October 2025

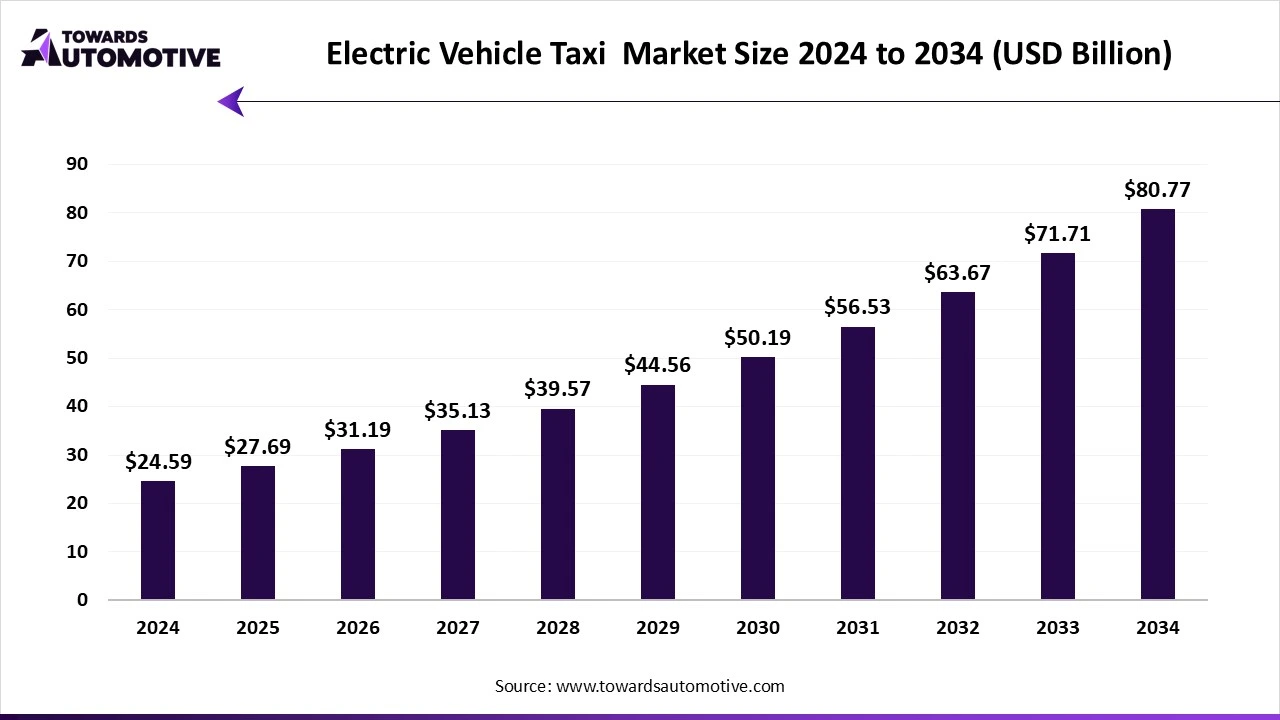

The electric vehicle taxi market is projected to reach USD 80.77 billion by 2034, growing from USD 27.69 billion in 2025, at a CAGR of 12.63% during the forecast period from 2025 to 2034.

