April 2025

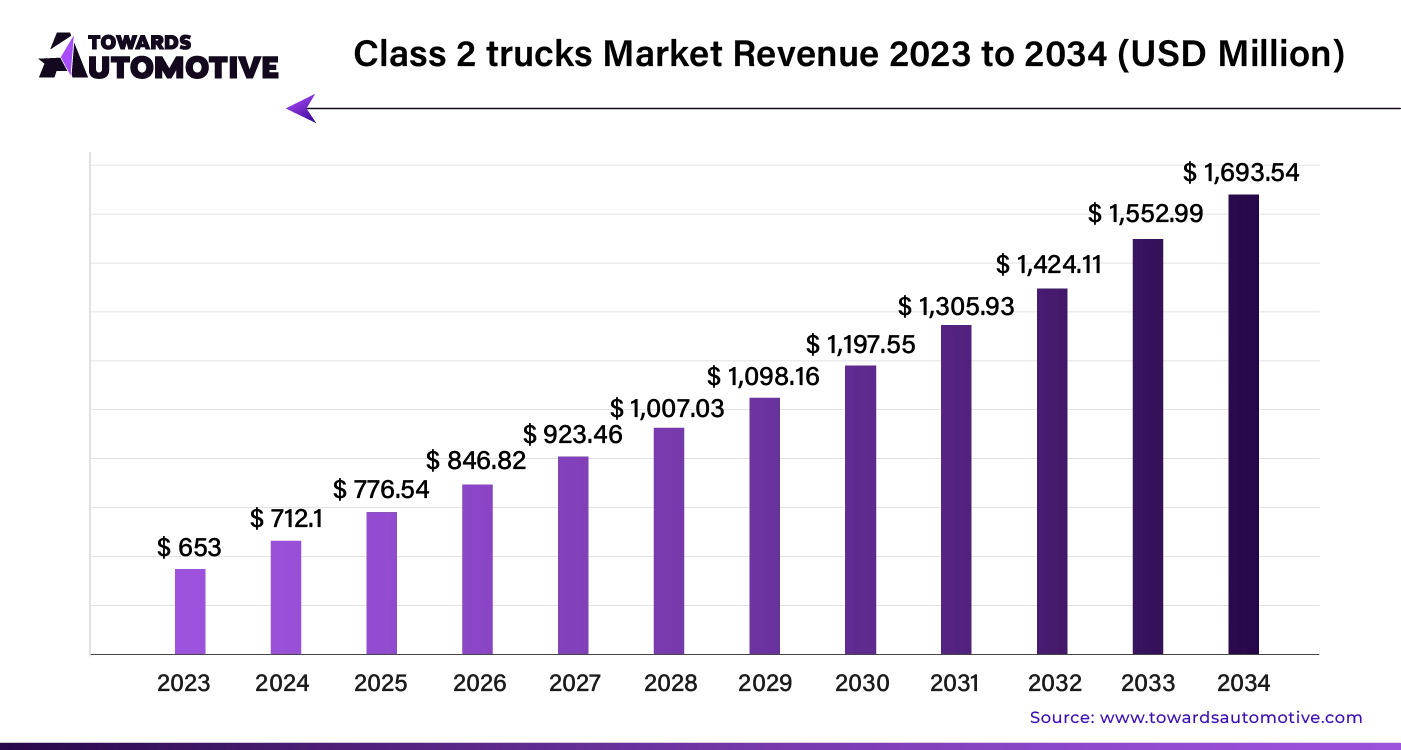

The global class 2 trucks market size is calculated at USD 712.1 million in 2024 and is expected to be worth USD 1,693.54 million by 2034, expanding at a CAGR of 9.05% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The Class 2 trucks market, encompassing vehicles with a gross vehicle weight rating (GVWR) ranging from 6,001 to 10,000 pounds, plays a pivotal role in the commercial transportation sector. These trucks are widely used for a variety of applications, including local deliveries, small-scale logistics, and utility services. Their versatility, affordability, and ease of maneuverability make them a popular choice among businesses for urban and suburban operations.

