April 2025

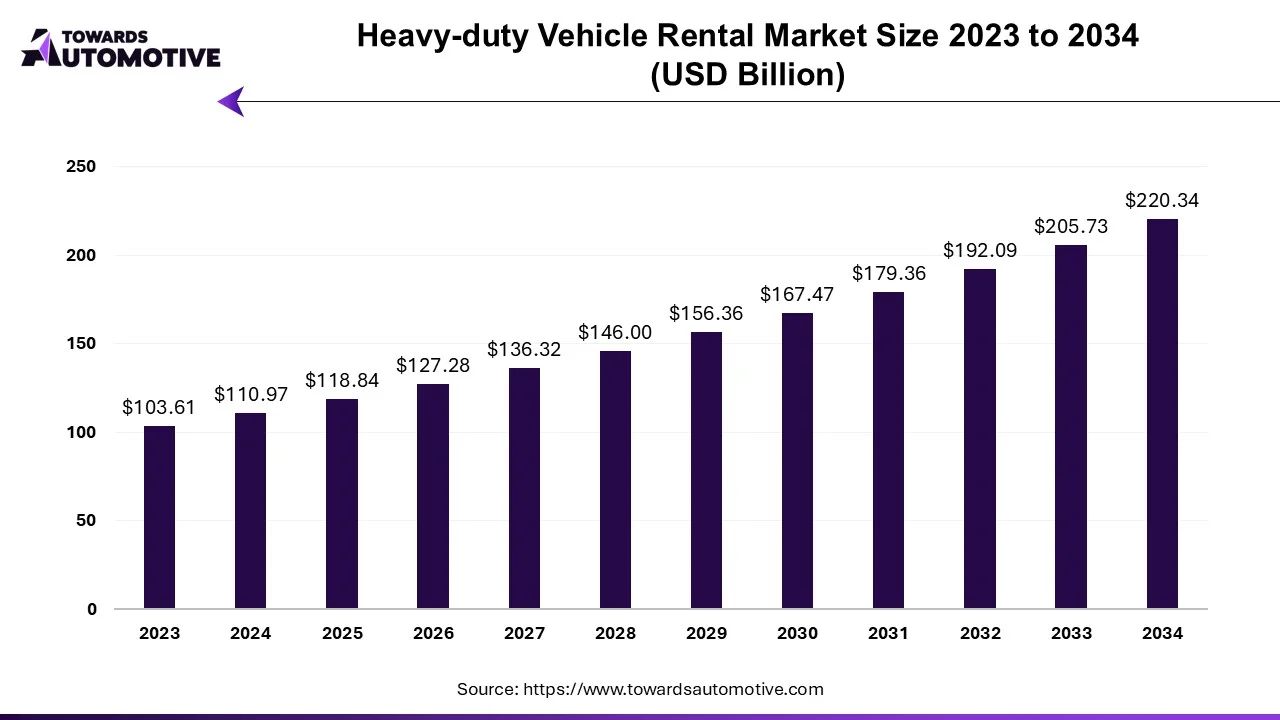

The global heavy-duty vehicle rental market is expected to grow from USD 118.84 billion in 2025 to USD 220.34 billion by 2034, with a CAGR of 7.10% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The heavy-duty vehicle rental market stands as a critical sector within the broader transportation and logistics industry, offering businesses and individuals flexible access to essential commercial vehicles without the burden of ownership. The heavy-duty vehicle rental market includes a wide array of commercial vehicles, including trucks, trailers, buses, and specialized equipment, rented or leased for short to medium-term periods. These vehicles cater to various industries such as logistics, construction, manufacturing, agriculture and infrastructure development.

Economic fluctuations create demand variability, prompting businesses to opt for rental solutions over ownership for flexibility and cost efficiency. Technological advancements, such as telematics and electric vehicle integration, enhance operational efficiency and align with sustainability goals, stimulating market growth. Additionally, urbanization and infrastructure development projects augment the demand for heavy-duty vehicles, particularly in emerging markets.

The exponential growth of the e-commerce industry is a significant driver fueling demand in the heavy-duty vehicle rental market. As online retail continues to expand globally, the need for efficient transportation and logistics solutions becomes increasingly paramount. Heavy-duty vehicles play a crucial role in facilitating the movement of goods from warehouses to distribution centers and ultimately to the end consumer.

