April 2025

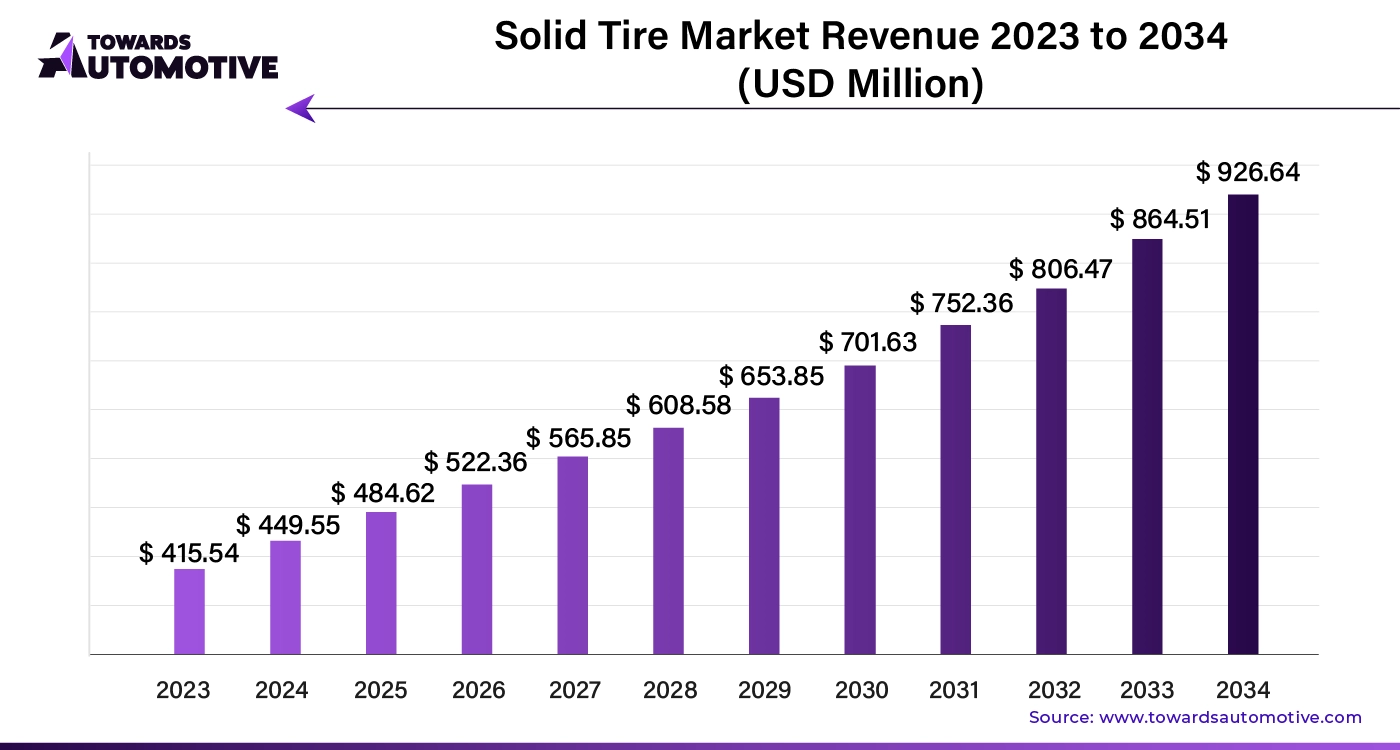

The global solid tire market size is calculated at USD 449.55 million in 2024 and is expected to be worth USD 926.64 million by 2034, expanding at a CAGR of 8.15% from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The solid tire market is gaining momentum as industries increasingly adopt solid tires for various heavy-duty applications due to their durability and low maintenance needs. Unlike pneumatic tires, solid tires are puncture-resistant and can withstand harsh environments, making them ideal for industrial vehicles, forklifts, construction equipment, and military vehicles. As industries look for ways to minimize downtime and improve operational efficiency, solid tires offer a reliable solution with longer lifespans and reduced risks of sudden failures.

The growth of the solid tire market is also driven by the expanding construction, manufacturing, and warehousing sectors. In these industries, the ability to maintain consistent performance in challenging conditions, such as uneven terrains or debris-filled environments, is crucial. Solid tires provide the necessary stability and strength to keep operations running smoothly. Additionally, increasing environmental concerns are pushing the demand for eco-friendly tires, and solid tires, which last longer and generate less waste, are becoming a popular choice.

Technological advancements are further boosting the market, with manufacturers focusing on improving the design and materials of solid tires to enhance load-bearing capacity, traction, and comfort. These innovations are making solid tires more versatile and suitable for a wider range of applications. As more industries recognize the benefits of solid tires in terms of durability, cost-effectiveness, and safety, the solid tire market is poised for significant growth in the coming years.

AI plays an increasingly important role in the solid tire market by optimizing design, production, and performance. Manufacturers are leveraging AI-driven technologies to improve tire design, ensuring that solid tires are more durable, efficient, and suited to specific industrial applications. AI algorithms analyze large datasets on tire wear, performance under different conditions, and material properties, allowing manufacturers to create more robust and long-lasting tires. This helps reduce downtime for industrial vehicles and increases operational efficiency.