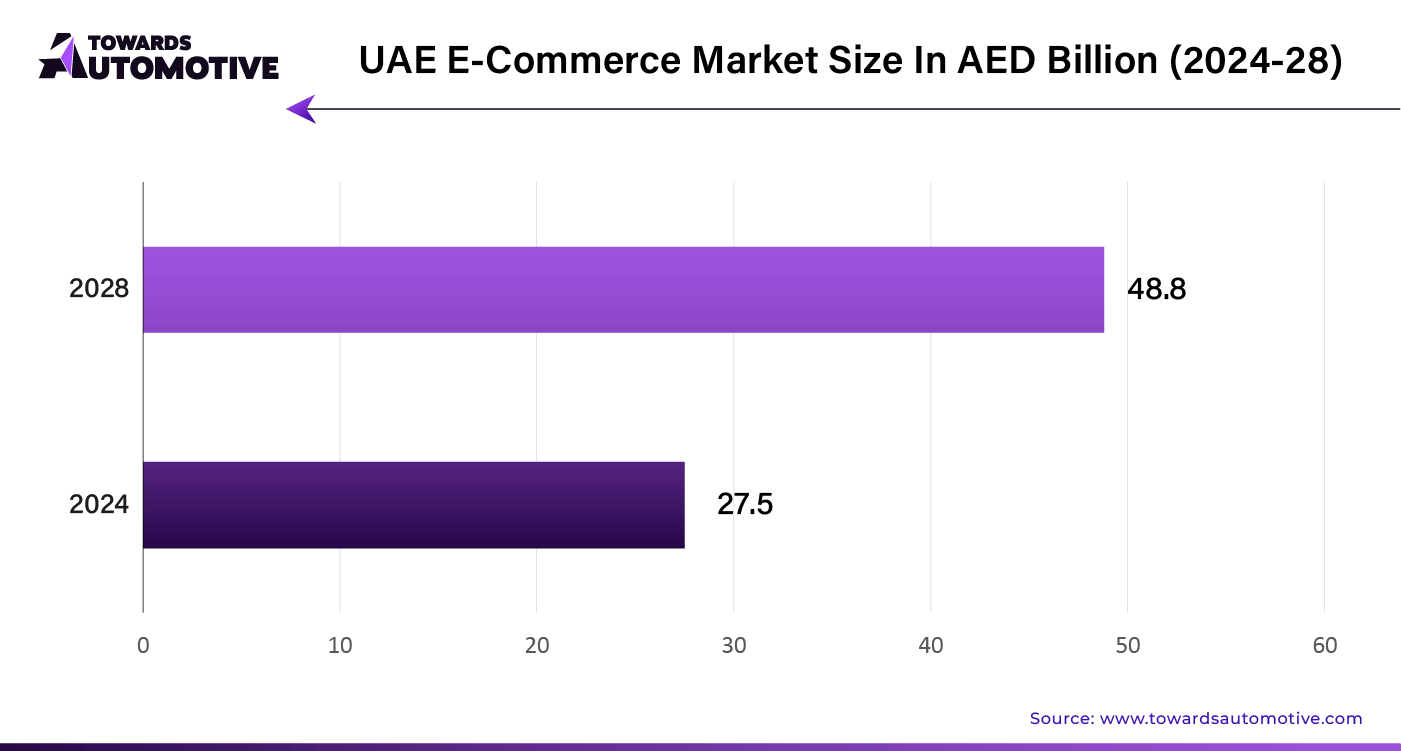

One of the key drivers of growth in the Class 2 trucks market is the increasing demand for efficient and reliable delivery solutions, spurred by the rise of e-commerce and last-mile delivery services. As online shopping continues to expand, businesses require more agile and capable vehicles to handle smaller loads and navigate congested urban environments. Class 2 trucks, with their optimal size and payload capacity, meet these needs effectively.

