October 2025

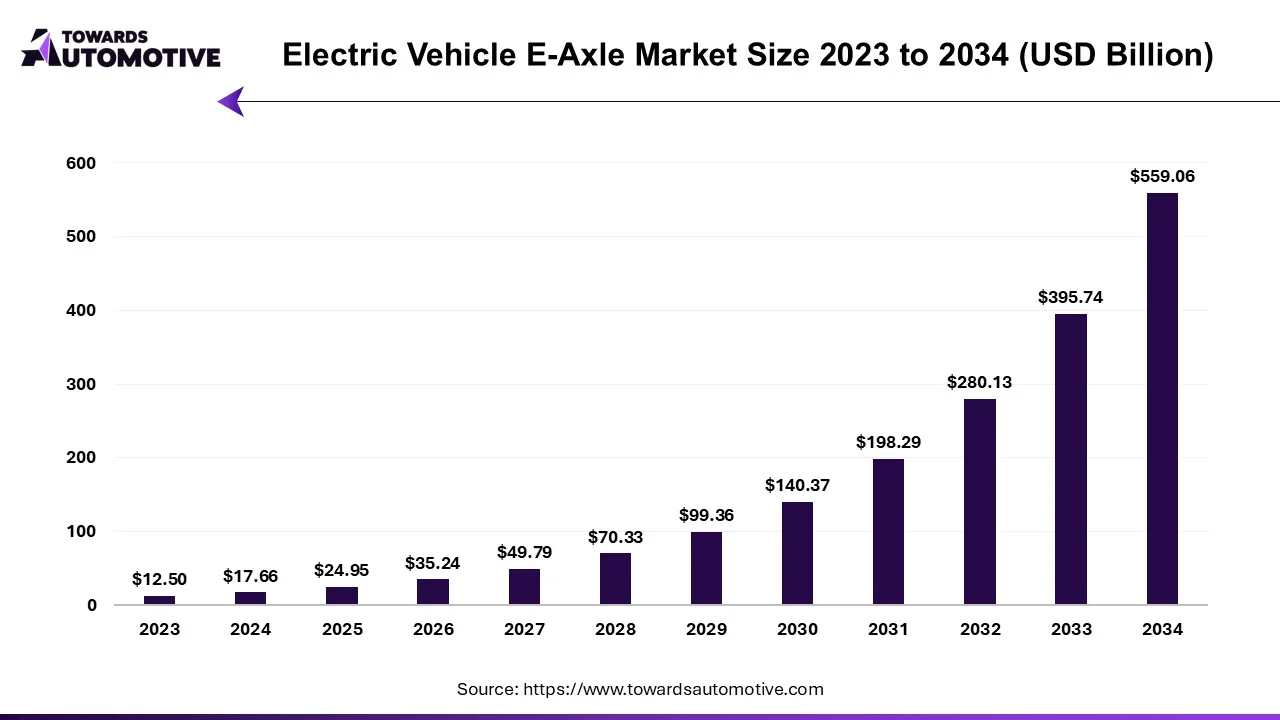

The electric vehicle e-axle market is projected to reach USD 559.06 billion by 2034, growing from USD 17.66 billion in 2024, at a CAGR of 41.27% during the forecast period from 2025 to 2034.

The electric vehicle (EV) e-axle market is experiencing significant growth as the automotive industry shifts toward sustainable mobility solutions. An e-axle, or electric axle, integrates several key components of an electric vehicle's powertrain, including the electric motor, power electronics, and transmission, into a single compact unit. This system is designed to enhance the efficiency, performance, and overall driving experience of electric vehicles. As demand for EVs continues to rise, driven by growing environmental concerns, government regulations, and advancements in EV technology, the e-axle market is poised to play a pivotal role in shaping the future of the automotive sector.

The e-axle offers several advantages, such as reduced weight, improved energy efficiency, and a simplified drivetrain, making it an ideal solution for modern electric vehicles. In addition, the adoption of e-axles supports the trend toward integrating advanced technologies like regenerative braking, torque vectoring, and autonomous driving features. The e-axle market is being further bolstered by the rise of electric commercial vehicles and an increasing emphasis on reducing carbon emissions in the transportation sector. As automakers work to meet stricter emissions standards and enhance vehicle performance, e-axles are becoming a crucial component in achieving these goals. With ongoing research and development in electric drivetrains and increasing investments in EV infrastructure, the e-axle market is expected to witness substantial growth in the coming years, fostering innovation and revolutionizing the EV industry.

AI plays a transformative role in the electric vehicle (EV) e-axle market by enhancing performance, improving energy efficiency, and supporting the development of smart vehicle technologies. AI algorithms are used in conjunction with e-axle systems to optimize motor control, torque distribution, and power management. This enables better integration of powertrains, maximizing efficiency and improving the overall driving experience. AI helps in real-time monitoring and predictive maintenance of e-axles, reducing the likelihood of failures by anticipating issues before they arise, thus extending the lifespan of components.

Additionally, AI is integral to the development of advanced features such as torque vectoring, which distributes power to specific wheels for better handling, stability, and traction control. By using AI to process data from sensors in the e-axle, manufacturers can continuously adjust the performance to match driving conditions, providing a smoother and more responsive experience for drivers.

