April 2025

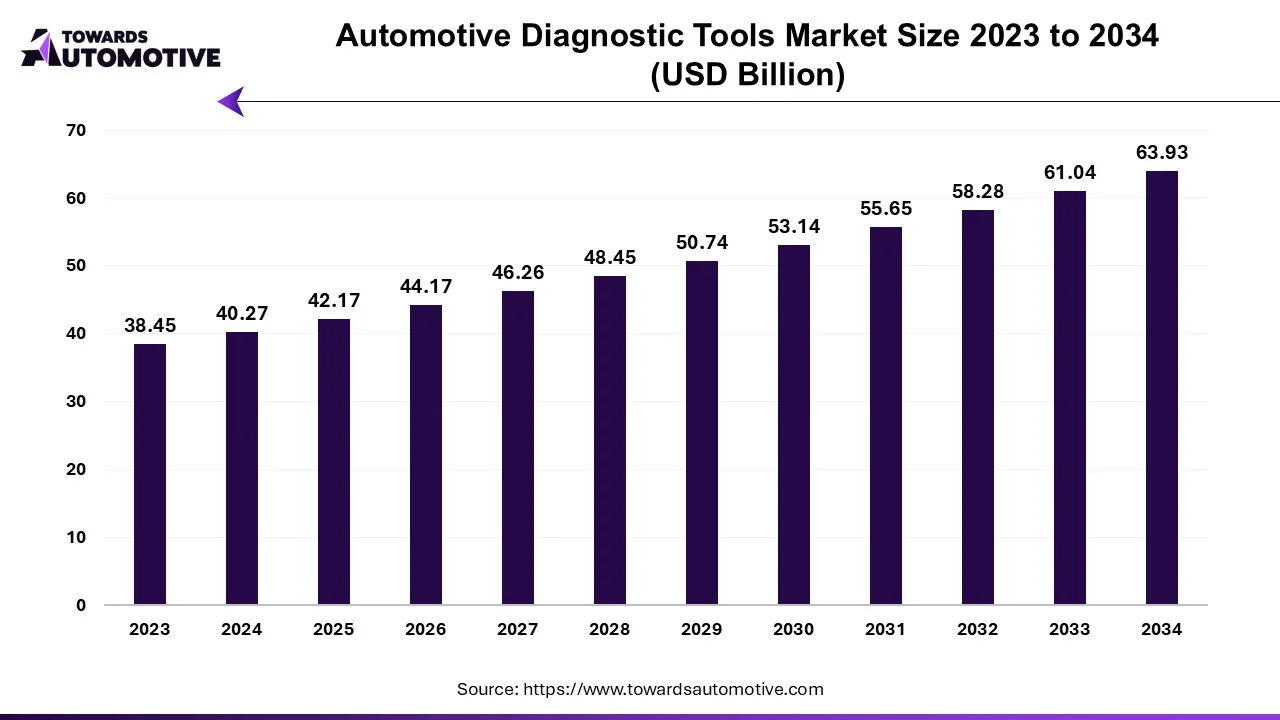

The global automotive diagnostic tools market is forecasted to expand from USD 42.17 billion in 2025 to USD 63.93 billion by 2034, growing at a CAGR of 4.73% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The automotive diagnostic tools market is a rapidly evolving segment of the automotive industry, driven by advancements in vehicle technology and the growing need for efficient maintenance and repair solutions. These tools are designed to identify, analyze, and resolve issues in various vehicle systems, such as engines, transmissions, brakes, and electronic control units (ECUs). As modern vehicles become increasingly complex with the integration of advanced electronics, sensors, and on-board diagnostics (OBD) systems, the demand for sophisticated diagnostic tools has surged among both professional mechanics and individual vehicle owners.

The market's growth is further fueled by the increasing adoption of electric vehicles (EVs) and hybrid vehicles, which require specialized diagnostic solutions tailored to their unique powertrain and battery systems. Additionally, the proliferation of connected cars and the implementation of stricter emission and safety regulations globally have accelerated the adoption of diagnostic tools, as they enable real-time monitoring and compliance with industry standards.

Technological advancements, such as the integration of artificial intelligence (AI), machine learning, and cloud connectivity, are enhancing the functionality of diagnostic tools, making them more accurate, user-friendly, and capable of predictive maintenance. The rising vehicle population, coupled with the growing automotive aftermarket and a shift toward preventive maintenance practices, further contributes to the market’s expansion. With increasing consumer awareness about vehicle health and the continuous evolution of automotive technologies, the automotive diagnostic tools market is poised for significant growth in both developed and emerging economies.

Artificial intelligence (AI) is revolutionizing the automotive diagnostic tools market, enhancing the efficiency, accuracy, and functionality of vehicle diagnostics. As modern vehicles become more advanced with interconnected systems, on-board diagnostics (OBD), and electronic control units (ECUs), the complexity of identifying and resolving issues has grown significantly. AI-powered diagnostic tools address this challenge by enabling faster and more precise fault detection, predictive maintenance, and real-time analysis. These tools leverage machine learning algorithms and data analytics to interpret vast amounts of vehicle data, streamlining repair processes and reducing downtime.

