April 2025

Senior Research Analyst

Reviewed By

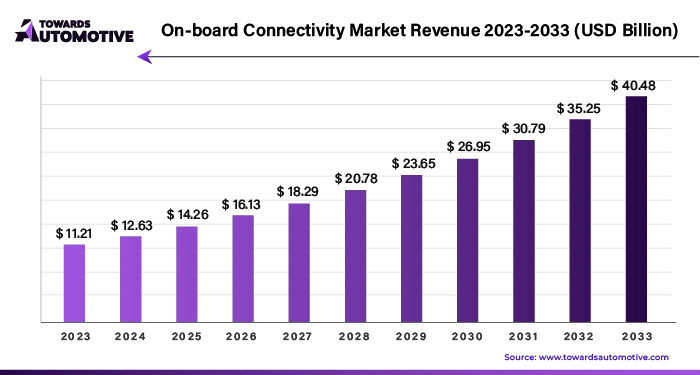

The on-board connectivity market is expected to increase from USD 14.26 billion in 2025 to USD 46.07 billion by 2034, growing at a CAGR of 13.81% throughout the forecast period from 2025 to 2034.

The on-board connectivity market is rapidly expanding as demand for seamless internet access, communication services, and entertainment systems grows across multiple transportation sectors, including aviation, maritime, and railways. With passengers increasingly expecting uninterrupted connectivity during their journeys, airlines, shipping companies, and rail operators are investing in advanced solutions to enhance customer experience and operational efficiency. On-board connectivity systems enable travelers to browse the internet, stream content, use social media, and stay connected with their personal and professional networks, which has become a critical service differentiator, especially in the highly competitive aviation and maritime industries.

In aviation, the rise of in-flight Wi-Fi and entertainment systems is a major driver of market growth, as airlines are focusing on enhancing passenger satisfaction on both long-haul and short-haul flights. Similarly, the maritime sector is seeing a surge in connectivity demand, especially for cruise ships and commercial vessels, where internet access has become essential for crew welfare and operational needs. High-speed satellite communication and ground-to-air systems are being integrated into these modes of transport to provide reliable connectivity, even in remote areas.

Additionally, the growing adoption of Internet of Things (IoT) technologies is boosting the on-board connectivity market. IoT enables real-time data exchange between vehicles and ground control, improving operational safety, fuel management, and predictive maintenance. Technological advancements such as 5G and next-generation satellite networks are further accelerating the adoption of on-board connectivity solutions by offering faster speeds, lower latency, and broader coverage.

As transportation operators increasingly prioritize connected services, the on-board connectivity market is expected to experience significant growth, driven by technological innovations, rising passenger expectations, and the need for operational efficiency.

Artificial Intelligence (AI) plays a transformative role in the on-board connectivity market by optimizing connectivity solutions, enhancing passenger experiences, and improving operational efficiency for transportation operators. One of the primary functions of AI in this market is its ability to manage and analyze large volumes of real-time data from connected systems on airplanes, trains, and ships. By processing this data, AI algorithms can dynamically adjust bandwidth distribution, ensuring optimal connectivity for passengers based on demand patterns and service requirements. This improves the overall quality of in-flight or in-transit internet services, providing passengers with seamless browsing, streaming, and communication experiences.

AI also aids in predictive maintenance and operational efficiency. By monitoring the health of connectivity systems, AI can detect potential issues in satellite or ground-based communication networks before they cause disruptions. This allows operators to take preventive measures, reducing downtime and ensuring a more reliable and efficient service. In aviation, for instance, AI can analyze weather patterns and adjust network resources to maintain strong communication links even in challenging conditions, ensuring uninterrupted connectivity.

Additionally, AI enhances personalized services for passengers. Through machine learning and data analysis, AI-powered systems can predict individual preferences for in-flight entertainment, offering tailored content suggestions, and creating a more engaging and customized experience. AI-driven chatbots and virtual assistants can also assist passengers with real-time travel information, customer service, and even in-flight purchases.

