April 2025

Senior Research Analyst

Reviewed By

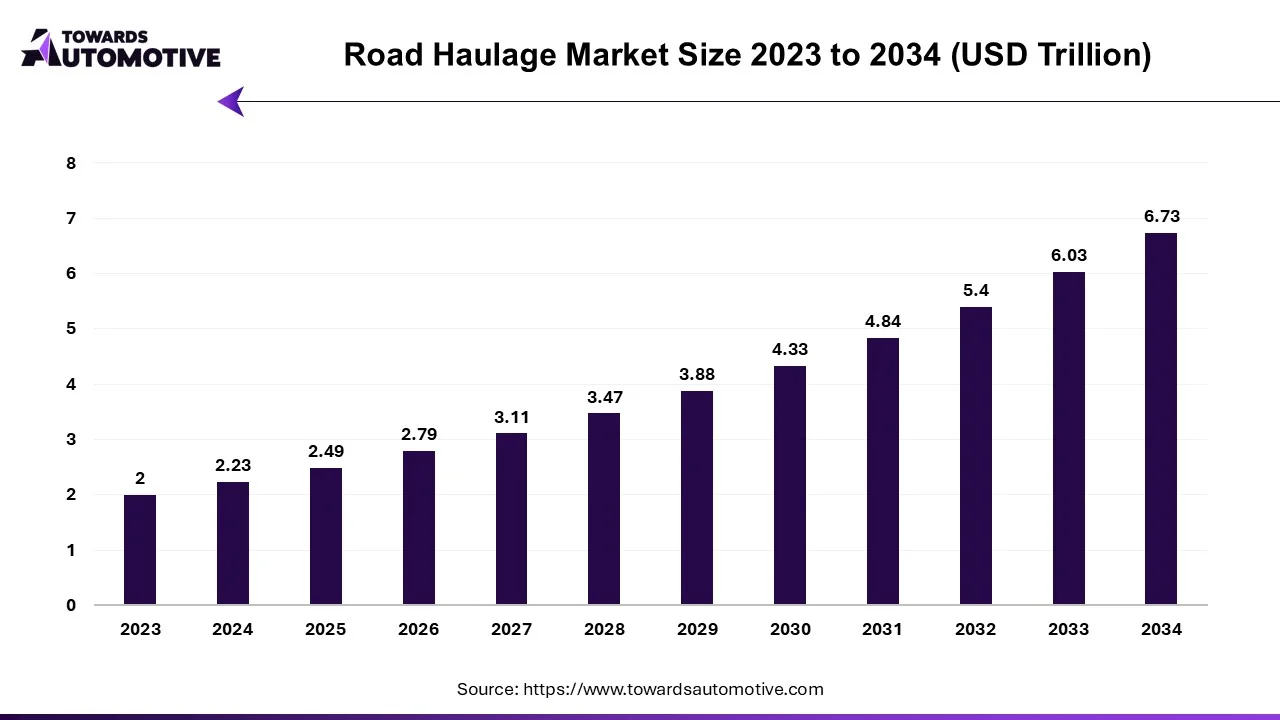

The road haulage market is forecasted to expand from USD 2.49 trillion in 2025 to USD 6.73 trillion by 2034, growing at a CAGR of 11.67% from 2025 to 2034.

The road haulage market plays a pivotal role in global trade and commerce, serving as the backbone for the transportation of goods across regions and industries. This market encompasses the movement of freight via road networks, offering flexibility, reliability, and cost-effectiveness for businesses worldwide. Key stakeholders in the market include logistics companies, fleet operators, and third-party transportation providers that ensure the timely delivery of goods, ranging from perishable items to industrial raw materials.

In recent years, the road haulage market has witnessed substantial growth, driven by factors such as the rapid expansion of e-commerce, urbanization, and the increasing need for efficient supply chain solutions. Technological advancements, including telematics, route optimization, and fleet management systems, have further enhanced operational efficiency, enabling real-time tracking and reducing transit times. Sustainability is also becoming a key focus, with the integration of electric and alternative fuel-powered vehicles gaining traction to reduce carbon emissions.

