April 2025

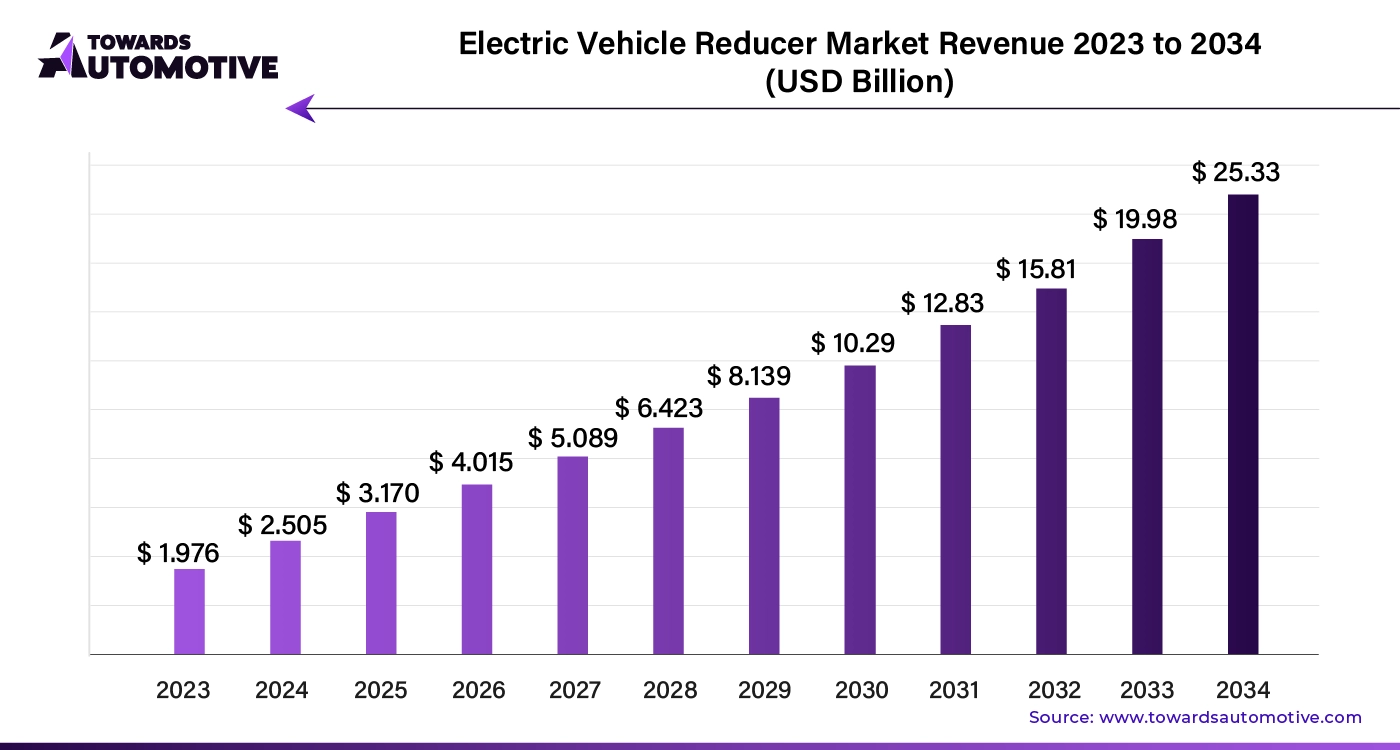

The global electric vehicle reducer market size is calculated at USD 2.505 billion in 2024 and is expected to reach around USD 25.33 billion by 2034, growing at a CAGR of 26.69% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The electric vehicle reducer market is gaining momentum as the automotive industry shifts towards electric mobility. EV reducers, also known as gear reducers or reduction gear systems, play a critical role in optimizing the performance and efficiency of electric drivetrains. These components convert the high-speed, low-torque output of an electric motor into the lower-speed, higher-torque output needed to drive the wheels, thus enhancing vehicle acceleration and overall efficiency. As electric vehicles become more prevalent due to environmental regulations and consumer preferences for sustainable transportation, the demand for advanced reducer systems is growing. Innovations in reducer technology, such as improved gear designs and advanced materials, are driving the market forward by offering better performance, durability, and noise reduction.

