April 2025

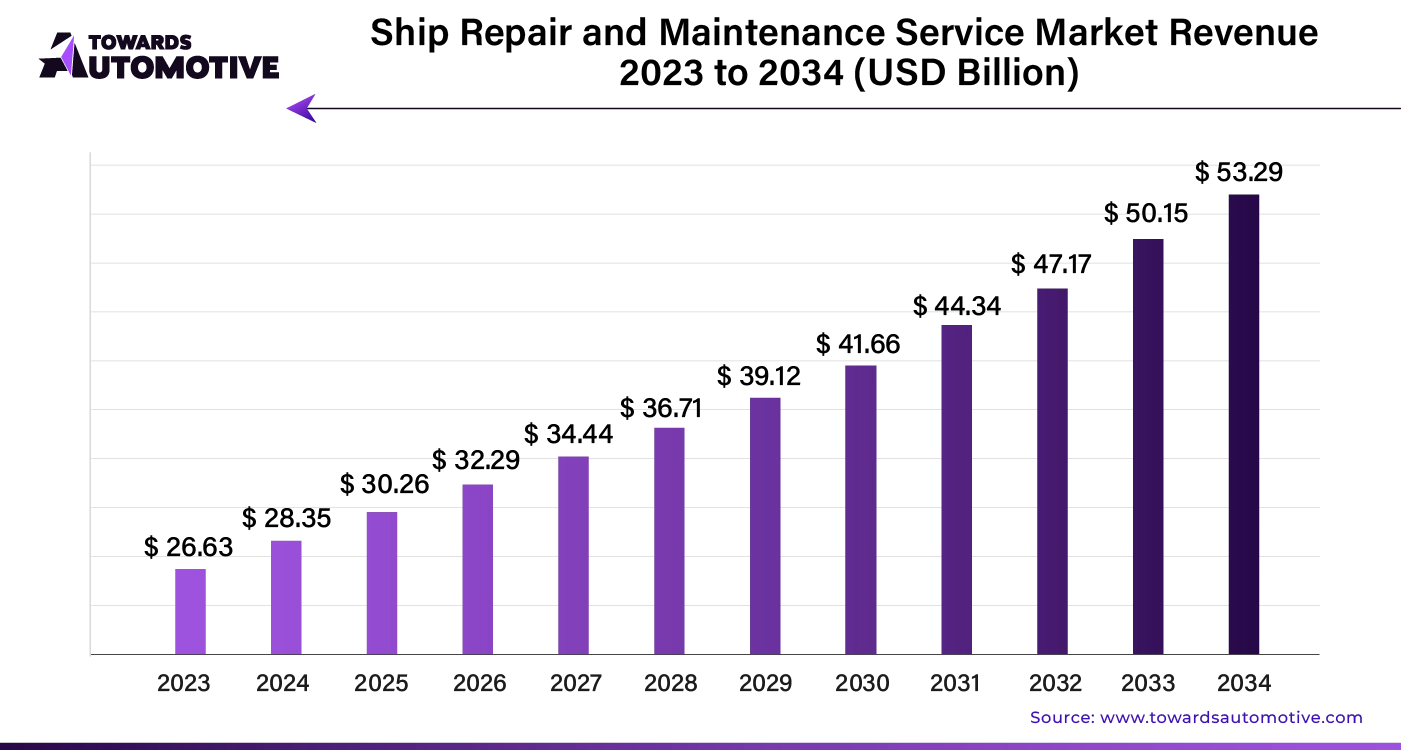

The ship repair and maintenance service market is projected to reach USD 53.29 billion by 2034, expanding from USD 30.26 billion in 2025, at an annual growth rate of 6.63% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Drivers:

Challenges:

AI integration is revolutionizing the ship repair and maintenance service market by enhancing efficiency and reducing costs. Predictive maintenance, powered by AI, allows for early detection of potential issues, enabling timely repairs before they escalate into costly problems. AI algorithms analyze data from sensors and historical records to predict when parts will fail, optimizing maintenance schedules and minimizing downtime. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

AI-driven automation streamlines routine tasks, such as inspection and diagnostics, by using advanced image recognition and machine learning. This reduces human error and accelerates repair processes. Additionally, AI assists in parts inventory management, predicting demand and ensuring the availability of critical components. This minimizes delays and improves service delivery.

