October 2025

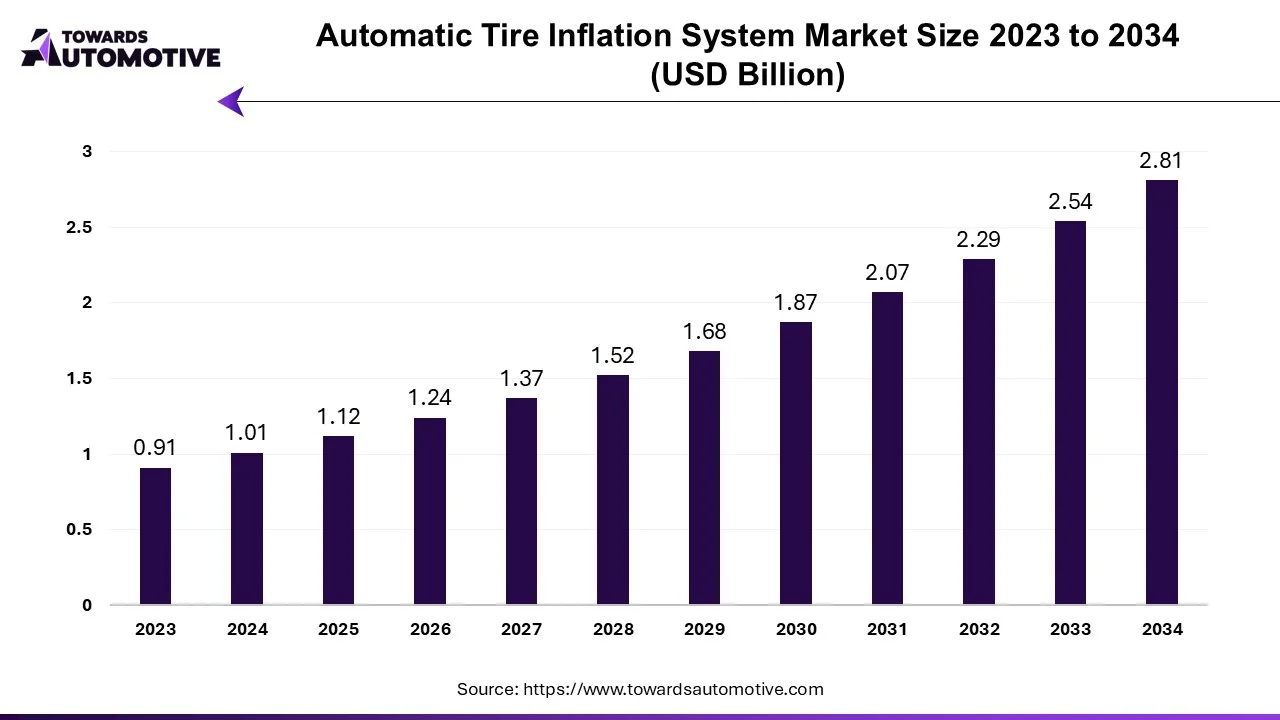

The automatic tire inflation system market size is calculated at USD 1.01 billion in 2024 and is anticipated to reach around USD 2.81 billion by 2034, growing at a CAGR of 10.8% from 2025 to 2034.

The automatic tire inflation system (ATIS) market is witnessing significant growth due to the increasing demand for enhanced vehicle safety, fuel efficiency, and maintenance cost reduction. These systems are designed to maintain optimal tire pressure automatically, ensuring that tires remain inflated to the manufacturer-recommended levels without the need for manual intervention. The rising adoption of ATIS is driven by the growing awareness of the critical role tire pressure plays in vehicle performance, including fuel efficiency, tire lifespan, and safety. With tire underinflation being a major factor contributing to road accidents, tire wear, and increased fuel consumption, the demand for solutions that address these issues is on the rise.

Furthermore, the automotive industry’s emphasis on technology integration, vehicle automation, and smart systems has accelerated the implementation of automatic tire inflation systems in commercial and passenger vehicles alike. The market is also benefiting from stringent government regulations regarding vehicle safety and environmental standards, which encourage the use of technologies like ATIS to improve road safety and reduce carbon emissions. Additionally, the expanding commercial vehicle fleet, particularly in logistics and transportation sectors, is driving the need for ATIS to reduce fleet operating costs and ensure the safety of long-haul transport. As the market continues to evolve, advancements in sensor technology, smart monitoring systems, and integration with electric vehicles (EVs) are expected to further propel the growth of the automatic tire inflation system market.

