicles benefit from the 3-5% fuel economy improvement that DCTs offer over manual transmissions. In India, affordable luxury models like the Tata Altroz and Hyundai i20 are incorporating DCT technology, reflecting its increasing popularity.

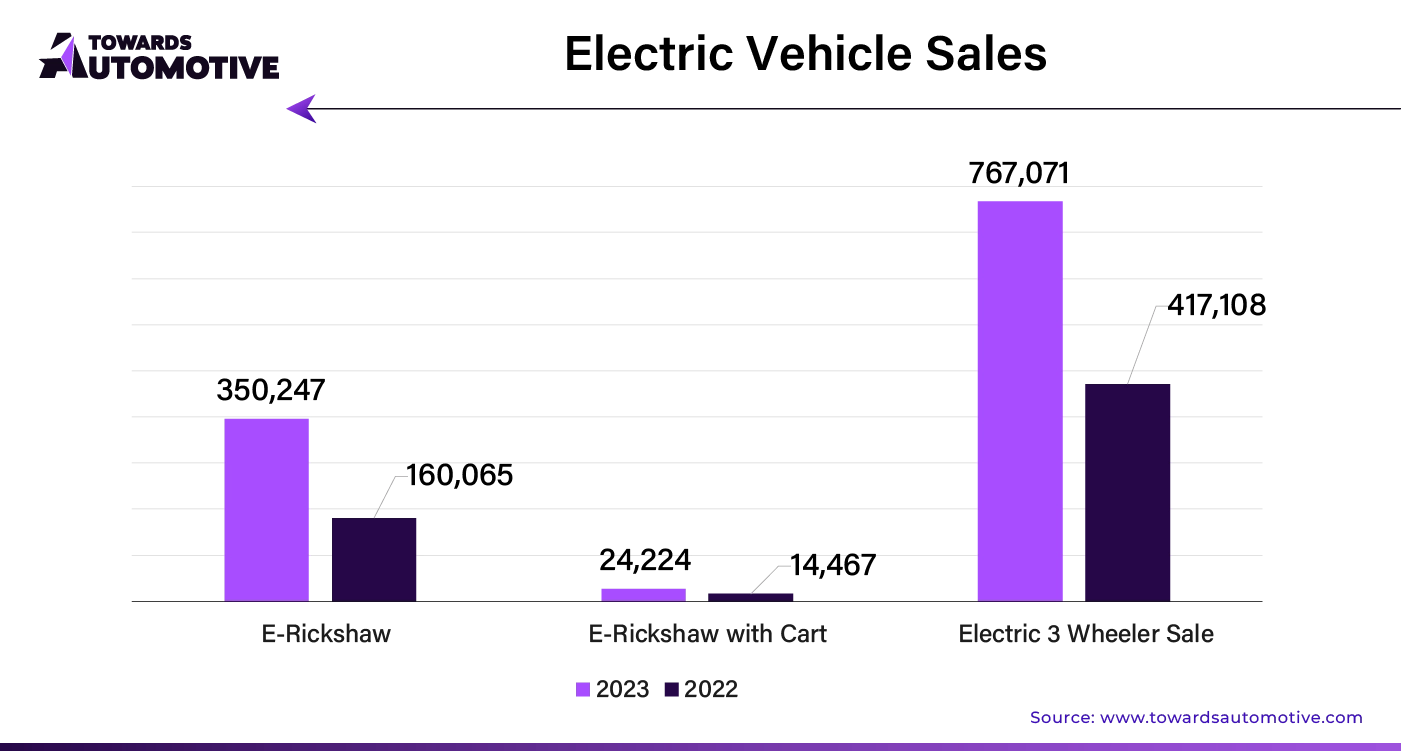

The rise in hybrid electric vehicles also supports the growth of DCT systems, combining manual and automated operations for a better driving experience. Additionally, the preference for automatic transmissions among senior citizens and those with limited mobility is boosting demand. Automatic transmissions, including DCTs, offer greater ease of use and comfort, particularly in heavy traffic and urban environments.

However, the complex design of DCTs poses challenges. The need for specialized parts and sophisticated engineering makes manufacturing DCTs more costly and complicated than traditional transmissions. Despite these challenges, DCTs deliver significant performance and efficiency benefits, driving their global popularity.

AI integration is set to revolutionize the Dual Clutch Transmission (DCT) market by significantly enhancing performance and efficiency. AI technologies enable advanced predictive maintenance, which reduces downtime and operational costs. By analyzing real-time data, AI can predict component failures before they occur, ensuring smoother vehicle operation and extending the lifespan of transmission systems.

Additionally, AI-driven algorithms optimize gear shifts based on driving conditions and driver behavior, improving fuel efficiency and driving comfort. This customization leads to better vehicle performance and enhances the overall driving experience. AI also supports the development of autonomous driving technologies, where precise control of gear shifts is crucial for safe and efficient operation.

The incorporation of AI in DCT systems aligns with the industry's shift towards smarter, more efficient automotive technologies. It accelerates innovation, driving market growth as manufacturers and consumers increasingly demand advanced, reliable transmission solutions. By leveraging AI, the DCT market can expect to see substantial advancements in technology and performance, reinforcing its role in the future of automotive engineering.

The supply chain in the dual clutch transmission (DCT) market operates through a streamlined process, ensuring efficiency from production to delivery. It begins with raw material procurement, where suppliers provide essential components such as gears, shafts, and electronics. These materials are sourced from specialized vendors to meet stringent quality standards.