The rising application of satellite communication is a key driver of growth in the on-board connectivity market, particularly in sectors like aviation, maritime, and rail transportation. Satellite communication provides reliable, high-speed internet access and data transfer capabilities, even in remote and hard-to-reach areas where traditional ground-based communication infrastructure is unavailable or inadequate. This has made satellite connectivity essential for maintaining continuous internet access for passengers and crew during long-haul flights, sea voyages, or cross-border train journeys.

In aviation, the integration of satellite communication systems allows airlines to offer in-flight Wi-Fi services, meeting growing passenger expectations for connectivity during travel. These services enable passengers to browse the internet, stream videos, and stay connected with work or personal contacts, which enhances their travel experience. As airlines increasingly view connectivity as a competitive differentiator, demand for satellite-based communication solutions is growing rapidly.

Similarly, in the maritime sector, satellite communication is crucial for vessels operating in open oceans, where maintaining a connection with shore-based systems is necessary for operational efficiency, crew welfare, and safety. Cruise ships, in particular, rely on satellite systems to provide passengers with entertainment options and communication services, while commercial vessels use these technologies for real-time tracking, navigation, and data exchange.

Furthermore, the advent of next-generation satellite technologies, such as Low Earth Orbit (LEO) satellites, is improving connectivity speeds and reducing latency, making satellite communication more effective and widespread. This technological advancement is expected to further drive the expansion of the on-board connectivity market by offering better service quality, wider coverage, and improved cost efficiency for operators across various transportation modes.

The on-board connectivity market faces several restraints, primarily due to high installation and operational costs, which can deter adoption, especially among smaller transportation providers. Satellite communication systems, essential for seamless connectivity, involve significant expenses, including equipment, maintenance, and bandwidth costs. Additionally, regulatory challenges related to spectrum allocation and data privacy concerns further complicate market expansion. Limited bandwidth availability, particularly in crowded airspaces or maritime routes, can lead to inconsistent service quality. These factors, coupled with technological complexities and integration issues, hinder the widespread implementation of advanced on-board connectivity solutions.

Advancements in 5G technology are creating significant opportunities in the on-board connectivity market by enhancing internet speed, reducing latency, and increasing bandwidth. The introduction of 5G on planes, trains, buses, and ships is revolutionizing passenger experiences by enabling faster, more reliable connections for streaming, browsing, and real-time communication during travel. 5G’s ability to handle more data and connect multiple devices simultaneously offers seamless in-flight entertainment and better communication between vehicles and ground systems.

In the aviation sector, 5G enables improved operational efficiencies, such as real-time data sharing for predictive maintenance and enhanced safety through better communication between pilots and ground control. It also supports advanced applications like video conferencing, gaming, and cloud-based services, providing an enhanced passenger experience. Similarly, in maritime and rail transportation, 5G facilitates real-time monitoring of systems, which improves safety, navigation, and fuel efficiency.

Additionally, the expansion of 5G networks allows transportation operators to implement smarter services, such as personalized entertainment and more efficient logistical operations. As 5G infrastructure continues to roll out globally, it will accelerate the adoption of on-board connectivity solutions, creating new revenue streams and fostering innovation across the transportation industry.

The ground to air segment led the industry. The ground-to-air segment is a key driver of growth in the on-board connectivity market, as it provides a reliable and cost-effective solution for in-flight internet and communication services. Unlike satellite-based connectivity, ground-to-air communication systems use a network of ground stations that transmit signals directly to aircraft, enabling fast and stable internet connections during flights. This technology is particularly effective for flights over land, where coverage from ground stations is more accessible and consistent, making it an attractive option for airlines looking to offer high-speed connectivity without the high costs of satellite systems.

