April 2025

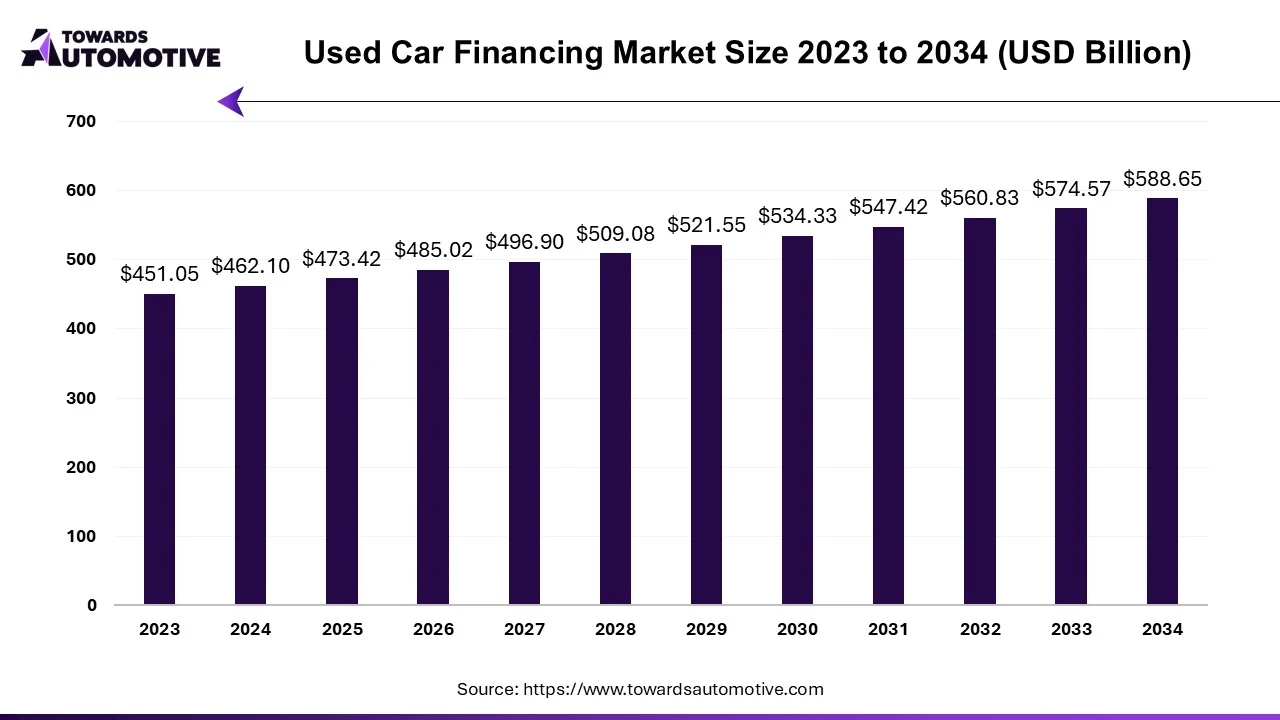

The used car financing market is projected to reach USD 588.65 billion by 2034, growing from USD 473.42 billion in 2025, at a CAGR of 2.45% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

