April 2025

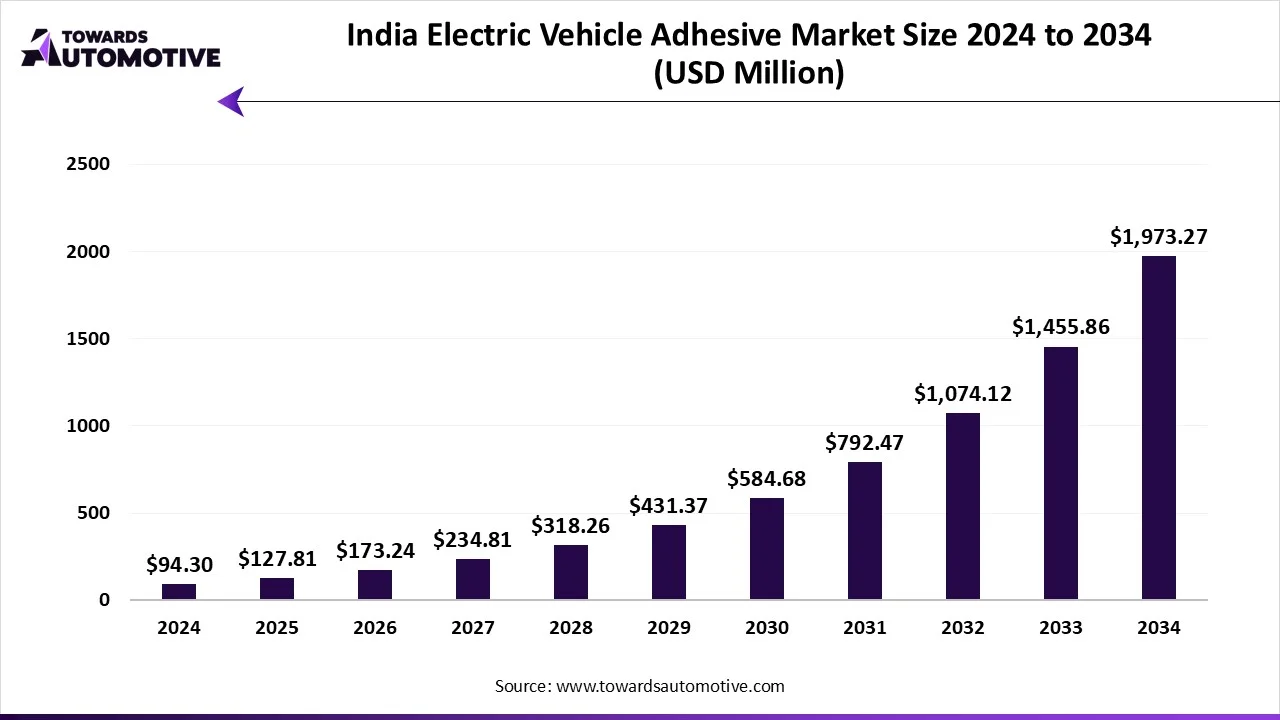

The India electric vehicle adhesive market is set to grow from USD 127.81 million in 2025 to USD 1973.27 million by 2034, with an expected CAGR of 35.54% over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