Technological advancements are also contributing to market growth, with improvements in fuel efficiency, safety features, and telematics enhancing the performance and operational efficiency of Class 2 trucks. The integration of advanced driver assistance systems (ADAS) and connectivity solutions provides real-time data and enhances driver safety, making these trucks more attractive to fleet operators.

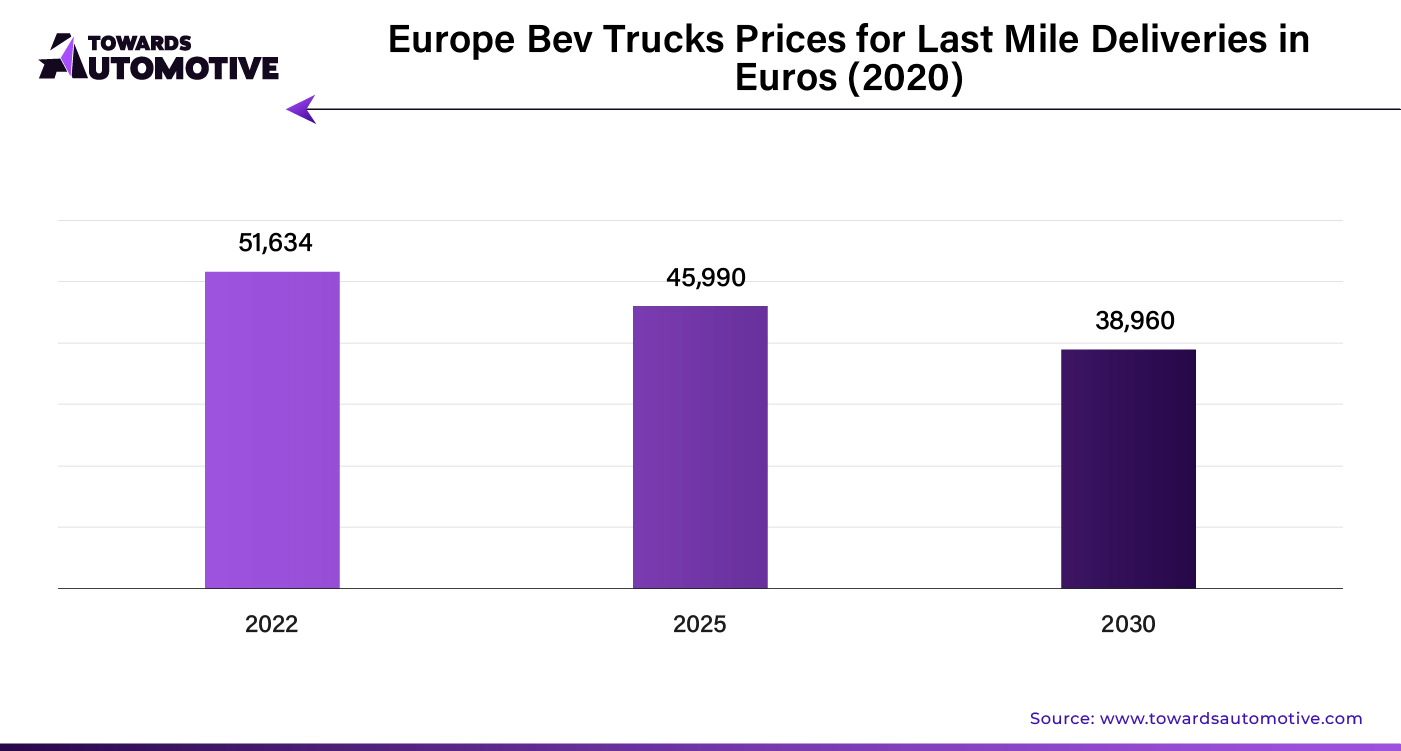

Moreover, the shift towards sustainable transportation solutions is influencing the market, with increasing interest in electric and hybrid Class 2 trucks. These alternative powertrains offer reduced emissions and lower operating costs, aligning with regulatory pressures and environmental goals.

