March 2025

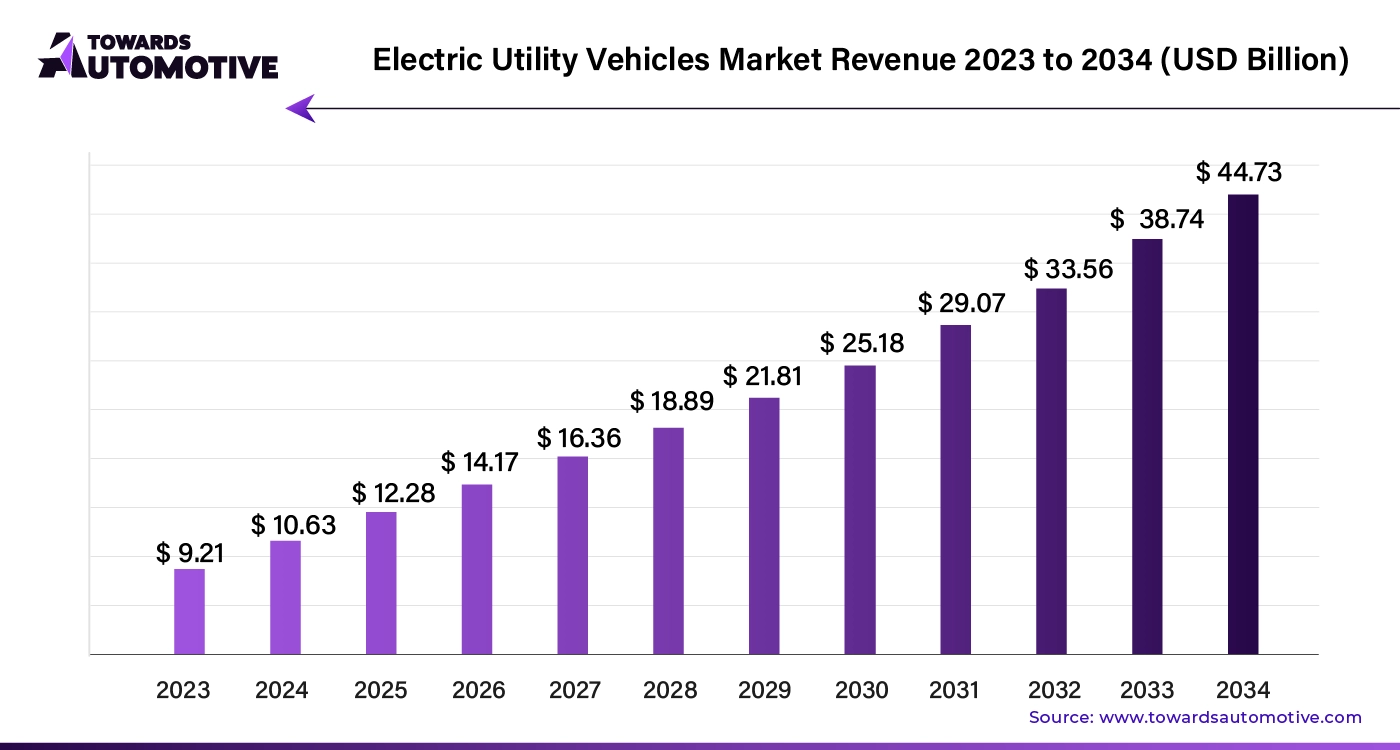

The global electric utility vehicles market size is calculated at USD 10.63 billion in 2024 and is expected to be worth USD 44.73 billion by 2034, expanding at a CAGR of 15.45% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The electric utility vehicles market is experiencing rapid growth as businesses and municipalities seek sustainable alternatives to traditional fossil-fuel-powered utility vehicles. This sector includes electric models of forklifts, golf carts, street sweepers, and other essential utility vehicles used in diverse applications from warehouses to public parks. This industry is driven by increasing environmental regulations and the push for greener operations, companies are transitioning to electric utility vehicles to reduce emissions, lower operating costs, and meet sustainability goals.

Advances in battery technology and improvements in electric drivetrains are enhancing the performance and range of these vehicles, making them more viable for various operational needs. Additionally, the expansion of charging infrastructure and technological innovations in electric vehicle (EV) management are further supporting market growth. As industries recognize the benefits of electric utility vehicles such as quieter operation and reduced maintenance requirements, the demand for these vehicles is expected to rise significantly. The EUV market is set to grow as industries are moving towards electrification driven by regulatory pressures along with the pursuit of operational efficiency and environmental friendliness.

