January 2025

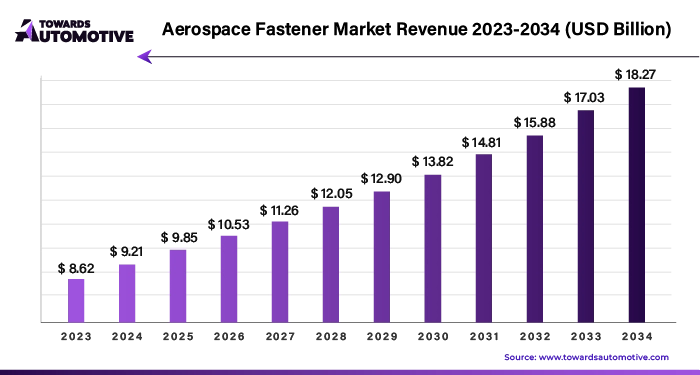

The global aerospace fastener market size is expected to be valued at about USD 9.21 billion in 2024. It is projected to grow at a compound annual growth rate (CAGR) of 6.9% and reach approximately USD 18.27 billion by the end of 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

As air travel becomes increasingly common, the number of aircraft in the skies is soaring. This rapid growth encompasses both commercial flights and military operations, significantly boosting the demand for aerospace equipment. Among the many critical components that ensure the safety and functionality of aircraft, fasteners play a crucial role. As the aerospace sector expands, the significance of these fasteners is also rising.

