April 2025

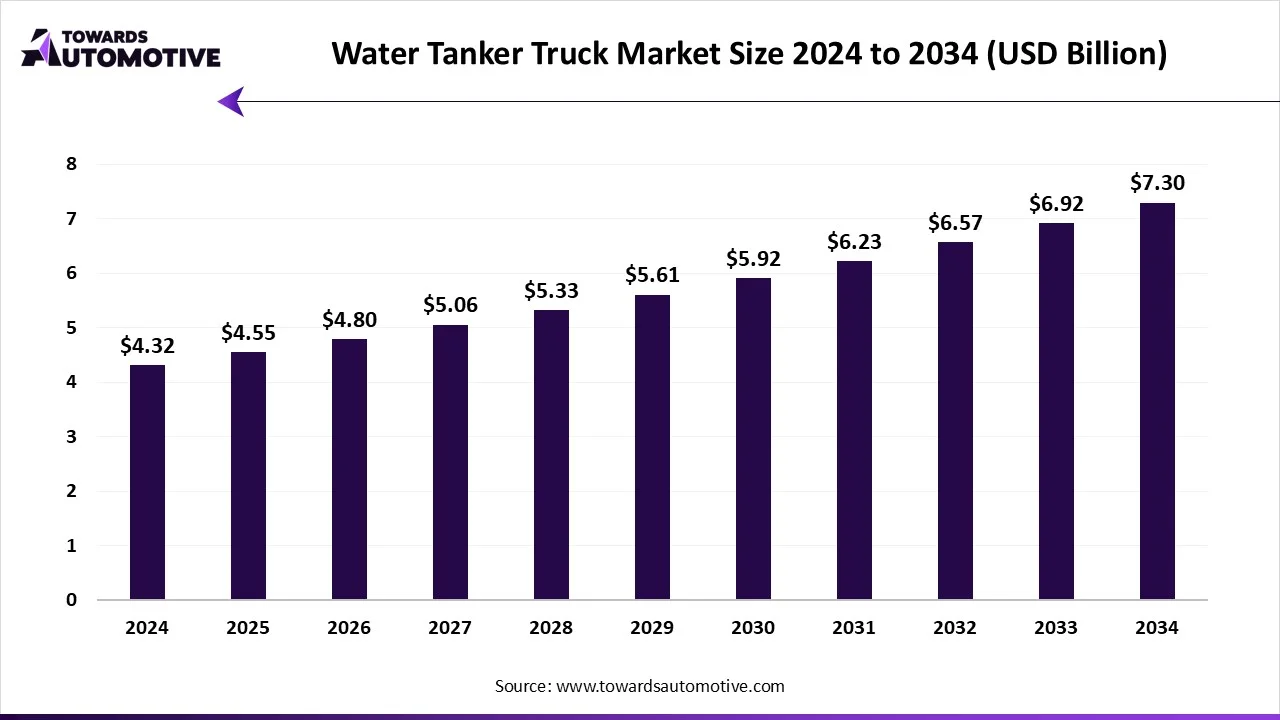

The water tanker truck market is forecasted to expand from USD 4.55 billion in 2025 to USD 7.30 billion by 2034, growing at a CAGR of 5.38% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The water tanker truck market is a crucial sector of the automotive industry. This industry deals in manufacturing and distribution of water tanker trucks in different parts of the world. There are various types of tankers developed in this sector including small tankers, medium tankers, large tankers and some others. These tankers are manufactured using several materials such as steel, aluminum, polyethylene, fiberglass and some others. It finds application in numerous sectors consisting of construction, agriculture, mining, fire-fighting, municipal services and some others. The rising development in the mining sector in different parts of the world has boosted the market expansion. This market is predicted to grow significantly with the rise of the construction industry around the globe.

| Metric | Details |

| Market Size in 2024 | USD 4.32 Billion |

| Projected Market Size in 2034 | USD 7.30 Billion |

| CAGR (2025 - 2034) | 5.38% |

| Leading Region | North America |

| Market Segmentation | By Application, By Material, By Tanker Size, By Fuel Type and By Region |

| Top Key Players | Mitsubishi Fuso, KAMAZ, Volvo, Tata Motors, Kenworth, MAN, Hino |