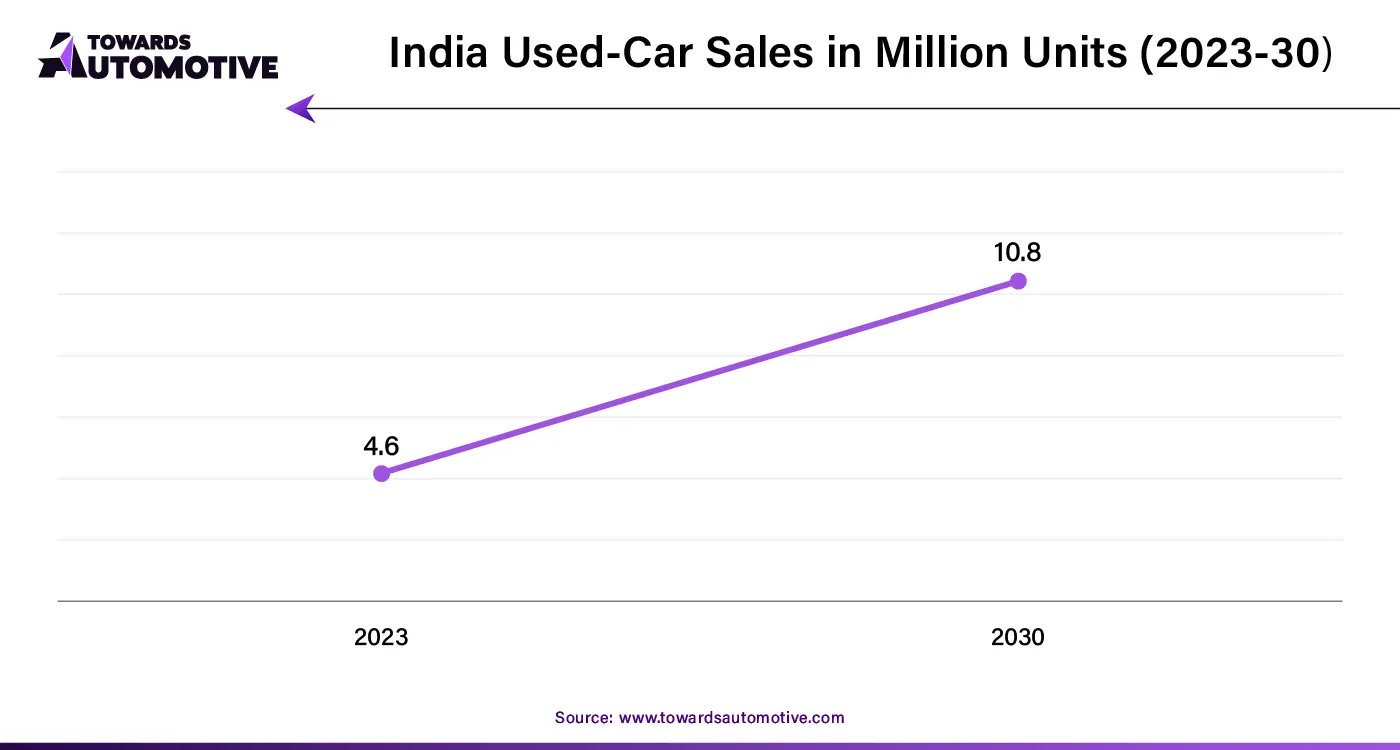

The used car financing market is a prominent sector of the BFSI industry. This industry deals in providing financing services for purchasing used vehicles. There are several types of loans provided by this sector comprising of secured loans, unsecured loans, lease financing and others. These financial services are provided by various institutions such as bank financing, credit union financing, online financing and dealer financing. It is designed for numerous types of consumers including corporate buyers, small businesses, and individual buyers. The growing sales of used cars in middle-income countries is driving the market growth. This market is expected to grow exponentially with the rise of the automotive sector in different parts of the globe.

In May 2024, Mani Singh, the director of Nxfin Technologies announced that” Nxcar integrates various services on a single tech platform, making the experience of buying a used car as transparent and convenient as buying a new one from a showroom.”

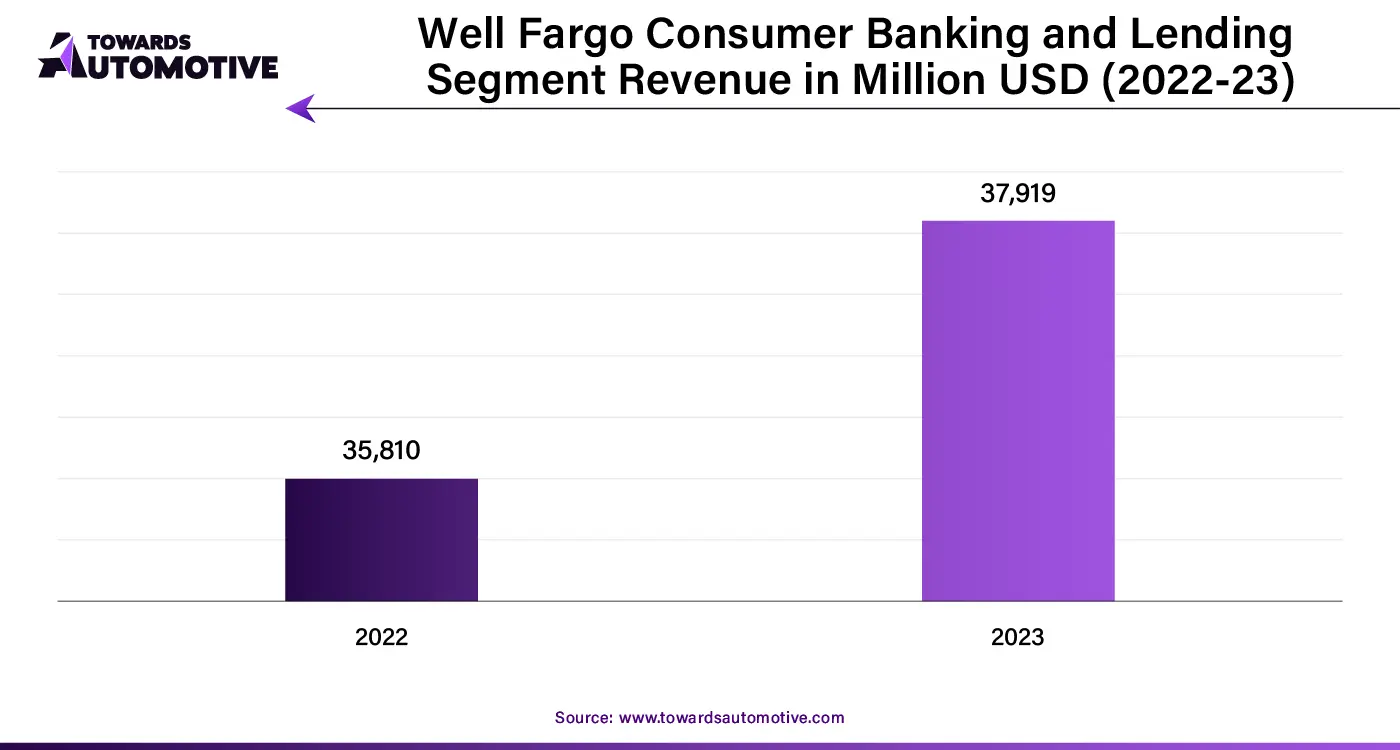

The used car financing market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of GM Financial, Bank of America, Nissan Motor Acceptance Corporation, Wells Fargo, JPMorgan Chase, Volkswagen Financial Services and some others. These market players are constantly engaged in launching numerous financial services and adopting several strategies for maintaining their dominance in this industry.

By Financing Type

By Customer Type

By Loan Type

By Credit Score Range

By Region

April 2025

April 2025

March 2025

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us