April 2025

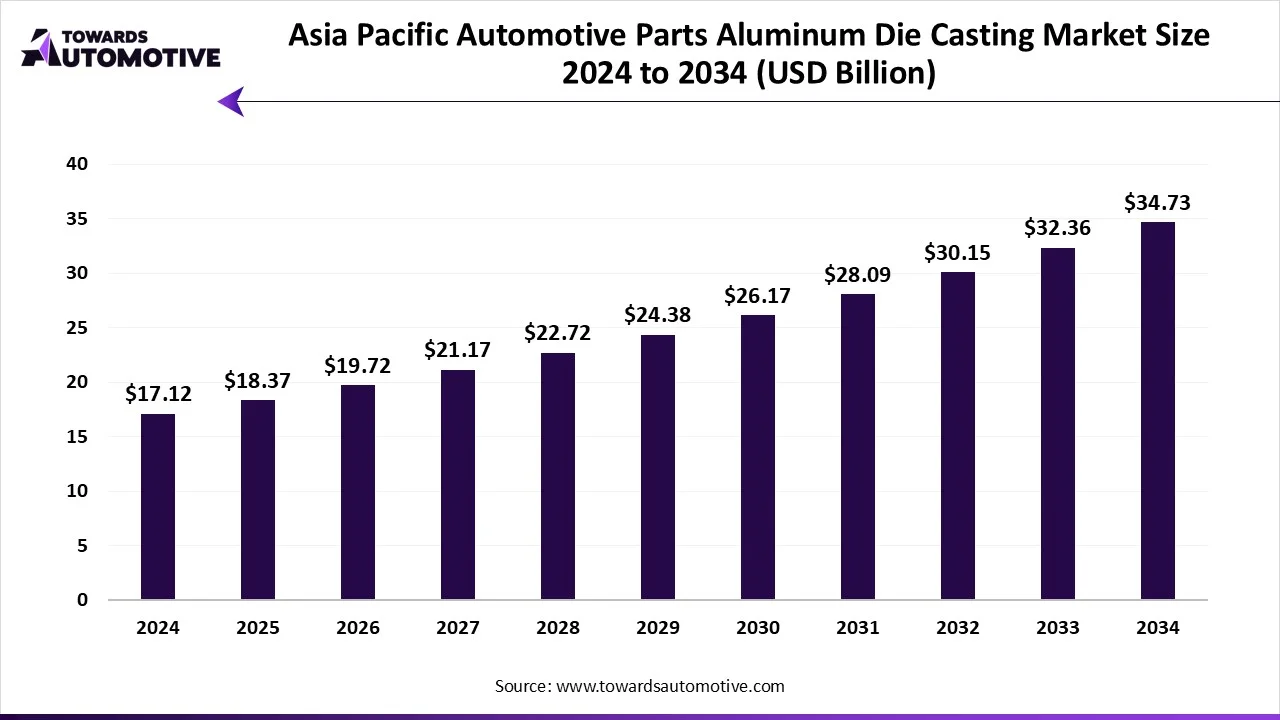

The Asia Pacific automotive parts aluminum die casting market is anticipated to grow from USD 18.37 billion in 2025 to USD 34.73 billion by 2034, with a compound annual growth rate (CAGR) of 7.33% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Asia Pacific automotive parts aluminum die casting market is a crucial segment of the automotive industry. This industry deals in developing metal-forming process for creation of complex aluminum parts used in the automotive sector. There are various production processes used in this sector comprising of pressure die casting, vacuum die casting, squeeze die casting, gravity die casting and some others. These processes are used for manufacturing different automotive parts consisting of body parts, engine parts, transmission parts, battery and related components, and some others. The growing application of aluminum parts in commercial vehicles has boosted the market expansion. This industry is expected to rise significantly with the growth of the automotive components industry across Asia Pacific region.

