October 2025

The remote operated vehicle market is expected to grow from USD 2.27 billion in 2025 to USD 5.56 billion by 2034, with a CAGR of 10.47% throughout the forecast period from 2025 to 2034.

The market for ROVs has been steadily growing due to increased demand for underwater exploration, maintenance of offshore oil and gas infrastructure, underwater construction, scientific research, environmental monitoring, and defense applications. The remote operated vehicles are equipped with cameras, sensors, manipulators, and other tools to perform tasks in underwater environments where it may be difficult or dangerous for humans to operate directly.

The growing interest in deep-sea mining, fueled by technological advancements and depleting terrestrial resources, presents new opportunities for ROV deployment. Scientific research initiatives in marine biology, oceanography, and geology further contribute to market growth, as ROVs are essential tools for underwater exploration and data collection. Furthermore, the continuous evolution of ROV technology, including improvements in sensors, robotics, and communication systems, enhances their capabilities and widens their applicability across industries.

The expansion of offshore activities is fueled by the rising global demand for oil and gas, alongside the depletion of easily accessible onshore reserves. As energy companies venture further into offshore fields to meet this demand, the need for efficient exploration and production methods intensifies.

According to the projections from U.S. Energy Information Administration, in 2024, global liquid fuel consumption is projected to rise by 1.4 million barrels per day (b/d), followed by an additional increase of 1.3 million b/d in 2025. The primary surge in liquid fuel demand is anticipated to occur in non-OECD Asia, with China and India spearheading the trend. Together, these nations are forecasted to witness a consumption hike of 0.6 million b/d in 2024, followed by a further 0.5 million b/d increase in 2025.

Remote operated vehicles (ROVs) emerge as indispensable tools in this scenario, facilitating a range of crucial tasks beneath the waves. These tasks include subsea inspections to ensure the integrity of underwater infrastructure, repairs to address any faults or damages, and routine maintenance activities. ROVs provide a cost-effective and versatile solution for operating in challenging underwater environments, where human intervention is often impractical or unsafe. Consequently, the demand for ROVs is expected to rise during the forecast period.

The initial investment required for acquiring, operating, and maintaining ROVs presents a significant barrier to market entry, particularly for small and medium-sized enterprises (SMEs) and emerging markets. The substantial upfront costs associated with ROV deployment encompass not only the purchase of the vehicles themselves but also the requisite infrastructure, training, and on-going maintenance expenses. These high capital expenditures can strain the financial resources of organizations, impeding their ability to invest in ROV technology. Consequently, many companies, especially those operating in sectors with limited financial resources, may be deterred from adopting ROVs, thereby restricting market growth and innovation.

The integration of robotics, artificial intelligence (AI), and automation technologies heralds a new era of enhanced capabilities and efficiency for remote operated vehicles (ROVs). With AI-driven algorithms and automation, ROVs can achieve unprecedented levels of autonomy, precision and intelligence. Autonomous navigation systems enable ROVs to navigate complex underwater environments with minimal human intervention, increasing operational efficiency and reducing the risk of errors. Predictive maintenance algorithms analyze real-time data to anticipate equipment failures and schedule maintenance proactively, minimizing downtime and enhancing reliability.

This integration aims to enhance operational efficiency and reduce project costs, providing a more intelligent approach to working. Consequently, Rovco will be able to offer its clients a significant improvement in autonomous services, leveraging the expertise of its technology spin-off, Vaarst.

Additionally, machine learning algorithms enable ROVs to adapt and learn from past experiences, optimizing performance and decision-making in dynamic underwater environments. These advancements unlock a myriad of new applications and market opportunities for ROVs, ranging from deep-sea exploration and underwater construction to environmental monitoring and defense applications.