Artificial intelligence (AI) is playing a transformative role in the Electric Utility Vehicle (EUV) market by enhancing operational efficiency, safety, and vehicle management. AI technologies, such as machine learning and predictive analytics, are significantly improving the performance and functionality of electric utility vehicles. Through real-time data analysis, AI systems can monitor vehicle health, predict maintenance needs, and prevent potential breakdowns, thereby minimizing downtime and reducing overall maintenance costs.

AI-driven optimization algorithms help in managing energy consumption and extending battery life, ensuring that electric utility vehicles operate efficiently. These algorithms can analyze driving patterns and environmental conditions to adjust energy usage and enhance vehicle range. Additionally, AI enhances vehicle safety by integrating advanced driver-assistance systems (ADAS) that provide features like collision avoidance, adaptive cruise control, and automated parking.

Furthermore, AI facilitates the development of smart fleet management solutions. By analyzing data from multiple vehicles, AI can optimize fleet operations, improve route planning, and manage charging schedules efficiently. As the EUV market expands, AI will continue to play a crucial role in driving innovation, making electric utility vehicles more reliable, efficient, and integrated into modern operational ecosystems.

Longer battery life and decreased battery prices are significantly impacting the Electric Utility Vehicle (EUV) market by enhancing vehicle performance and affordability. As battery technology advances, manufacturers are developing batteries with improved energy density and extended lifespans, allowing electric utility vehicles to operate longer on a single charge. This increased battery life reduces the frequency of recharging and lowers operational downtime, making EUVs more practical for various applications, from warehouse logistics to municipal services.

Additionally, the reduction in battery prices makes electric utility vehicles more cost-effective. As economies of scale and technological improvements drive down production costs, both manufacturers and consumers benefit from lower upfront vehicle prices. This affordability encourages wider adoption of electric utility vehicles across industries and municipalities, supporting broader sustainability goals and operational efficiency. The combined effect of longer battery life and reduced costs is making electric utility vehicles a more attractive option compared to traditional fossil-fuel-powered alternatives, accelerating the transition towards greener and more economical utility solutions.

The electric utility vehicles (EUV) market faces several constraints, including high upfront costs compared to traditional utility vehicles. Despite falling battery prices, the initial investment in electric vehicles and charging infrastructure remains significant. Limited vehicle range and insufficient charging facilities can also hinder operational efficiency and flexibility. Additionally, the need for specialized maintenance and technician training adds to the costs. Rapid technological advancements in EV components may create uncertainty, as businesses might be reluctant to invest in vehicles that could quickly become outdated. These factors collectively challenge the growth of the EUV market.

