March 2025

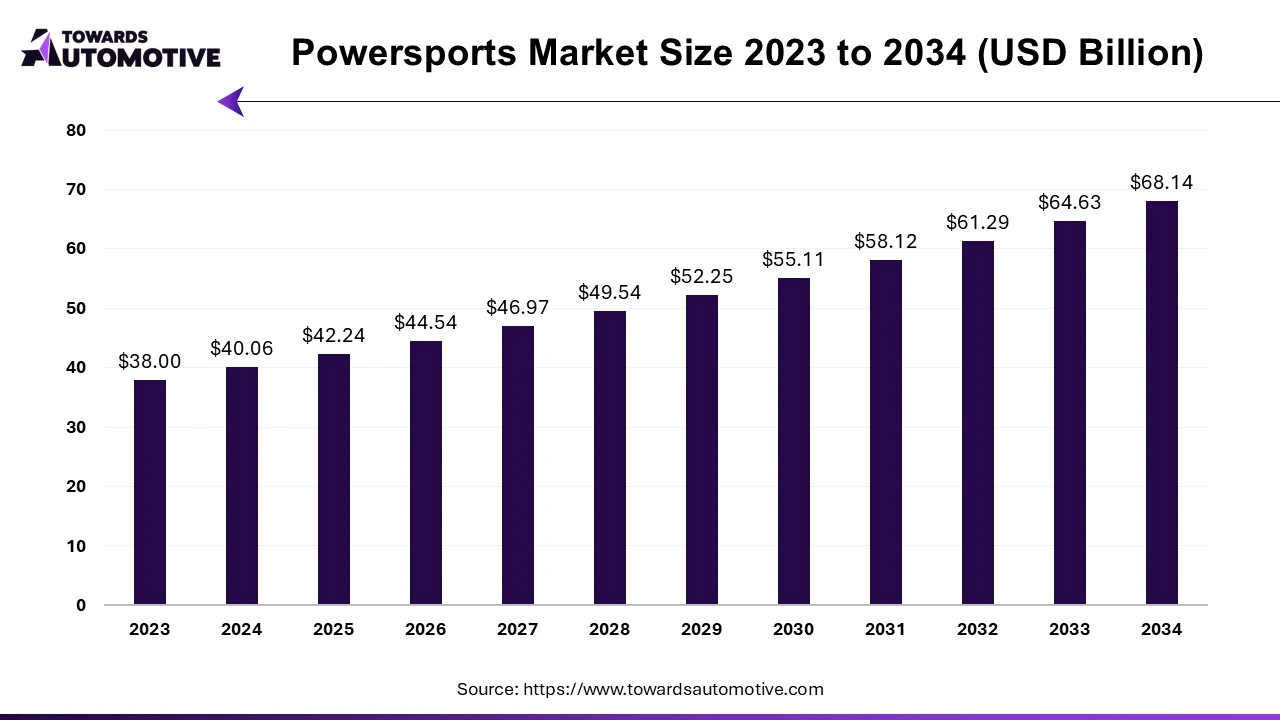

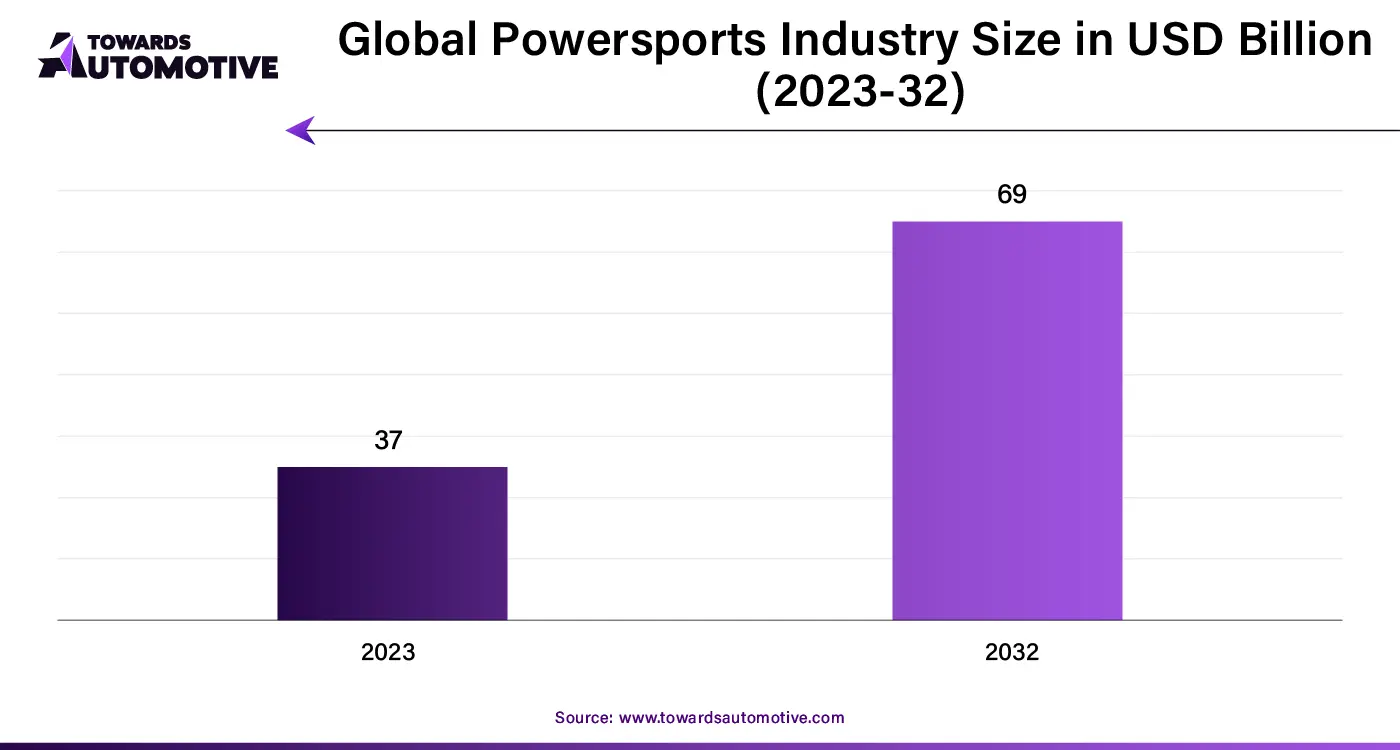

The powersports market is projected to reach USD 68.14 billion by 2034, growing from USD 42.24 billion in 2025, at a CAGR of 5.43% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The powersports market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of powersport vehicles around the world. There are various types of vehicles developed in this industry consisting of heavyweight motorcycle, ROVs, Jetski, snowmobiles and some others. These vehicles find several applications such as on-road, off-road and other applications. The powersport vehicles are powered using numerous propulsion type including gasoline, diesel and electric. The rising development in the powersport sector has contributed to the industrial expansion. This market is predicted to rise significantly with the growth of the off-road vehicles industry in different parts of the world.