AI also contributes to the evolution of autonomous driving by enabling communication between the e-axle system and other vehicle components, such as sensors, cameras, and control units. This enhances vehicle autonomy and safety. Furthermore, AI can assist in the design phase, enabling simulations and modeling that optimize e-axle configurations for different vehicle types and driving environments.

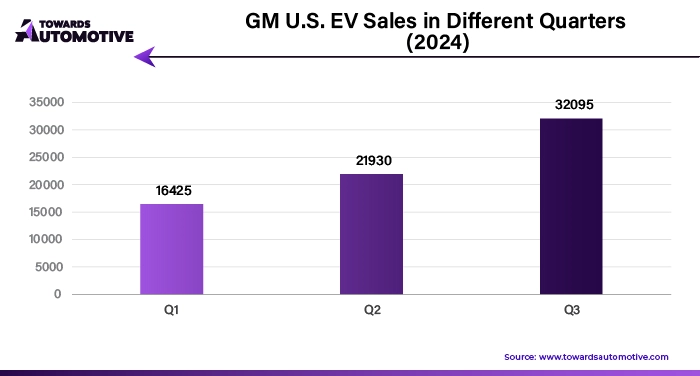

The rising sales of electric vehicles (EVs) significantly drive the growth of the electric vehicle e-axle market by boosting the demand for efficient, integrated drivetrain systems. As EV adoption accelerates worldwide due to government incentives, stricter emissions regulations, and growing environmental awareness, the need for advanced e-axle systems has surged. E-axles, which combine electric motor, power electronics, and transmission into a single compact unit, are critical in enhancing vehicle performance, efficiency, and cost-effectiveness. Their integration allows manufacturers to simplify production processes, reduce vehicle weight, and optimize energy consumption, which are key factors for EV competitiveness.

The shift toward mass-market EV production, led by automakers such as Tesla, BYD, and Volkswagen, has further amplified the adoption of e-axles. These systems are particularly favored in electric passenger cars, which form a significant portion of the EV market, as they deliver improved driving dynamics and support modular vehicle designs. Moreover, the growing popularity of SUVs and crossovers, which demand higher power and performance, has also contributed to the increasing implementation of e-axle systems in these segments.

Additionally, advancements in battery technology and the expansion of EV charging infrastructure have reduced range anxiety, encouraging more consumers to switch to EVs. This rising consumer demand is driving automakers to innovate and adopt cutting-edge e-axle solutions to stay competitive, fueling the overall growth of the market. As global EV sales continue to climb, the e-axle market is poised for robust expansion.

The electric vehicle (EV) e-axle market faces several restraints, including high production costs and limited raw material availability, such as rare earth metals used in electric motors. These factors increase the overall cost of EVs, potentially limiting adoption among price-sensitive consumers. Additionally, the complexity of manufacturing advanced e-axle systems requires skilled labor and significant R&D investments, which may hinder smaller manufacturers. Furthermore, concerns over battery efficiency and range limitations also indirectly impact the demand for e-axle systems.

Advancements in integrated systems are creating significant opportunities in the electric vehicle (EV) e-axle market by enhancing efficiency, performance, and cost-effectiveness. Integrated e-axle systems combine electric motors, transmissions, and power electronics into a single, compact unit, simplifying the overall drivetrain architecture. This consolidation not only reduces the weight and complexity of EVs but also optimizes energy efficiency and increases vehicle range—key factors driving consumer adoption. These advancements allow automakers to streamline manufacturing processes, minimize production costs, and accelerate time-to-market for new EV models.

The growing focus on modular platforms in EV manufacturing further amplifies the potential of integrated e-axles. Modular systems enable manufacturers to scale components across multiple vehicle models, including sedans, SUVs, and commercial vehicles, offering flexibility and cost savings. Additionally, the improved design of integrated systems supports higher torque delivery and smoother power distribution, catering to the growing consumer demand for better driving dynamics and performance.

Emerging technologies, such as silicon carbide-based power electronics and advanced cooling systems, are also contributing to the evolution of integrated e-axles. These innovations enable higher power density, improved thermal management, and extended system durability, making integrated systems more appealing to automakers. Furthermore, partnerships between e-axle suppliers and OEMs are fostering innovation, as manufacturers strive to deliver cutting-edge solutions for next-generation EVs.

The passenger car segment led the industry. The passenger car segment is a significant driver of growth in the electric vehicle (EV) e-axle market, owing to the rapid adoption of EVs in this category. As consumer preferences shift toward environmentally friendly and cost-efficient vehicles, the demand for EVs, particularly passenger cars, has surged. Governments across the globe are implementing policies and offering incentives such as subsidies, tax benefits, and reduced registration fees, which are making EVs more accessible to consumers. This rise in passenger EV sales directly drives the demand for e-axles, as they are a critical component of electric powertrains, offering improved efficiency and compact designs.

