April 2025

Senior Research Analyst

Reviewed By

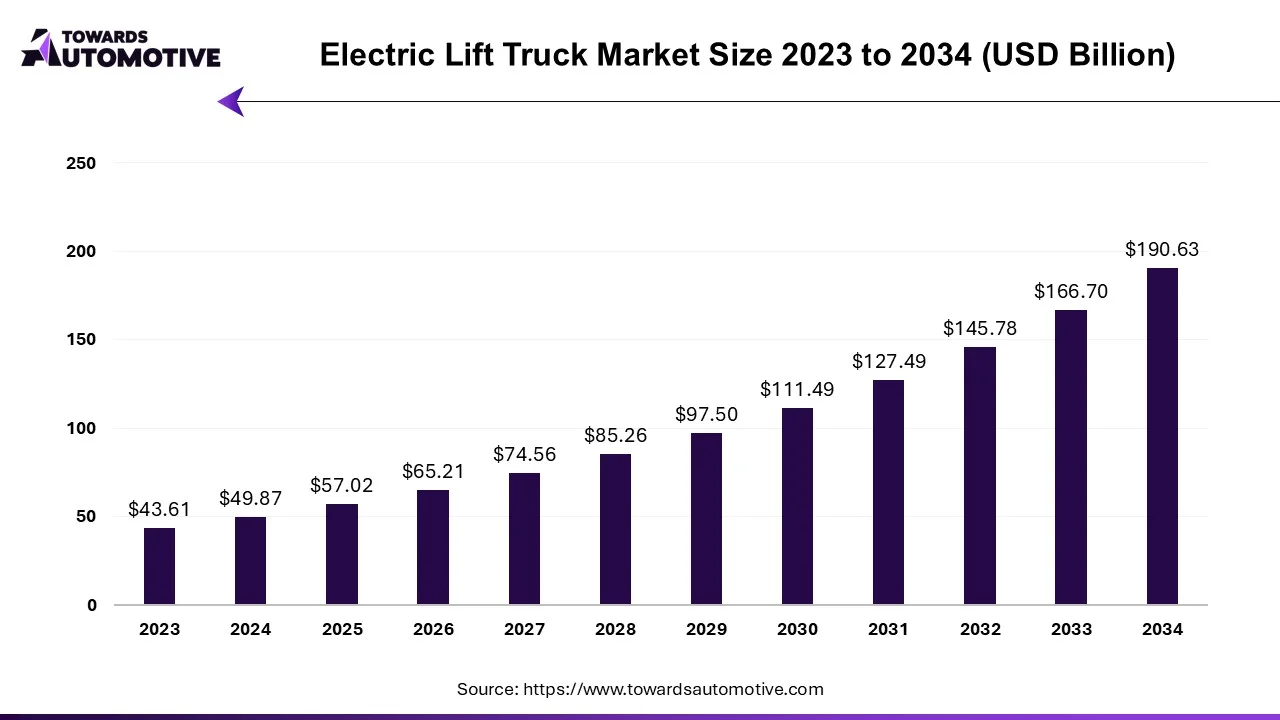

The global electric lift truck market is projected to reach USD 190.63 billion by 2034, expanding from USD 57.02 billion in 2025, at an annual growth rate of 14.35% during the forecast period from 2025 to 2034.

The electric lift truck market has been experiencing robust growth in recent years, driven by several key factors. One of the primary drivers is the increasing emphasis on sustainability and environmental responsibility among businesses worldwide. Electric lift trucks offer a cleaner and quieter alternative to traditional internal combustion engine (ICE) forklifts, aligning with the growing demand for eco-friendly solutions in the industrial sector.

Moreover, stringent government regulations aimed at reducing emissions and promoting energy efficiency have further propelled the adoption of electric lift trucks. In regions such as Europe and North America, regulatory measures incentivize businesses to invest in electric and low-emission vehicles, including electric lift trucks, through tax incentives, subsidies, and emissions standards.

The stringent environmental regulations, with a focus on emissions reduction and sustainability, serves as a significant driver propelling the adoption of electric lift trucks in the industrial sector. Governments worldwide implement stricter standards to combat climate change and curb air pollution; businesses are compelled to seek out cleaner and more eco-friendly alternatives for their material handling operations.

The largest sustainability initiative, the EU’s Green Deal, unveiled in 2019, is a comprehensive policy framework aimed at making Europe the world’s first climate-neutral continent by 2050. Among its objectives are reducing greenhouse gas emissions, increasing energy efficiency, and promoting circular economy practices.

Clean Air Act Enforced by the Environmental Protection Agency (EPA), this law aims to reduce air pollution and greenhouse gas emissions. This law regulates air pollution from a variety of sources, including power plants, factories, and vehicles. The Clean Air Act has helped to reduce air pollution in the US by over 70% since it was passed in 1970.

Carbon Neutrality Commitment In September 2020, Chinese President Xi Jinping announced China’s commitment to achieving carbon neutrality by 2060. This ambitious goal involves reducing carbon emissions to net-zero by mid-century.

Electric lift trucks offer a compelling solution, as they produce zero tailpipe emissions during operation, thereby minimizing environmental impact and contributing to overall sustainability efforts. In response to these regulatory pressures, businesses are increasingly turning to electric lift trucks to align with compliance requirements and reduce their carbon footprint.

The initial investment required for electric lift trucks, including not only the cost of the vehicles themselves but also the associated expenses such as batteries and charging infrastructure, presents a significant hurdle to adoption for many businesses. A brand new, electric forklift with standard capacity might cost $20,000 – $45,000 dollars and up with an increase of $2,500 – $5,000 for a battery and charger. For models boasting higher capacities or advanced features, prices can escalate.