According to the estimates by U.S. Census Bureau of the Department of Commerce, the U.S. retail e-commerce sales in the fourth quarter of 2023 stood at $285.2 billion, reflecting a modest 0.8 percent rise (±1.1%) from the preceding quarter of 2023. Compared to the fourth quarter of 2022, e-commerce sales in the same period of 2023 saw a notable uptick of 7.5 percent (±1.2%). Notably, e-commerce transactions in the fourth quarter of 2023 constituted 15.6 percent of the total sales.

Rental companies are witnessing a surge in demand for their services as e-commerce businesses require flexible and scalable transportation options to manage fluctuating order volumes, seasonal peaks, and last-mile deliveries. The rapid growth of e-commerce has also led to the emergence of specialized logistics providers and delivery services, further driving demand for heavy-duty vehicle rentals.

Cost efficiency is a significant driver propelling the heavy-duty vehicle rental market during the forecast period. Opting to rent heavy-duty vehicles presents businesses with a multitude of cost advantages compared to ownership, particularly for short-term or project-based requirements. By choosing to rent instead of purchasing, companies can sidestep the substantial upfront capital investment typically associated with acquiring a fleet of heavy-duty vehicles. Thus, the cost-efficient nature of heavy-duty vehicle rentals not only enhances financial performance but also enables businesses to adapt swiftly to changing market dynamics and capitalize on emerging opportunities without being burdened by long-term ownership commitments.

Acquiring and managing a diverse fleet of heavy-duty vehicles necessitates substantial capital investment, which can present a formidable obstacle for new entrants and smaller rental firms. The upfront costs associated with purchasing or leasing vehicles, along with expenses for insurance, licensing, and facility maintenance, can strain financial resources and limit scalability. Moreover, heavy-duty vehicles often require significant on-going investment for upgrades, repairs, and fleet expansion, further amplifying the capital intensity of the business. This capital-intensive nature of the heavy-duty vehicle rental market can hinder the growth and competitiveness of smaller players, constraining market entry and expansion opportunities.

Ensuring the proper maintenance and upkeep of rental vehicles is imperative to uphold reliability, safety, and customer satisfaction. However, maintenance costs represent a substantial expenditure for rental companies, particularly for aging fleets or specialized equipment requiring specialized servicing. Regular inspections, repairs, and replacements of vehicle components, such as tires, brakes, and engines, can incur significant expenses and impact profitability. Moreover, unexpected breakdowns or mechanical issues can disrupt operations, lead to downtime, and result in additional repair costs and loss of revenue. As such, managing maintenance costs effectively is essential for rental companies to maintain fleet reliability, minimize downtime, and preserve profitability amidst competitive pressures.

The growing emphasis on environmental sustainability presents a significant opportunity for the heavy-duty vehicle rental market. Increasing awareness of climate change and pollution prompts a shift towards eco-friendly transportation solutions, including electric, hydrogen, and renewable energy-powered vehicles. This transition is bolstered by government incentives, such as tax credits and subsidies, aimed at promoting the adoption of sustainable technologies.

Furthermore, on-going infrastructure development, such as the expansion of charging stations and alternative fuel infrastructure, facilitates the integration of eco-friendly vehicles into rental fleets. With sustainable solutions, rental companies can not only meet growing customer demand for environmentally conscious transportation but also align with regulatory requirements and contribute to a greener, more sustainable future.

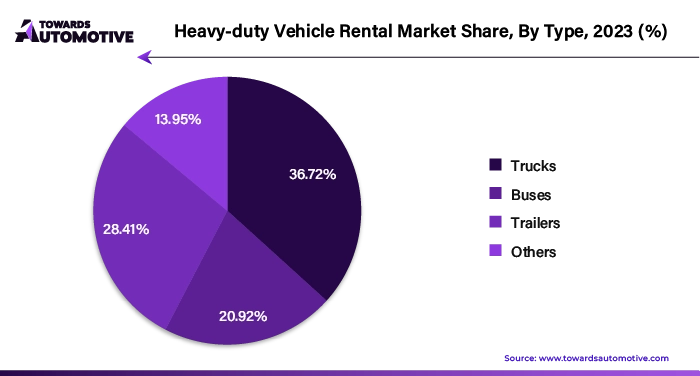

The trucks segment captured a substantial market share of 36.72% in 2023. The versatile nature of trucks makes them indispensable across various industries, including logistics, construction, agriculture, and manufacturing. Their ability to transport heavy loads over long distances efficiently contributes to their widespread use and demand. Additionally, the growing e-commerce industry and increasing urbanization have heightened the need for transportation services, further fueling the demand for trucks.