The expansion of EV infrastructure, including charging stations and service networks, further supports this growth by enabling the widespread adoption of electric vehicles. Additionally, the automotive industry's focus on developing more efficient and cost-effective EV drivetrains is fueling advancements in reducer technology. These factors collectively contribute to the dynamic expansion of the electric vehicle reducer market, positioning it as a vital component in the future of transportation.

Artificial intelligence (AI) plays a transformative role in the electric vehicle (EV) reducer market by enhancing the design, manufacturing, and performance of reduction gear systems. AI-driven simulations and modeling allow engineers to optimize gear designs and improve efficiency by analyzing vast amounts of data and predicting performance outcomes. This leads to the development of more precise and effective reducer systems that meet the evolving demands of electric drivetrains. Machine learning algorithms also enable predictive maintenance, identifying potential issues before they occur and reducing downtime, which is crucial for maintaining vehicle reliability.

Additionally, AI contributes to the innovation of advanced materials and manufacturing processes, leading to lighter, more durable, and cost-effective reducers. In production, AI-powered automation streamlines assembly lines and quality control, ensuring consistent and high-quality output. As EV technology advances, AI helps manufacturers adapt quickly to new requirements and integrate cutting-edge features into reducer systems. Overall, AI enhances the efficiency, reliability, and performance of electric vehicle reducers, driving growth and innovation in the market.

Environmental friendliness and efficiency are key drivers of growth in the electric vehicle (EV) reducer market. As global concerns about climate change and pollution intensify, consumers and governments alike are pushing for cleaner, more sustainable transportation solutions. EV reducers, which optimize the efficiency of electric drivetrains by converting high-speed motor output into the necessary torque for vehicle movement, play a crucial role in improving vehicle performance while reducing energy consumption. By enhancing energy efficiency, reducers help extend the driving range of EVs, making them more practical and attractive to consumers who prioritize sustainability.

Government regulations and incentives aimed at reducing carbon emissions further boost demand for efficient EV components including reducers. Automakers are increasingly focused on designing electric vehicles that not only meet stringent environmental standards but also deliver superior performance. Advanced reducers made with lightweight and durable materials contribute to both goals by improving powertrain efficiency and reducing overall vehicle weight, which in turn enhances energy conservation.

As efficiency and environmental considerations become central to automotive innovation, the role of EV reducers grows more critical. Their contribution to minimizing energy loss and maximizing performance directly supports the expansion of the electric vehicle market, aligning with global efforts to transition toward greener transportation options.

The electric vehicle (EV) reducer market faces restraints primarily due to high production costs and the complexity of developing advanced reducer systems. The use of specialized materials and precision engineering drives up manufacturing expenses, making EVs less affordable in price-sensitive markets. Additionally, supply chain issues and the limited availability of raw materials further hinder production. Moreover, slower infrastructure development, such as charging networks in certain regions, affects EV adoption, indirectly restraining the demand for reducers.

Multi-speed reducers are creating significant opportunities in the electric vehicle (EV) reducer market by offering enhanced performance and efficiency for electric drivetrains. Unlike traditional single-speed reducers, multi-speed systems provide multiple gear ratios, allowing for more precise control of vehicle acceleration and top speed. This flexibility improves overall vehicle efficiency by optimizing torque delivery and energy usage across various driving conditions, which is crucial for enhancing driving range and performance.

As electric vehicles become more advanced, the demand for multi-speed reducers is growing, driven by their ability to deliver smoother and more responsive driving experiences. Multi-speed reducers also contribute to better thermal management and noise reduction, addressing key concerns for both manufacturers and consumers. Their adaptability makes them suitable for a wider range of EV applications, from high-performance sports cars to everyday passenger vehicles.

Additionally, the integration of multi-speed reducers supports the development of more sophisticated and efficient electric drivetrains, fostering innovation in the EV sector. As automakers seek to differentiate their products and improve performance, multi-speed reducers offer a compelling solution, driving growth and opportunities in the electric vehicle reducer market.

The multi-stage type segment dominated the market with a share of 69%. Multi-stage reducers use a series of gear stages to convert electric motor output into the necessary torque for providing more precise control over vehicle acceleration and speed. This design allows for better optimization of power delivery, enhancing overall vehicle performance and extending driving range.

