April 2025

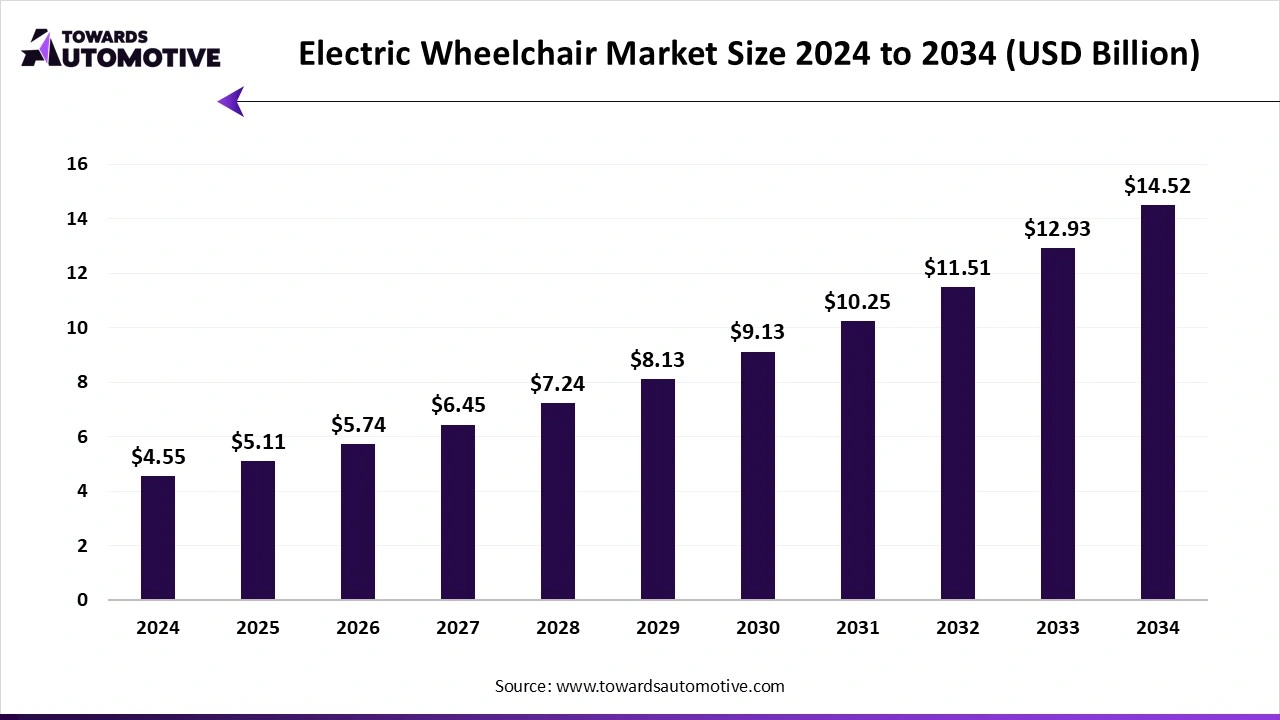

The electric wheelchair market is anticipated to grow from USD 5.11 billion in 2025 to USD 14.52 billion by 2034, with a compound annual growth rate (CAGR) of 12.35% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

