April 2025

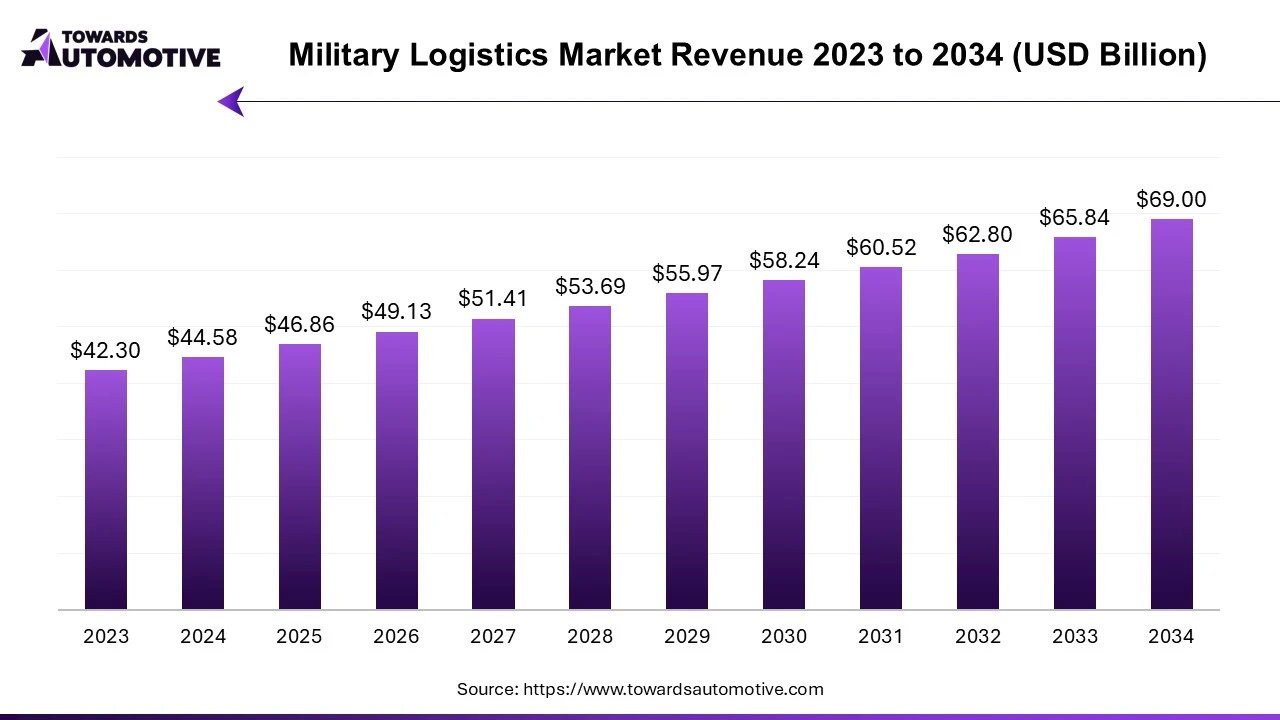

The global military logistics market is projected to reach USD 69.00 billion by 2034, growing from USD 46.86 billion in 2025, at a CAGR of 4.94% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The military logistics market plays a vital role in supporting defense operations worldwide, encompassing a range of activities essential for the effective movement, supply, and maintenance of military forces and equipment. This market includes various sectors, such as transportation, supply chain management, inventory control, and warehousing, which are critical for ensuring that military personnel have the necessary resources to execute their missions efficiently. The growth of the military logistics market is driven by factors such as increasing defense budgets, rising geopolitical tensions, and the need for enhanced operational readiness in modern warfare.

Moreover, advancements in technology, such as automation, artificial intelligence, and real-time data analytics, are revolutionizing military logistics, allowing for more efficient planning and execution of logistics operations. These innovations enable better tracking of assets, predictive maintenance, and streamlined supply chains, which contribute to cost savings and improved operational effectiveness. As nations invest in modernization and seek to enhance their military capabilities, the demand for sophisticated logistics solutions continues to rise. Additionally, partnerships with private logistics providers are becoming more common, allowing for the integration of commercial logistics practices into military operations.