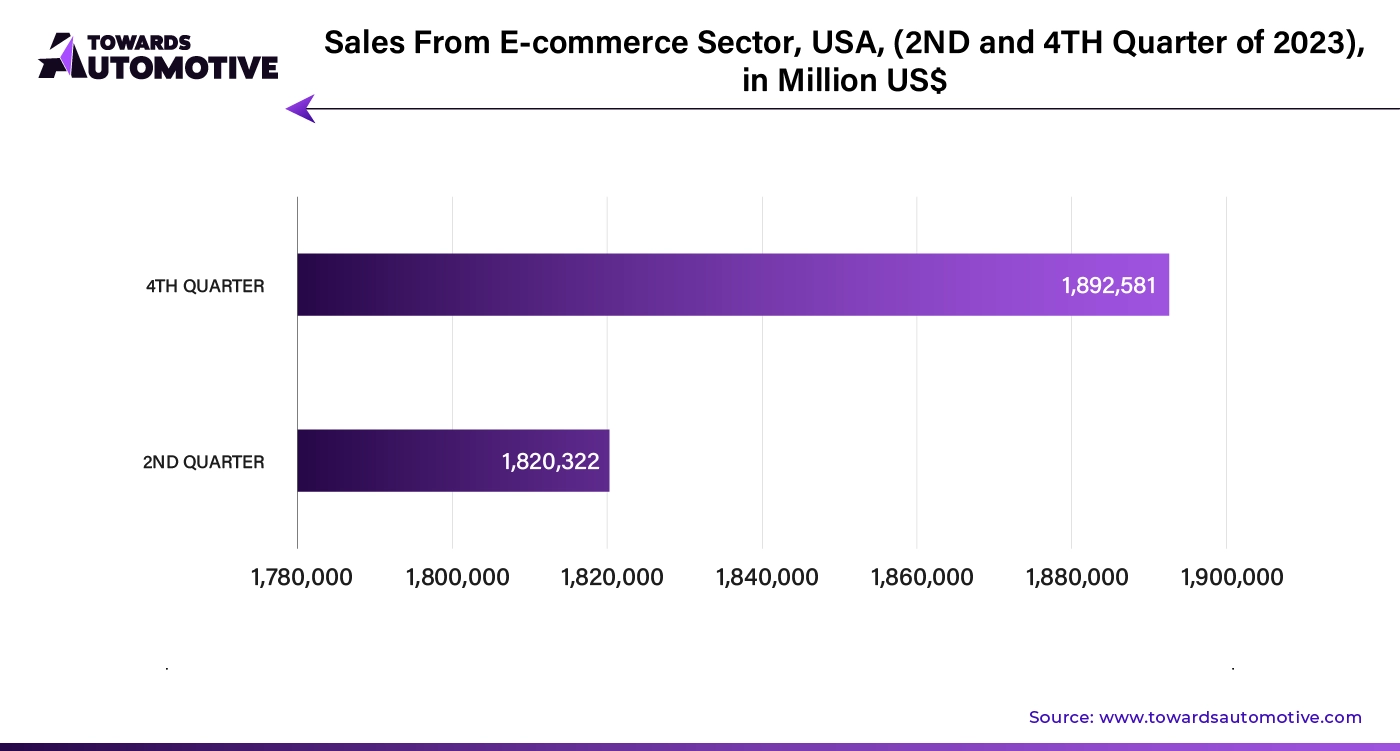

The rising e-commerce sector is creating significant opportunities in the Electric Utility Vehicles (EUV) market. As online shopping continues to grow, the demand for efficient and sustainable last-mile delivery solutions is increasing. Electric utility vehicles, including electric vans and delivery trucks, offer a greener alternative to traditional fossil-fuel-powered vehicles, aligning with e-commerce companies' sustainability goals and reducing their carbon footprint.

E-commerce companies are investing in electric utility vehicles to enhance operational efficiency and meet stringent environmental regulations. The shift towards electric fleets helps reduce fuel costs and maintenance expenses while supporting corporate sustainability initiatives. Additionally, advancements in battery technology and charging infrastructure make electric utility vehicles more practical for the high-frequency, short-distance deliveries typical of the e-commerce sector.

As the e-commerce sector expands, it drives increased demand for electric utility vehicles and related infrastructure, such as depot charging stations and fleet management systems. This growth presents opportunities for EUV manufacturers and service providers to cater to a burgeoning market segment, contributing to the broader adoption of electric vehicles and supporting the transition towards greener logistics solutions.

According to the data published by the Census Bureau of USA, in August 2024, the sales from the E-Commerce sector in 2nd Quarter of 2023 was 1,820,322 and in the same year the 4th Quarter sales was 1,892,581 across the U.S.

The li-ion segment held the dominant share of the market with 73.5%. Li-ion batteries offer high energy density, which allows electric utility vehicles to achieve longer ranges on a single charge compared to older battery technologies. This extended range addresses one of the major concerns associated with electric vehicles, making them more viable for various utility applications, including logistics, maintenance, and municipal services.

Moreover, Li-ion batteries have a relatively long lifespan and require less frequent replacement, which reduces overall maintenance costs and improves the total cost of ownership for electric utility vehicles. Their lightweight nature and efficient energy storage also contribute to better vehicle performance and efficiency. The continuous advancements in Li-ion technology, including improvements in energy density, charging speed, and thermal management, further enhance the attractiveness of electric utility vehicles.

The widespread adoption of Li-ion batteries is also driving innovation in charging infrastructure and battery management systems, supporting the broader integration of electric utility vehicles into operational fleets. As Li-ion battery technology continues to evolve, it plays a crucial role in expanding the capabilities and appeal of electric utility vehicles, fueling market growth.

The commercial segment held the largest share of the market. Businesses and municipalities are turning to electric utility vehicles to enhance sustainability, reduce operational costs, and meet regulatory requirements. In sectors such as logistics, warehousing, and public services, electric utility vehicles offer an environmentally friendly alternative to traditional diesel-powered vehicles, aligning with corporate sustainability goals and reducing carbon footprints.