One of the main advantages of the ground-to-air segment is its ability to support real-time data exchange between aircraft and ground control. Airlines can use this connectivity to improve flight operations, such as real-time monitoring of aircraft performance, weather updates, and air traffic management. This not only enhances safety but also helps in optimizing flight routes, reducing delays, and minimizing fuel consumption, which contributes to overall operational efficiency. As airlines strive to meet rising demands for more efficient operations and better passenger services, the adoption of ground-to-air connectivity solutions is gaining momentum.

Furthermore, the growing trend of offering in-flight entertainment and Wi-Fi on domestic and short-haul flights, where ground-to-air connectivity is most practical, is significantly driving this segment. Airlines are increasingly equipping their aircraft with ground-to-air systems to meet passenger expectations for uninterrupted internet access, even on shorter routes. As a result, the ground-to-air segment is playing a vital role in expanding the on-board connectivity market, especially in regions with well-developed ground-based communication infrastructure, such as North America and Europe.

The aviation segment held the largest share of the market. The aviation segment plays a crucial role in driving the growth of the on-board connectivity market, as airlines increasingly adopt in-flight connectivity solutions to meet passenger demands and enhance overall travel experience. In-flight Wi-Fi and entertainment systems have become a major differentiator for airlines, especially on long-haul flights, as passengers expect seamless internet access for browsing, streaming, and staying connected during their journeys. This has prompted airlines to invest heavily in advanced satellite and air-to-ground (ATG) communication systems, which enable reliable, high-speed connectivity at cruising altitudes.

Additionally, the aviation industry's focus on enhancing operational efficiency is contributing to the growth of the on-board connectivity market. Airlines are leveraging connected technologies to improve real-time communication between aircraft and ground-based systems. This enables better flight monitoring, predictive maintenance, and fuel management, leading to cost savings and improved safety. On-board connectivity also supports the use of data analytics to optimize flight routes, reduce delays, and enhance air traffic management, all of which are critical in the highly competitive aviation industry.

The growing demand for business jets and private aviation, particularly in regions like North America, Europe, and Asia-Pacific, is also boosting the adoption of on-board connectivity solutions. High-net-worth individuals and corporate travelers increasingly expect uninterrupted connectivity during flights to manage business operations, access emails, and conduct virtual meetings. As a result, aviation companies are partnering with technology providers to offer customized, high-speed connectivity services that cater to the needs of premium passengers.

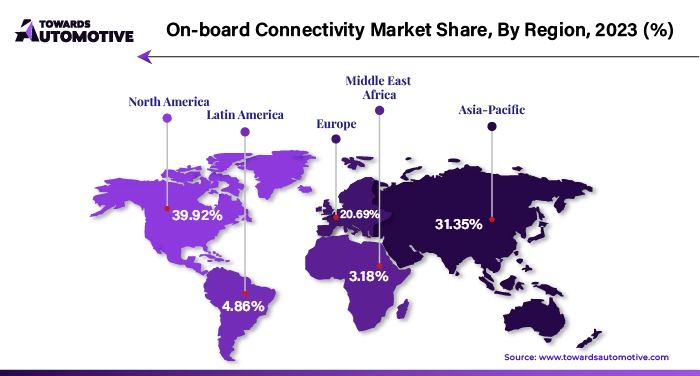

North America dominated the on-board connectivity market. The on-board connectivity market in North America is driven by several key growth factors. One of the primary factors is the increasing consumer demand for in-vehicle entertainment and communication services. As vehicles become more connected, passengers expect seamless access to high-speed internet, streaming services, and navigation tools, boosting the adoption of on-board connectivity solutions. Automakers are responding to this trend by integrating advanced infotainment systems that provide real-time data, media streaming, and enhanced user experience, further fueling market growth.

