February 2025

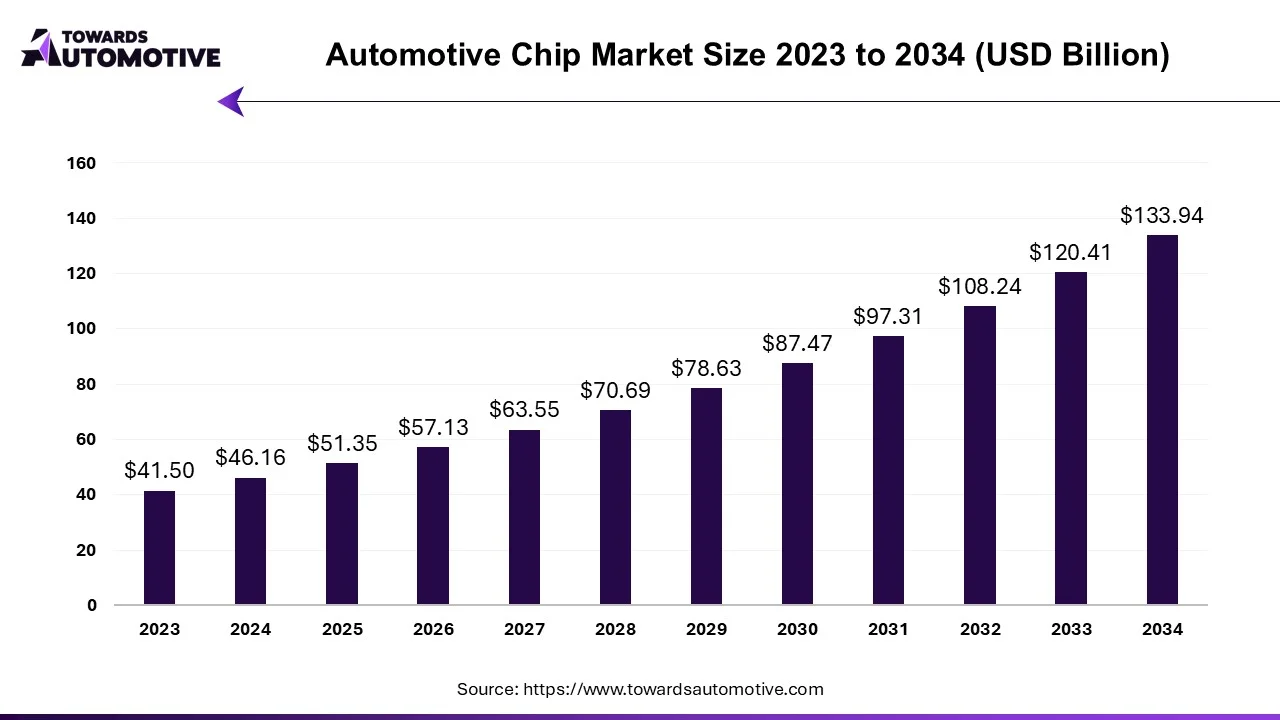

The automotive chip market is expected to increase from USD 51.35 billion in 2025 to USD 133.94 billion by 2034, growing at a CAGR of 11.24% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