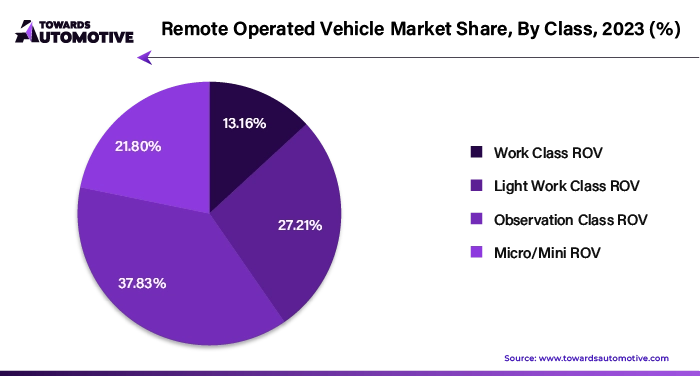

The observation class ROVs segment captured a substantial market share of 37.83% in 2023. The observation class ROVs are widely utilized for assessing water safety before divers embark on missions and perform inspections. These ROVs can be outfitted with sonar and tailor-made sensors. Advancements in sensor and imaging technology have enhanced the capabilities of observation class ROVs, allowing for detailed data collection and analysis in real-time. Moreover, the increasing demand for underwater surveillance and monitoring in industries such as oil and gas, marine research, and defense further propels the adoption of observation class ROVs.

The oil and energy segment held largest market share of 40.98% in 2023. The global reliance on fossil fuels for energy production continues to drive significant demand within the oil and energy sector, with offshore oil and gas exploration and production activities being major contributors. Additionally, the increasing need for energy security and the on-going development of offshore fields, particularly in deep-water and ultra-deep-water regions, have spurred investments in underwater technologies, including ROVs, to support exploration, production and maintenance operations.

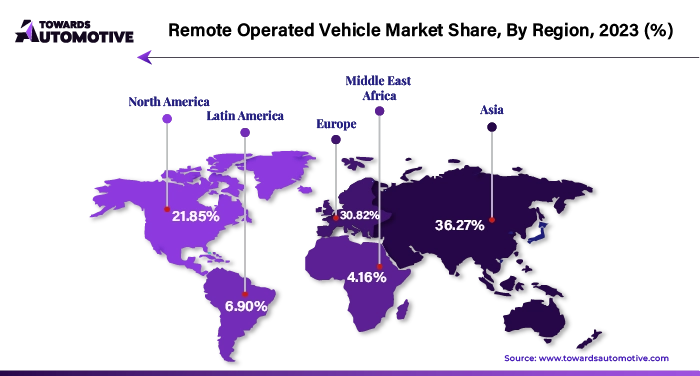

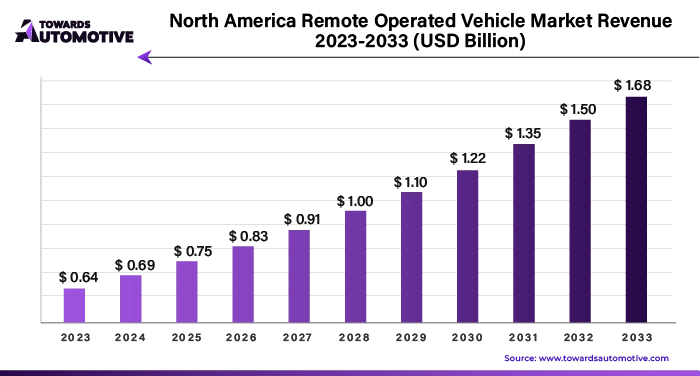

North America dominated the market in 2023 and stood at value of USD 0.64 billion in the global remote operated vehicle market. North America boasts significant offshore oil and gas reserves in the Gulf of Mexico, off the coast of Canada, and in the Arctic region. The exploration and extraction of these resources require extensive underwater operations, including inspections, repairs, and maintenance, driving the demand for ROVs in the region. Furthermore, there is increasing demand from US military is also likely to support the growth of the market in the region.

For Instance,

Middle-East and Africa is expected to grow at a considerable CAGR of 12.28% during the forecast period. The Middle East is home to some of the world's largest oil and gas reserves, making it a hub for exploration and production activities. The area harbors five of the planet's leading ten oil producers Saudi Arabia, Iraq, the United Arab Emirates, Iran, and Kuwait, alongside three of the top 20 gas producers. In 2022, it represented over 40% of worldwide oil exports, exceeding four out of every ten barrels. ROVs help in supporting offshore drilling operations, pipeline inspections, and subsea construction projects in the region, driven by the continuous demand for energy resources.

Some of the key players in remote operated vehicle market are Saab Seaeye, Oceaneering International, Forum Energy Technologies, TechnipFMC, ROVOP, Subsea 7, Deep Ocean Engineering, Soil Machine Dynamics (SMD), DOF Subsea, Fugro, and Ocean Infinity, among others.

By Class

By Application

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us