Artificial Intelligence (AI) is playing a transformative role in the automatic tire inflation system market by enhancing the efficiency, accuracy, and functionality of tire inflation systems. AI technologies are being integrated into ATIS to enable real-time monitoring, predictive analytics, and smart decision-making.

AI-powered sensors and algorithms continuously monitor tire pressure and provide real-time data to the driver or fleet manager. AI can process vast amounts of data from the tires, such as pressure levels, temperature, and wear patterns, to make instant adjustments. By leveraging machine learning, AI can detect deviations from the ideal tire pressure much earlier than traditional systems, providing more accurate and timely inflation corrections.

AI enhances predictive maintenance capabilities by analyzing historical tire data and identifying trends in wear and tear. This allows for the anticipation of tire issues, such as leaks or damage, before they occur. By predicting when maintenance or inflation adjustments are needed, AI helps extend tire lifespan, reduce downtime, and improve fleet efficiency, particularly in commercial vehicle fleets.

AI can optimize tire inflation based on real-time driving conditions. For instance, it can adjust tire pressure based on factors like load, speed, or road conditions, ensuring optimal performance for fuel efficiency, safety, and tire wear. This dynamic adjustment reduces fuel consumption, minimizes tire damage, and lowers the risk of road accidents caused by incorrect tire pressure.

The rising sales of light-duty vehicles (LDVs) are driving the growth of the automatic tire inflation system market by creating increased demand for enhanced vehicle performance, safety, and fuel efficiency. As the global demand for LDVs, including passenger cars, SUVs, and light trucks, continues to grow, manufacturers are increasingly adopting advanced technologies to improve vehicle safety and reduce operating costs. Proper tire inflation plays a crucial role in optimizing fuel efficiency, extending tire lifespan, and enhancing road safety. ATIS offers a solution by maintaining the ideal tire pressure without the need for manual intervention, ensuring that tires are always inflated to the optimal level.

This is particularly important in LDVs, where fuel efficiency is a primary concern for both manufacturers and consumers. With rising fuel costs and increasing awareness about environmental sustainability, consumers and fleet operators are seeking ways to reduce fuel consumption and minimize tire-related issues. As a result, automakers are integrating ATIS in more vehicles, particularly in premium models, to cater to this demand for fuel-efficient and safety-conscious solutions. Additionally, as governments introduce stricter regulations regarding vehicle emissions and safety standards, the adoption of ATIS is expected to increase, as it helps meet these standards by optimizing tire performance. The growing sales of LDVs, driven by consumer preference for fuel-efficient and safe vehicles, are thus contributing to the expansion of the automatic tire inflation system market.

The automatic tire inflation system market faces several restraints, including high installation costs, which may deter smaller fleets from adopting the technology. The complexity of retrofitting existing vehicles with ATIS and the need for ongoing maintenance also pose challenges. Additionally, limited awareness and understanding of the system's benefits in certain regions may slow market growth. Moreover, compatibility issues with older vehicle models and concerns regarding the long-term reliability of the system may further hinder widespread adoption, particularly in emerging markets.

The emergence of on-the-go tire inflation systems presents significant opportunities in the automatic tire inflation system market, particularly in industries requiring continuous operation without downtime. On-the-go tire inflation systems allow vehicles to maintain optimal tire pressure while in motion, eliminating the need for vehicles to stop for manual inflation. This capability is especially beneficial for commercial fleets, such as long-haul trucks, construction vehicles, and agricultural machinery, where tire pressure consistency is crucial for operational efficiency. By ensuring that tires are continuously inflated at the right pressure, these systems help reduce fuel consumption, minimize tire wear, and prevent costly breakdowns or accidents caused by underinflated tires.