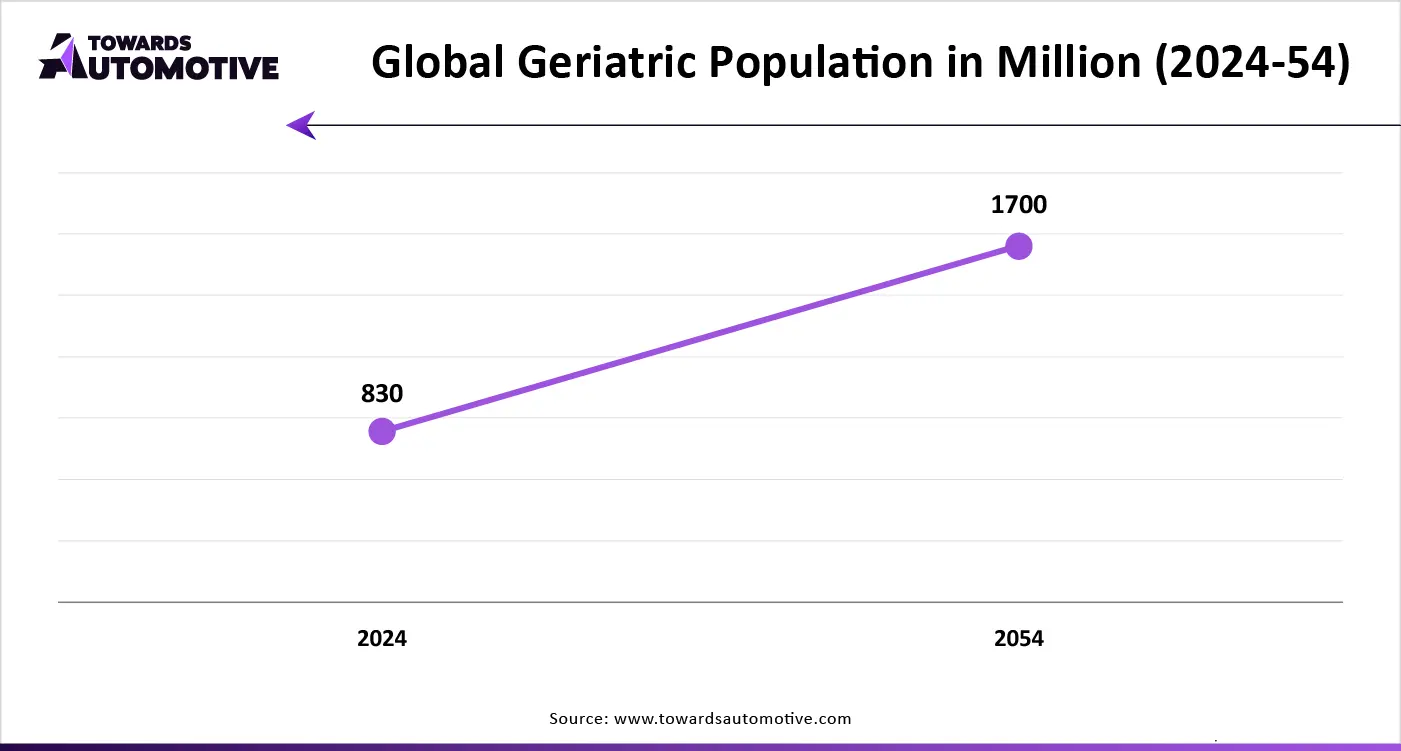

The electric wheelchair market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of electric-powered wheelchairs around the world. There are numerous types of wheelchairs developed in this sector consisting of front-wheel drive chairs, mid-wheel drive chairs, rear-wheel drive chairs and some others. These wheelchairs are designed for different age groups comprising of adult, pediatric, geriatric and some others. The end-users of this sector consists of homecare, hospitals, ambulatory surgical centers, rehabilitation centers and some others. The rising old-age population across the world has contributed significantly to the market expansion. This market is expected to rise drastically with the developments in the healthcare sector in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 4.55 Billion |

| Projected Market Size in 2034 | USD 14.52 Billion |

| CAGR (2025 - 2034) | 12.35% |

| Leading Region | North America |

| Market Segmentation | By Product, By Age Group, By Portability, By End-Use and By Region |

| Top Key Players | Pride Mobility Products Corp.; Numotion Sunrise Medical LLC; Invacare Corp.; Permobil |

The rear-wheel drive segment held a dominant share of the market. The rising demand for superior speed and stability in wheelchairs has boosted the market growth. Also, the growing use of wheelchairs for outdoor usage along with technological advancements in wheelchairs is crucial for the industrial expansion. Additionally, several wheel chair manufacturers are developing new models to cater the demands of the disabled community, thereby fostering the growth of the electric wheelchair market.