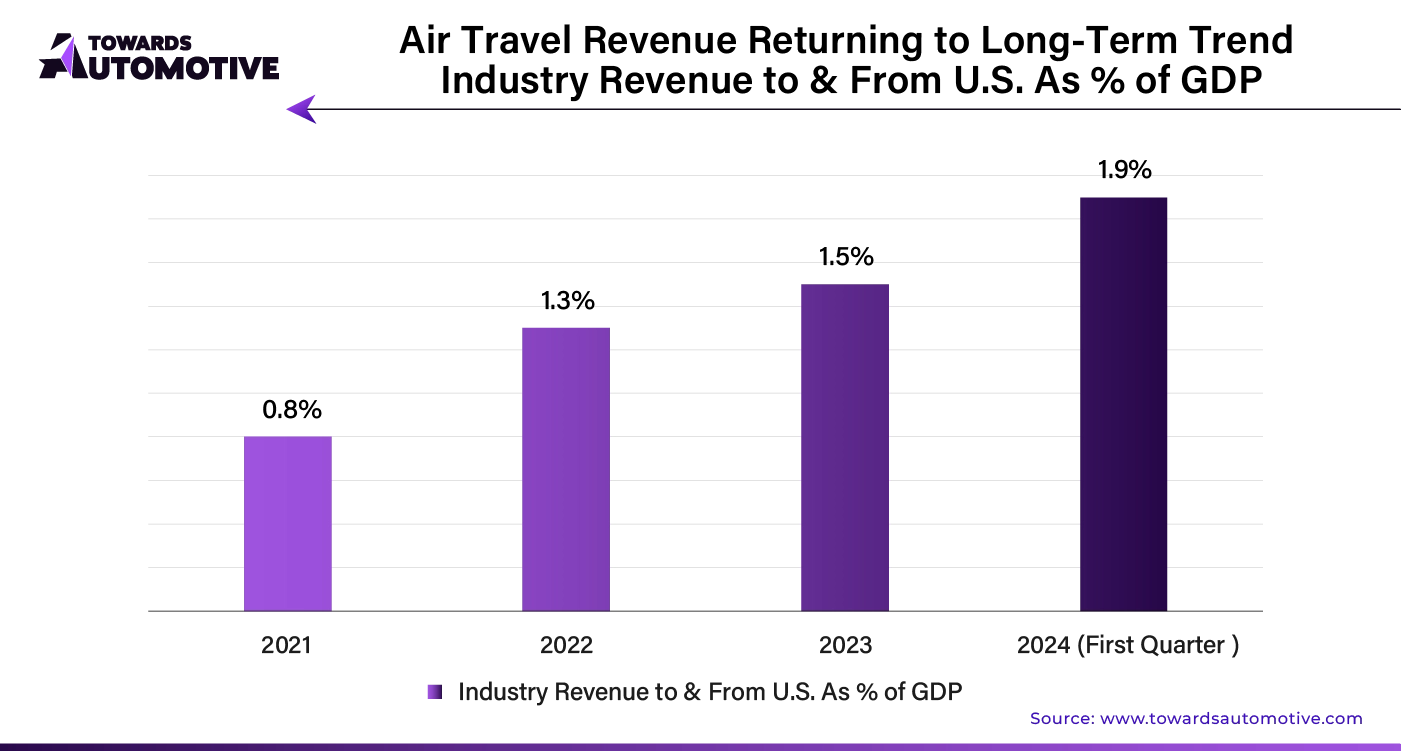

Furthermore, globalization process has had a major impact on the rise of aviation. Because of the increased worldwide connection that fosters trade, tourism, and cross-cultural relationships, there is a growing need for air travel. The expansion of global commerce has led to a rise in demand for air freight services. Over the course of the forecast period, the country's increased freight and passenger traffic has resulted in an increase in MRO (Maintenance, Repairs, and Operations) activities for commercial aircraft. This expansion is anticipated to propel the worldwide aerospace fastener market.

For instance,

The environmental impact of air travel has come under heightened scrutiny in recent years, with aircraft manufacturers facing pressure to develop more sustainable solutions. One of the key strategies in addressing this issue is the design and construction of lighter aircraft. Lighter aircraft not only reduce fuel consumption but also lower emissions, contributing to a more sustainable future for aviation.

In the quest for lighter aircraft, the role of fasteners becomes even more critical. These newly designed, lighter aircraft must ensure the same level of safety and durability as their bulkier predecessors, despite using significantly less material. Fasteners are integral to maintaining this safety, as they secure various components of the aircraft, ensuring structural integrity under various conditions. As a result, the demand for high-quality aerospace fasteners is set to increase in the coming years.

To meet the growing demands of the aerospace industry, manufacturers are continuously improving fastener technology. Newer fasteners are being developed with enhanced properties, such as increased resistance to corrosion and the ability to withstand extreme temperatures. These advancements are crucial in boosting the confidence of aircraft manufacturers, as they rely on these fasteners to perform under harsh operational conditions.

The development of fasteners that are not only lighter but also more durable and reliable is driving the growth of the aerospace fastener market. As aircraft designs evolve, fasteners are being engineered to meet the specific requirements of modern aviation, making them indispensable to the industry.

National Aerospace Fasteners has demonstrated a steady but modest growth in earnings, with an average annual increase of 1.7%. In comparison, the broader Machinery industry has experienced a much stronger earnings growth rate of 10.7% annually. Despite this, the company has managed to achieve a respectable revenue growth rate of 5% per year.

The company's financial health is highlighted by a solid return on equity (ROE) of 15.4% and net profit margins of 11.3%. The past performance score for National Aerospace Fasteners is rated at 5 out of 6, indicating strong quality earnings and a positive trend in profit margins.

| Metric | National Aerospace Fasteners | Machinery Industry |

| Earnings Growth Rate | 1.7% | 10.7% |

| EPS Growth Rate | 1.2% | - |

| Revenue Growth Rate | 5.0% | - |

| Return on Equity (ROE) | 15.4% | - |

| Net Margin | 11.3% | - |

| Last Earnings Update | 30 Jun 2024 | - |

National Aerospace Fasteners' performance reflects its stability and solid financial metrics, although it lags behind the broader industry in terms of earnings growth.

Developing advanced materials and technologies, such as lightweight composites and high-strength alloys, can improve performance and reduce weight, driving demand. Growth in commercial and military aircraft production increases the need for fasteners, driven by rising air travel and defense spending. Expanding MRO activities for existing aircraft fleets can boost the demand for replacement fasteners. Integrating fasteners with new design concepts and systems, including those in electric and autonomous aircraft, can drive market expansion. Expanding aerospace industries in emerging economies can provide new growth opportunities for fastener suppliers. Meeting stringent aerospace standards and regulations can create opportunities for specialized fasteners.