Moreover, the passenger car segment is benefiting from advancements in e-axle technology, such as integrated systems that combine electric motors, power electronics, and transmissions into a single unit. These innovations enhance vehicle performance by improving energy efficiency, reducing weight, and increasing power density, making them particularly suitable for passenger vehicles where space optimization is critical. Leading automakers are increasingly integrating e-axles into their EV models to enhance vehicle range and performance, further boosting market demand.

The segment also benefits from the rising preference for urban and subcompact EVs, especially in regions with growing urbanization and stringent emission regulations. Automakers are prioritizing the development of affordable passenger EVs to cater to a broader consumer base, further accelerating the adoption of e-axles. With passenger cars accounting for the majority of EV sales globally, this segment plays a pivotal role in driving the growth of the electric vehicle e-axle market.

The front-wheel drive segment held the largest share of the market. The front-wheel-drive (FWD) segment significantly drives the growth of the electric vehicle (EV) e-axle market due to its widespread adoption in compact and mid-sized ADs. FWD configurations are known for their cost-effectiveness, lightweight design, and superior energy efficiency, making them ideal for urban and commuter EVs, which form a substantial portion of the global EV market. The e-axle's integration into FWD systems simplifies the powertrain architecture by combining the electric motor, power electronics, and transmission into a single compact unit, reducing vehicle weight and manufacturing costs. This aligns with the industry's push for more affordable and accessible EV models.

Automakers are increasingly prioritizing FWD electric vehicles to cater to the growing demand in urban areas, where compact EVs dominate. The configuration offers advantages such as improved traction on slippery surfaces and more space-efficient designs, allowing manufacturers to maximize cabin and cargo space in smaller vehicles. These benefits resonate strongly with consumers seeking practicality and efficiency in city driving, boosting the adoption of FWD e-axles.

Technological advancements in FWD e-axles, such as higher power densities and improved energy conversion efficiency, further contribute to their growing popularity. Additionally, governments worldwide are implementing stringent emission regulations and offering incentives to encourage the adoption of EVs, particularly in the FWD segment, which is highly favored for its affordability and functionality. As a result, the front-wheel-drive segment plays a crucial role in propelling the growth of the electric vehicle e-axle market, catering to both consumer and regulatory demands.

Asia Pacific dominated the electric vehicle e-axle market. The electric vehicle e-axle market in the Asia-Pacific (APAC) region is experiencing robust growth due to several key factors. Firstly, the increasing adoption of electric vehicles, driven by government incentives, subsidies, and stricter emission regulations, is significantly boosting the demand for EV e-axles. Countries such as China, Japan, and South Korea are actively promoting EV adoption through favorable policies, tax benefits, and substantial investments in EV infrastructure, creating a conducive environment for market expansion.

Secondly, the presence of a well-established automotive manufacturing base in APAC, particularly in China and India, plays a pivotal role. These countries are home to some of the largest automakers and suppliers, facilitating large-scale production of EVs and their components, including e-axles. Moreover, the rising demand for affordable EVs in emerging markets such as India and Southeast Asian nations is pushing manufacturers to innovate and produce cost-effective e-axle solutions.

Thirdly, advancements in technology and the increasing focus on improving EV efficiency are driving the growth of the e-axle market. APAC is witnessing significant research and development efforts to enhance the integration of electric motors, power electronics, and transmission systems within e-axles, reducing vehicle weight and improving performance.

Additionally, the region's rapid urbanization and expanding middle class are contributing to increased consumer demand for electric mobility solutions. The growing focus on reducing reliance on fossil fuels and improving air quality further supports the shift towards EVs, indirectly bolstering the EV e-axle market.

North America is expected to grow with a significant CAGR during the forecast period. The electric vehicle (EV) e-axle market in North America is witnessing substantial growth due to several key factors. Firstly, the region's robust adoption of electric vehicles, driven by government policies, subsidies, and tax incentives, is a major driver. Initiatives like the U.S. federal EV tax credit and state-specific incentives are encouraging EV purchases, creating a growing demand for e-axles as a critical component of EV powertrains.

Secondly, the increasing investment in EV infrastructure, including widespread development of charging stations, is facilitating the adoption of electric vehicles. This expansion supports the growth of the e-axle market by ensuring EV owners have access to the necessary infrastructure, making electric mobility more practical and appealing.

Thirdly, North America's strong automotive manufacturing base, particularly in the United States and Canada, plays a crucial role. Major automakers and suppliers in the region are investing heavily in EV technologies, including e-axles, to meet the rising demand for electrified powertrains. Additionally, collaborations and partnerships between automakers and technology companies are accelerating advancements in e-axle design, enhancing efficiency, and reducing costs.

The growing focus on sustainability and reducing greenhouse gas emissions is another significant factor. With increasing environmental regulations and corporate commitments to achieving net-zero emissions, automakers are prioritizing EV production, further driving the e-axle market.

Furthermore, advancements in e-axle technology, such as integrated motor and gearbox systems, lightweight materials, and enhanced thermal management, are fueling market growth. These innovations improve vehicle performance, efficiency, and range, making EVs more attractive to North American consumers. Thus, the above-mentioned factors position North America as a key region for the growth of the global EV e-axle market.

By Vehicle Type

By Drive Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us