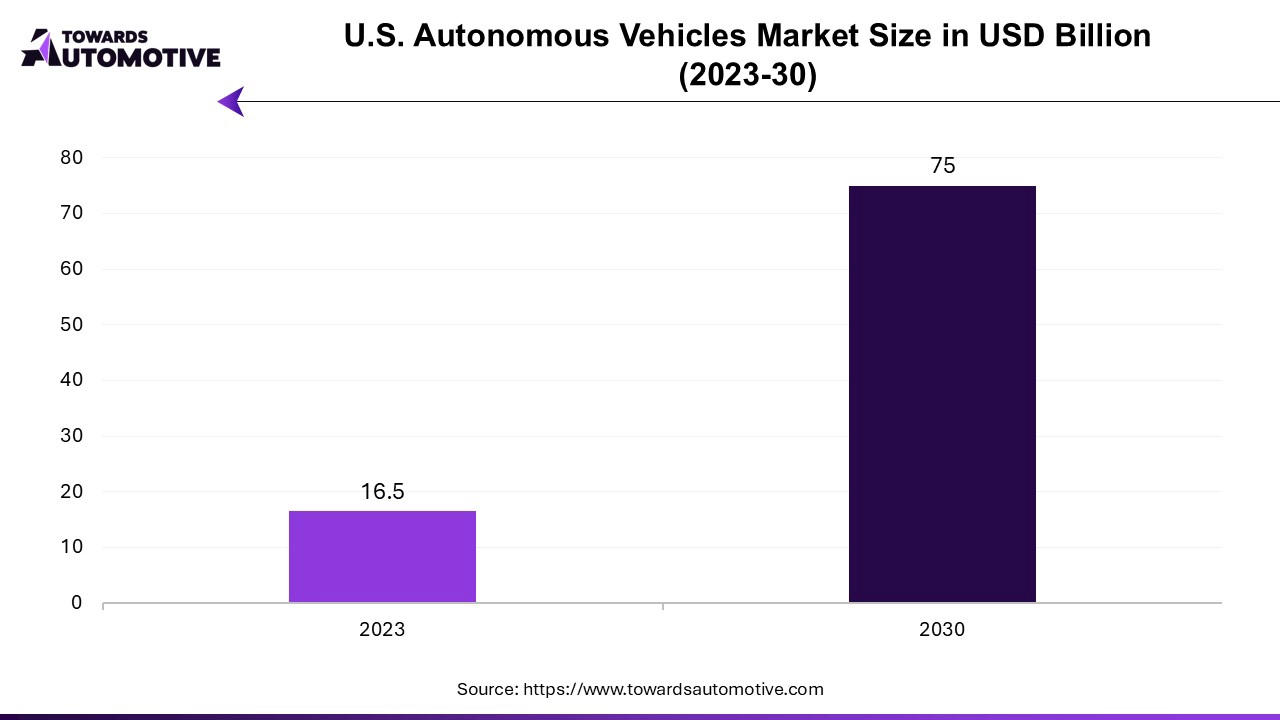

Another significant factor is the growing deployment of connected and autonomous vehicles in the region. As North America leads in the development and adoption of autonomous driving technologies, the need for reliable and fast connectivity in vehicles becomes paramount. On-board connectivity plays a critical role in enabling real-time communication between vehicles, infrastructure, and cloud systems, ensuring safe and efficient autonomous driving.

The rise in fleet management solutions, particularly in the logistics and transportation industries, also drives the demand for on-board connectivity. Fleet operators increasingly rely on connected systems to monitor vehicle performance, optimize routes, and manage real-time data for better operational efficiency. Moreover, government regulations focused on vehicle safety, emissions monitoring, and fuel efficiency are pushing automakers to implement connected technologies, supporting the growth of the on-board connectivity market in North America.

Asia Pacific is expected to grow with a significant CAGR during the forecast period. The on-board connectivity market in Asia-Pacific (APAC) is experiencing significant growth due to several key factors. One of the primary drivers is the rapid increase in vehicle ownership, particularly in emerging economies such as China, India, and Southeast Asia. As middle-class populations grow and disposable incomes rise, there is increasing demand for advanced in-vehicle technologies, including connectivity features that enhance the driving experience with real-time navigation, infotainment, and communication services.