Artificial Intelligence (AI) is revolutionizing the military logistics market by enhancing operational efficiency, improving decision-making, and streamlining supply chain management. One of the primary roles of AI in military logistics is predictive analytics, where AI algorithms analyze vast amounts of data to forecast demand for supplies and equipment. This capability enables military planners to optimize inventory levels, reduce waste, and ensure that troops are adequately supplied during operations.

AI also enhances transportation logistics by optimizing routes and schedules for the movement of personnel and equipment. By processing real-time data on traffic conditions, weather patterns, and vehicle availability, AI systems can recommend the most efficient paths, thereby reducing transit times and operational costs. Additionally, AI-powered systems can manage maintenance schedules for military vehicles and equipment, predicting when maintenance is needed before failures occur, thus minimizing downtime and enhancing readiness.

Moreover, AI facilitates improved communication and coordination among various branches of the military and logistics providers. Automated systems can quickly relay information, streamline processes, and provide real-time updates on supply status, enhancing situational awareness for commanders.

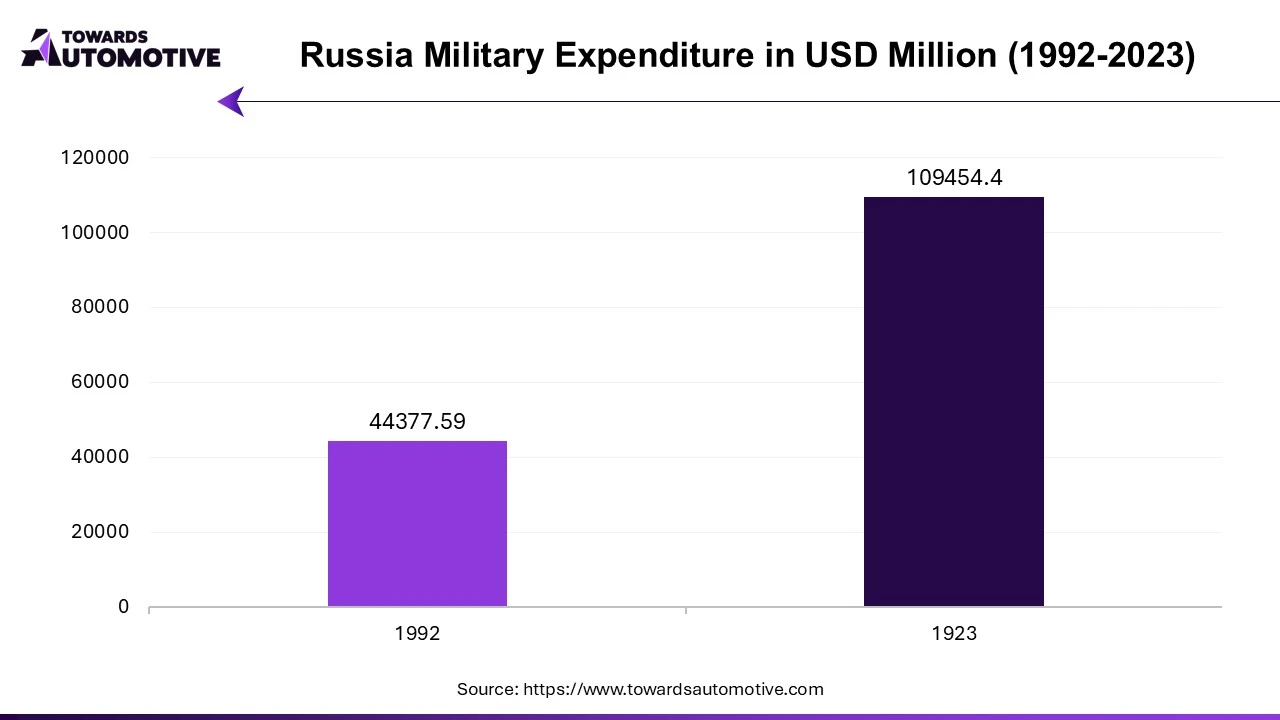

Increasing defense budgets across various countries are significantly driving the growth of the military logistics market. As nations prioritize national security and enhance their military capabilities, they allocate substantial financial resources toward improving logistics and supply chain operations. A larger defense budget enables governments to invest in advanced technologies, infrastructure, and training, which are essential for modernizing military logistics systems. This modernization includes the adoption of automated logistics solutions, real-time tracking systems, and artificial intelligence to streamline operations and enhance operational efficiency.