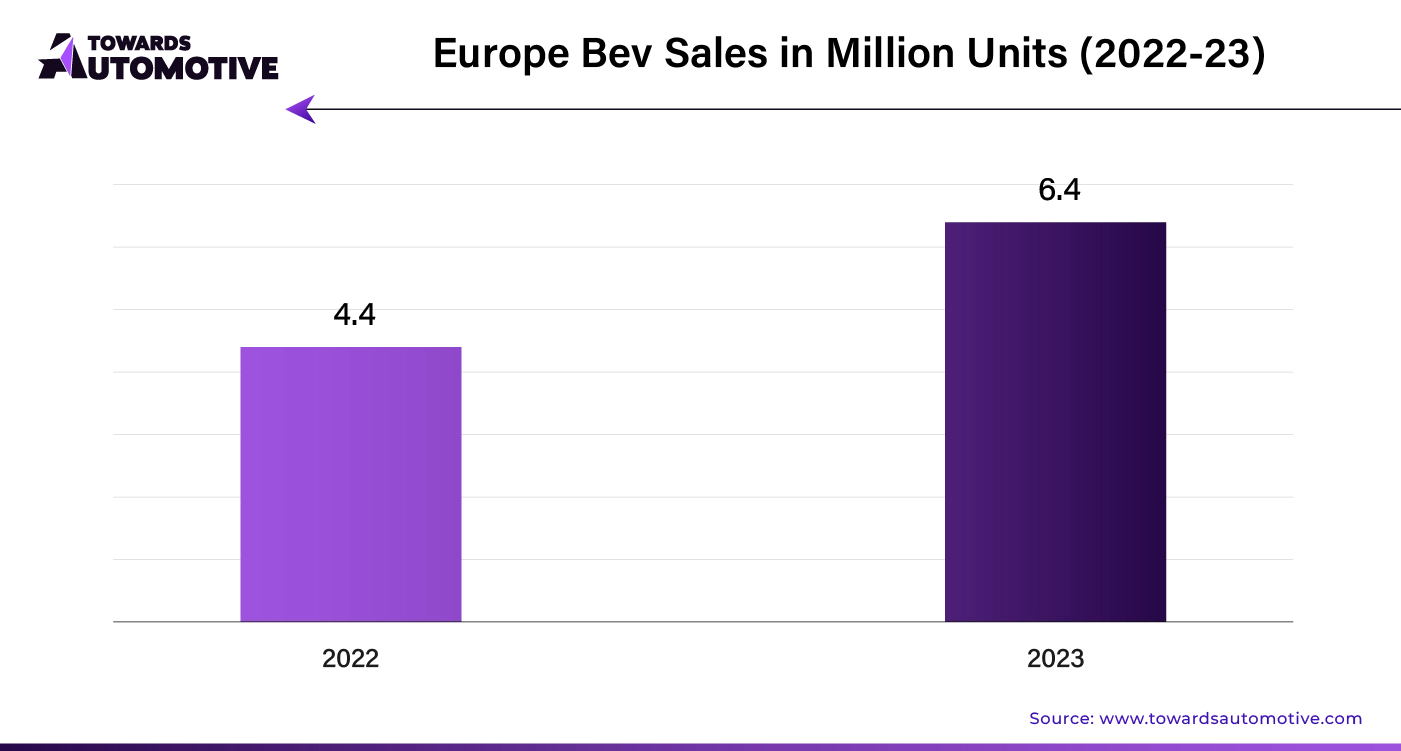

The electric vehicle taxi market is a prominent segment of the EV industry. This industry deals in providing taxi services based on electric vehicles across the world. There are several types of vehicles used in this sector consisting of battery electric vehicles (BEVs), hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs) and some others. This sector provides different types of taxis including short-range taxis and long-range taxis. The rising sales of electric vehicles in different parts of the world has driven the market expansion. This industry is expected to rise significantly with the growth of the ride-hailing services sector in different parts of the globe.

| Metric | Details |

| Market Size in 2024 | USD 24.59 Billion |

| Projected Market Size in 2034 | USD 80.77 Billion |

| CAGR (2025 - 2034) | 12.63% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Vehicle, By Range, By Ownership Model, By Charging Infrastructure and By Region |

| Top Key Players | Xanh SM, BAIC Group, BluSmart Mobility, BMW, BYD Company |

The short-range EV taxis segment held a dominant share of the market. The rising use of electric taxis for short commutes has driven the market in a positive direction. Also, the growing adoption of affordable electric vehicles by fleet operators for operating taxi services further propels the industrial expansion. Moreover, the rising demand for low-price taxis by office goers and school goers further adds to the market growth.

The long-range EV taxis segment is predicted to grow with a significant growth rate during the forecast period. The growing investment in the EV battery industry coupled with increasing emphasis on developing EVs with high driving range has boosted the market expansion. Moreover, the rising consumer interest to travel long distance in a sustainable way further propels the industrial growth.

The company-owned segment led the industry. The rise in number of ride-hailing companies across the world has increased the demand for electric vehicles for taxi purposes, thereby boosting the market growth. Also, numerous partnerships among car rental companies and EV brands coupled with rapid investment by fleet operators for deploying electric taxis has accelerated the growth of the electric vehicle taxi market.

The individually-owned segment is anticipated to rise with the highest growth rate during the forecast period. The rising adoption of electric vehicles among individual owners due to less maintenance and enhanced efficiency boosts the market expansion. Moreover, people of developing nations have started putting their EVs for rental services to earn extra amount of money, thereby fostering the market growth.

Asia Pacific held the highest share of the electric vehicle taxi market. The rising sales and production of electric vehicles in countries such as India, China, Japan, South Korea, Singapore and some others has boosted the market growth. Additionally, the growing investment by government for strengthening the EV infrastructure along with increasing awareness about reducing emission is playing a vital role in shaping the industrial landscape. Furthermore, the presence of various electric taxi providers coupled with technological advancements in automotive sector is expected to boost the market growth in this region.

China held the dominant share of the industry in this region. In China, the market is generally driven by the rising emphasis on manufacturing EVs along with growing investment by government and private entities for strengthening the EV charging infrastructure. Additionally, increasing adoption of battery swapping solutions as well as availability of raw materials and skilled workforce is another integral factor that propels the industrial expansion.

India also held significant share of the market. The growing demand for fuel-efficient vehicles along with rising consumer awareness regarding eco-friendly transportation has boosted the market expansion. Moreover, the rise in number of fleet operators coupled with government initiatives aimed at adopting EVs further accelerates the industrial growth. Furthermore, rapid adoption of ride-hailing services as well as availability of cab booking apps in Play Store and Apps Store is projected to foster the growth of the electric vehicle taxi market.