The mid-wheel drive segment is predicted to grow with the fastest growth rate during the forecast period. The growing adoption of mid-wheel drive wheelchairs for indoor uses has boosted the market growth. Also, there are several benefits of these wheel chairs including superior maneuverability, short turning radius, reduced tipping, enhanced traction and some others is playing a vital role in shaping the industrial landscape. Moreover, various market players are engaged in developing mid-wheel drive wheelchairs for end-users that in turn is expected to propel the growth of the electric wheelchair market.

The geriatric segment held the lion’s share of the market. The rise in number of old-age population in different parts of the world has boosted the market growth. Also, growing prevalence of chronic diseases such as CVDs and cancers among geriatric population is driving the industrial expansion. Moreover, several wheelchair companies are investing heavily for developing electric wheelchairs for aged people is likely to drive the growth of the electric wheelchair market.

The adult segment is likely to rise with the highest growth rate during the forecast period. The rising cases of road accidents among middle-aged people has boosted the market expansion. Also, rapid prevalence of nerve diseases such as Cerebral palsy, Alzheimer's Disease, Parkinson's Disease and some others is increasing the demand for electric wheelchairs, thereby fostering the market growth. Moreover, several wheel chair manufacturing brands are developing hands free wheel chairs for youths is anticipated to propel the growth of the electric wheelchair market.

The standalone segment led the industry. The rising demand for standalone wheelchairs among individual users has boosted the market expansion. Also, rapid adoption of these wheelchairs in airports and shopping malls for disabled users is crucial for the industrial growth. Moreover, several market players are constantly engaged in manufacturing wheelchairs that can be operated without third-party intervention is predicted to foster the growth of the electric wheelchair market.

The portable segment is projected to grow with the highest CAGR during the forecast period. The rising demand for small-sized wheelchairs for enhancing convenience and usability during travelling has boosted the market expansion. Also, the growing use of these wheel chairs for saving spaces and improving transportation has further added to the market growth. Moreover, rapid investment by wheelchair companies for manufacturing portable wheelchairs is also accelerating the growth of the electric wheelchair market.

The home care segment dominated the market. The rising use of wheelchairs in residential settings for transporting disabled patients has boosted the market growth. Also, the rapid adoption of reclining wheelchairs and commode wheelchairs for indoor usage is accelerating the market expansion. Moreover, the increasing emphasis of market players for developing electric wheelchairs for residential purposes has further bolstered the growth of the electric wheelchair market.

The ambulatory surgical centers (ASCs) segment is likely to witness highest growth rate during the forecast period. The rising cases of road accidents in different parts of the world has increased the application of wheelchairs in ambulatory surgical centers, thereby driving the market expansion. Moreover, rapid investment by government for developing ambulatory surgical centers to operate during emergency situations has further driven the growth of the electric wheelchair market.