In November 2024, David Shan, the CEO of Massimo announced that,” The 2025 Buck 550-6 Crew is meeting market needs with consumer-focused design, and represents our continued commitment to innovation and quality, This vehicle meets the demands of families, outdoor enthusiasts, and light-duty users, all while offering the most competitive price in the market. We believe this UTV will set a new standard in the industry and drive significant growth for Massimo Motor."

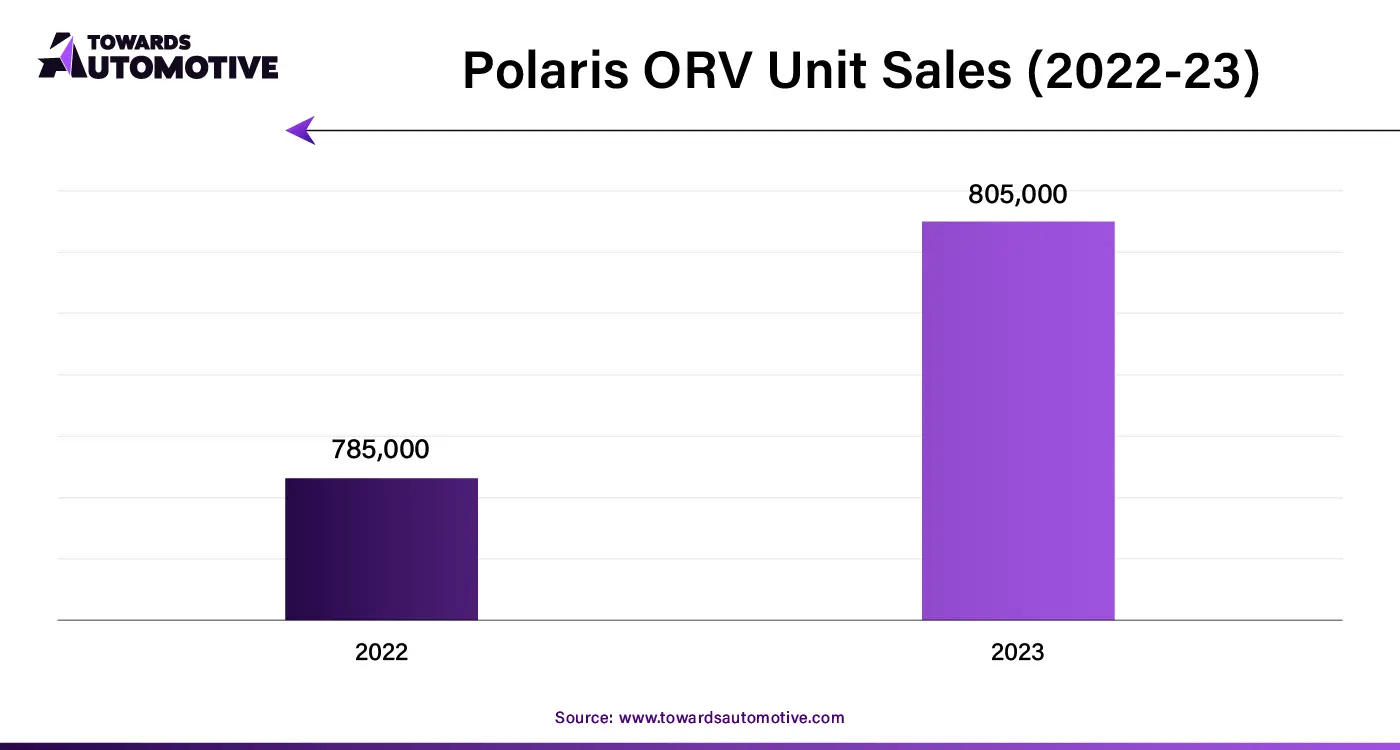

The powersports market is a highly fragmented industry with the presence of various dominant players. Some of the prominent companies ruling this industry comprises of Polaris Inc. (U.S.), Textron Inc. (U.S.), Arctic Cat Inc. (U.S.), Honda Motor Co., Ltd. (Japan), BRP (Canada), Harley Davidson (U.S.), Kawasaki Heavy Industries, Ltd. (Japan), KYMCO (Taiwan), CF Moto (China), KTM (Austria), Argo (Canada) and some others. These market players are constantly engaged in manufacturing powersports vehicles and adopting several strategies to sustain their dominant position in this industry.

By Vehicle Type

By Application

By Fuel Type

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us