Artificial Intelligence (AI) is revolutionizing the Class 2 trucks market by enhancing safety, efficiency, and operational performance. AI-driven Advanced Driver Assistance Systems (ADAS) are pivotal, offering features like lane-keeping assistance, adaptive cruise control, and automated emergency braking, which significantly improve driver safety and vehicle control. Predictive maintenance powered by AI analyzes data from truck sensors to forecast potential issues, enabling timely interventions and reducing downtime. In fleet management, AI optimizes routes, monitors driver behavior, and manages fuel consumption, leading to cost savings and improved operational efficiency.

While fully autonomous Class 2 trucks are still in development, AI is facilitating semi-autonomous features that support functions like automated parking and highway driving assistance. Additionally, AI contributes to enhanced safety through real-time hazard detection and driver monitoring systems. AI-based simulation tools and virtual training programs also support driver training by providing personalized feedback and practice scenarios. Collectively, these AI-driven innovations are transforming the Class 2 trucks market, making operations safer, more efficient, and paving the way for future advancements in commercial transportation.

The emergence of e-commerce and the growing demand for last-mile delivery services are significantly driving the growth of the Class 2 trucks market. As e-commerce continues to expand globally, there is an increasing need for efficient and reliable transportation solutions to handle the surge in online orders. Class 2 trucks, with their optimal size and payload capacity, are particularly well-suited for navigating urban and suburban environments, making them ideal for last-mile delivery operations. These trucks offer a balance of cargo space and maneuverability, allowing businesses to efficiently deliver goods to consumers in densely populated areas.

The rise of same-day and next-day delivery services has intensified the demand for Class 2 trucks, as companies seek to enhance their logistics capabilities and meet consumer expectations for quick, reliable service. These trucks are integral to last-mile delivery fleets, offering the flexibility to handle a variety of package sizes and volumes while easily navigating city streets and residential neighborhoods.

Moreover, advancements in technology and telematics are further boosting the appeal of Class 2 trucks in the e-commerce sector. Features such as route optimization, real-time tracking, and advanced safety systems enhance operational efficiency and customer satisfaction. As e-commerce continues to grow and last-mile delivery becomes increasingly critical, the demand for Class 2 trucks is expected to rise, driving market expansion and innovation in the commercial vehicle sector.

The Class 2 trucks market faces several restraints, including high initial costs and fluctuating fuel prices. The advanced technologies integrated into modern trucks, such as telematics and safety systems, can drive up vehicle costs, making them less accessible to small businesses. Additionally, fluctuating fuel prices impact operational costs, particularly for traditional gasoline and diesel-powered trucks. Stringent emissions regulations also pose challenges, requiring manufacturers to invest in cleaner technologies, which can increase development costs. These factors collectively limit the widespread adoption and growth of the Class 2 trucks market.

Autonomous driving technology is creating significant opportunities in the Class 2 trucks market by revolutionizing the way these vehicles operate and enhancing efficiency across industries. With the integration of advanced driver assistance systems (ADAS) like lane-keeping assistance, adaptive cruise control, and automated braking, Class 2 trucks are becoming safer and easier to operate. These features reduce the likelihood of human error, improving overall road safety and minimizing accidents, which is particularly beneficial for businesses reliant on reliable and efficient transportation.

The potential for fully autonomous Class 2 trucks also presents exciting possibilities for reducing labor costs and optimizing operations. Autonomous trucks can operate continuously without the need for driver breaks, increasing productivity and streamlining delivery processes, especially in industries like e-commerce and last-mile logistics. This creates opportunities for companies to maximize efficiency while minimizing operational costs.

Additionally, autonomous driving technology can improve fuel efficiency through optimized driving patterns and route planning. With AI-powered systems analyzing traffic and road conditions, these trucks can take the most efficient routes, saving time and reducing fuel consumption. Overall, the rise of autonomous driving is set to transform the Class 2 trucks market, offering new growth opportunities in safety, efficiency, and operational scalability.