Incorporating AI also enables real-time monitoring and data analysis, providing actionable insights for continuous improvement. By leveraging AI, companies can enhance operational efficiency, lower maintenance costs, and extend the lifespan of vessels. The result is a more responsive, cost-effective, and efficient ship repair and maintenance industry poised for significant growth.

In the ship repair and maintenance service market, an efficient supply chain is crucial for timely and cost-effective operations. The process begins with procurement, where companies source high-quality materials and spare parts from reliable suppliers. Timely delivery of these components is essential to prevent delays in repair schedules.

Once materials arrive, they are stored in well-organized warehouses that ensure easy access and inventory management. Repair facilities then coordinate with suppliers and service teams to schedule maintenance activities. This coordination helps streamline workflows and minimize downtime for ships.

Logistics play a key role in the supply chain, involving transportation of equipment and parts to and from repair sites. Effective logistics management ensures that parts are available when needed, reducing wait times and avoiding disruptions.

Furthermore, strong relationships with suppliers and efficient inventory control contribute to reducing costs and enhancing service quality. By maintaining clear communication channels and employing advanced tracking systems, the supply chain in ship repair and maintenance ensures that services are delivered efficiently, meeting both safety and performance standards.

The ship repair and maintenance service market thrives on several critical components and key players. Leading companies such as Damen Shipyards, Hyundai Heavy Industries, and Naval Group offer comprehensive repair solutions, ensuring vessel longevity and performance. Damen Shipyards excels in global repair services, leveraging its extensive network and specialized facilities to address diverse maritime needs. Hyundai Heavy Industries focuses on advanced technology and innovation, enhancing repair efficiency and reducing downtime.

Other significant contributors include BAE Systems, which provides specialized maintenance services for naval vessels, and Vard Group, known for its expertise in offshore and specialized ships. These companies utilize state-of-the-art equipment and skilled personnel to deliver high-quality repairs.

Regional players like Singapore Technologies Marine and Dubai Drydocks World also play pivotal roles by offering localized services and support tailored to regional maritime requirements. Collectively, these companies contribute to a robust ship repair and maintenance ecosystem, ensuring vessels remain operational and efficient throughout their service lives. Their diverse expertise and global presence underscore the market's complexity and dynamic nature.

