March 2025

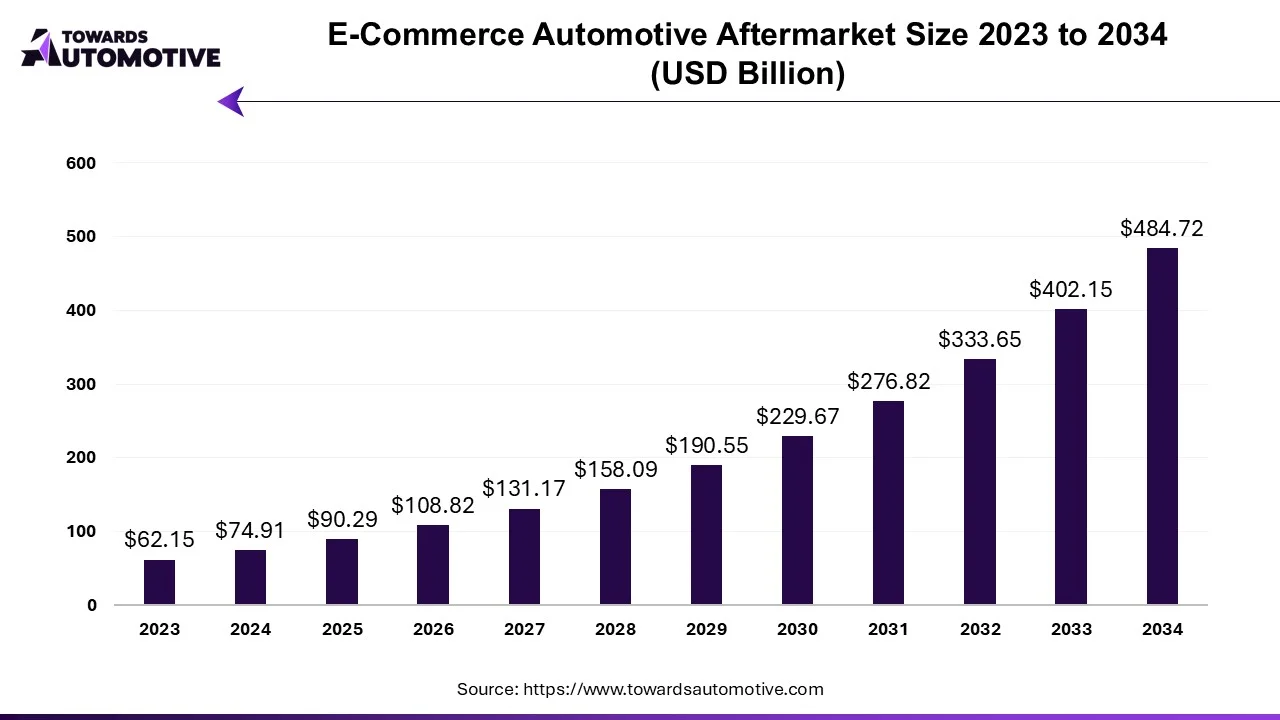

The e-commerce automotive aftermarket is forecast to grow at a CAGR of 20.53%, from USD 90.29 billion in 2025 to USD 484.72 billion by 2034, over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