Regional dynamics play a crucial role in shaping market trends, with developed regions prioritizing infrastructure upgrades and emerging economies experiencing significant demand due to industrial growth and improving road networks. The road haulage market is poised for continued evolution, leveraging innovation and adaptability to address changing consumer demands and global logistics challenges.

Artificial Intelligence (AI) is transforming the road haulage market by optimizing operations, enhancing efficiency, and addressing key challenges such as cost control, environmental impact, and customer demands. AI-powered solutions enable fleet operators and logistics companies to streamline processes and make data-driven decisions, improving overall performance.

One of AI's most significant contributions lies in route optimization. By analyzing traffic patterns, weather conditions, and delivery schedules, AI systems recommend the most efficient routes, reducing fuel consumption and transit times. This improves cost efficiency and minimizes carbon emissions, supporting sustainability goals. Predictive maintenance is another critical application, where AI monitors vehicle performance through IoT sensors, identifying potential issues before they lead to breakdowns, thereby minimizing downtime and maintenance costs.

AI also plays a vital role in demand forecasting, helping companies anticipate market fluctuations and allocate resources effectively. In addition, it facilitates real-time tracking and communication with customers, enhancing transparency and service quality. Autonomous vehicles, driven by AI, are gradually being integrated into the road haulage market, offering the potential to revolutionize long-haul transportation by reducing labor costs and improving safety.