The commercial sector benefits from lower fuel and maintenance costs associated with electric vehicles. The reliability and efficiency of electric utility vehicles make them ideal for demanding applications, such as delivery services and facility management, where uptime and operational efficiency are critical. Additionally, as governments and local authorities implement stricter emissions regulations, businesses are increasingly investing in electric utility vehicles to avoid penalties and gain competitive advantages.

The growing focus on reducing environmental impact and increasing operational efficiency in the commercial segment is accelerating the adoption of electric utility vehicles. This trend is driving demand for advanced electric vehicle technologies and infrastructure, such as charging stations and fleet management solutions, further contributing to the expansion of the Electric Utility Vehicles market.

The pure electric segment dominated the global electric utility vehicles. This segment is driving significant growth in the Electric Utility Vehicles (EUV) market by providing a fully emissions-free alternative to traditional utility vehicles. Unlike hybrid models, pure electric utility vehicles operate exclusively on electric power, eliminating tailpipe emissions and aligning with stringent environmental regulations and sustainability goals. This complete electrification appeals to businesses and municipalities aiming to reduce their carbon footprint and improve air quality in urban areas.

Advancements in battery technology have significantly enhanced the performance and practicality of pure electric utility vehicles. Improvements in energy density and charging speed have extended vehicle ranges and reduced downtime, making these vehicles suitable for a range of utility applications, including logistics, public maintenance, and municipal services. Additionally, lower operational and maintenance costs associated with pure electric vehicles further attract commercial users, offering long-term economic benefits.

The growing emphasis on sustainability and clean energy solutions drives increased investment in pure electric utility vehicles. As more organizations adopt these vehicles to meet environmental goals and regulatory requirements, the demand for supportive infrastructure, such as fast-charging stations and battery management systems, also rises. This collective shift towards pure electric solutions is a key factor in the expanding Electric Utility Vehicles market

