April 2025

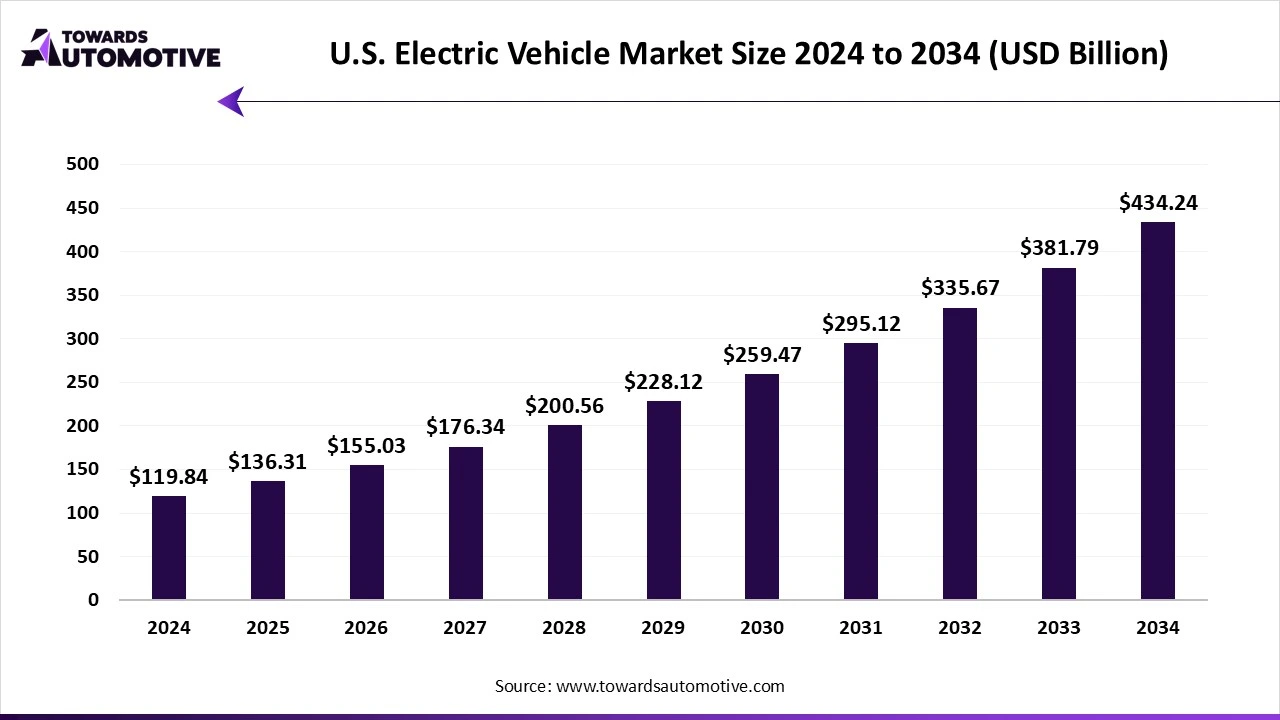

The U.S. electric vehicle market is expected to increase from USD 136.31 billion in 2025 to USD 434.24 billion by 2034, growing at a CAGR of 13.74% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