For instance,

Growth in both commercial and military aerospace sectors increases the overall need for fasteners. Innovations in materials, propulsion systems, and avionics have enhanced the capabilities and efficiency of aircraft and spacecraft, leading to increased demand. Rising global incomes and economic development increase the demand for air travel and space exploration, boosting the aerospace sector. Increased international trade and connectivity drive demand for both commercial aviation and cargo transport. Higher defense budgets in many countries contribute to growth in military aerospace projects and technologies. Growing interest in space exploration, including missions to Mars, satellite deployment, and private space travel, fuels expansion in the aerospace industry. The push for more fuel-efficient and environmentally friendly aircraft stimulates innovation and investment in the aerospace sector. Significant investments from both government and private sector stakeholders support research, development, and infrastructure growth in aerospace.

For instance,

Technological advancements are playing a significant role in the evolution of the aerospace fastener market. One of the most notable innovations is the adoption of 3D printing technology. This technology has revolutionized the manufacturing process by allowing for the production of complex fasteners with precision and efficiency. With 3D printing, production batches are not only larger but also more cost-effective, reducing both production time and material waste.

Moreover, 3D printing minimizes the margin for human error, which is particularly crucial in the aerospace industry, where precision and reliability are paramount. This technology is quickly becoming an integral part of fastener manufacturing, as it aligns with the industry's demands for high-quality, cost-efficient, and precisely engineered components.

Another technological advancement that is transforming the aerospace fastener market is the use of robotics in manufacturing. Robotics enhances production efficiency by automating repetitive tasks, reducing the time and labor required for fastener production. The integration of robotics into manufacturing processes also ensures consistent quality, as robots can perform tasks with a level of precision that is difficult to achieve manually.

AI integration in the aerospace fastener market is poised to revolutionize the industry by enhancing efficiency, precision, and innovation. AI-driven technologies can streamline the manufacturing process, ensuring faster production cycles with minimal errors. By utilizing AI for predictive maintenance, manufacturers can reduce downtime and extend the lifespan of equipment, leading to cost savings and improved productivity.

Moreover, AI-powered analytics can optimize supply chain management by predicting demand fluctuations and identifying potential disruptions. This ensures a steady flow of materials and components, reducing lead times and enhancing overall market responsiveness. AI also plays a crucial role in quality control, using machine learning algorithms to detect defects with higher accuracy than traditional methods, thereby reducing waste and improving product reliability.

In the design and development, AI can simulate and optimize fastener designs, leading to innovations that meet the increasingly stringent demands of the aerospace industry. This fosters market growth by enabling the production of advanced, high-performance fasteners that are critical to modern aircraft. Overall, AI integration is set to drive significant advancements in the aerospace fastener market, making it more competitive and responsive to future challenges.

The supply chain in the aerospace fastener market is a complex network designed to ensure the timely delivery of critical components used in aircraft manufacturing and maintenance. It begins with the sourcing of raw materials like high-grade metals and alloys, which are then processed and manufactured into precision fasteners. These fasteners must meet strict industry standards for quality and reliability.

Manufacturers often rely on a network of specialized suppliers for raw materials and component production, ensuring that all parts meet stringent specifications. Once produced, fasteners undergo rigorous testing before being distributed to original equipment manufacturers (OEMs) and maintenance, repair, and overhaul (MRO) service providers.

Supply chain efficiency is critical, given the aerospace industry's demand for timely and reliable delivery. To achieve this, companies often employ advanced inventory management systems, real-time tracking, and just-in-time delivery models. Collaboration among suppliers, manufacturers, and distributors is essential to mitigate risks such as material shortages or logistical delays.

In recent years, the integration of digital technologies and data analytics has further streamlined the supply chain, allowing for better forecasting, inventory optimization, and enhanced quality control, ensuring that the aerospace industry’s needs are met with precision and reliability.

The aerospace fastener market is a complex ecosystem comprising several key components, each playing a critical role in ensuring the structural integrity and safety of aircraft. The primary components include nuts, bolts, rivets, and screws, which are manufactured from high-strength materials like titanium, aluminum, and stainless steel to withstand extreme conditions. These fasteners are essential in both commercial and military aviation, holding together various aircraft parts, including fuselage panels, wings, and engines.