The gasoline segment held the dominant share of this industry. The gasoline segment plays a significant role in driving the growth of the Class 2 trucks market due to its widespread availability, affordability, and established infrastructure. Gasoline-powered trucks remain a popular choice for businesses in industries such as delivery, construction, and utilities that require reliable, light-duty vehicles for their operations. One of the primary advantages of gasoline engines is their lower upfront cost compared to diesel and electric alternatives, making them an attractive option for small and medium-sized businesses seeking cost-effective solutions.

Additionally, gasoline engines are known for their versatility and ease of maintenance, which contributes to their sustained demand. The extensive network of refueling stations across urban and rural areas further supports the dominance of gasoline-powered Class 2 trucks, offering convenience and minimizing downtime for fleet operators.

Despite the growing focus on electric and alternative fuel trucks, gasoline-powered vehicles continue to serve as a bridge technology, especially in regions with less-developed EV infrastructure. With advancements in engine efficiency and emissions control, gasoline engines are becoming cleaner and more fuel-efficient, contributing to the continued growth of the Class 2 trucks market. These trucks offer an affordable and reliable option, supporting a wide range of commercial applications.

The all-wheel drive segment led the market share by 54% in 2023. The all-wheel drive (AWD) segment is driving growth in the Class 2 trucks market by offering enhanced traction, stability, and performance, making it highly desirable for businesses operating in challenging terrains or adverse weather conditions. AWD systems distribute power to all four wheels, providing better control and handling, especially on rough roads, snow, mud, or wet surfaces. This makes AWD trucks ideal for industries such as construction, utilities, and agriculture, where vehicles often need to navigate uneven landscapes or work sites.

With increasing demand for versatile vehicles that can perform in a variety of conditions, the AWD segment is gaining traction in both urban and rural markets. Companies that rely on dependable transportation for deliveries, maintenance, and off-road activities find AWD Class 2 trucks particularly useful for their ability to maintain mobility and safety in difficult driving environments.

Additionally, advancements in AWD technology have improved fuel efficiency and reduced maintenance costs, making it a more viable option for businesses seeking high-performance vehicles without sacrificing economy. As industries prioritize reliability and performance, the demand for AWD-equipped Class 2 trucks continues to grow, contributing to the market’s expansion across various sectors.