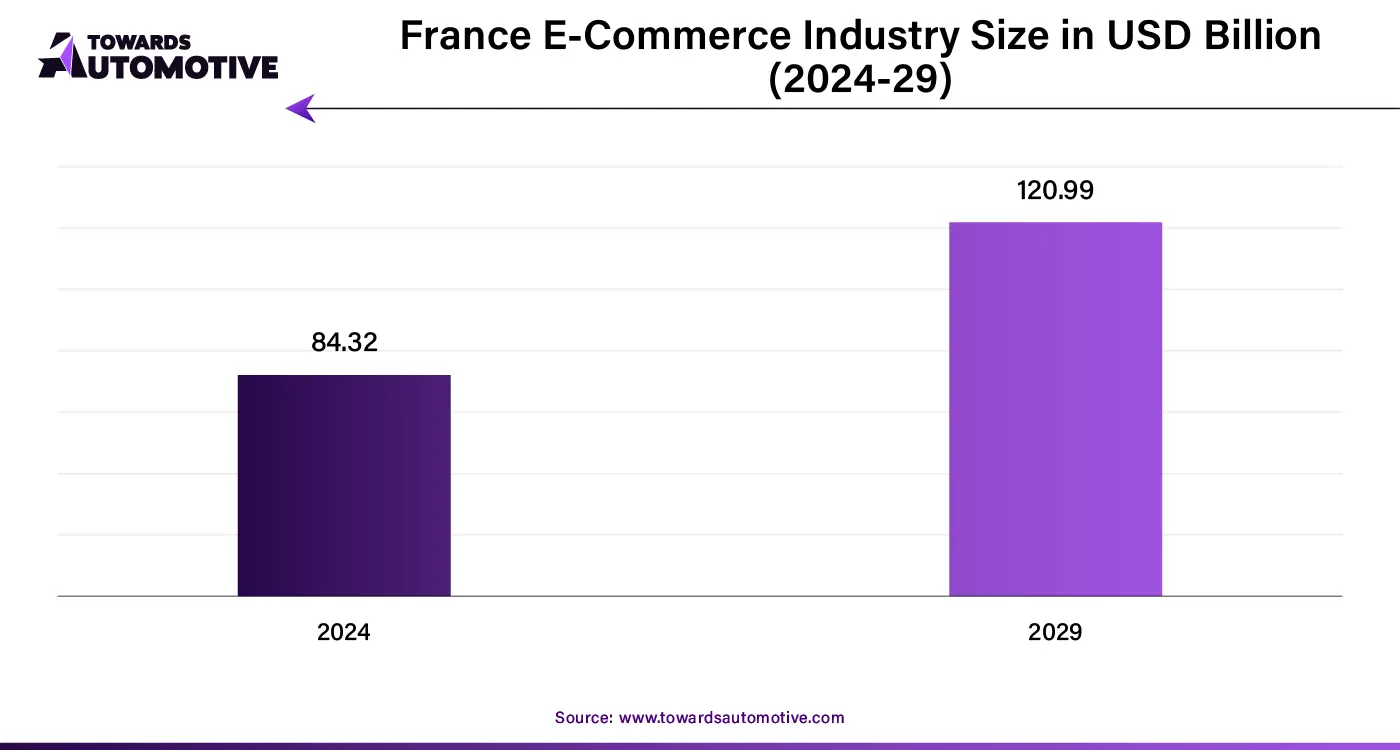

The rapid development of the e-commerce sector is a significant driver of growth in the road haulage market, as it necessitates efficient logistics and transportation solutions to meet the rising demand for goods delivery. The surge in online shopping, fueled by increasing internet penetration, smartphone usage, and consumer preference for convenience, has transformed the retail landscape, placing unprecedented pressure on supply chains. Road haulage services are integral to e-commerce operations, enabling the transportation of goods from warehouses to distribution centers and, ultimately, to consumers’ doorsteps through last-mile delivery.

E-commerce platforms prioritize quick and reliable delivery services to enhance customer satisfaction, driving logistics companies to expand their fleets and optimize operations. Technologies such as GPS tracking, real-time delivery updates, and route optimization tools have become essential for ensuring timely deliveries and reducing costs. Moreover, the growth of same-day and next-day delivery options has further amplified the need for efficient road haulage services, particularly in urban and suburban areas.

The sector also supports small and medium enterprises (SMEs) by providing accessible logistics solutions to broaden their market reach. As the e-commerce sector continues to expand globally, the demand for road haulage services is expected to grow in tandem, reinforcing its role as a critical enabler of this dynamic industry.

The road haulage market faces several restraints that challenge its growth, including rising fuel costs, stringent environmental regulations, and infrastructure limitations in certain regions. High operational expenses, driven by fluctuating fuel prices and maintenance costs, pressure profit margins for operators. Additionally, labor shortages, particularly a lack of skilled drivers, exacerbate operational inefficiencies. Compliance with emissions standards demands significant investments in greener technologies, further straining budgets. These challenges hinder market expansion and necessitate strategic adaptations by industry stakeholders.

The rapid adoption of electrification in the logistics sector is creating significant opportunities in the road haulage market, as sustainability and cost-efficiency become top priorities for businesses. With growing concerns over carbon emissions and stringent environmental regulations, logistics companies are increasingly transitioning to electric vehicles (EVs) to reduce their ecological footprint. This shift is driving innovation and investment in electric truck manufacturing, charging infrastructure, and energy-efficient fleet management systems, transforming the road haulage landscape.

Electric trucks offer advantages such as lower operating costs, reduced fuel dependency, and compliance with emission standards, making them an attractive option for road haulage operators. Government incentives, including subsidies for EV purchases and investments in charging stations, further accelerate the adoption of electrified fleets. Additionally, advancements in battery technology are addressing concerns around range and payload capacity, enabling EVs to cater to both short-haul and long-haul logistics needs.

The electrification trend is also fostering collaboration among automakers, technology providers, and logistics companies to develop integrated solutions, such as AI-driven route optimization and smart energy management. As more businesses prioritize green supply chains, the adoption of electric vehicles in the logistics sector is not only driving operational efficiency but also opening new growth avenues in the road haulage market.