Leading companies in this market, such as Precision Castparts Corp., Stanley Black & Decker, and LISI Aerospace, contribute significantly by offering innovative solutions and advanced fastening systems tailored to meet stringent aerospace standards. These companies invest heavily in research and development to improve the performance, durability, and environmental sustainability of their products. Additionally, suppliers of raw materials and specialized coatings play a crucial role in the ecosystem, providing the necessary components that ensure fasteners can endure harsh environmental conditions, such as high temperatures and corrosion. This intricate collaboration among manufacturers, suppliers, and OEMs (Original Equipment Manufacturers) drives the growth and technological advancement of the aerospace fastener market, meeting the evolving demands of the global aerospace industry.

The aerospace sector is on the cusp of a transformative era, driven by advancements in electric aircraft technology and a growing emphasis on sustainability. As the industry moves towards greener alternatives, the demand for specialized aerospace fasteners is poised to rise. These components are critical to the assembly and integrity of aircraft, and their evolution is essential to meet the new demands of the industry.

Electric aircraft represent a significant opportunity for growth within the aerospace sector. The push towards reducing emissions is a primary driver, as electric aircraft offer a compelling alternative to traditional fossil-fuel-powered planes. Stakeholders, from manufacturers to governments, are increasingly viewing electric aircraft as a solution to the environmental challenges posed by aviation.

While a few electric aircraft have already been deployed, the majority are still undergoing rigorous testing and development. This stage is crucial for the refinement of technologies and components, including aerospace fasteners. The unique requirements of electric aircraft, such as the need for lighter and more durable materials, are expected to drive increased demand for fasteners specifically designed for these applications. Over the next decade, the market for fasteners tailored to electric aircraft is anticipated to expand significantly.

Among the various types of fasteners, self-clinching fasteners are gaining traction within the aerospace industry. These fasteners are becoming the preferred choice for manufacturers due to their ability to reduce the need for multiple hardware components. This not only lowers material costs but also contributes to the overall reduction in aircraft weight—a critical factor as the industry moves towards more fuel-efficient and environmentally friendly designs.

The appeal of self-clinching fasteners lies in their simplicity and efficiency. By integrating seamlessly into the material, they eliminate the need for additional parts, streamlining the manufacturing process. As a result, aerospace companies are increasingly adopting these fasteners, and industry leaders are actively promoting the use of clinch nuts. This trend is expected to continue, with more companies likely to incorporate self-clinching fasteners into their production lines.

Despite the optimistic outlook, the aerospace fastener market faces several challenges that could temper its growth. One of the primary concerns is the high cost of raw materials. Aerospace fasteners are typically made from advanced materials to meet the stringent requirements of the industry, but these materials come at a premium. As a result, producers must navigate fluctuating costs, which can impact profitability and market expansion.

Additionally, the growing use of composite materials in aerospace applications presents competition to traditional fasteners. Composites offer advantages such as reduced weight and increased strength, which are highly desirable in aircraft design. As the adoption of composite materials increases, fastener manufacturers may need to innovate and adapt their products to remain competitive.

Aluminum continues to be the leading material of choice in the production of aerospace fasteners, commanding an estimated 38% of the market share in 2024. The popularity of aluminum fasteners is largely due to their excellent resistance to corrosion, a critical factor given the significant costs associated with manufacturing and maintaining aircraft.

In addition to being durable, aluminum fasteners are non-magnetic, which further enhances their suitability for use in aviation. This non-magnetic property is particularly advantageous in aircraft, where magnetic interference can be a concern. The combination of these properties ensures that aluminum fasteners are highly reliable, making them the preferred choice among aerospace manufacturers.

The commercial aerospace sector is anticipated to account for approximately 68% of the market share in the aerospace fasteners industry by 2024. The growth of this segment is being driven by several factors, including rising disposable incomes and an increased willingness among consumers to travel long distances. As the commercial airline industry continues to expand, the demand for high-quality, durable fasteners is also on the rise.

This surge in the commercial aerospace sector not only drives the market for fasteners but also highlights the importance of using materials like aluminum that offer both durability and reliability. As airlines prioritize safety and performance, the role of high-quality fasteners becomes increasingly vital in ensuring the integrity and longevity of aircraft.

