April 2025

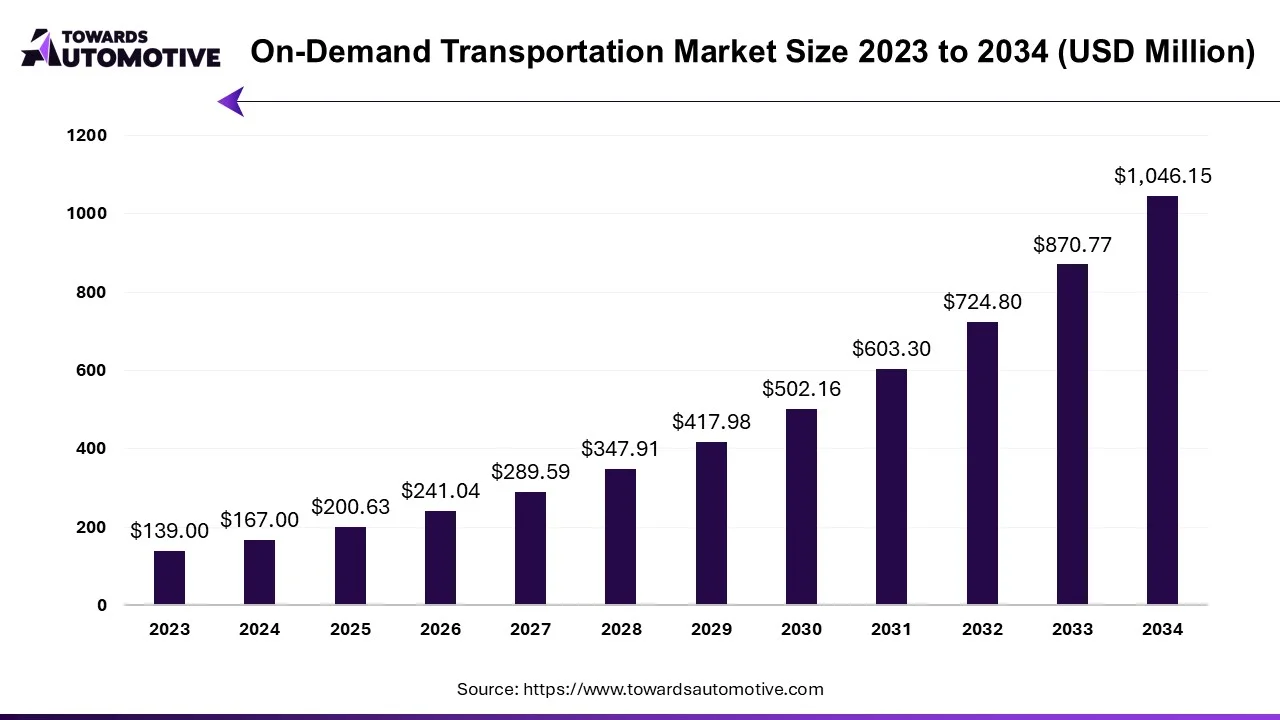

The on-demand transportation market size is forecasted to expand from USD 200.63 million in 2025 to USD 1046.15 million by 2034, growing at a CAGR of 20.14% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