The increasing demand for high-performance electric vehicles is fueling the need for multi-stage reducers, as they enable smoother and more responsive driving experiences. Additionally, multi-stage reducers contribute to improved thermal management and reduced noise, addressing key concerns in EV design. Their ability to handle a wider range of driving conditions makes them suitable for diverse applications, from luxury vehicles to commercial electric trucks.

As automakers continue to push the boundaries of electric vehicle technology, the multi-stage segments are becoming essential in achieving higher efficiency and performance standards. This growth in demand for sophisticated gear systems is driving innovation and expansion in the electric vehicle reducer market, making multi-stage reducers a pivotal component in the evolution of electric mobility.

The PHEV segment held a dominant share of the market. PHEVs, which combine an internal combustion engine with an electric motor and a rechargeable battery, require sophisticated reducers to efficiently manage the power transition between the electric and combustion systems. These reducers optimize the power output from the electric motor, providing smooth acceleration and enhancing overall vehicle performance.

The increasing popularity of PHEVs, driven by their extended driving range and reduced emissions compared to conventional vehicles, boosts the need for high-performance reducers that can handle complex powertrain configurations. Multi-speed and multi-stage reducers, in particular, are crucial for maximizing efficiency and delivering a seamless driving experience in PHEVs. They facilitate smooth transitions between electric and engine power, improve energy utilization, and contribute to better thermal management and noise reduction.

As automakers continue to innovate and expand their PHEV offerings, the demand for advanced reducers grows, propelling the electric vehicle reducer market forward. The evolution of PHEV technology underscores the critical role of reducers in achieving optimal performance and efficiency in hybrid-electric drivetrains.

United States held 9.5% share of the global market. Several drivers are fueling the growth of the electric vehicle (EV) reducer market in the USA, as the country moves towards widespread electric mobility. A key driver is the increasing demand for electric vehicles, spurred by government incentives, tax credits, and regulations aimed at reducing greenhouse gas emissions. As more consumers prefer EVs, manufacturers are focusing on developing advanced drivetrains that require high-performance reducers to improve vehicle efficiency and performance. These reducers, essential in converting electric motor output into the necessary torque for driving, are seeing growing demand as EV production rises.