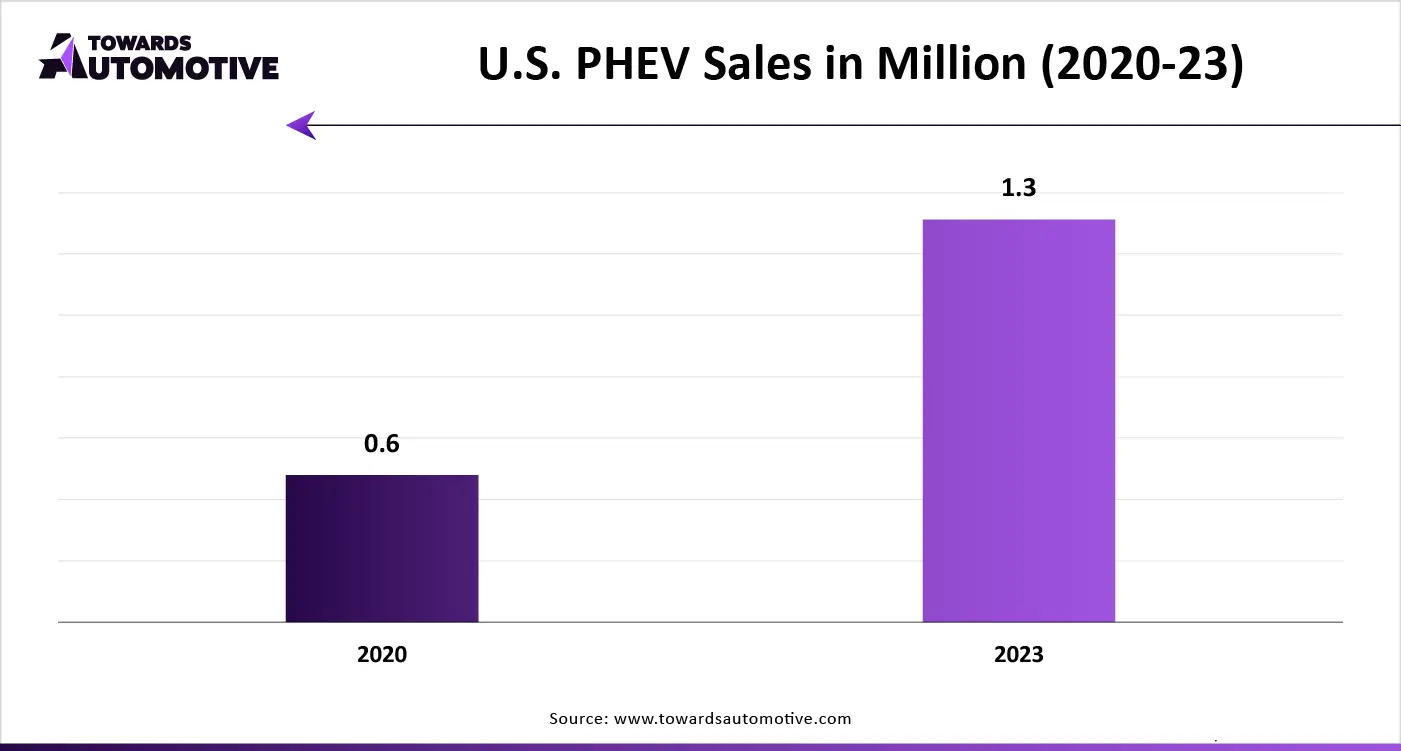

The U.S. electric vehicle market is a crucial segment of the EV industry. This industry deals in manufacturing and distribution of EVs in the U.S. There are different types of vehicles developed in this sector consisting of two-wheelers, passenger cars, commercial vehicles and some others. These vehicles are integrated by various types of drivetrains comprising of front-wheel drive, rear-wheel drive and all-wheel drive. It is powered by numerous batteries including sealed lead acid battery, nickel metal hydride, lithium ion and some others. The rising sales of hybrid vehicles in the U.S. has accelerated the market expansion. This market is predicted to rise significantly with the growth of the automotive sector.

| Metric | Details |

| Market Size in 2024 | USD 119.84 Billion |

| Projected Market Size in 2034 | USD 434.24 Billion |

| CAGR (2025 - 2034) | 13.74% |

| Market Segmentation | By Propulsion, By Vehicle, By Drivetrain, By Battery, By Range, By Price Range and By End Use |

| Top Key Players | Lucid Motors, Ford, Chevrolet, General Motors, Rivian, Tesla |

The BEV segment held a dominant share of the market. The growing demand for eco-friendly vehicles among the people of the U.S. has boosted the market growth. Also, the rising investment by government for strengthening the EV charging infrastructure is crucial for the industrial expansion. Moreover, the increasing prices of gasoline and diesel along with technological advancements in battery industry has driven the growth of the U.S. electric vehicle market.

The FCEV segment is predicted to grow with a significant growth rate during the forecast period. The growing demand for fuel-efficient vehicles coupled with numerous government initiatives aimed at lowering emission in the environment propels the industrial expansion. Additionally, the rising adoption of hydrogen-powered trucks in several industries such as oil and gas, food and beverage, e-commerce and some others has proliferated the market growth. Furthermore, collaborations and partnerships among various automotive companies for developing FCEVs in the U.S. boosts the growth of the U.S. electric vehicle market.

The passenger car segment led the industry. The rising demand for luxury electric vehicles among rich people has boosted the market growth. Also, the people of U.S. are transitioning towards EVs due to the rapid deployment of fast-chargers in charging stations coupled with the increasing prices of fossil fuels is driving the industrial expansion. Moreover, the growing preference of youths towards off-roading activities has increased the demand for electric SUVs, thereby fostering the growth of the U.S. electric vehicle market.

The lithium-ion segment held the largest share of the industry. The rising demand for long-range electric vehicles among the people of the U.S. increases the demand for li-ion batteries, thereby driving the market expansion. Also, numerous benefits of li-ion batteries including high energy density, light-weight, long lifespans, temperature tolerance, fast charging and some others is crucial for the industrial growth. Furthermore, several li-ion battery companies are opening up new production plants in the U.S. is expected to propel the growth of the U.S. electric vehicle market.

The commercial segment held a notable share of the market. The rising adoption of electric vehicles by government agencies in the U.S. to lessen CO2 emission has bolstered the market expansion. Also, the rise in number of ride-sharing platforms along with growing deployment of electric trucks by fleet operators is playing a vital role in shaping the industrial landscape. Moreover, the increasing use of electric buses in cities such as New York, Los Angeles, Chicago, Dallas, San Diego and some others is likely to foster the growth of the U.S. electric vehicle market.