Next, manufacturers assemble the dual clutch systems using advanced machinery and skilled labor. During this phase, components are meticulously tested to ensure functionality and durability. The assembly process integrates automated systems for precision and consistency, minimizing errors.

Once assembled, the dual clutch transmissions undergo rigorous quality control checks. This step is crucial to verify that each unit meets performance specifications. After passing inspection, products are packaged and distributed to various automotive manufacturers and aftermarket suppliers.

Logistics plays a vital role in the supply chain, coordinating the transportation of components and finished products. Efficient warehousing and inventory management ensure timely availability and reduce delays.

Overall, the supply chain in the DCT market emphasizes precision, quality, and efficiency, facilitating a smooth flow from component suppliers to end-users.

The Dual Clutch Transmission (DCT) market thrives on several critical components and contributions from leading companies. The core components of DCT systems include the dual clutches, two separate gear shafts, and advanced electronic control units. These components work together to enable smooth gear transitions and improved fuel efficiency.

Companies like ZF Friedrichshafen AG, BorgWarner Inc., and Getrag (now part of Magna International) are pivotal in advancing DCT technology. ZF Friedrichshafen AG leads with its extensive range of DCT solutions, enhancing performance and driving dynamics in various vehicles. BorgWarner Inc. specializes in innovative dual-clutch systems that offer enhanced acceleration and fuel efficiency, contributing significantly to the market. Getrag's integration with Magna International strengthens its ability to deliver high-quality DCT systems, focusing on reliability and performance.

Additionally, companies like Aisin Seiki Co., Ltd. and Hyundai Dymos Inc. play crucial roles by developing advanced DCT systems tailored for diverse automotive applications. Their contributions help in optimizing vehicle performance and meeting stringent emissions standards. Together, these companies drive the evolution of DCT technology, ensuring its continued growth and innovation in the automotive industry.

China Dominates East Asia's Dual-Clutch Transmission Market

By 2034, China is projected to hold a commanding 76.8% share of the dual-clutch transmission (DCT) market in East Asia. The country’s strong growth is driven by its significant role as a manufacturing hub and increasing vehicle production. With an 8.1% CAGR, China’s robust automotive sector is expected to continue expanding, benefiting from its low manufacturing costs and innovative capabilities.

India and Japan Lead in Market Growth

India and Japan are emerging as key growth leaders in the dual-clutch transmission market. India is anticipated to achieve a CAGR of 9.1% from 2024 to 2034, driven by rising vehicle sales, demand for industrial machinery, and growing shipbuilding activities. Similarly, Japan is projected to grow at an 8.7% CAGR due to its strong automotive industry and technological advancements.

United States and France: Diverse Market Contributions

In the United States, the dual-clutch transmission market is expected to reach USD 25,900 million by 2034, with an 8.5% CAGR. The popularity of DCTs in high-performance vehicles like the 2024 Ford Mustang GT reflects the growing demand for improved fuel efficiency and driving comfort. France is also expected to contribute significantly to the market with an 8.5% CAGR, driven by its diverse automotive, marine, defense, and aerospace industries.

China’s Export Growth and Market Expansion

China’s automotive industry is expanding rapidly, with vehicle sales hitting 30 million units in 2023. The country’s auto exports reached 4.3 million units, surpassing Japan. Known for its low manufacturing costs and high production capacity, China is well-positioned to innovate and capture a larger share of the global DCT market.

India’s Rising Demand for Automatic Vehicles

India’s dual-clutch transmission market is set to grow to USD 13,000 million by 2034, with a 9.1% CAGR. The post-COVID-19 increase in private vehicle ownership has led to a surge in demand for automatic transmissions. As traffic congestion rises, the shift towards automatic vehicles, including those with dual-clutch systems like the Hyundai Verna, highlights India's growing adoption of DCT technology.

Wet Plate Clutches Lead the Market

In 2024, wet plate clutches are expected to dominate the dual-clutch transmission market, capturing approximately 90.5% of the market share. These clutches, which are bathed in oil, benefit from improved cooling and lubrication, enabling them to handle high torque and enjoy an extended lifespan. Their effectiveness in managing modern engine demands and superior heat dissipation make them suitable for high-performance vehicles such as sports cars and luxury models. Furthermore, wet plate clutches experience less wear and tear, requiring less frequent maintenance than dry clutches, which solidifies their leading position.

Passenger Cars Drive Market Growth

Passenger cars are anticipated to represent around 80.7% of the dual-clutch transmission market in 2024. The appeal of dual-clutch transmissions in passenger vehicles is driven by their quick gear selection and smooth shifting, which enhance driving dynamics and deliver a sporty experience. As more consumers opt for automatic transmissions for convenience in city driving, manufacturers are increasingly incorporating dual-clutch systems into their models. Advances in technology, including electronic control modules and torque converters, are enhancing the efficiency and attractiveness of these transmissions, further driving their adoption in passenger cars.

Competition Outlook in the Global Dual-Clutch Transmission Market

The global dual-clutch transmission market is moderately consolidated, with key companies holding a 65-70% market share. These leaders are focusing on technological innovations, sustainability, and expanding their global presence. They aim to enhance customer satisfaction by offering customized solutions and partnering with major automakers to provide cost-effective products.

Several companies are investing heavily in advanced manufacturing facilities across Europe, Asia Pacific, and North America. India and China are emerging as key manufacturing hubs due to their low-cost raw materials and labor.

By Product Type

By Torque Capacity

By Propulsion Type

By Vehicle Type

By Sales Channel

By Region

February 2025

February 2025

August 2024

August 2024

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us