Moreover, increased funding allows for the expansion and improvement of transportation networks, including roadways, railways, and air transport, which are crucial for the rapid deployment of troops and equipment. Enhanced logistics capabilities also support a wider range of military operations, from humanitarian missions to combat readiness. As countries face evolving threats and geopolitical tensions, there is a growing emphasis on maintaining high operational readiness, necessitating robust logistics support.

Additionally, the rise in defense budgets fuels collaboration with private logistics providers, further enhancing the effectiveness and efficiency of military supply chains. In summary, the increasing defense budgets are not only facilitating technological advancements and infrastructure improvements but also ensuring that military forces are well-equipped to respond to emerging challenges, thus propelling the growth of the military logistics market.

The military logistics market faces several restraints that can hinder its growth. One significant challenge is budget constraints and fluctuating defense spending, which can impact investment in logistics infrastructure and technology. Additionally, the complexity of supply chain management in military operations, coupled with geopolitical uncertainties, can lead to disruptions and inefficiencies. Regulatory hurdles and compliance requirements can further complicate logistics operations, especially when collaborating with private sector partners. Moreover, the integration of advanced technologies often requires extensive training and adaptation, which can slow down implementation and increase costs. These factors collectively pose challenges to the efficiency and effectiveness of military logistics.

Drones are creating significant opportunities in the military logistics market by revolutionizing supply chain operations and enhancing the efficiency of resource delivery. These unmanned aerial vehicles (UAVs) enable rapid transportation of supplies, ammunition, and medical aid to remote or inaccessible areas, reducing the time and logistical complexities associated with traditional delivery methods. By utilizing drones, military forces can ensure timely support to frontline troops, which is critical in combat scenarios where every minute counts.

Moreover, drones can be deployed for surveillance and reconnaissance, providing real-time situational awareness that informs logistics planning and decision-making. This capability allows for better coordination of resources and enhances operational readiness. Drones also reduce the risk to personnel by minimizing the need for ground convoys in hostile environments, thus improving the safety of logistics operations.

As drone technology continues to advance, including improvements in payload capacity, battery life, and navigation systems, their application in military logistics is expected to expand. The integration of artificial intelligence and machine learning further enhances drone capabilities, allowing for autonomous flights and intelligent route optimization. Overall, the adoption of drones in military logistics represents a transformative opportunity, increasing efficiency, reducing costs, and enhancing the overall effectiveness of defense operations.

The logistics & distribution segment held the largest share of the market. The logistics and distribution segment is a crucial driver of growth in the military logistics market, as it encompasses the planning, implementation, and management of the flow of goods and services essential for military operations. Effective logistics ensures that personnel have timely access to the necessary supplies, equipment, and maintenance services, which is vital for operational readiness. The increasing complexity of military operations, characterized by rapid deployment and varied mission requirements, necessitates robust logistics and distribution frameworks to manage the movement of goods across multiple theaters of operation.

As military forces expand their global reach and engage in more complex missions, the demand for sophisticated logistics solutions has surged. This includes advanced inventory management systems, transportation planning tools, and distribution networks capable of responding swiftly to changing circumstances. Additionally, technological advancements such as real-time tracking and data analytics enhance supply chain visibility, enabling better decision-making and resource allocation.

Collaboration with private logistics providers is also gaining traction, as these partnerships leverage commercial expertise and innovations to improve military logistics operations. Overall, the logistics and distribution segment is instrumental in optimizing supply chains, reducing costs, and ensuring that military forces remain agile and effective in executing their missions, thereby driving growth in the military logistics market.