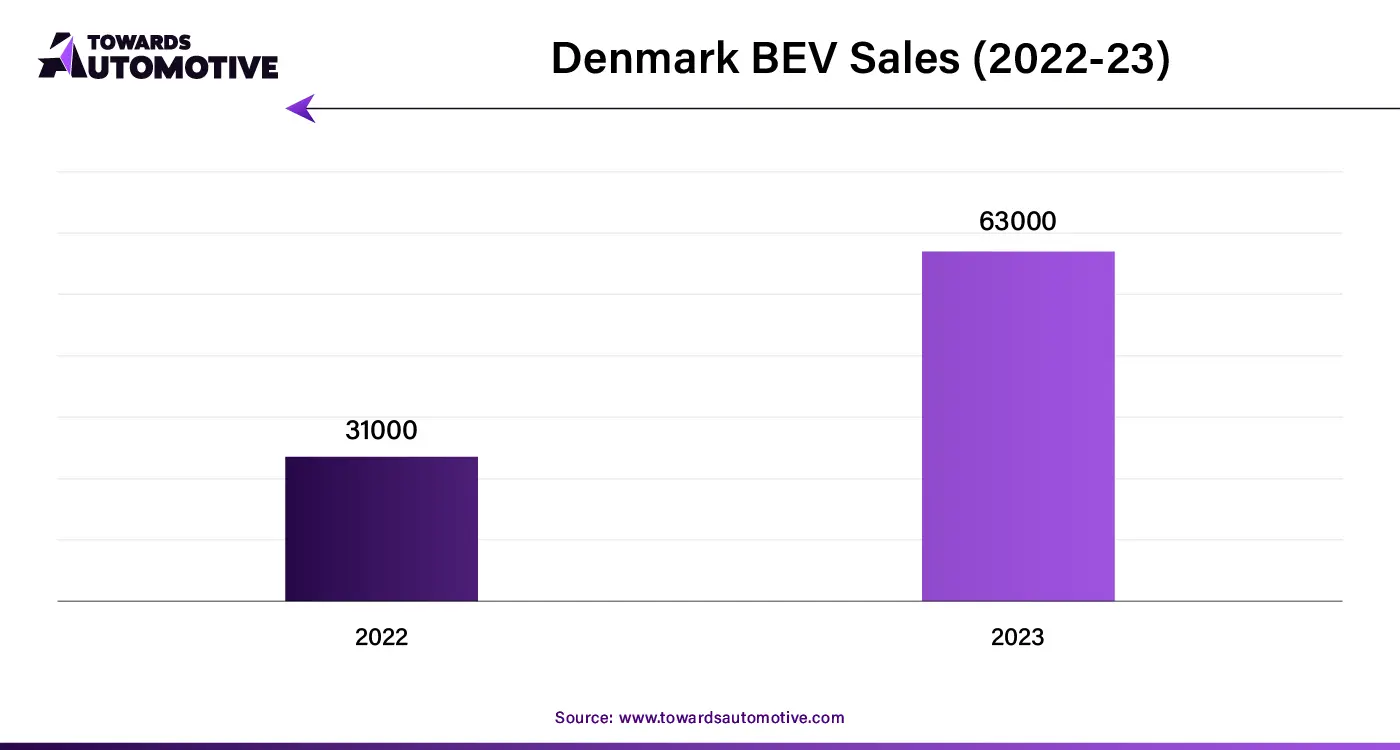

The e-commerce automotive aftermarket is a crucial branch of the online retail industry. This industry deals in distribution of automotive components through e-commerce platforms in different parts of the world. There are several engine components available in this market comprising of piston and piston rings, engine valves and parts, fuel injection systems, power train components and some others. Also, these platforms allow consumers to purchase different automotive components such as transmission systems, braking components, lighting components, electrical parts, suspension systems, wipers and some others. The growing demand for electric vehicles in developed nations has played a prominent role in shaping the industry in a positive direction. This market is projected to rise significantly with the growth of the automotive industry across the world.

In November 2023, Mike Manley, the CEO of AutoNation made an announcement stating that,” "Increasingly, consumers want the ability to go directly to a website and order exactly the car parts they need at a competitive price, with fast shipping times and transparent pricing, People are holding on to cars longer. As the lifecycle of vehicle ownership grows, AutoNation wants to continue to be there for our Customers who take pride in doing their own maintenance, repairs, and customizations."

The e-commerce automotive aftermarket is a highly fragmented industry with the presence of numerous dominant players. Some of the important market players in this industry consists of Advance Auto Parts, Alibaba Group Holding Limited, Amazon.com, Inc., AutoZone Inc., CARiD.com and some others. These market players are investing heavily for developing their platforms and adopting numerous strategies such as launches, collaborations, investments, business expansions and some others to sustain their position in this industry.

.webp)

By Replacement Parts

By Use

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us