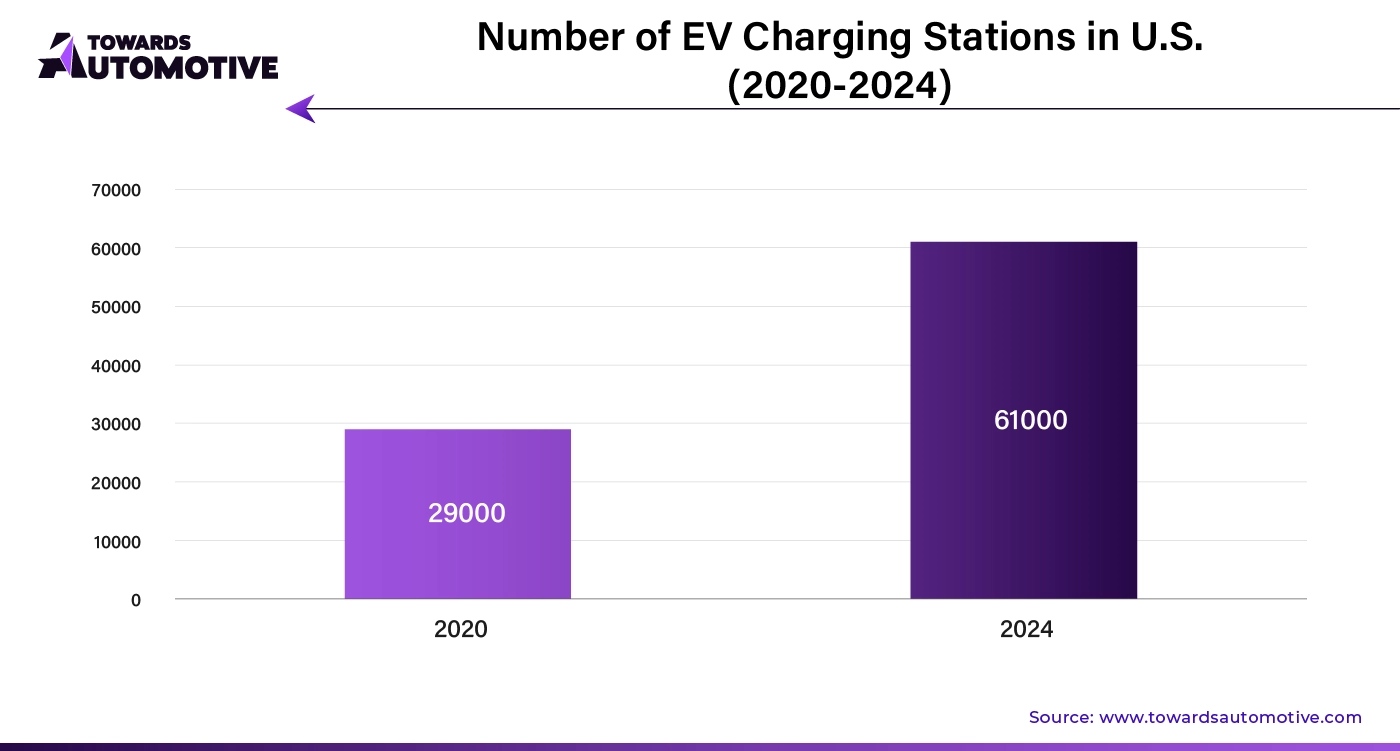

Technological advancements in gear design and materials are also contributing to the market's growth. Innovations such as lightweight, durable materials and precision engineering enhance the efficiency of reducers, improving vehicle acceleration and range. The USA’s strong focus on research and development within the automotive sector further accelerates innovation in reducer systems, ensuring they meet the needs of modern electric drivetrains. Additionally, the expansion of EV infrastructure, including charging networks and manufacturing facilities, supports the market by fostering greater EV adoption. These factors collectively drive the expansion of the electric vehicle reducer market in the USA, positioning it as a key segment in the electric mobility revolution.

Germany dominated the global market with a share of 11.5%. There are various factors that are driving the electric vehicle (EV) reducer market in Germany as the country leads the shift toward electric mobility. One of the primary drivers is the strong government support for EV adoption, including tax incentives, subsidies, and stringent emissions regulations aimed at reducing carbon footprints. These policies have significantly boosted demand for electric vehicles, increasing the need for high-performance reducers that optimize drivetrain efficiency. EV reducers, essential for converting electric motor output into the torque required for smooth and efficient vehicle operation, are becoming crucial components in this rapidly growing market.