The roadways segment led the industry. The roadways segment plays a vital role in driving the growth of the military logistics market by providing essential infrastructure for the efficient movement of troops, equipment, and supplies. As military operations often require rapid deployment and mobility, well-maintained road networks are crucial for ensuring that logistical support can reach frontline forces in a timely manner. The expansion and modernization of roadway infrastructure allow military logistics to adapt to the increasing demands of contemporary warfare, where agility and speed are paramount.

Investments in roadway improvements, such as enhanced road surfaces, better signage, and increased capacity, directly contribute to more effective supply chain management. These enhancements reduce transit times and ensure reliable access to critical resources, particularly in remote or conflict-prone areas. Furthermore, the development of strategic routes facilitates the safe transport of sensitive materials and high-value equipment, minimizing the risk of delays or losses during operations.

Additionally, advancements in transportation technology, such as automated vehicles and real-time tracking systems, are increasingly integrated into roadway logistics. These innovations improve the efficiency and safety of military convoys, enabling more precise planning and execution of logistics operations.

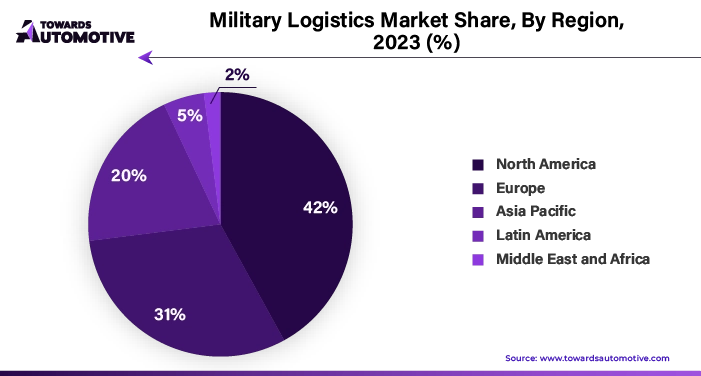

North America dominated the military logistics market. Increased defense spending in North America is a significant driver of growth in the military logistics market, reflecting a commitment to modernizing and enhancing the capabilities of armed forces. With nations like the United States consistently allocating higher budgets to defense, there is a strong emphasis on improving logistical support systems. This funding enables the procurement of advanced logistics technologies, infrastructure improvements, and the training of personnel, all of which are essential for efficient military operations.

Moreover, growing geopolitical tensions, particularly in regions such as Eastern Europe and the Indo-Pacific, have heightened the need for robust military logistics. Nations are compelled to enhance their logistical capabilities to ensure rapid response times and operational readiness in the face of potential conflicts. The ability to swiftly mobilize troops and resources is crucial in contemporary warfare, where speed and efficiency can dictate the outcome of engagements.

Collaboration with the private sector also plays a pivotal role in advancing military logistics. Public-private partnerships leverage the expertise and innovation of commercial logistics firms, resulting in more efficient supply chains and advanced logistical solutions. This collaboration facilitates the integration of best practices from the private sector, ensuring that military logistics operations benefit from the latest technologies and methodologies.

Additionally, technological advancements are transforming military logistics by introducing automation, artificial intelligence, and data analytics. These innovations streamline supply chain management, enhance situational awareness, and enable real-time decision-making. For example, AI can optimize inventory management, ensuring that troops have the necessary supplies without overstocking.