| Metric | Details |

| Market Size in 2024 | USD 17.12 Billion |

| Projected Market Size in 2034 | USD 34.73 Billion |

| CAGR (2025 - 2034) | 7.33% |

| Leading Region | China |

| Market Segmentation | By Production Process, By Application Type and By Region |

| Top Key Players | Guangdong Hongtai Technology, Roots Cast Private Ltd., Endurance Technologies, Craftsman Automation, A.I.S Corporation, Cola Gokin Corporation |

The pressure die casting segment led the industry. The growing adoption of pressure die casting for manufacturing different automotive components such as oil sumps, engine blocks, engine mounts, gearbox casings and some others has boosted the market growth. Also, the rising use of pressure die casting process for developing intricate and thin automotive parts along with technological advancements in pressure die casting process is driving the market in a positive way. Moreover, several benefits of this process including cost-effectiveness, material versatility, dimensional accuracy and some others is projected to foster the industrial expansion.

The ICE segment held a dominant share of the market. The growing demand for high performance cars in countries such as China and Japan has boosted the market growth. Also, lack of well-established charging infrastructure in Asia Pacific region encourages people to adopt ICE vehicles for daily operations, thereby boosting the industrial expansion. Moreover, the growing sales of gasoline-powered vehicles in India, South Korea, Australia, Singapore and some others has driven the growth of the Asia Pacific automotive parts die casting market.

The engine parts segment held the largest portion of the industry. The rising demand for heavy duty vehicles coupled with technological advancements in engine manufacturing sector has boosted the market expansion. Also, the rapid adoption of aluminum alloys in automotive engines along with rising investment by automotive brands for developing superior engines is crucial for the industrial growth. Moreover, the growing demand for fuel-efficient engines in APAC region is boosting the industrial growth.

China held the largest share of the Asia Pacific automotive parts die casting market. The market in this country is generally driven by the presence of skilled workforce along with availability of raw materials used in the automotive sector. Also, the rise in number of startup companies dealing in automotive parts coupled with rising sales of automotives has played a crucial role in shaping the industrial landscape. Moreover, several automotive brands such as Xpeng, BYD, Geely, SAIC Motor and some others are launching new vehicles that increases the application of aluminum products, thereby fostering the market expansion.