Asset Alliance, a British truck rental company, placed an order for 1,500 new trucks from the Dutch manufacturer. While the majority of the trucks are diesel-powered, at least 75 of them will be electric. These electric trucks belong to the latest lineup of DAF vehicles, including the XF, X.G., and XG+ models, offering a range of up to 500 kilometers.

The ICE segment held largest market share of 87.93% in 2023. The widespread availability and established infrastructure supporting ICE vehicles have contributed to their market dominance. With a robust network of fueling stations and familiarity among consumers and businesses, ICE vehicles have remained the preferred choice for transportation needs. Additionally, the relatively lower upfront costs and longer driving ranges offered by ICE vehicles make them more accessible and practical for many users.

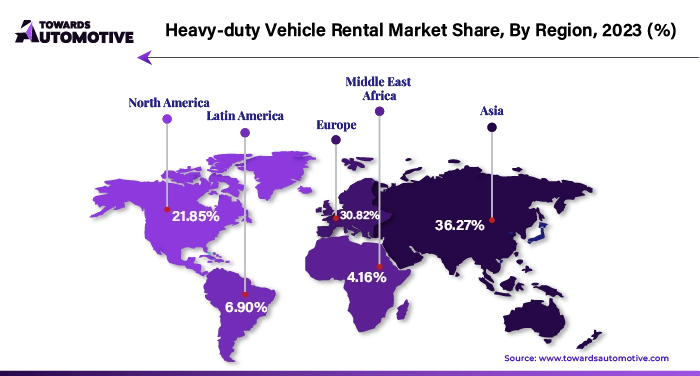

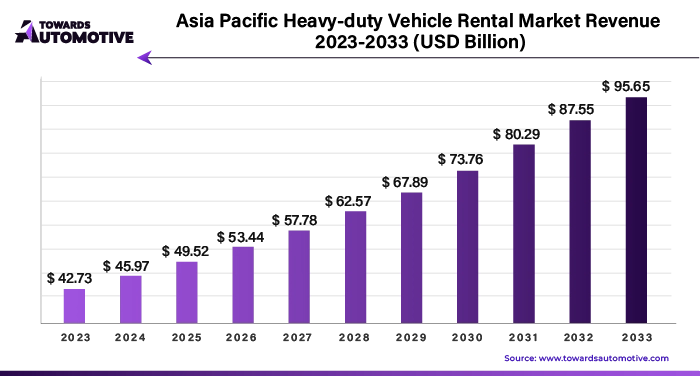

Asia Pacific dominated the market with 41.24% of shares in the global heavy-duty vehicle rental market. The growing e-commerce industry and expanding logistics sector in the Asia Pacific region drive demand for heavy-duty vehicle rentals. With the rise of online shopping and delivery services, there is a growing need for trucks, vans, and specialized vehicles for last-mile delivery, warehousing, and distribution operations. Furthermore, rapid urbanization and infrastructure development in countries like China, India, and Southeast Asian nations create demand for heavy-duty vehicles for construction, road building, and urban transportation projects. Rental companies are important in providing equipment and vehicles for infrastructure development, benefiting from the increasing demand for rental services.

North America is expected to grow at a considerable CAGR of 6.60% during the forecast period. The region's robust economy drives demand across various sectors such as construction, transportation, logistics, and manufacturing, creating a steady need for heavy-duty vehicles.. Furthermore, the reliance on trucking for freight transportation, coupled with the growth of e-commerce and retail sectors, contributes to the sustained demand for heavy-duty trucks, vans, and trailers for transportation and logistics operations. Additionally, fleet modernization efforts by operators and the adoption of advanced vehicle technologies contribute to the growth of the rental market as companies seek to upgrade their fleets with newer and more efficient models.

Some of the key players in heavy-duty vehicle rental market are Penske Truck Leasing, Ryder System, Inc., Enterprise Holdings, Inc. (Enterprise Truck Rental), Herc Holdings Inc. (Herc Rentals), United Rentals, Inc., The Hertz Corporation (Hertz Equipment Rental Corporation), Sunbelt Rentals, Big Truck Rental, Sixt S.E., and Premier Truck Rental, among others.

By Type

By Propulsion

By Service Provider

By Rental Type

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us