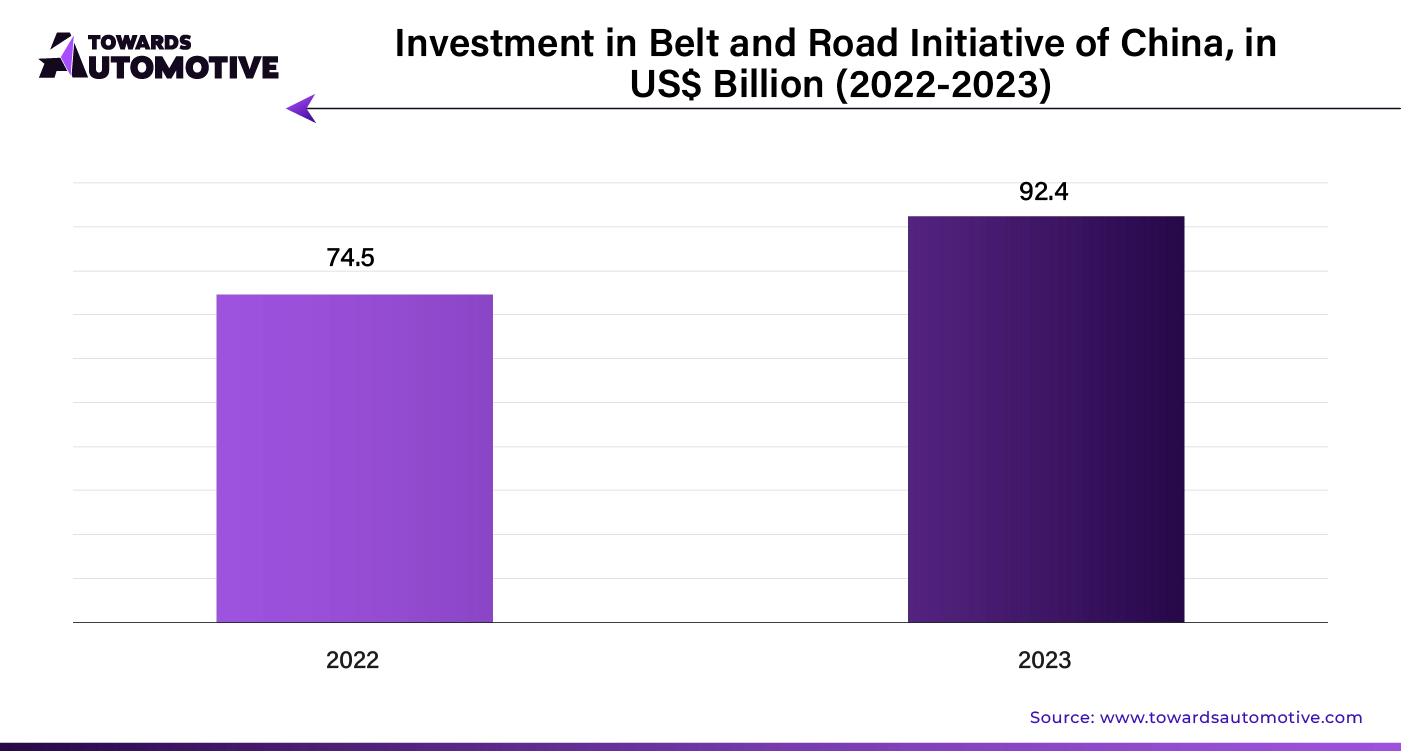

Asia Pacific dominated the class 2 trucks market. Urbanization, infrastructural development and industrial growth are the key drivers of the Class 2 trucks market in Asia Pacific. Rapid urbanization in countries such as China, India, and Southeast Asia has led to increased demand for transportation solutions to support expanding cities and logistics networks. Class 2 trucks, known for their maneuverability and capacity, are ideal for navigating congested urban streets, making them essential for delivering goods in densely populated areas.

Infrastructural development further fuels the need for these trucks, as they play a critical role in transporting construction materials and equipment for ongoing projects. Additionally, industrial growth across sectors such as manufacturing, retail, and agriculture has increased the demand for efficient transportation of raw materials and finished products. Class 2 trucks provide the necessary flexibility and capacity for these industries to move goods efficiently within cities and regions.

LAMEA is expected to grow with a notable CAGR during the forecast period. Trade expansion, government initiatives, and the e-commerce boom are key factors driving the growth of the Class 2 trucks market in LAMEA (Latin America, Middle East, and Africa). The region's increasing trade activities, particularly in agriculture, manufacturing, and construction, require efficient transportation solutions for moving goods between urban centers and rural areas. Class 2 trucks, with their versatility and ability to handle mid-sized loads, are ideal for supporting this growing trade network.

Government initiatives aimed at modernizing transportation infrastructure and reducing carbon emissions further boost the demand for Class 2 trucks. Many governments in LAMEA are promoting the adoption of cleaner, more fuel-efficient vehicles, encouraging businesses to invest in new, eco-friendly trucks. These policies create a favorable environment for the growth of the Class 2 trucks market, particularly with the introduction of hybrid and electric models.

Additionally, the rapid growth of e-commerce across the region is fueling the demand for last-mile delivery solutions. Class 2 trucks offer the cargo space and maneuverability required for efficient, frequent deliveries in both urban and suburban areas. As online shopping continues to rise, businesses are increasingly relying on these trucks to meet the growing logistical needs of the e-commerce sector.

By Product

By Fuel

By Application

By Drive Configuration

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us