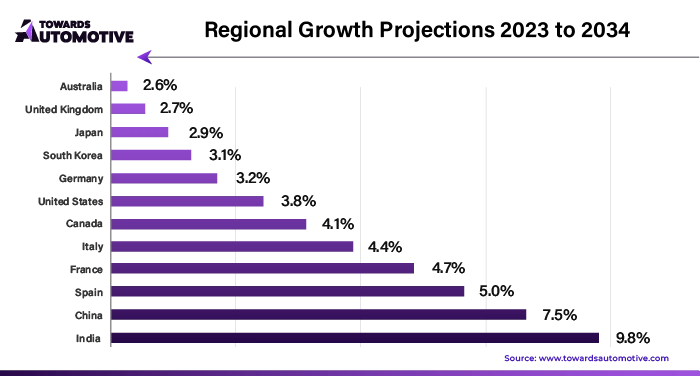

The aerospace fastener market is poised for significant growth over the next decade, with varying degrees of expansion across different regions. This growth is influenced by factors such as military investments, advancements in aircraft technology, and the increasing demand for air travel. Below is an overview of key regions and their projected Compound Annual Growth Rates (CAGR) from 2024 to 2034, along with insights into the market dynamics in specific countries.

The aerospace fastener market in the United States is expected to grow at a CAGR of 3.8% through 2034. The country's robust military aircraft fleet and ongoing investments in expanding and upgrading this fleet are major drivers of this growth. The U.S. military’s continuous need for high-performance fasteners, coupled with a budget that supports fleet expansion, positions the country as a significant consumer of aerospace fasteners.

Moreover, foreign investments in the U.S. aerospace sector are on the rise. A notable example is the acquisition of Houston Precision Fasteners by Italian company Poggipolini in November 2023, which underscores the global interest in the U.S. aerospace fastener market.

India is emerging as a lucrative market for aerospace fasteners, with a projected CAGR of 9.8% through 2034. The Indian government’s initiatives to promote domestic manufacturing of aircraft for both military and commercial purposes are key factors contributing to this growth.

In June 2023, GE Aerospace signed a Memorandum of Understanding (MOU) with Hindustan Aeronautics Limited (HAL) to manufacture the GE414 fighter jet engine in India. Such partnerships are expected to significantly increase the demand for aerospace fasteners in the country as domestic production scales up.

The United Kingdom's aerospace fastener market is set to grow at a CAGR of 2.7% over the next decade. Despite challenges such as irregular raw material supplies and labor shortages, the market shows promise due to ongoing experimentation and innovation in electric aircraft. These advancements are creating new avenues for growth in the aerospace fastener sector.

Manufacturers in the U.K. are exploring lightweight and durable fasteners that meet the unique requirements of electric aircraft, which could drive market expansion despite the existing challenges.

The aerospace fastener market is characterized by a competitive landscape where both established giants and emerging startups vie for market share. The safety-critical nature of aerospace components often means that airlines and manufacturers place significant trust in well-established brands, which have proven reliability and quality. However, this does not entirely crowd out smaller players. The market dynamics offer room for growth to newer entrants, particularly those that can offer innovative solutions or more cost-effective alternatives.

3V Fasteners Company Inc. exemplifies the strategy of leveraging longstanding relationships with key airlines and aircraft manufacturers to maintain and expand its market position. By providing consistent quality and reliability, 3V Fasteners secures its role as a trusted supplier in the aerospace industry.

On the other hand, Acumen Global Technologies adopts a customer-centric approach, focusing on designing and producing fasteners tailored to the specific needs of its clients. This strategy allows Acumen to differentiate itself in a crowded market, appealing to customers who require customized solutions that meet unique specifications.

The startup culture within the aerospace fastener industry also fosters innovation, with new companies pushing the boundaries of materials science and manufacturing processes. These startups often challenge the status quo by introducing advanced materials, improving manufacturing efficiency, and offering more agile and responsive customer service.

By Product Type

By Application

By Material

By Region

January 2025

September 2024

September 2024

September 2024

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us