The domestic road haulage segment held a dominant share of the market. The domestic road haulage segment plays a crucial role in driving the growth of the overall road haulage market by catering to the increasing demand for efficient and cost-effective transportation of goods within national boundaries. This segment thrives on the expanding needs of industries such as retail, manufacturing, agriculture, and construction, which rely on road transport for timely delivery of raw materials and finished products. The rise of e-commerce has significantly bolstered domestic road haulage, as businesses prioritize last-mile delivery solutions to meet consumer expectations for faster and reliable service.

Additionally, the segment benefits from advancements in infrastructure, including the development of better road networks and logistics hubs, which enhance connectivity between urban, suburban, and rural areas. Government initiatives focused on improving domestic supply chains, such as subsidies for fleet upgrades and digital transformation in logistics, further strengthen this segment. Technologies like GPS tracking, telematics, and route optimization software empower domestic haulage operators to improve operational efficiency, reduce costs, and meet tight delivery schedules.

The flexibility and accessibility of domestic road haulage also make it a preferred choice for small and medium enterprises (SMEs), further amplifying its contribution to market growth. As industries and consumer needs evolve, the domestic road haulage segment continues to drive expansion in the road haulage market.

The food & beverage segment led the industry. The food and beverage segment is a significant driver of growth in the road haulage market, as it relies heavily on efficient and reliable transportation to ensure the timely delivery of perishable and non-perishable goods. This segment is critical to maintaining the supply chain for retailers, restaurants, supermarkets, and food processors. The rising global demand for fresh produce, packaged food, and beverages spurred by population growth, urbanization, and changing consumer preferences has amplified the need for road haulage services.

Temperature-controlled logistics, such as refrigerated trucks, play a vital role in this segment, ensuring the safe transport of perishable items like dairy, meat, fruits, and vegetables. Road haulage operators are increasingly adopting advanced technologies, such as IoT-enabled temperature monitoring and real-time tracking, to maintain product quality and comply with stringent food safety regulations. Moreover, the expansion of the e-commerce sector has further accelerated demand for last-mile delivery of food and beverages, particularly with the rise of online grocery platforms and meal delivery services.

Road haulage offers unmatched flexibility and speed, making it the preferred choice for businesses in this sector. As consumer expectations for fresh, high-quality products and faster deliveries continue to rise, the food and beverage segment will remain a pivotal growth engine for the road haulage market.