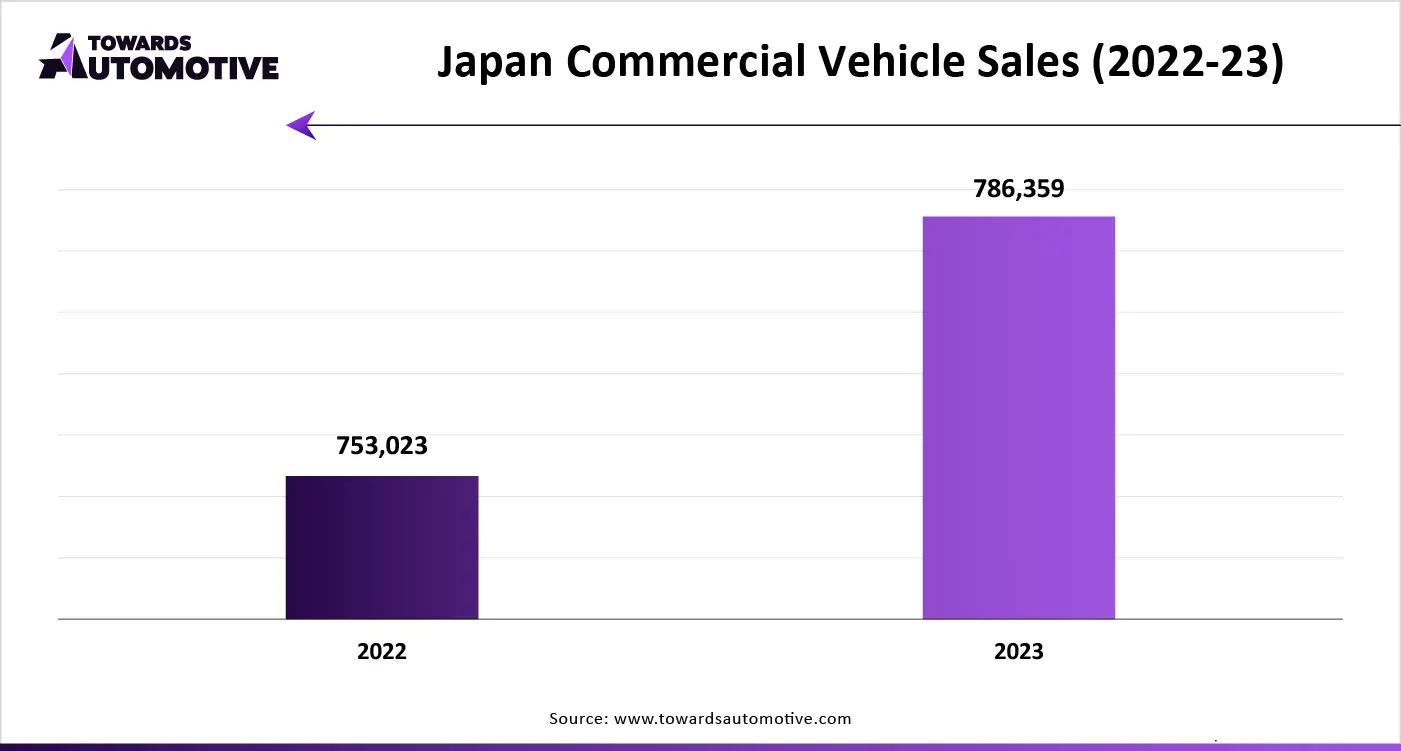

Japan is expected to grow with a significant CAGR during the forecast period. The rising demand for fuel-efficient and light-weight vehicles in Japan has boosted the market growth. Also, rapid technological advancements in precision casting along with rapid investment in automotive sector by government is positively impacting the market expansion. Moreover, the growing emphasis on using sustainable materials in vehicles coupled with launches of new die casting machines by market players is projected to bolster the market growth in this country.

India is projected to rise with a considerable growth rate during the forecast period. The rising investment in the automotive components industry by public and private sector entities has boosted the market expansion. Also, the growing developments in the die casting sector coupled with government initiatives aimed at recycling aluminum is playing a vital role in shaping the industrial landscape. Moreover, the EV companies of India such as Mahindra and Tata have increased the adoption of aluminum alloys in their vehicles to reduce body weight and improve performance, thereby driving the industrial growth across India.