Thus, particularly for smaller enterprises with constrained capital budgets, the higher upfront cost of electric lift trucks compared to their ICE counterparts can pose a considerable financial challenge. However, their operational costs decrease over time compared to those of internal combustion forklifts (because less maintenance is required). Electric forklifts also require battery charging stations to be installed, which increases initial costs. Also, electric forklifts have a limited run time and require a battery recharge, which can take several hours. But this depends on the type of battery and needed charging infrastructure. These barriers may deter some businesses from transitioning to electric lift trucks, despite the potential long-term cost savings and environmental benefits.

The integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), and robotics into electric lift trucks represents a compelling opportunity to revolutionize their functionality and performance. Autonomous lift trucks could help companies eliminate the safety risks and delays associated with manual pallet transport workflows. Most of the companies in the market are now focussing on combining the electric forklift with AI.

For instance,

With AI and ML algorithms, electric lift trucks can optimize route planning, load balancing, and predictive maintenance, resulting in improved operational efficiency and reduced downtime. Additionally, the integration of robotics enables electric lift trucks to autonomously navigate complex warehouse environments, interact with other automated systems, and perform tasks with precision and accuracy. These technological advancements not only enhance the capabilities of electric lift trucks but also unlock new applications and markets.

The pallet trucks segment dominated the market with share of 27.58% in 2023 and is likely to grow at a CAGR of 14.72% during the forecast period. The increase in demand across diverse end-use sectors and the extensive array of load-handling capabilities provided are propelling the expansion of the worldwide electric pallet truck segment. Electric pallet trucks are increasingly being embraced in logistics and warehouse settings for their effectiveness in managing goods. Unlike conventional pallet jacks, electric pallet jacks utilize a magnetic motor, leading to notably decreased maintenance needs. This distinctive feature contributes to the growing preference for electric pallet trucks in industrial operations.

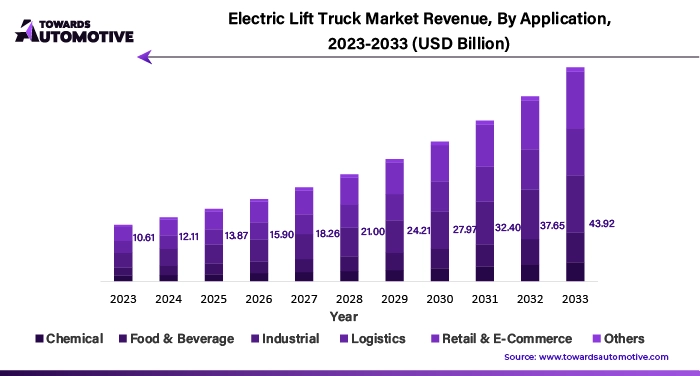

The industrial segment captured a substantial market share of 26.35% in 2023. In industrial settings, forklifts play essential roles in tasks such as loading and unloading, lifting, transporting goods via tractor-trailers, straight trucks, and railway cars. Industries are prioritizing the adoption of energy-efficient solutions to improve operational efficiency and reduce environmental impact. Electric-powered forklifts are increasingly favoured due to their lightweight construction, reduced noise levels, and minimal maintenance requirements. These inherent attributes are anticipated to drive higher demand for electric forklifts across the industrial sector.

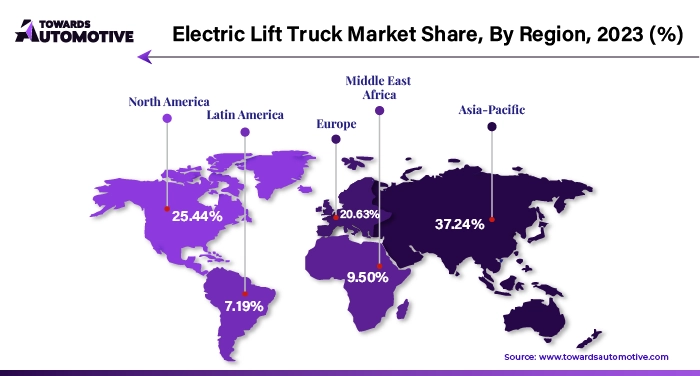

Asia Pacific dominated the global electric lift truck market with 37.24% of the share of the total market in 2023. The e-commerce industry is experiencing rapid growth in the region. The fully autonomous electric lift trucks are being introduced to improve efficiency in fulfilment processes. Additionally, companies in the region are optimizing the productivity of their lift truck fleets by utilizing low-tech features such as attachment units. Electric trucks are particularly suitable for indoor material handling as they offer high accuracy and safety while minimizing human errors.

North America is likely to grow at a considerable CAGR of 14.03% in the electric lift truck market during the forecast period. North America has been at the forefront of implementing strict environmental regulations aimed at reducing emissions and promoting sustainability. Thus, businesses in the region are increasingly turning to electric lift trucks to comply with these regulations and minimize their carbon footprint. Government incentives, such as tax credits, grants, and rebates, encourage businesses in North America to invest in electric vehicles. These incentives help offset the higher upfront cost of electric lift trucks and accelerate their adoption in the market.

Some of the key players in electric lift truck market are Doosan Industrial Vehicle America Corp., Crown Equipment Corporation, Anhui HELI Co., Ltd., Mitsubishi Logisnext Co., Ltd., Clark Material Handling Company, Konecranes, Combilift Material Handling Solutions, Godrej and Boyce Group, Hangcha Group Co., Ltd., Hubtex Maschinenbau GmbH & Co. KG, KION GROUP AG, Komatsu Ltd., Lonking Holdings Limited, Hyster-Yale Materials Handling, Inc., Manitou Group, Paletrans Forklifts, and Toyota Industries Corporation, among others.

By Product

By Class

By Application

By Region

April 2025

April 2025

April 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us