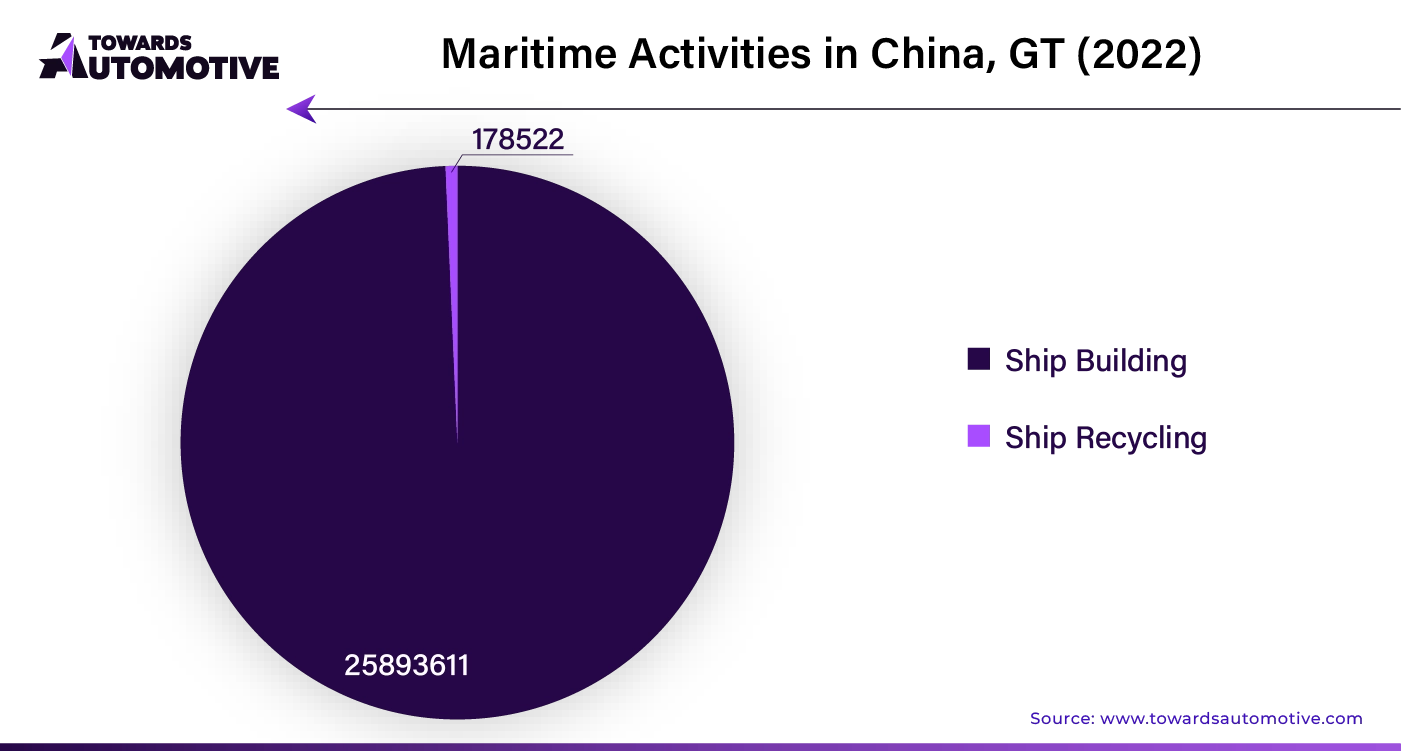

China Leads the Market

China tops the global ship repair and maintenance market, driven by its strategic position as a major maritime hub. With its vast coastline and busy ports, China has a strong demand for vessel maintenance, supporting a large fleet of cargo ships, tankers, and container vessels. The forecasted compound annual growth rate (CAGR) for China from 2024 to 2034 is 7.1%.