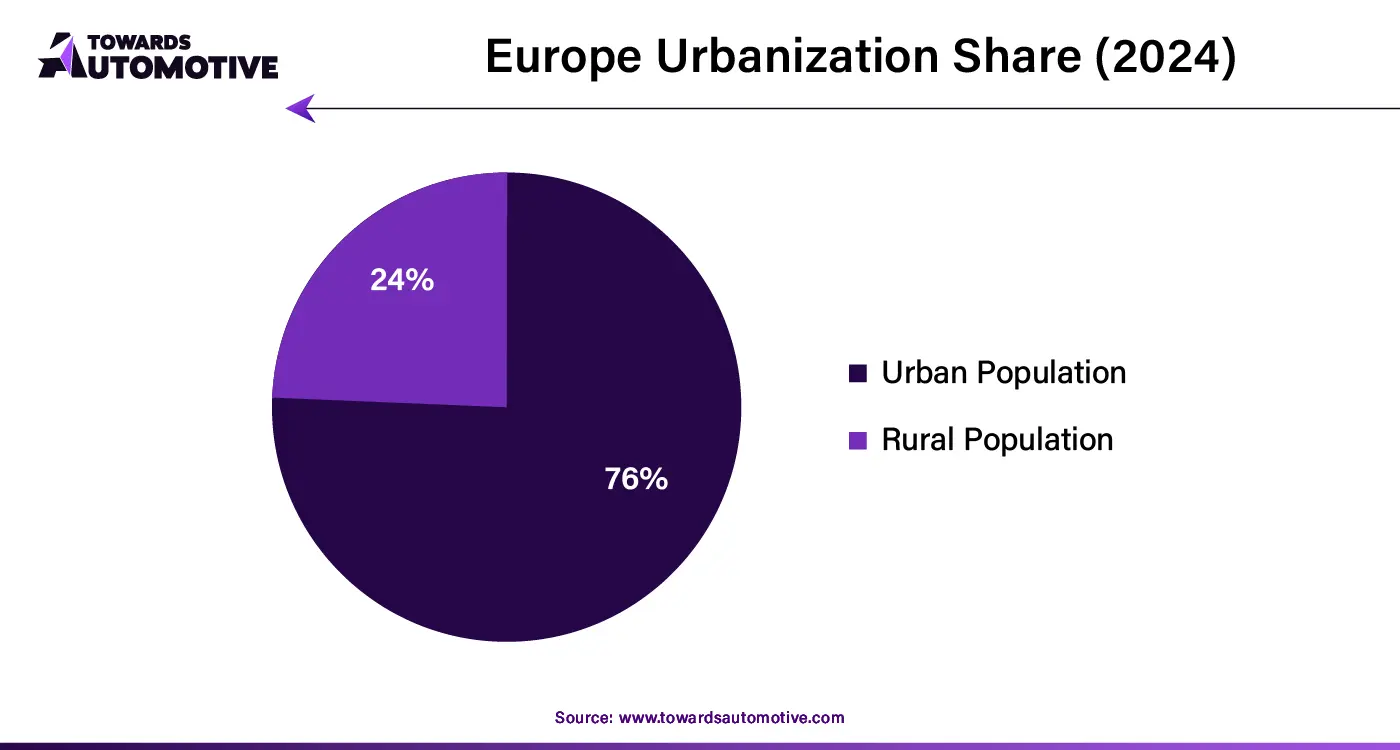

The on-demand transportation market is a prominent branch of the automotive industry. This industry deals in providing flexible transportation systems across the world. There are various types of services provided by this industry consisting of e-hailing, car sharing, car rental, station-based mobility and others. These services are operated using four wheelers and bikes. This industry uses different types of connectivity such as V2V, V2I, V2P and V2N. The rising adoption of electric vehicles along with rapid urbanization across the world is contributing to the industrial expansion. This market is expected to grow significantly with the rise in electric mobility sector around the globe.

In July 2024, Alessandro Villa, the COO of Wayla made an announcement stating that,” “Living in Milan and reading the local news over the past years, it’s evident that there is a lack of transportation solutions available to citizens, especially in the evening hours. Wayla will finally offer a safe, economical, and sustainable alternative to residents and tourists, ensuring a quality service thanks to the direct management of vehicles and drivers and the unparalleled experience of our partner ioki.”

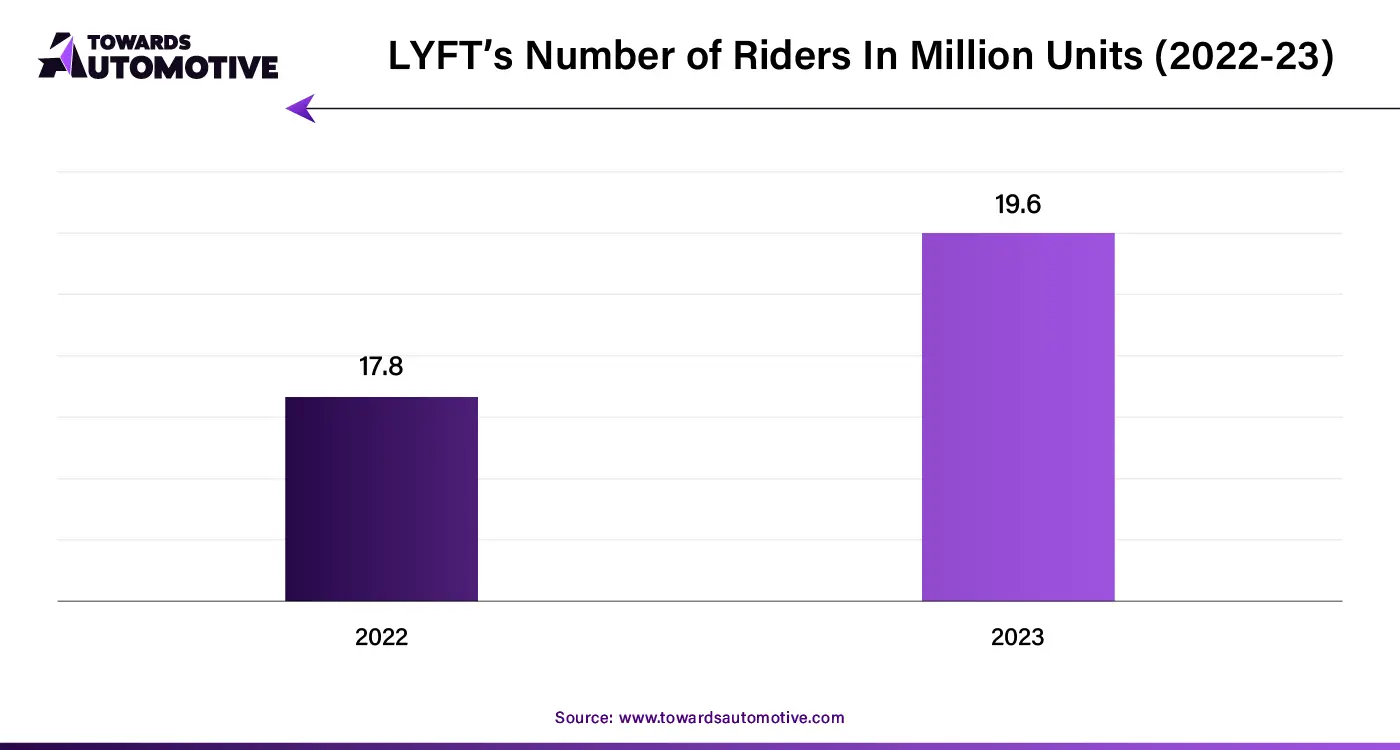

The on-demand transportation market is a highly competitive market with the presence of numerous dominant players. Some of the prominent players in this industry comprises of Uber Technologies, Inc.; Lyft, Inc.; Ola Electric Mobility Pvt Ltd.; Grab, Beijing Xiaoju Technology Co, Ltd. and some others. These companies are continuously engaged in expanding their business in different regions to sustain their position in this competitive industry.

By Type

By Service

By Connectivity

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us