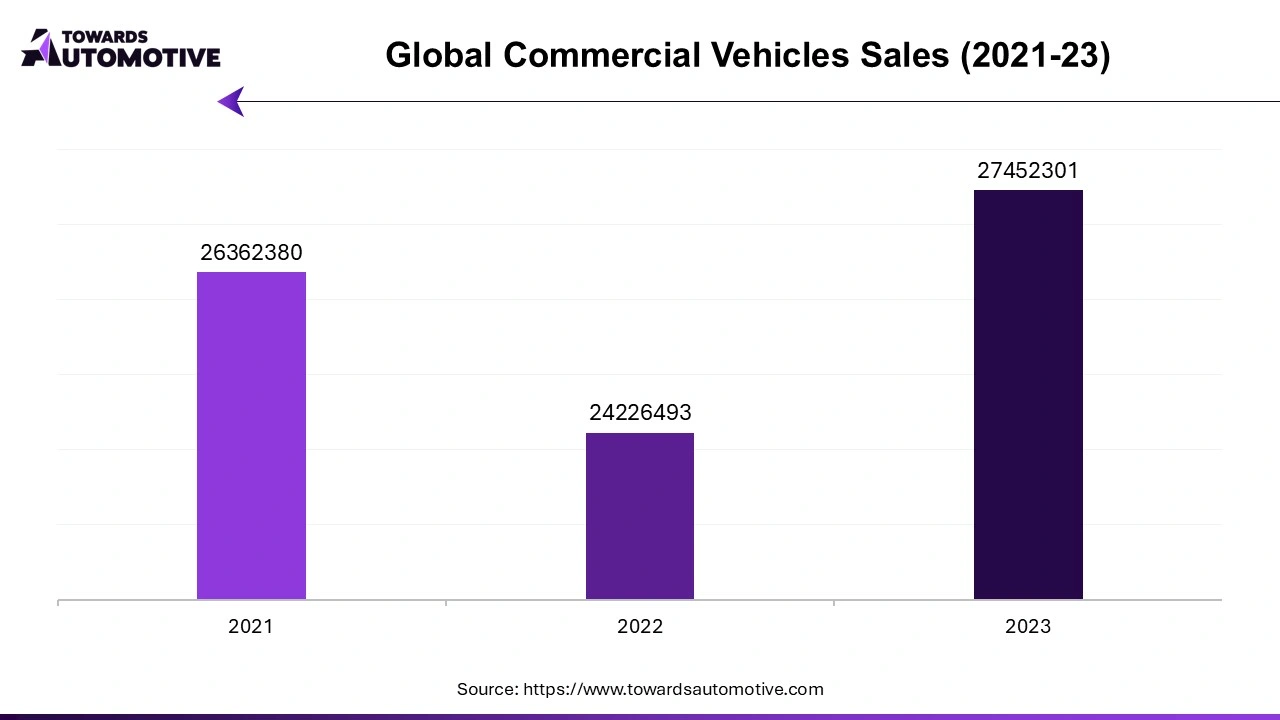

The automotive chip market is a crucial sector of the automotive components industry. This industry deals in manufacturing and distribution of advanced chips for automotives. There are numerous types of chips developed in this industry comprising of analog ICs, microcontrollers & microprocessors and logic ICs. These chips are designed for operating several applications such as chassis, powertrain, safety, telematics & infotainment, body electronics and some others. The growing sales of commercial vehicles in different parts of the world has contributed to the market expansion. This market is projected to rise significantly with the growth of the overall automotive industry around the world.

In August 2024, the vice president and general manager of Intel Automotive made an announcement stating that, “Intel’s strategy is to bring the power of AI into devices of every size and shape, and we’re thrilled to bring that expertise and our vast open AI ecosystem to the automotive industry, China’s rapid electric vehicle development cycles and advanced technological adoption make it an ideal testing ground for our next-generation technologies.”

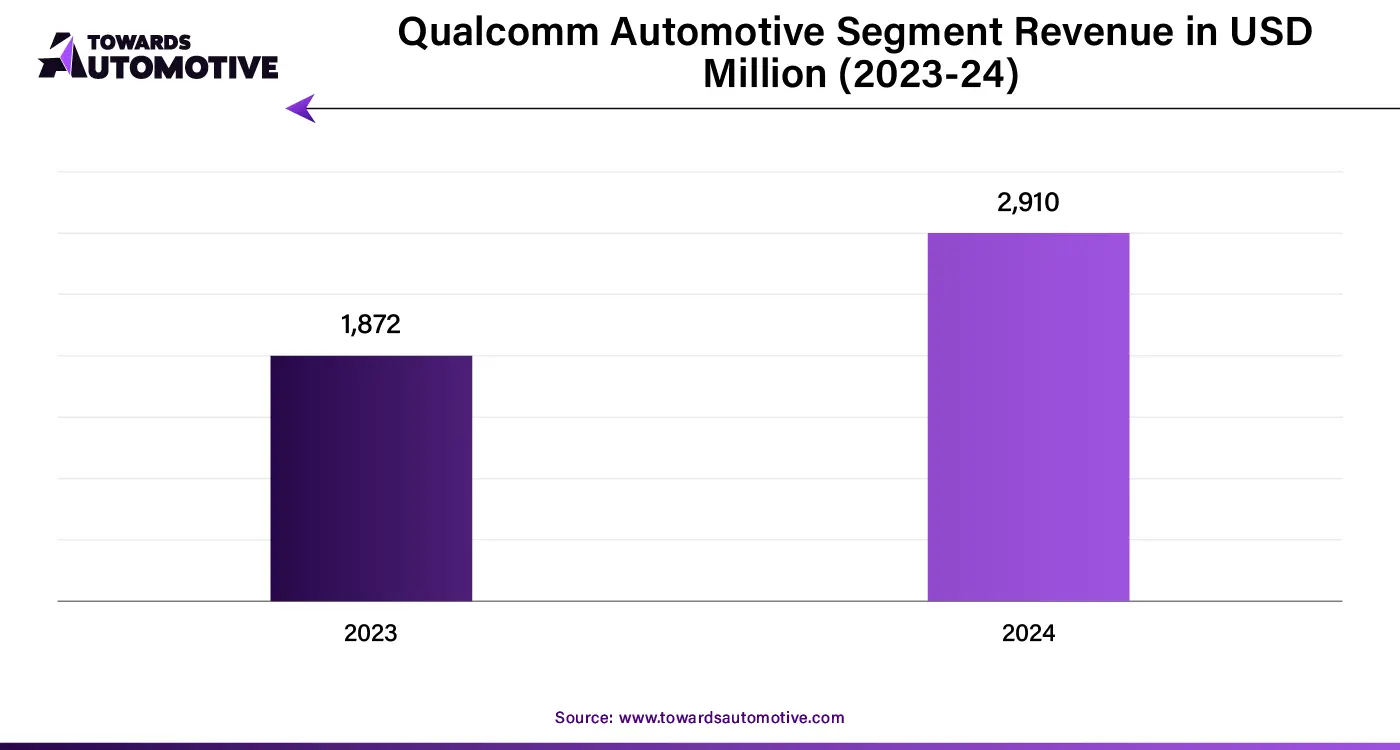

The automotive chip market is a highly fragmented industry with the presence of numerous dominant players. Some of the prominent market players in this industry consists of Texas Instruments Incorporated, NXP Semiconductors, Broadcom, Qualcomm, Micron Technology, Inc, Intel Corporation and some others. These market players are increasing their investment in research and development of advanced chips for automotives in different parts of the world.

By Type

By Vehicle

By Application

By Region

February 2025

February 2025

February 2025

February 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us