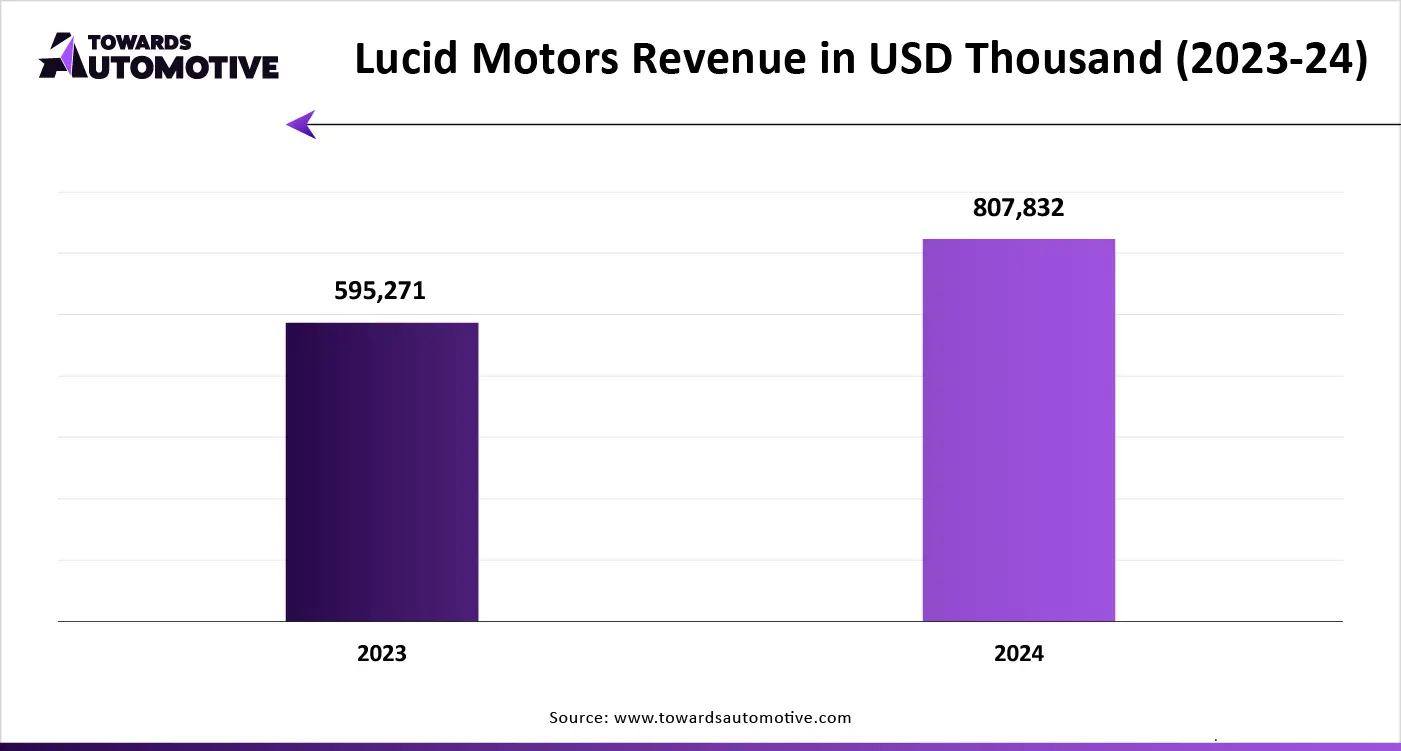

California held the highest share of the U.S. electric vehicle market. The growing demand for sustainable transportation along with rise in number of charging stations along with opening of new manufacturing facilities by global EV companies has boosted the market growth. Also, several government mandates on automotive companies for maintaining emission levels coupled with rising sales of EVs is shaping the industry in a positive direction. Moreover, the presence of numerous EV brands such as Lucid Motors, Rivian, Aptera Motors, Tesla and some others as well as rapid government investment for deploying fast-charging stations is expected to propel the growth of the U.S. electric vehicle market.

Michigan is expected to grow with a significant CAGR during the forecast period. The presence of several automotive brands in Detroit along with rapid investment in EV sector by automotive giants boosts the market expansion. Additionally, the rising sales and production of luxury EVs as well as presence of well-established EV charging infrastructure further propels the industrial growth. Moreover, growing investment by government to bolster the EV battery manufacturing sector is predicted to boost the growth of the U.S. electric vehicle market.

In March 2025, Christian Meunier, the chairman at Nissan Americas made an announcement stating that, “This agreement with SK On is a significant milestone for Nissan's electrification journey and supports further investment in U.S. manufacturing, through this smart partnership with SK On, we can leverage their growing U.S. production capacity to deliver innovative, high-quality electric vehicles that meet the needs of our customers.”

The U.S. electric vehicle market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Lucid Motors, Ford, Chevrolet, General Motors, Rivian, Tesla and some others. These companies are constantly engaged in developing electric vehicles for the U.S. and adopting numerous strategies such as product launches, joint venture, partnerships, business expansion, acquisition, and some others to maintain their dominant position in this industry. For instance, in February 2025, Ford announced to launch extended-range electric SUVs by 2027. This SUV is expected to be integrated with high-capacity battery to provide extended driving range. Also, in November 2024, Rivian joined hands with Volkswagen. This joint venture is done for developing an EV software that enhances the functionality of vehicles.

By Propulsion

By Vehicle

By Drivetrain

By Battery

By Range

By Price Range

By End Use

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us