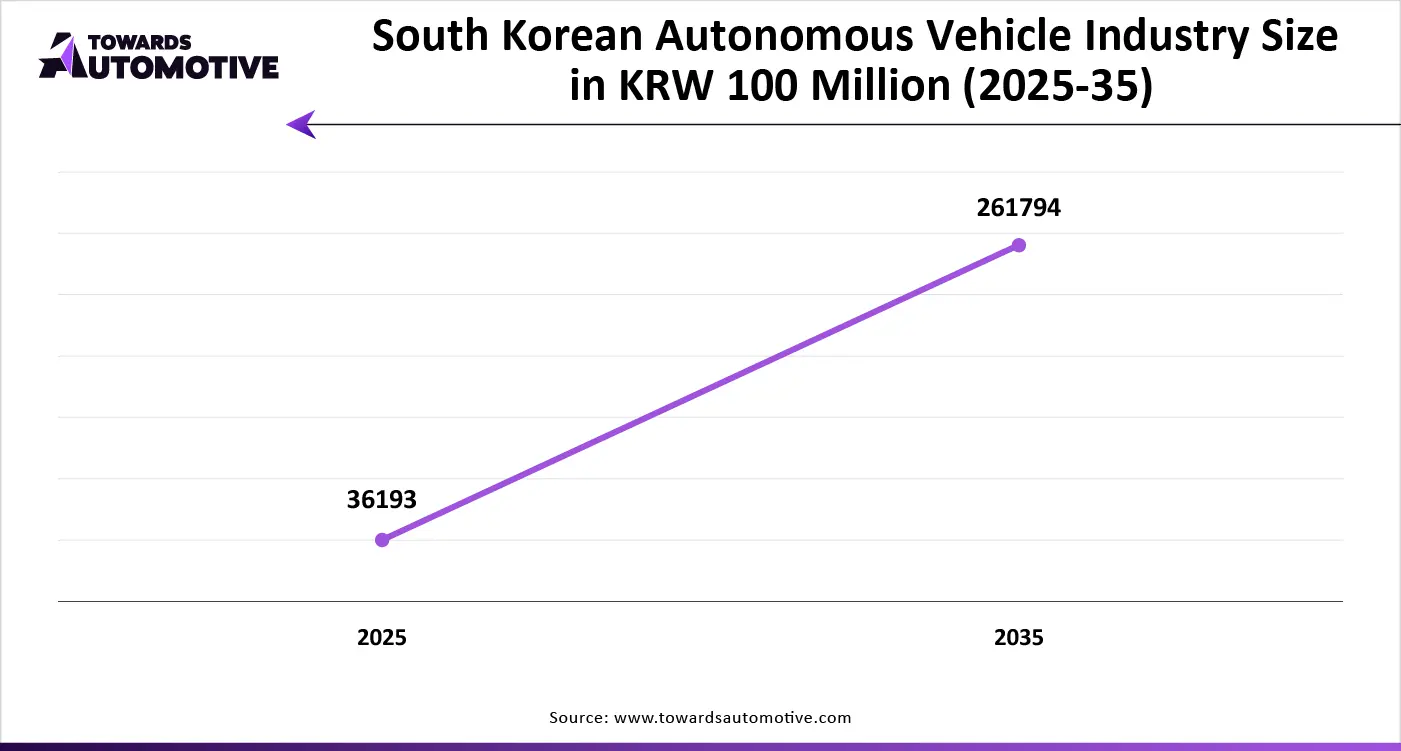

South Korea is anticipated to held a notable share of the industry. The growing popularity of autonomous vehicles among the people of this country has boosted the market expansion. Also, the rising production of aluminum along with inauguration of new die casting facilities is contributing significantly to the industrial growth. Moreover, the increasing demand for hybrid vehicles coupled with presence of various automotive brands such as Genesis, Hyundai, Kia and some others is predicted to boost the market growth in this country.

In November 2024, Pramuk Dediwela, the Managing Director of Alumex PLC made an announcement stating that, “In this transformative era of Industry 4.0, Alumex PLC stands at the forefront of innovation, revolutionizing the aluminium industry in Sri Lanka. This new state-of-the-art manufacturing facility showcases the latest technology, which will help not only to expand our product portfolio and offer value addition to customers but also position Alumex as a beacon of excellence in the international market, driving economic growth and showcasing Sri Lanka as a hub of high-quality aluminium solutions.”

The Asia Pacific automotive parts aluminum die casting market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Cixi Aida Metal Co., Ltd., Lijia Group Co., Ltd., Dalian Yaming Automotive Parts Co. Ltd., Guangdong Hongtai Technology, Roots Cast Private Ltd., Endurance Technologies, Craftsman Automation, A.I.S Corporation, Cola Gokin Corporation, Ahresty Corporation, Iwaki Die Cast Co. Ltd and some others. These companies are constantly engaged in developing aluminum die casting technologies for the automotive sector and adopting numerous strategies such as product launches, collaboration, business expansion, acquisition and some others to maintain their dominant position in this industry. For instance, in June 2024, Craftsman Automation Limited acquired Sunbeam Lightweighting Solutions Private Limited. This acquisition is done for advancing the aluminum die-casting business across India. Also, in April 2024, Endurance Technologies Limited announced to increase its aluminum die casting capacity in Pune, India.

By Production Process

By Application Type

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us