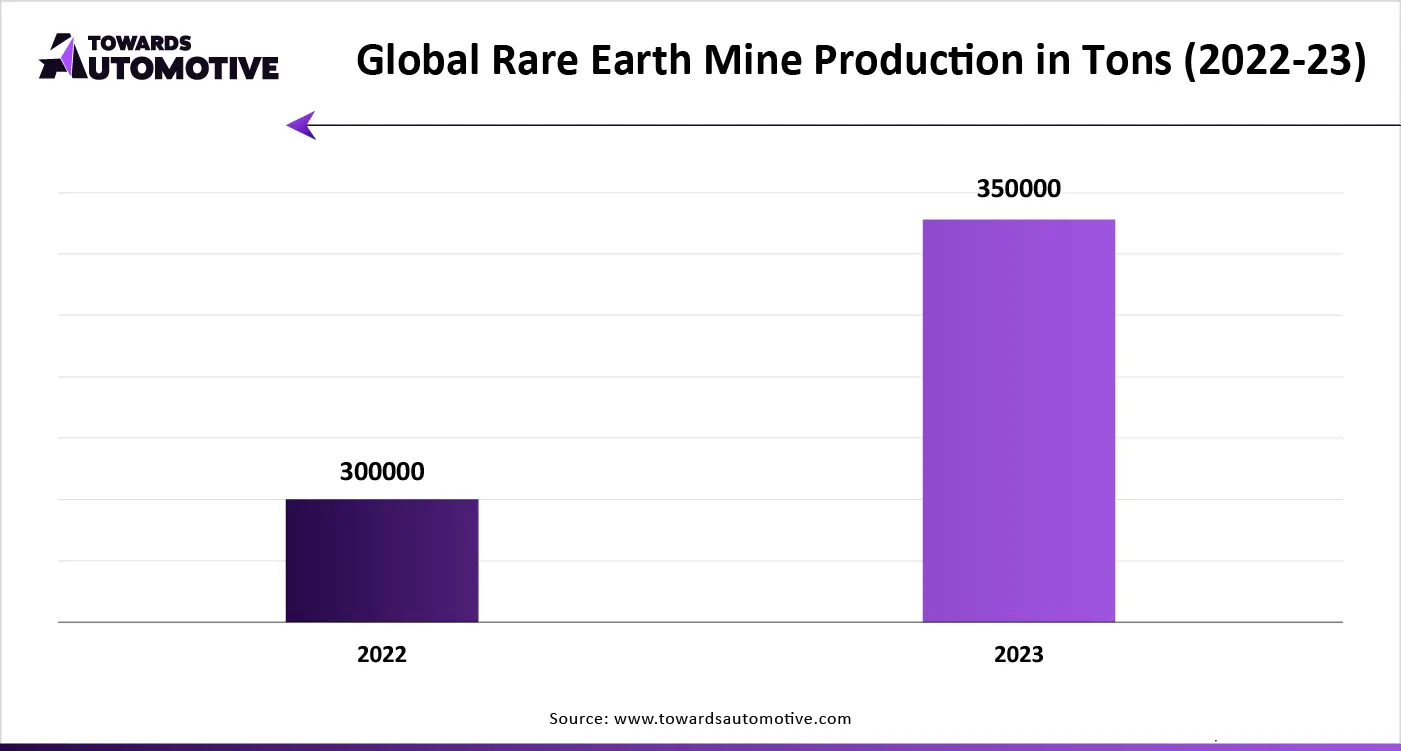

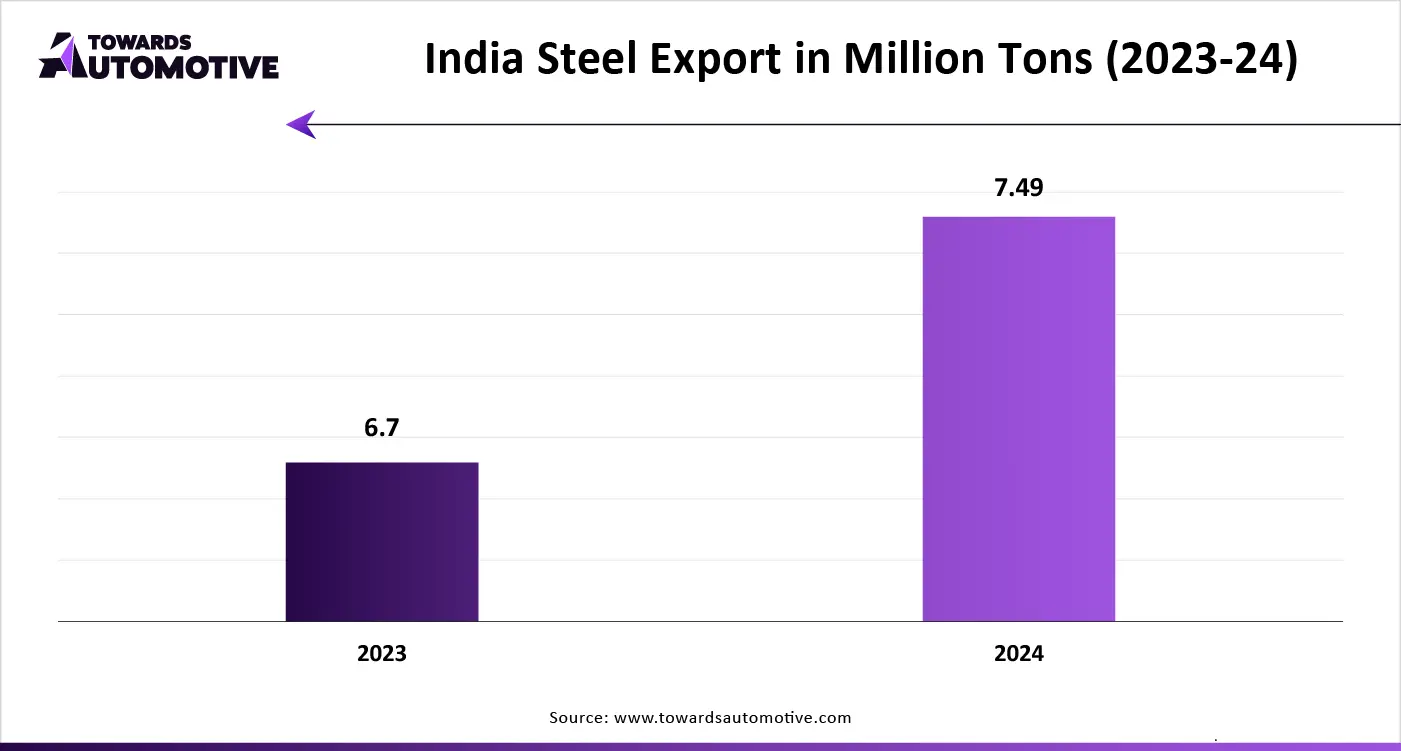

The steel segment led the industry. The rising use of steel for manufacturing tankers has boosted the market growth. Also, the growing investment by government of several countries such as U.S., India and Japan for strengthening the steel industry is accelerating the industrial expansion. Moreover, several truck manufacturers are partnering with steel companies along with numerous benefits of steel such as durability, strength, adaptability and some others is further accelerating the growth of the water tanker truck market.

The polyethylene segment is expected to grow with a considerable CAGR during the forecast period. The rising application of polyethylene for manufacturing tanks has boosted the market expansion. Also, advancements in several processes such as polymerization and injection molding is further adding to the industrial growth. Moreover, numerous benefits of polyethylene such as water and chemical resistance, lightweight, durability, flexibility and some others is expected to propel the growth of the water tanker truck market.

The municipal services segment held a dominant share of the market. The rising investment by government for strengthening the municipality sector has boosted the market expansion. Also, several municipal corporations are launching several initiatives to bolster the water supply infrastructure is further propelling the market growth. Moreover, collaborations among municipalities and tanker companies for operating water supply is projected to foster the growth of the water tanker truck market.

The construction segment is likely to rise with a notable growth rate during the forecast period. The rise in number of residential constructions in different parts of the world has boosted the market growth. Also, rapid investment by government for strengthening the infrastructure coupled with increasing building activities in urban areas is predicted to boost the growth of the water tanker truck market.

North America held the highest share of the water tanker truck market. The rise in number of construction establishments in countries such as the U.S. and Canada has bolstered the market expansion. Also, the growing emphasis on sustainable water management practices along with rapid investment in disaster management sector is further accelerating the industrial growth. Moreover, the increasing urbanization coupled with strict government regulations is likely to boost the growth of the water tanker truck market in this region.