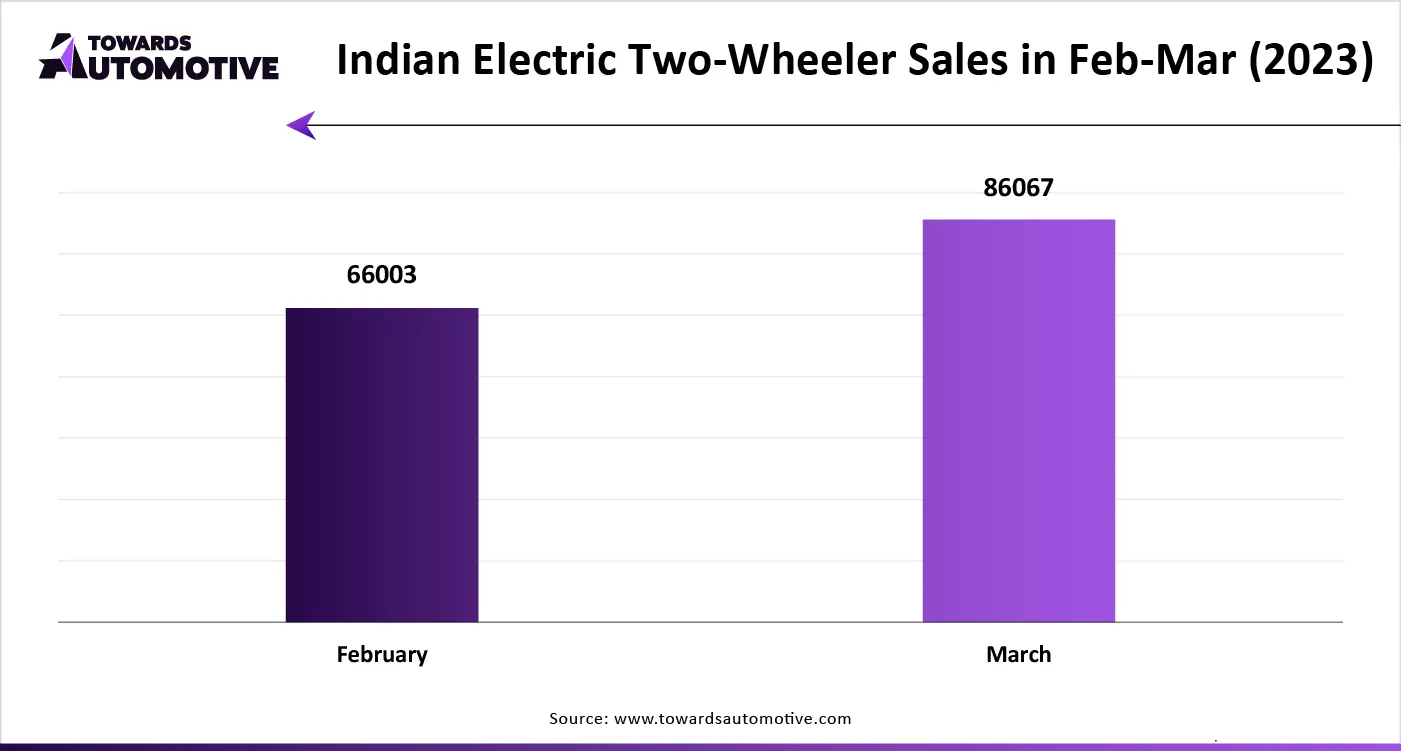

The India electric vehicle adhesive market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of adhesives for the EV industry across India. There are various types of resins used in the production of these adhesives including epoxy, polyurethane, silicon resins, acrylic resins and some others. These adhesives are available in different forms consisting of liquid, films and tapes, paste and some others. It finds application in structural and battery components in EVs. The rising application of adhesives in electric two-wheeler has boosted the industrial expansion. This market is expected to rise significantly with the growth of the EV sector in different parts of India.

The polyurethane adhesives segment led the industry. The growing developments in polymer manufacturing sector has boosted the market expansion. Also, the rising application of these adhesives for several EV applications such as battery pack construction, structural bonding, vibration damping, encapsulation and some others is driving the industrial growth. Moreover, numerous advantages of polyurethane adhesives including flexibility, durability, strong bonding, eco-friendliness and some others is expected to propel the growth of the India electric vehicle adhesive market.

The battery segment held a dominant share of the market. The technological advancements in the battery manufacturing industry has boosted the market growth. Also, the rising emphasis on developing solid-state batteries for EVs along with rapid investment by automotive companies in EV battery sector is crucial for the industrial expansion. Moreover, the increasing application of epoxy adhesives for EV battery assembling is expected to foster the growth of the India electric vehicle adhesive market.

The liquid adhesives segment is projected to rise with a significant CAGR during the forecast period. The rising demand for liquid adhesives from the EV sector has boosted the market expansion. Also, the growing emphasis on developing eco-friendly liquid adhesives is crucial for the industrial growth. Moreover, the increasing adoption of liquid adhesives in EV sector for enhancing vibration damping and sealing activities is projected to propel the market growth.