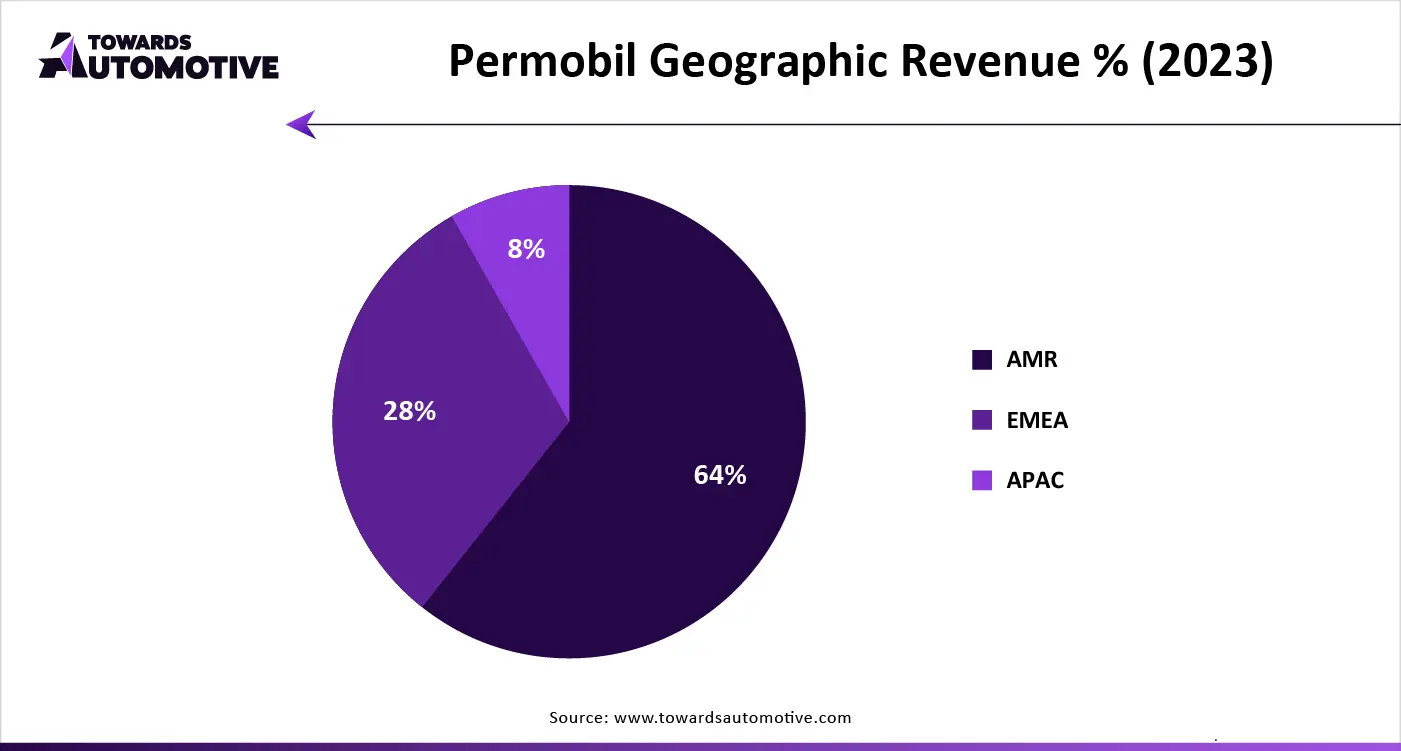

North America held the highest share of the electric wheelchair market. The growing development in the healthcare sector in countries such as the U.S. and Canada has boosted the market growth. Also, rising prevalence of chronic diseases including cancers, arthritis, chronic respiratory diseases and some others is adding to the industrial expansion. Additionally, numerous government initiatives aimed at strengthening the medical sector coupled with presence of various market players is predicted to boost the market growth in this region.

The U.S. is a major contributor in this region. The rise in number of government hospitals coupled with advancements in healthcare technology boosts the market expansion. Also, presence of several wheelchair manufacturing brands such as Golden Technologies, Invacare Corporation, Pride Mobility Products and some others further drives the industrial expansion.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The rising cases of road accidents in countries such as China, India, Japan and some others has boosted the market growth. Also, technological advancements in medical sector along with growing incidences of nerve and bone diseases is playing a vital role in shaping the industrial landscape. Moreover, the rapid developments in healthcare tourism coupled with rise in number of disabled people is driving the market growth in this region.

China dominated the market in this region. The market in China is generally driven by the availability of raw materials along with technological advancements in healthcare sector. Also, rapid developments in the battery manufacturing industry coupled with rise in number of old-age people further adds to the market growth.

The electric wheelchair market is a developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Pride Mobility Products Corp.; Numotion Sunrise Medical LLC; Invacare Corp.; Permobil; Ottobock; MEYRA GmbH and some others. These companies are constantly engaged in developing electric wheelchairs and adopting numerous strategies such as business expansion, acquisition, partnerships, collaborations, joint venture, product launches and some others to maintain their dominant position in this industry.

By Product

By Age Group

By Portability

By End-Use

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us