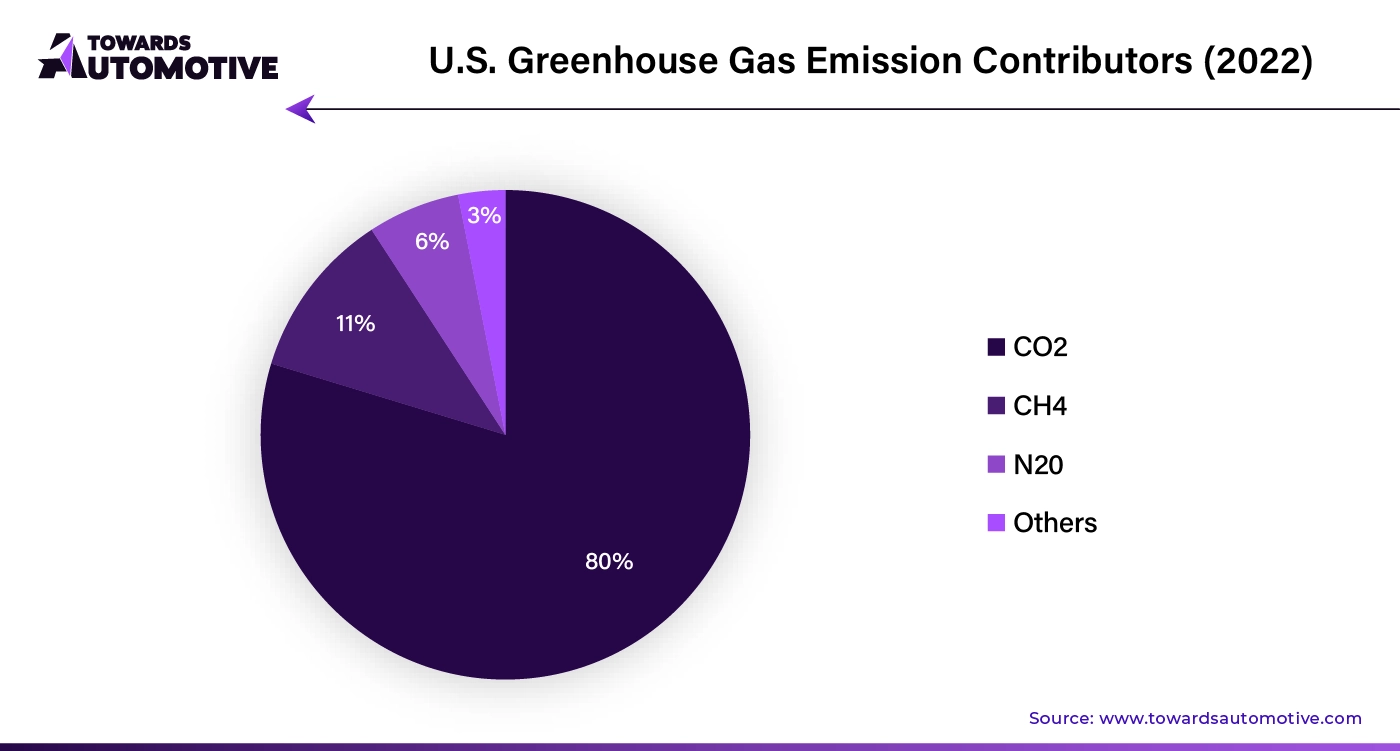

United States is one of the prominent marketplaces globally. The market is generally driven by the increasing focus on sustainability and reducing greenhouse gas emissions, as both businesses and municipalities adopt electric vehicles to meet environmental regulations and corporate sustainability goals. Government incentives, including tax credits and rebates, are encouraging the adoption of electric utility vehicles across various sectors such as logistics, public services, and industrial operations.

Advancements in battery technology are also playing a significant role in market growth. Improved battery efficiency, longer ranges, and faster charging capabilities make electric utility vehicles more practical and cost-effective for a wide range of applications. Additionally, the growing infrastructure of charging stations throughout the country is reducing range anxiety, making it easier for businesses to integrate electric vehicles into their operations.

Furthermore, the lower maintenance and operational costs of electric utility vehicles are attracting commercial users. With fewer mechanical parts and reduced fuel expenses, electric vehicles offer long-term savings, driving their appeal in industries focused on efficiency and sustainability. As a result, the combination of government support, technological advancements, and cost benefits is propelling the growth of the EUV market in the USA.

According to the U.S. Environment Protection Agency, CO2 (80%) was the major contributor to GHGs emission in the country followed by CH4 (11%), N20 (6%) and others (3%) in the year 2022.

Germany held 13.8% share of the global market. The market in this country is driven by its strong commitment to reducing emissions and achieving its climate goals. Government incentives, such as subsidies and tax breaks, are encouraging businesses and municipalities to adopt electric utility vehicles as part of their sustainability initiatives. These policies, combined with strict emissions regulations, are pushing the transition from traditional fossil-fuel vehicles to electric alternatives across industries like logistics, public services, and agriculture.

Technological advancements in battery efficiency and energy storage are also contributing to market growth. Improved range, faster charging capabilities, and more durable battery systems are making electric utility vehicles a viable solution for various operational needs. Additionally, Germany’s well-established charging infrastructure, which continues to expand, supports the growing adoption of electric vehicles by reducing range anxiety and downtime.

Furthermore, the focus on automation and the integration of smart technologies, such as predictive maintenance and fleet management systems, is enhancing the operational efficiency of electric utility vehicles, driving their appeal. As Germany continues to prioritize clean energy and innovation, these factors are collectively propelling the growth of the EUV market.

According to the Mobility Portal Europe, there are around 97000 EV charging stations presently in Germany and is expected to reach 1 million charging stations by 2030.

The United Kingdom is likely to grow with a CAGR of 10.6% during the forecast period. Several drivers are fueling the growth of the Electric Utility Vehicles (EUV) market in the UK. One of the primary factors is the government’s focus on reducing carbon emissions and meeting its ambitious net-zero targets. Policies like grants for electric vehicle purchases and low-emission zones in major cities are encouraging businesses and public sector organizations to switch to electric utility vehicles. These incentives, combined with strict environmental regulations, are accelerating the shift towards electric solutions in logistics, construction, and public services.

Advancements in electric vehicle technology, particularly in battery efficiency and range, are making EUVs more practical for a wide range of applications. The UK’s expanding charging infrastructure, including plans for nationwide fast-charging networks, is also making electric utility vehicles more accessible and reducing concerns about range limitations.

Additionally, the push for sustainability by large corporations and municipalities is creating demand for electric utility vehicles as part of broader green initiatives. Lower operational costs, reduced maintenance needs, and improved vehicle performance are further driving their adoption in industries that prioritize long-term efficiency and environmental responsibility.