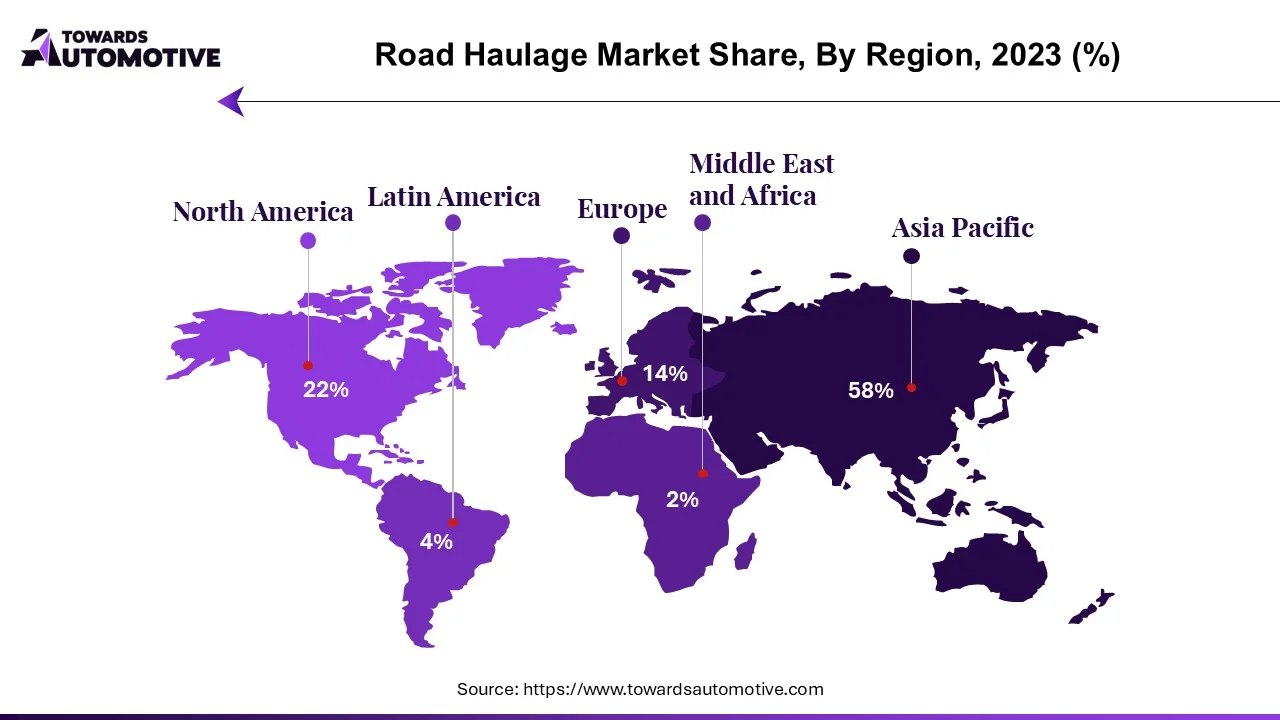

Asia Pacific dominated the road haulage market. The road haulage market in Asia Pacific is experiencing significant growth, driven by rapid urbanization, industrial expansion, and increasing trade activities in the region. One of the primary factors is the robust growth of e-commerce, which has created a surging demand for efficient logistics and last-mile delivery services. With consumers expecting faster and more reliable deliveries, road haulage operators are expanding their networks and adopting advanced technologies to meet these requirements.

Infrastructure development is another critical growth driver. Governments in countries such as China, India, and Southeast Asian nations are heavily investing in improving road networks, expressways, and cross-border transportation corridors to facilitate the seamless movement of goods. Initiatives like China's Belt and Road Initiative and India's Bharatmala project are enhancing connectivity and boosting the efficiency of road haulage services.

The rise of the manufacturing sector in Asia Pacific, particularly in countries like Vietnam, Thailand, and Indonesia, also contributes to the market's expansion. These industries depend on road haulage for the transportation of raw materials and finished goods. Additionally, the growing adoption of technology, such as GPS tracking, route optimization, and telematics, is enabling more efficient operations, reducing costs, and enhancing service quality.

As the region's economy continues to grow and consumer demands evolve, the road haulage market in Asia Pacific is poised for sustained expansion, supported by infrastructure upgrades, industrial growth, and technological advancements.

North America is expected to grow with a significant CAGR during the forecast period. The road haulage market in North America is experiencing robust growth, driven by several key factors that underscore its critical role in the region's economy. One of the primary drivers is the booming e-commerce sector, which has created a surging demand for efficient logistics and last-mile delivery solutions. Consumers' increasing expectations for faster delivery times have prompted logistics providers to expand their fleets and optimize operations, significantly boosting the road haulage market.

Infrastructure investments across the United States, Canada, and Mexico further fuel growth. Initiatives to improve road networks, highways, and cross-border trade corridors facilitate the seamless transportation of goods, enhancing the efficiency and reliability of road haulage services. The United States-Mexico-Canada Agreement (USMCA) has also strengthened cross-border trade, creating new opportunities for freight operators in the region.

Technological advancements are playing a pivotal role in shaping the market. The adoption of telematics, GPS tracking, and route optimization software is improving operational efficiency, reducing fuel consumption, and enhancing delivery accuracy. Additionally, the focus on sustainability has led to the integration of electric and alternative fuel-powered trucks, aligning with environmental goals and reducing operating costs.

The diverse industrial landscape in North America, including automotive, retail, agriculture, and construction sectors, further drives demand for road haulage services. As industries expand and supply chain complexities grow, the market is expected to continue its upward trajectory, supported by technological innovation, infrastructure development, and evolving consumer needs.

By Type

By Vehicle Type

By Application

By Region

April 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us