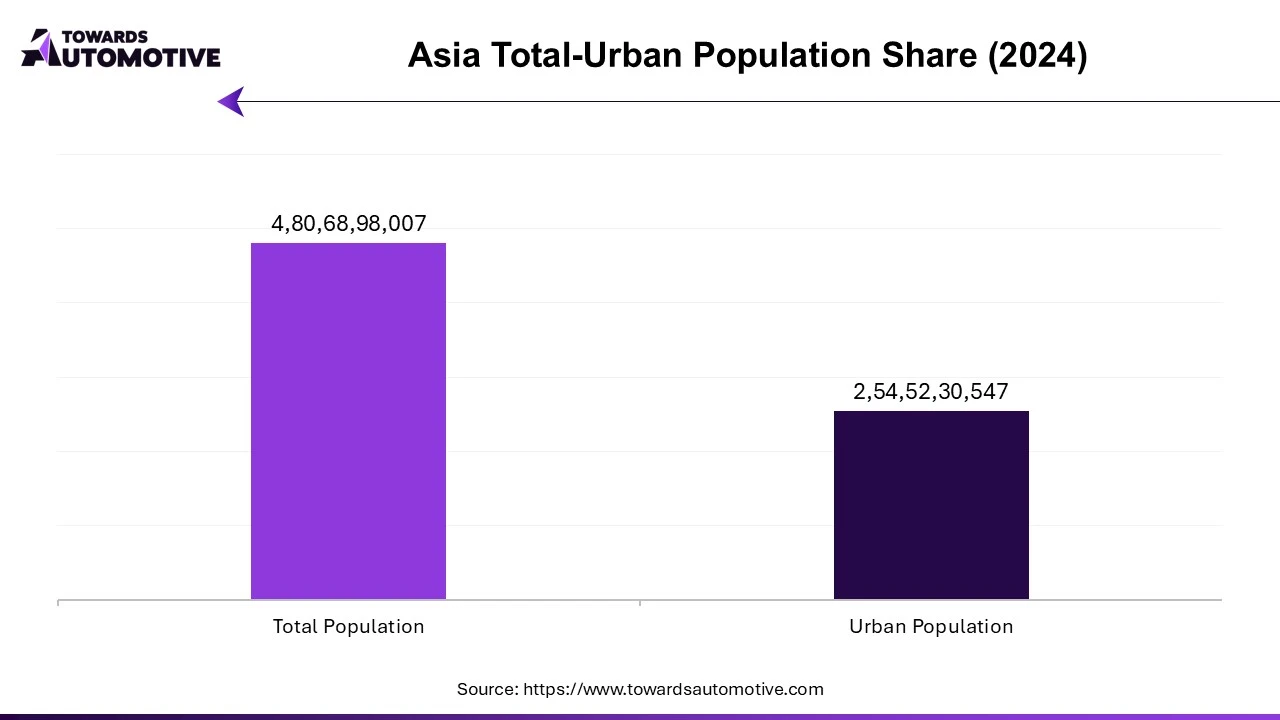

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The military logistics market in the Asia-Pacific (APAC) region is experiencing robust growth driven by several interconnected factors, including a focus on joint military exercises, rapid urbanization, the integration of advanced technologies, and the necessity for supply chain resilience. As regional tensions escalate and nations seek to bolster their defense capabilities, joint military exercises have become increasingly common. These exercises require meticulous logistical planning and execution, highlighting the importance of robust supply chains that can support collaborative operations among multiple military forces. The emphasis on interoperability during these exercises drives investments in logistics infrastructure, ensuring that nations can efficiently coordinate and share resources during joint missions.

Additionally, rapid urbanization in APAC contributes significantly to the growth of military logistics. As urban areas expand and population densities increase, military operations must adapt to new logistical challenges, including the transport of personnel and equipment through congested urban environments. Improved infrastructure development, including roads and transport networks, is essential for facilitating swift logistics operations, which in turn strengthens military capabilities.

The integration of advanced technologies, such as artificial intelligence, automation, and data analytics, further enhances military logistics in APAC. These technologies streamline operations, improve inventory management, and provide real-time insights into supply chain dynamics, enabling military forces to respond more effectively to changing operational requirements.

Finally, the lessons learned from recent global disruptions, such as the COVID-19 pandemic, have underscored the need for supply chain resilience. APAC nations are increasingly focusing on building flexible and adaptive logistics frameworks to withstand unforeseen challenges, ensuring that military forces can maintain operational readiness despite potential disruptions. Together, these factors significantly drive the growth of the military logistics market in the APAC region, enhancing the capability and effectiveness of armed forces in a rapidly changing security landscape.

By Type

By Mode of Transportation

By Region

April 2025

April 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us