U.S. dominated this region. The growing initiatives by government for delivering clean water along with rising urban population has boosted the market expansion. Additionally, rapid investment in water management solutions coupled with presence of several market players such as Ford, Kenworth, Freightliner, Peterbilt and some others is further anticipated to foster the market growth in this nation.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The rising population in countries such as India and China has increased the demand for clean water, thereby increasing the demand for tanker truck which in turn drives the market growth. Also, the growing development in the agricultural sector coupled with rise in number of residential constructions is adding to the industrial expansion. Moreover, numerous initiatives by government bodies such as municipalities, panchayats and some others for providing clean water has further bolstered the growth of the water tanker truck market in this region.

China and India are the major contributor in this region. In China, the market is driven by the presence of several truck companies such as Sinotruk, Dongfeng, Shaanxi, JAC and some others. In India, the rising investment by government for strengthening the water supply infrastructure has driven the market expansion.

The water tanker truck market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Mitsubishi Fuso, KAMAZ, Volvo, Tata Motors, Kenworth, MAN, Hino, Peterbilt, Klein, Ford, Isuzu, Freightliner, Scania, Mercedes-Benz, Dongfeng Moto and some others. These companies are constantly engaged in developing water tanker trucks and adopting numerous strategies such as partnerships, business expansion, acquisitions, collaborations, joint ventures, service launches and some others to maintain their dominant position in this industry. For instance, in November 2024, Donfeng announced partnership with Shiyan Yuanliang. This partnership is done to launch an electric water truck named as ‘Dongfeng Huashen T5’. Also, in June 2024, Klein Products collaborated with Papé Kenworth. This collaboration is done for launching a water tanker truck named as ‘K400SS-TD’.

By Application

By Material

By Tanker Size

By Fuel Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us