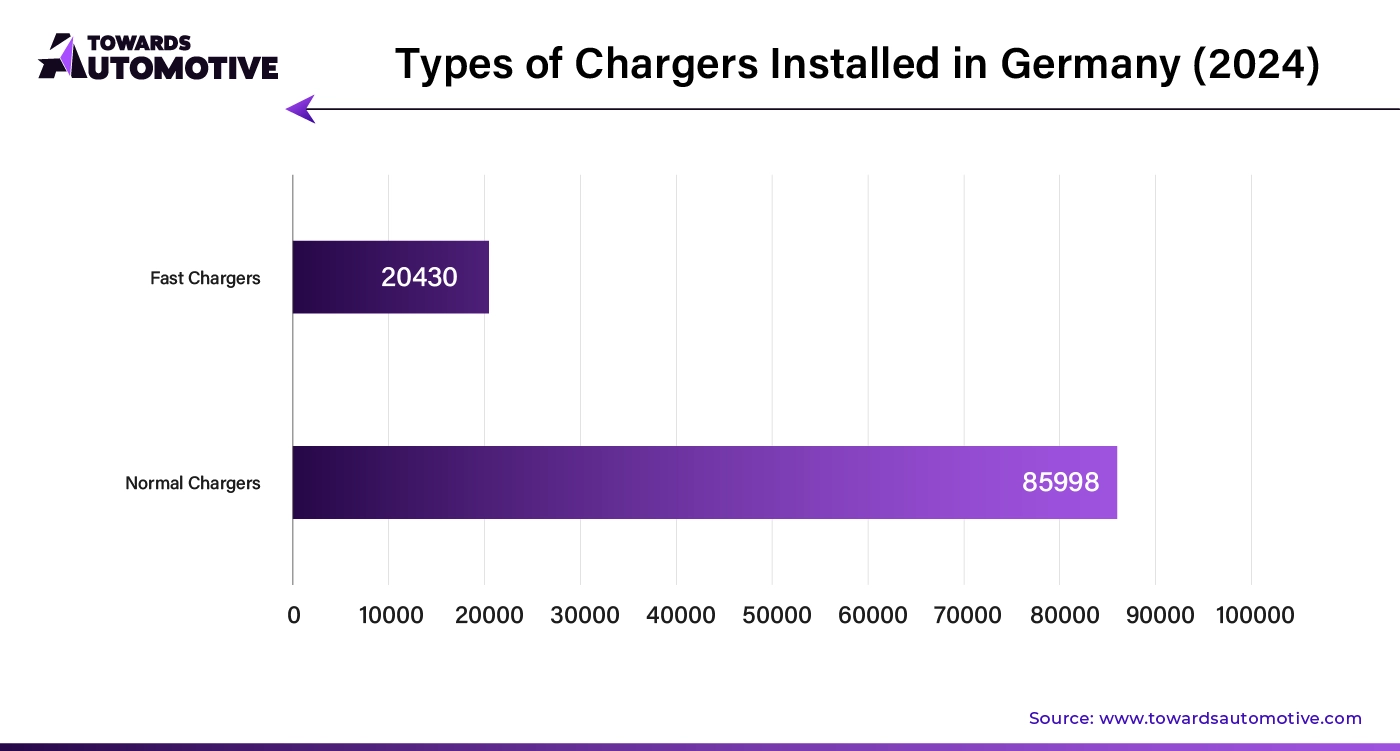

Germany’s automotive industry, known for its commitment to engineering excellence, is another key driver. Leading automakers are heavily investing in research and development to innovate and produce advanced reducers that enhance EV performance, improving acceleration, range, and energy efficiency. Technological advancements in materials and gear systems are further contributing to the growth of high-quality, durable reducers. Additionally, the expansion of EV infrastructure, including widespread charging networks and enhanced manufacturing capabilities, is supporting the market's expansion. With a strong focus on sustainability and cutting-edge technology, Germany’s automotive sector is pushing the electric vehicle reducer market forward, solidifying the country’s position as a global leader in electric mobility innovation.

Asia Pacific dominated the electric vehicle reducer market. The market in Asia Pacific region is driven by rapid adoption of electric vehicles, spurred by government initiatives, subsidies, and policies aimed at reducing air pollution and carbon emissions. Countries such as China, Japan, and South Korea are leading the charge, offering significant incentives for EV production and purchase, which directly boosts the demand for high-performance reducers that improve drivetrain efficiency.

Technological advancements in the region’s automotive industry also play a crucial role. Innovations in gear design and lightweight materials are enhancing the performance and durability of EV reducers, making them more efficient in converting motor output into usable torque. The region's robust manufacturing capabilities, supported by heavy investment in research and development, further propel market growth, allowing for the mass production of advanced reducers.

Additionally, the expansion of EV infrastructure, including charging networks and localized manufacturing hubs, is accelerating EV adoption across the Asia Pacific. The push for sustainable transportation and the rising middle class’s increasing interest in EVs make the Asia Pacific region a key growth area for the electric vehicle reducer market.

India is expected to grow with a CAGR of 30.13% during the forecast period. The industry in India is mainly driven by government’s strong focus on promoting electric mobility through initiatives such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, which offers subsidies and incentives to both consumers and manufacturers. These policies are accelerating the adoption of EVs, increasing demand for high-performance reducers that optimize drivetrain efficiency by converting motor output into the torque required for smooth operation.

India's rapidly expanding automotive industry, combined with increasing urbanization and rising environmental concerns, is further driving the need for efficient EV components such as reducers. Technological advancements in materials and gear systems are also contributing to market growth, enabling the development of lightweight, durable reducers that enhance vehicle performance and range. Additionally, the expansion of EV infrastructure, such as charging networks and localized production facilities, supports the growing EV market and encourages manufacturers to invest in advanced reducer technologies.

By Product Type

By Vehicle Type

By Sales Channel

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us