India is expected to grow with a CAGR of 14.56% during the forecast period. There are several key drivers are propelling the growth of the Electric Utility Vehicles (EUV) market in India. The Indian government’s strong push towards electric mobility through initiatives like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme is a major catalyst. Subsidies, tax incentives, and policy support encourage businesses to adopt electric utility vehicles, especially in industries such as logistics, public services, and agriculture.

Additionally, India’s focus on reducing air pollution in urban areas is prompting both municipalities and companies to transition to electric vehicles, which offer zero emissions and quieter operation. The rising cost of fuel is also driving demand for electric alternatives, as electric utility vehicles offer significant long-term savings in fuel and maintenance expenses.

Technological advancements, particularly in battery efficiency and charging infrastructure, are making electric utility vehicles more feasible for Indian operations. The expanding network of charging stations across the country is easing concerns over range limitations. Moreover, India’s growing interest in sustainable and efficient transport solutions is creating opportunities for electric vehicles, further fueling the growth of the EUV market.

China is anticipated to grow with a CAGR of 18.53% during the forecast period. China’s Electric Utility Vehicles (EUV) market is growing rapidly, driven by strong government support and industrial innovation. The Chinese government has implemented aggressive policies to reduce carbon emissions, offering subsidies and tax incentives for the adoption of electric vehicles. This push is a central part of China’s commitment to sustainability and reducing urban air pollution, particularly in major cities.

In addition to government backing, the rapid development of battery technology and electric vehicle infrastructure in China is propelling the EUV market. Chinese manufacturers are at the forefront of producing high-efficiency batteries, which extend the range and operational capabilities of electric utility vehicles. The country’s extensive charging infrastructure, with a vast and growing network of public and private charging stations, further supports widespread adoption.

Furthermore, the cost advantages of electric vehicles, such as reduced fuel and maintenance expenses, are making them increasingly attractive to businesses in industries like logistics, manufacturing, and municipal services. China’s strong focus on technology and automation also supports the growth of electric utility vehicles, as smart fleet management and vehicle-to-grid (V2G) solutions gain traction.

Japan held 1.5% share of the global market. The Electric Utility Vehicles (EUV) market in Japan is driven by several key factors. The Japanese government’s commitment to reducing carbon emissions and promoting clean energy is a major catalyst. Through subsidies, tax incentives, and emissions regulations, Japan is encouraging businesses and municipalities to adopt electric utility vehicles for various applications, from logistics to public services. This push aligns with Japan’s broader environmental goals and its focus on achieving carbon neutrality by 2050.

Technological advancements, particularly in battery efficiency and electric vehicle innovation, are also fueling market growth. Japanese companies are leaders in battery technology, which has resulted in electric utility vehicles with longer ranges and faster charging times. These improvements make electric vehicles more practical for demanding operations, such as delivery services and industrial tasks.

Additionally, the country’s expanding charging infrastructure supports the adoption of electric vehicles. With the rise of smart cities and sustainable mobility solutions, Japan is seeing increased demand for electric utility vehicles, which offer lower operating costs, reduced maintenance, and quieter operation. These factors, combined with Japan’s focus on environmental sustainability and technological leadership, are driving the growth of the EUV market in the country.

Australia held 0.67% share of the market globally. Numerous drivers are fueling the growth of the Electric Utility Vehicles (EUV) market in Australia. A key factor is the country’s increasing focus on reducing carbon emissions and addressing climate change. As Australia commits to cleaner energy solutions, both the government and private sectors are adopting electric vehicles to meet environmental targets and improve sustainability in industries like logistics, mining, and agriculture.

Government incentives, such as grants, tax breaks, and subsidies for electric vehicles, are encouraging businesses to invest in electric utility vehicles. Additionally, Australia's vast landscape and focus on reducing fuel dependence have made electric utility vehicles more appealing due to their lower operational and maintenance costs compared to traditional vehicles.

The expansion of charging infrastructure is another important driver. With more charging stations being built in urban and regional areas, electric utility vehicles are becoming more practical for long-distance travel and demanding utility tasks. Technological advancements in battery technology, offering longer ranges and faster charging, are also enhancing the appeal of EUVs. These factors, coupled with a growing awareness of environmental sustainability, are driving the adoption and growth of electric utility vehicles in Australia.

By Type

By Battery Type

By Drive Type

By Application

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us