The convenience of maintaining proper tire inflation while on the move also boosts productivity, as vehicles can stay operational for longer periods without the need for tire checks or manual adjustments. As the demand for efficient, cost-effective, and safe vehicle operations increases, on-the-go tire inflation systems are becoming increasingly attractive to fleet operators. Furthermore, the integration of these systems with telematics and real-time monitoring technologies allows for remote tracking of tire conditions, enabling fleet managers to optimize maintenance schedules and prevent potential issues before they arise. As industries seek to improve fleet management and reduce maintenance costs, on-the-go tire inflation systems offer a promising opportunity for growth in the automatic tire inflation system market.

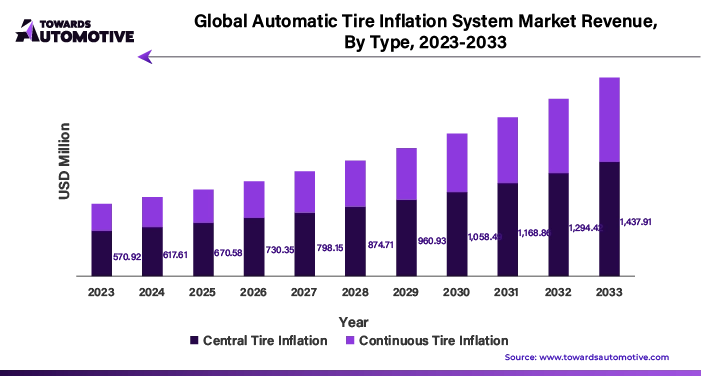

The central tire inflation system segment held a dominant share of the market. The central tire inflation system segment plays a crucial role in driving the growth of the automatic tire inflation system market by offering a more advanced and integrated solution for maintaining optimal tire pressure in vehicles. CTIS enables automatic and centralized control of tire pressure across all tires of a vehicle, ensuring that each tire is consistently inflated to the ideal level. This system is particularly beneficial for off-road vehicles, heavy-duty trucks, military vehicles, and commercial fleets that operate in varying and challenging terrain. By allowing tire pressure adjustments based on real-time road conditions, load, or vehicle speed, CTIS enhances vehicle performance, safety, and fuel efficiency.

The increasing adoption of CTIS in commercial and industrial applications is driving market growth as businesses aim to reduce tire wear, prevent tire blowouts, and minimize downtime associated with manual inflation. Additionally, the integration of CTIS with telematics and fleet management systems allows fleet operators to monitor and control tire pressure remotely, further enhancing operational efficiency and reducing maintenance costs. As more industries recognize the benefits of CTIS for improving vehicle safety, lowering fuel consumption, and extending tire life, the demand for these systems is expected to continue to rise, contributing significantly to the overall growth of the automatic tire inflation system market.

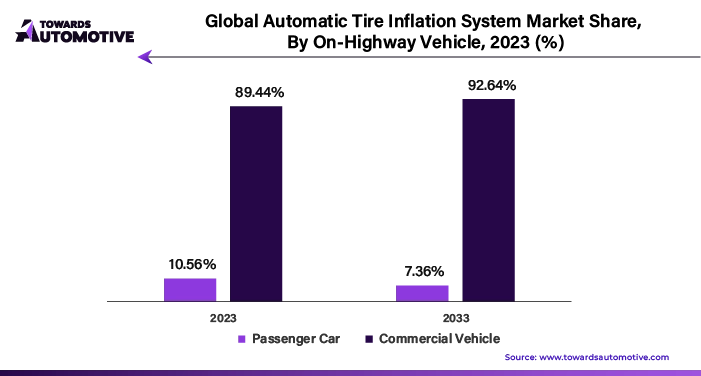

The on-highway vehicle segment led the industry. The on-highway vehicle segment is a key driver of growth in the automatic tire inflation system market, as it accounts for a significant portion of vehicle fleets on the road. On-highway vehicles, including commercial trucks, buses, and delivery vans, rely heavily on efficient tire management to ensure safety, fuel efficiency, and operational cost savings. ATIS plays a crucial role in maintaining optimal tire pressure, which directly impacts vehicle performance, reducing the risk of tire wear, blowouts, and fuel inefficiency caused by underinflated tires. The increasing demand for long-haul trucking and freight transportation, coupled with rising fuel prices and growing concerns about road safety, is driving the adoption of ATIS in the on-highway vehicle segment.