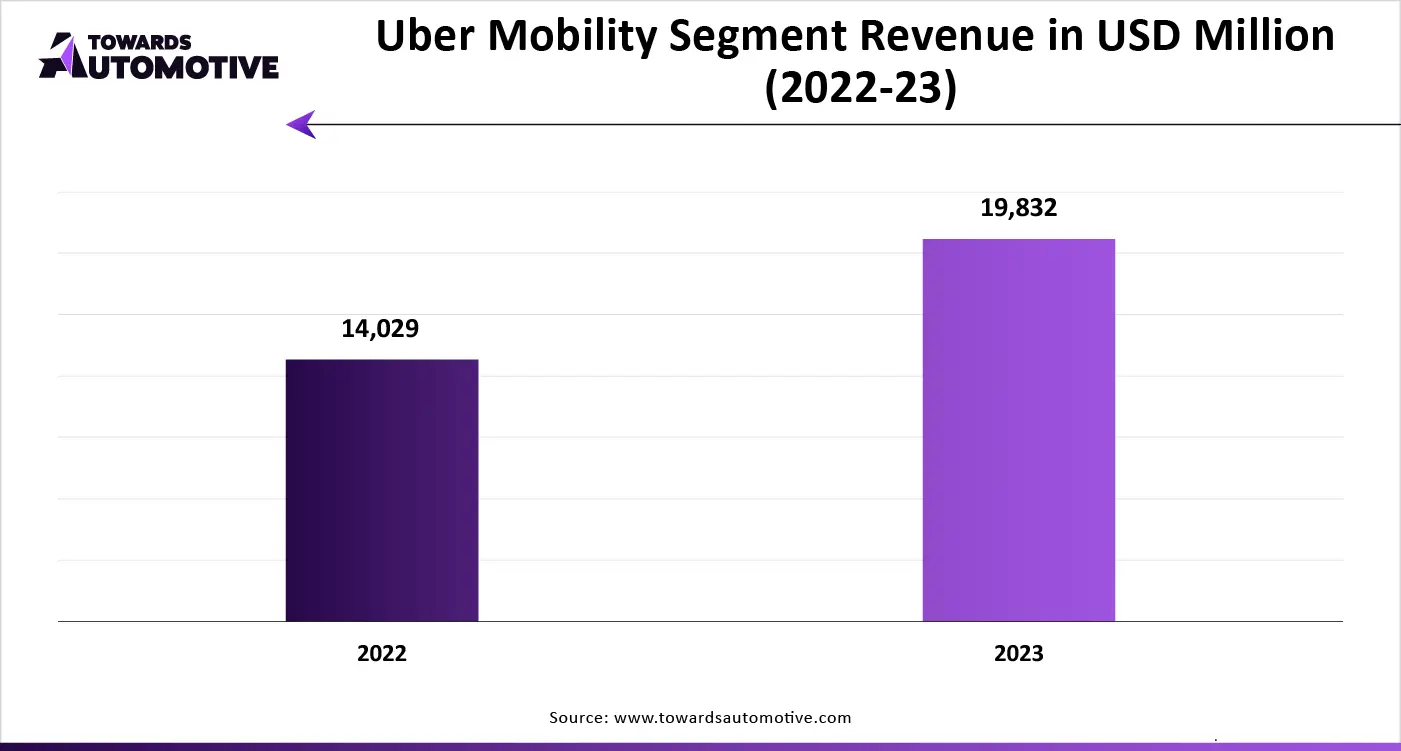

North America is expected to grow with a significant CAGR during the forecast period. The growing trend of electric vehicles along with presence of prominent automotive brands propels the market growth. Also, surge in demand for eco-friendly transportation coupled with rapid investment for developing the EV infrastructure propels the industrial expansion. Moreover, the rise in number of ride-sharing platforms as well as increasing proliferation of 5G technology is anticipated to foster the market growth in this region.

The U.S. is a major contributor of this industry. The rising demand for sustainable transportation coupled with rapid investment by fleet operators for deploying electric taxis drives the market expansion. Also, the growing emphasis on reducing emission along with numerous government initiatives aimed at deploying fast-charging stations further boosts the market growth. Moreover, the presence of several electric taxi service providers such as Uber, Waymo, Lyft and some others is likely to propel the growth of the electric vehicle taxi market.

The electric vehicle taxi market is a rapidly developing industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Xanh SM, BAIC Group, BluSmart Mobility, BMW, BYD Company, Didi Chuxing, Lyft, Ola and some others. These companies are constantly engaged in providing taxi services based on electric vehicles and adopting numerous strategies such as product launches, joint venture, partnerships, acquisition, and some others to maintain their dominant position in this industry. For instance, in January 2025, BYD partnered with Grab Holdings. This partnership is done for launching EV taxi services in Southeast Asia. Moreover, in December 2024, Xanh SM announced partnership with PT Agung Sedayu Retail Indonesia. This partnership is done for launching electric taxi services in Indonesia.

By Vehicle

By Range

By Ownership Model

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us