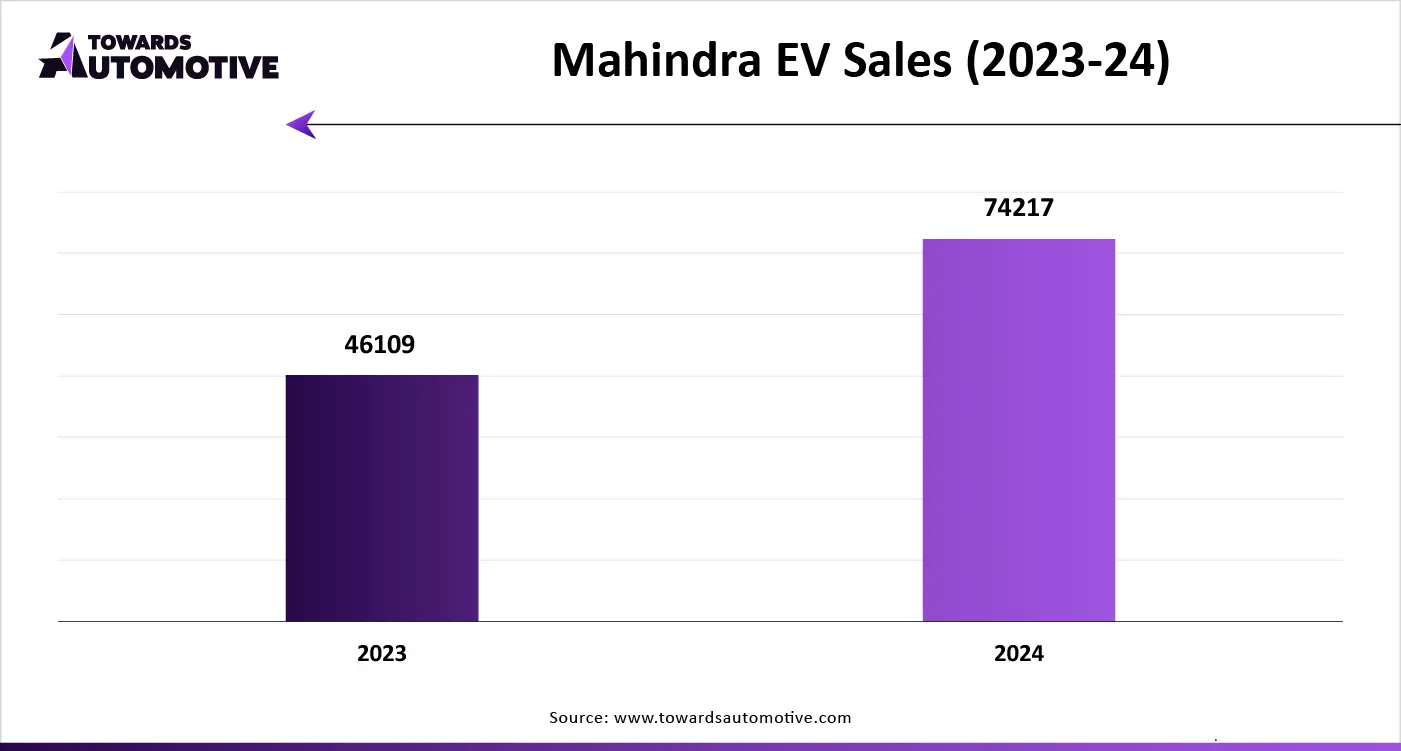

The electric cars held the largest portion of the industry. The rising demand for electric SUVs in different parts of India has driven the market growth. Also, numerous government initiatives aimed at developing the EV infrastructure along with technological advancements in EV sector is crucial for the industrial expansion. Moreover, the presence of several market players such as Tata, Mahindra, Ola Electric and some others is expected to boost the growth of the India electric vehicle adhesive market.

The OEM segment is anticipated to grow with the fastest growth rate during the forecast period. The rising consumer preference for purchasing genuine adhesives products has driven the market expansion. Also, the adhesive manufacturing companies are opening up new stores for enhancing the sales across India, thereby driving the market expansion. Additionally, the automotive OEMs are collaborating with adhesive brands for developing advanced adhesives for the EV industry that in turn is expected to boost the growth of the India electric vehicle adhesive market.

In India, Mumbai is a major contributor of the India electric vehicle adhesive industry. In Mumbai, the market is generally driven by the presence of several adhesive companies such as Superbond Adhesives, Kohesi Bond, Mario Industries Private Limited and some others. Also, the rising investment by public sector entities for strengthening the EV sector is crucial for the market expansion. Moreover, the growing awareness on adopting sustainable transportation and launches of EV-based ride hailing services has driven the market growth.

Bangalore is another prominent city that contributes significantly to the market expansion. In Bangalore, the market is generally driven by the rise in number of EV startups along with technological advancements in battery manufacturing sector. Also, several government initiatives aimed at strengthening the EV infrastructure has played a significant role in shaping the industrial landscape. Moreover, the growing demand for e-bikes coupled with presence of several adhesive brands such as Valco Melton Engineering India Pvt Ltd, Aim Solder India Private Limited, Dopag India Pvt. Ltd. and some others is proliferating the market growth.

The India electric vehicle adhesive market is a highly fragmented industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Jubilant Ingrevia Ltd, Astral Adhesives, Pidilite Industries Limited, HP Adhesives, Super Bond Adhesives, Asian Paints Ltd. and some others. These companies are constantly engaged in manufacturing adhesives for the EV sector in India and adopting numerous strategies such as business expansion, acquisition, product launches, collaboration, and some others to maintain their dominant position in this industry. For instance, in February 2025, Superbond Adhesives announced to open a new adhesive plant in Gujarat, India. This new production facility is expected to manufacture 300 metric tons of adhesives each month.

By Application

By Resin Type

By Form Type

By Vehicle Type

By Sales Channel

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us