AI's role extends beyond traditional diagnostics by enabling predictive and preventive maintenance. By analyzing historical and real-time vehicle data, AI-powered tools can forecast potential failures, allowing vehicle owners and service providers to address issues before they escalate into costly repairs. This capability is particularly valuable in fleet management, where downtime directly impacts operational efficiency.

Additionally, AI enhances the usability of diagnostic tools through natural language processing (NLP) and intuitive interfaces, making them accessible even to non-experts. Cloud connectivity, combined with AI, enables remote diagnostics and over-the-air updates, ensuring vehicles stay operational and compliant with regulatory standards.

As electric vehicles (EVs) and connected cars grow in popularity, the demand for AI-integrated diagnostic tools is increasing. These tools are crucial for managing the unique challenges posed by EVs' battery systems and connected cars' complex software. AI is not only shaping the future of automotive diagnostics but also driving the market toward smarter, faster, and more sustainable solutions.

The increasing trend of premium cars is driving significant growth in the automotive diagnostic tools market. Premium vehicles, equipped with advanced technologies such as autonomous driving systems, electric powertrains, and sophisticated infotainment systems, require specialized diagnostic tools for accurate diagnostics and maintenance. As these high-end vehicles incorporate more complex electronic systems and sensors, traditional diagnostic tools are often inadequate, creating a need for more advanced, high-precision equipment. This shift pushes the demand for automotive diagnostic tools capable of handling the intricacies of premium cars.

Moreover, premium cars often come with extended warranties and after-sales services, further increasing the demand for diagnostic tools in the service and repair sector. Automotive service centers that cater to premium vehicle owners must invest in advanced diagnostic tools to ensure optimal performance and meet the brand-specific maintenance standards. The growing popularity of premium cars, driven by rising disposable incomes and consumer demand for luxury and performance, means more vehicles requiring specialized maintenance. As a result, automotive diagnostic tool manufacturers are developing tailored solutions to meet these needs, such as tools capable of diagnosing hybrid and electric powertrains, advanced driver-assistance systems (ADAS), and high-tech safety features.

The automotive diagnostic tools market faces several restraints, including the high initial cost of advanced diagnostic equipment and the complexity of integrating new tools with existing systems. Also, limited awareness and adoption in developing regions, coupled with the need for skilled technicians to operate advanced tools, also hinder market growth. Furthermore, data privacy concerns related to connected diagnostics pose challenges for widespread implementation.

The adoption of telematics in fleet management is creating substantial opportunities in the automotive diagnostic tools market by enabling real-time vehicle monitoring and diagnostics. Telematics systems, which integrate GPS, wireless communication, and vehicle sensors, allow fleet managers to continuously track vehicle health and performance. This technology provides data on key parameters such as engine status, fuel efficiency, tire pressure, and emissions, which can be analyzed to identify potential issues before they lead to costly breakdowns. As a result, automotive diagnostic tools are becoming essential for fleet operators to ensure optimal vehicle performance and reduce maintenance costs.

The integration of telematics with diagnostic tools also facilitates predictive maintenance. By monitoring vehicle data, fleet managers can schedule repairs and replacements proactively, minimizing unexpected downtime and improving overall fleet efficiency. Additionally, telematics plays a crucial role in ensuring compliance with environmental regulations and safety standards by helping track emissions and other regulatory metrics.

As the demand for fleet management solutions grows, driven by industries like logistics, transportation, and e-commerce, the need for advanced diagnostic tools that support telematics-based diagnostics is increasing. This creates new opportunities for the automotive diagnostic tools market, particularly in fleet-heavy regions and sectors.

The diagnostic equipment/hardware segment held the largest share of the market. The diagnostic equipment segment is a crucial factor in driving the growth of the automotive diagnostic tools market, as it forms the backbone of modern vehicle diagnostics. With the automotive industry witnessing rapid advancements in technology, vehicles today are increasingly complex, incorporating intricate electronic systems, sensors, and software. Diagnostic equipment, such as scanners, code readers, and digital multimeters, plays a critical role in identifying and resolving faults in these sophisticated systems. As vehicle manufacturers introduce innovative features like advanced driver-assistance systems (ADAS), connected car technologies, and electric powertrains, the demand for advanced diagnostic equipment has surged to ensure efficient maintenance and repair processes.

One of the key growth drivers within this segment is the increasing shift towards electric and hybrid vehicles. These vehicles require specialized diagnostic tools capable of evaluating battery performance, electric motors, and energy management systems. Additionally, the growing focus on emissions control and regulatory compliance has led to widespread adoption of diagnostic equipment for monitoring vehicle emissions and ensuring adherence to environmental standards.

The integration of wireless and cloud-based technologies in diagnostic equipment further boosts its market potential. These innovations allow real-time diagnostics and remote monitoring, reducing downtime and improving service efficiency. Moreover, the aftermarket sector, which caters to a rising number of aging vehicles, heavily relies on diagnostic equipment to maintain vehicle performance and longevity.