Another important growth factor is the strong push from governments in APAC countries to develop smart city infrastructure and promote electric and autonomous vehicles. Governments are encouraging the adoption of connected technologies in vehicles as part of broader initiatives to improve traffic management, reduce emissions, and enhance road safety. The integration of on-board connectivity with smart infrastructure enables real-time data exchange between vehicles and urban environments, which is critical for autonomous driving and advanced driver-assistance systems (ADAS).

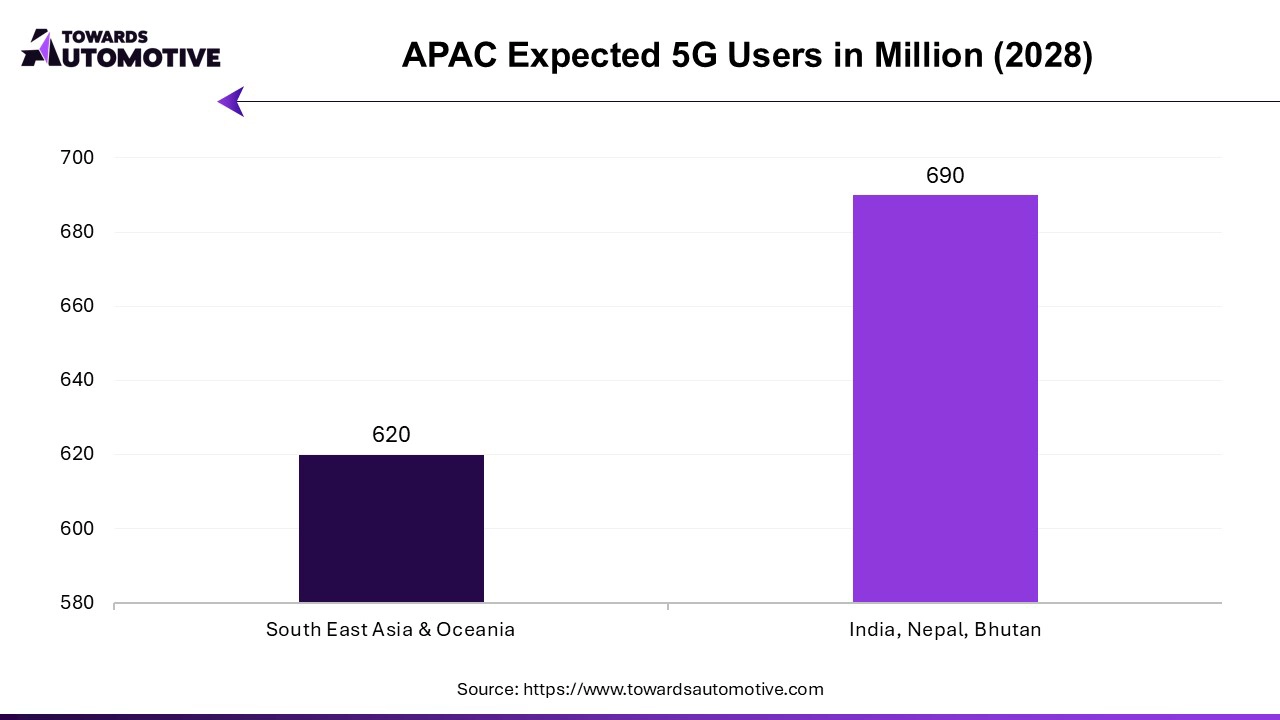

The increasing penetration of 4G and 5G networks across the region is also boosting the on-board connectivity market. With better and faster internet access, automakers are able to offer more sophisticated and reliable connectivity features. This is particularly important for providing real-time updates, over-the-air (OTA) software upgrades, and vehicle-to-everything (V2X) communication. Lastly, the rise in demand for telematics solutions in commercial fleets, especially in logistics and ride-hailing services, is further driving the need for connected vehicles, as fleet operators look to optimize operations and improve safety through real-time vehicle monitoring and data analytics.

By Component

By Application

By Technology

By End-User

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us