Fleet operators are increasingly recognizing the value of these systems in minimizing tire-related downtime, reducing maintenance costs, and enhancing vehicle safety. Moreover, the integration of ATIS with telematics allows for remote monitoring and data analysis, enabling fleet managers to make informed decisions about tire performance and maintenance. As regulatory pressures around vehicle emissions and safety intensify, the on-highway vehicle segment’s growing adoption of ATIS is contributing to the overall market expansion, as these systems help meet environmental standards and improve the overall efficiency of transportation networks. With the continuous growth of the logistics and transportation industry, the on-highway vehicle segment remains a key factor driving the widespread deployment of automatic tire inflation systems.

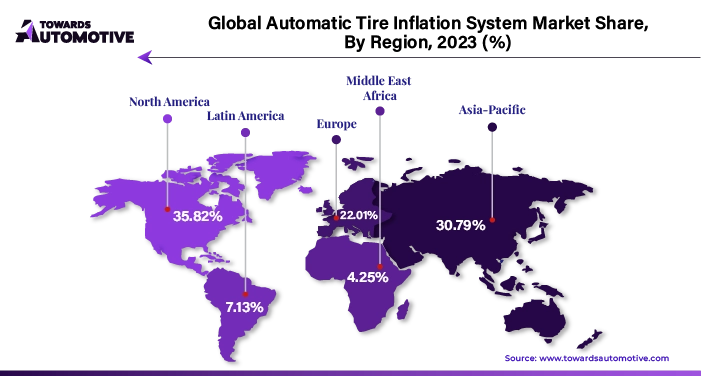

North America dominated the automatic tire inflation system market share by 35.82% in 2023. The expansion of the commercial vehicle fleet, coupled with an increasing focus on fuel efficiency and government incentives, is significantly driving the growth of the automatic tire inflation system market in North America. As the logistics, transportation, and e-commerce sectors continue to expand, the number of commercial vehicles on the road has surged, creating an increasing demand for advanced solutions that can optimize vehicle performance. ATIS ensures that tires are always properly inflated, helping to reduce fuel consumption and improve overall vehicle efficiency. Given that improper tire inflation is a major contributor to poor fuel economy, particularly for long-haul trucks, fleet operators are increasingly adopting ATIS to help cut fuel costs and minimize downtime due to tire-related issues.

Additionally, the rising regulatory emphasis on fuel efficiency and environmental sustainability has led to greater interest in technologies that can help commercial fleets meet emission standards. ATIS directly contributes to these efforts by improving fuel efficiency and reducing the carbon footprint of commercial vehicles. Moreover, government incentives and regulatory measures, such as tax rebates and green vehicle programs, are encouraging businesses to adopt advanced technologies like ATIS to enhance vehicle efficiency and reduce operational costs. These factors, combined with the growing demand for smarter fleet management solutions, are driving the widespread adoption of ATIS in North America. As the commercial vehicle fleet continues to grow and efficiency becomes a priority, the ATIS market is poised for continued expansion in the region.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The growth of the commercial vehicle fleet, coupled with an increased focus on fuel efficiency, cost reduction, and improved road safety regulations, is significantly driving the adoption of automatic tire inflation systems (ATIS) in the Asia-Pacific (APAC) region. As APAC continues to experience rapid industrialization and urbanization, the number of commercial vehicles, including trucks, buses, and delivery vans, has surged, creating a growing need for efficient tire management solutions. ATIS ensures that tires maintain optimal pressure, which directly impacts vehicle performance and efficiency. By reducing rolling resistance, ATIS helps enhance fuel efficiency, making it a critical tool for fleet operators aiming to minimize operating costs.

As fuel prices remain volatile, the demand for solutions that improve fuel economy has escalated across the region, especially in countries like China, India, and Japan, where commercial transportation is a backbone of the economy. In addition, the increased emphasis on road safety in APAC, driven by both government regulations and industry standards, is pushing for the adoption of ATIS. Proper tire inflation is essential for preventing tire blowouts, improving vehicle handling, and reducing accidents caused by underinflated tires. With governments tightening road safety regulations and vehicle standards, ATIS has become a crucial technology for compliance. Thus, these factors are propelling the growth of the automatic tire inflation system market in APAC, as more businesses look for innovative solutions to improve operational efficiency, reduce downtime, and enhance road safety.

By Type

By Vehicle Type

By Component

By Sales Channel

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us