The passenger cars segment led the industry. The passenger cars segment plays a pivotal role in driving the growth of the automotive diagnostic tools market. As the global demand for passenger cars continues to rise, fueled by increasing urbanization, higher disposable incomes, and a growing middle class, the need for efficient and advanced diagnostic solutions has become paramount. Modern passenger vehicles are equipped with sophisticated electronic control units (ECUs), sensors, and on-board diagnostics (OBD) systems that monitor various parameters such as emissions, engine performance, and safety features. As a result, automotive diagnostic tools are essential for detecting, analyzing, and addressing issues in these complex systems, ensuring optimal vehicle performance and compliance with regulatory standards.

Additionally, the increasing adoption of electric vehicles (EVs) and hybrid cars within the passenger car segment has further boosted the demand for specialized diagnostic tools tailored to these technologies. EVs require tools capable of monitoring battery health, electric drivetrains, and charging systems, while hybrid vehicles demand solutions that integrate diagnostics for both internal combustion engines and electric systems.

The rising consumer preference for preventive maintenance and real-time vehicle monitoring also contributes to this growth. Diagnostic tools help vehicle owners and service providers identify potential issues early, reducing repair costs and enhancing vehicle longevity. Moreover, advancements in connectivity and telematics have paved the way for remote diagnostics, making it easier to manage passenger vehicle maintenance efficiently. The passenger car segment's expansion, combined with evolving automotive technologies, underscores its crucial role in shaping the future of the automotive diagnostic tools market.

Asia Pacific dominated the automotive diagnostic tools market. The automotive diagnostic tools market in Asia Pacific is experiencing robust growth, driven by several key factors. One of the primary drivers is the rapid expansion of the automotive industry in the region, particularly in emerging economies such as China, India, and Southeast Asian countries. Rising disposable incomes, urbanization, and increased vehicle ownership have created a strong demand for automotive diagnostic tools, both in the aftermarket and among OEMs.

The increasing adoption of hybrid vehicles in the region is another significant growth factor. Governments across Asia Pacific are promoting EV adoption through subsidies, tax incentives, and stringent emission regulations, which has led to a need for advanced diagnostic tools tailored to these vehicles. These tools are essential for managing the unique requirements of EVs, such as battery health monitoring and electric drivetrain diagnostics.

The presence of leading automotive manufacturers and a growing automotive aftermarket further support the market’s expansion. Regional governments are also investing heavily in smart manufacturing and technology development, driving innovation in automotive diagnostic tools. With the region’s strong focus on technological advancements, coupled with rising consumer awareness about vehicle maintenance, Asia Pacific is poised to remain a key growth hub for the automotive diagnostic tools market.

Europe is expected to grow with a significant CAGR during the forecast period. The automotive diagnostic tools market in Europe is experiencing significant growth, driven by several key factors that align with the region’s strong focus on technological advancements and environmental sustainability. One of the primary drivers is the increasing adoption of electric vehicles (EVs) across Europe. Governments in the region are actively promoting cleaner transportation through stringent emission regulations, incentives, and subsidies, creating a rising demand for advanced diagnostic tools tailored to EVs powertrains.

The trend of connected cars and advanced automotive technologies, such as autonomous driving and advanced driver-assistance systems (ADAS), also contributes to market growth. These innovations require sophisticated diagnostic tools to ensure seamless integration, performance optimization, and compliance with safety and emission standards. The European Union’s regulations on vehicle emissions and safety further drive the adoption of diagnostic systems, as these tools play a critical role in monitoring and maintaining compliance.

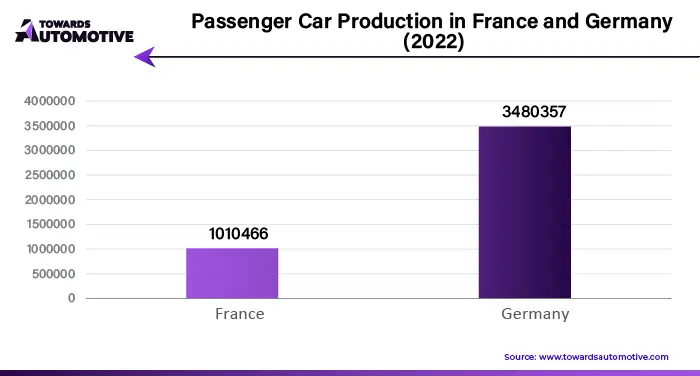

Moreover, the presence of leading automotive manufacturers and a well-established aftermarket industry in Europe supports the widespread adoption of diagnostic tools. Countries such as Germany, France, and the United Kingdom are hubs for automotive innovation, fostering advancements in diagnostic technology.

The growing emphasis on preventive maintenance among vehicle owners, combined with rising consumer awareness about vehicle health, is another crucial growth factor. With the increasing complexity of modern vehicles, diagnostic tools have become indispensable for ensuring performance and reducing long-term maintenance costs.

By Product

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us