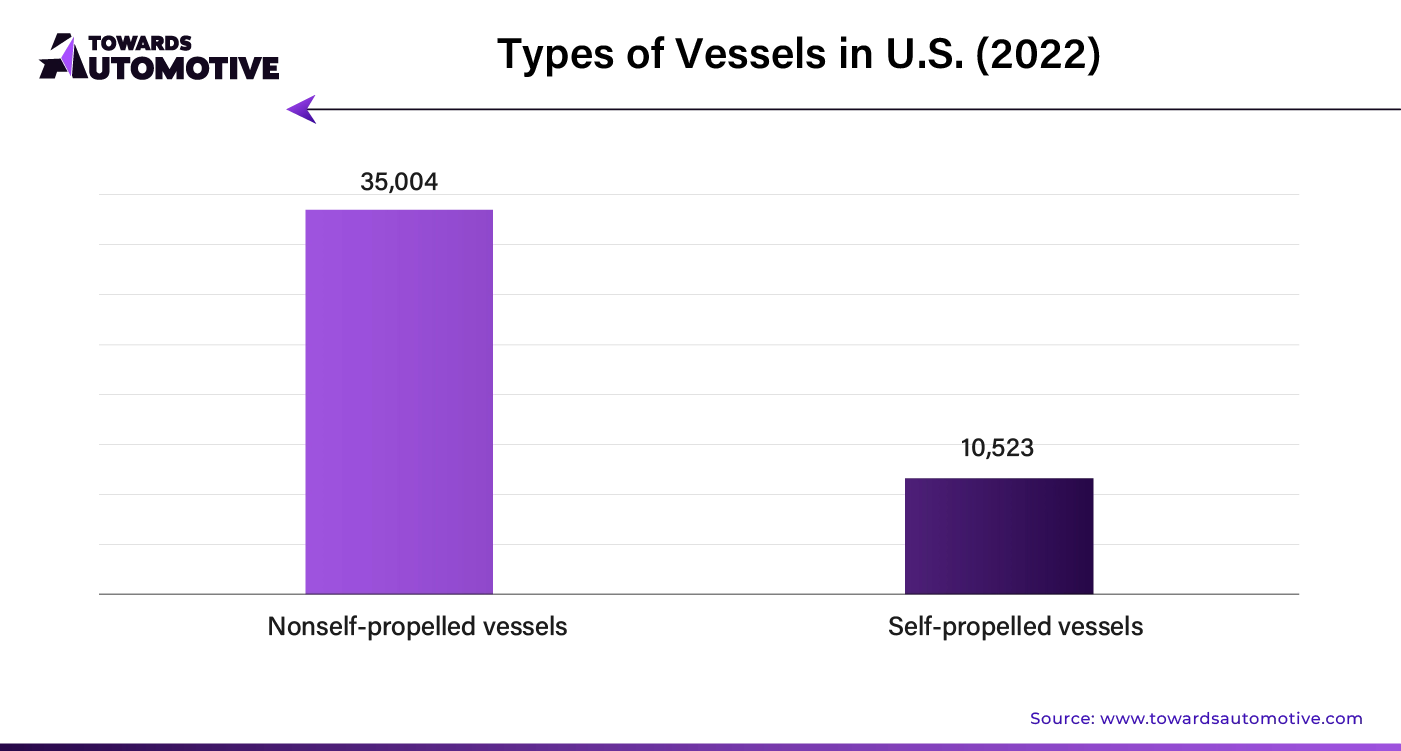

United States: Military and Commercial Fleet Support

The United States, with a CAGR of 4.4%, utilizes its extensive maritime industry for ship repair services. This includes maintaining the U.S. Navy’s large fleet and supporting commercial shipping operations. Major seaports on the East, West, and Gulf coasts require ongoing repairs to ensure safety and regulatory compliance.

Canada: Maritime Transportation and Arctic Focus

Canada’s ship repair market, growing at a CAGR of 3.1%, is driven by support for commercial shipping, fishing, offshore oil and gas, and naval operations. The increasing emphasis on Arctic shipping boosts demand for repairs on icebreakers and Arctic vessels.

Australia: Offshore Energy Sector Demand

Australia’s market, with a CAGR of 5.3%, depends on ship repair services to support its vibrant maritime sector, including offshore oil and gas exploration. The country’s strategic location in the Asia-Pacific region and its extensive coastline drive significant demand for repair and maintenance services.

United Kingdom: Strategic Maritime Hub

The United Kingdom’s ship repair market, growing at a CAGR of 3.5%, supports commercial shipping, offshore energy, fishing, and naval operations. Its strategic position in the North Sea and the English Channel enhances its role as a key maritime hub, driving demand for vessel maintenance and compliance.

In 2024, bulk carriers are projected to account for approximately 32.5% of the market. These vessels are crucial for transporting substantial quantities of commodities such as coal, grain, and ores, emphasizing their pivotal role in global trade.

Hull part services are expected to capture around 28.7% of the market. This segment includes essential repair tasks like welding, coating, and structural improvements to prolong the life of aging vessels.

The significant market shares for both bulk carriers and hull parts underscore the increasing demand for effective vessel maintenance and repair in the maritime industry.

Competitive Landscape of the Ship Repair and Maintenance Service Market

The ship repair and maintenance service market is highly competitive, with key players including major shipyards, repair facilities, and service providers. Companies compete through technological innovation, service quality, geographic reach, and pricing strategies. Collaborations and partnerships are common, especially for large projects and specialized services.

By Vessel Type

By Service Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us