In production, AI is used to streamline manufacturing processes, improving quality control and minimizing defects. Automated inspection systems powered by AI can detect potential issues in tire production early, ensuring consistent quality and reducing waste. This enhances production efficiency and helps companies meet the growing demand for solid tires in industries like construction, logistics, and manufacturing.

Additionally, AI-driven predictive maintenance tools allow companies using solid tires to monitor tire performance in real time. These systems can forecast potential failures based on usage patterns, enabling timely replacements and preventing costly breakdowns. As AI continues to evolve, its role in refining tire design, production, and maintenance will further drive the growth and innovation of the solid tire market.

The construction and industrial sectors significantly drive the growth of the solid tire market by creating a strong demand for durable and reliable tires. In the construction industry, heavy machinery such as excavators, bulldozers, and loaders require tires that can withstand rough terrains, heavy loads, and harsh operating conditions. Solid tires are ideal for these applications due to their superior puncture resistance and durability, which help reduce maintenance and downtime on construction sites. This reliability translates into increased efficiency and cost savings, making solid tires a preferred choice for construction equipment.

Similarly, the industrial sector contributes to the growth of the solid tire market through its use of material handling equipment, including forklifts, automated guided vehicles (AGVs), and other machinery used in warehouses and manufacturing facilities. These environments demand tires that can handle constant traffic, heavy loads, and various operational stresses. Solid tires offer the necessary strength and performance, ensuring uninterrupted operations and minimizing the risk of tire-related failures.

The solid tire market faces several restraints, including higher upfront costs compared to traditional pneumatic tires, which can deter budget-conscious buyers. Additionally, solid tires can offer a harsher ride compared to pneumatic options, potentially affecting comfort in certain applications. Limited flexibility in design and weight can also restrict their use in some high-performance or specialized vehicles. These factors can slow adoption and pose challenges for market growth despite the advantages of durability and low maintenance.

Smart tires create significant opportunities in the solid tire market by integrating advanced technology that enhances performance, safety, and efficiency. Equipped with sensors and IoT connectivity, smart tires provide real-time data on parameters such as temperature, pressure, and wear. This information enables predictive maintenance, allowing businesses to address potential issues before they lead to costly breakdowns or operational disruptions. By monitoring tire health continuously, smart tires help optimize performance and extend service life, offering a substantial return on investment.

Additionally, the ability to gather and analyze data allows for more informed decision-making and operational improvements. As industries increasingly focus on efficiency and data-driven solutions, the demand for smart tires is expected to rise. Manufacturers are leveraging this trend to innovate and offer advanced products that meet the growing need for high-performance, reliable, and intelligent tire solutions. This shift towards smart technology in solid tires opens new market opportunities and drives growth by meeting the evolving needs of modern industrial and commercial applications.

The 20–25-inch segment dominated the market. The demand for 20–25-inch solid tires is driving the growth of the solid tire market by providing heavy-duty vehicles with enhanced durability and performance in industrial applications. These larger tire sizes are commonly used in equipment like forklifts, loaders, and construction machinery, where strength and resistance to wear are crucial. With their increased load-bearing capacity, 20–25-inch solid tires offer the stability and strength needed for vehicles operating in harsh environments such as construction sites, warehouses, and mining areas.

As industries such as construction, logistics, and mining continue to expand, the need for reliable tires that can handle heavy loads and rough terrains is growing. The 20-25 inch solid tires provide excellent resistance to punctures, reducing the risk of sudden failures and minimizing downtime for industrial operations. This reliability makes them an ideal choice for companies looking to improve operational efficiency and reduce maintenance costs.

Moreover, these larger tires are designed for a longer lifespan, which makes them more cost-effective in the long run compared to pneumatic tires. Their durability leads to fewer replacements, contributing to lower overall operational expenses. As industries prioritize durability, safety, and efficiency, the adoption of 20-25 inch solid tires is fueling the growth of the solid tire market, meeting the demands of heavy-duty applications.

The curled on solid tires segment held the largest share of the market. Curled-on solid tires are driving the growth of the solid tire market by offering enhanced durability, safety, and performance in demanding industrial applications. These tires are designed with an extra layer of protection that helps prevent wear and tear, making them ideal for heavy-duty vehicles like forklifts, construction machinery, and industrial transport. The curled-on design ensures a tighter, more secure fit on the wheel, reducing the risk of slippage or separation during operation, which is critical for safety in environments where tire failure can lead to costly delays or accidents.

In addition, the rising focus on sustainability is pushing industries toward solid tires that last longer and produce less waste. Curled-on solid tires meet this need by offering extended service life, which minimizes tire disposal and replacement frequency. As industries continue to prioritize efficiency, safety, and sustainability, the demand for curled-on solid tires is expected to drive the growth of the solid tire market.

North America dominated the solid tire market. In North America, the expanding industrial and construction sectors, along with the rising demand for material handling equipment, are driving significant growth in the solid tire market. The ongoing industrial expansion, particularly in the construction and manufacturing industries, creates a need for durable, reliable tires that can withstand demanding conditions. Solid tires, known for their resistance to punctures and robustness, are well-suited to handle the heavy loads and challenging terrains typical in these sectors. Their ability to perform reliably in harsh environments reduces downtime and maintenance costs, making them an attractive option for industrial applications.

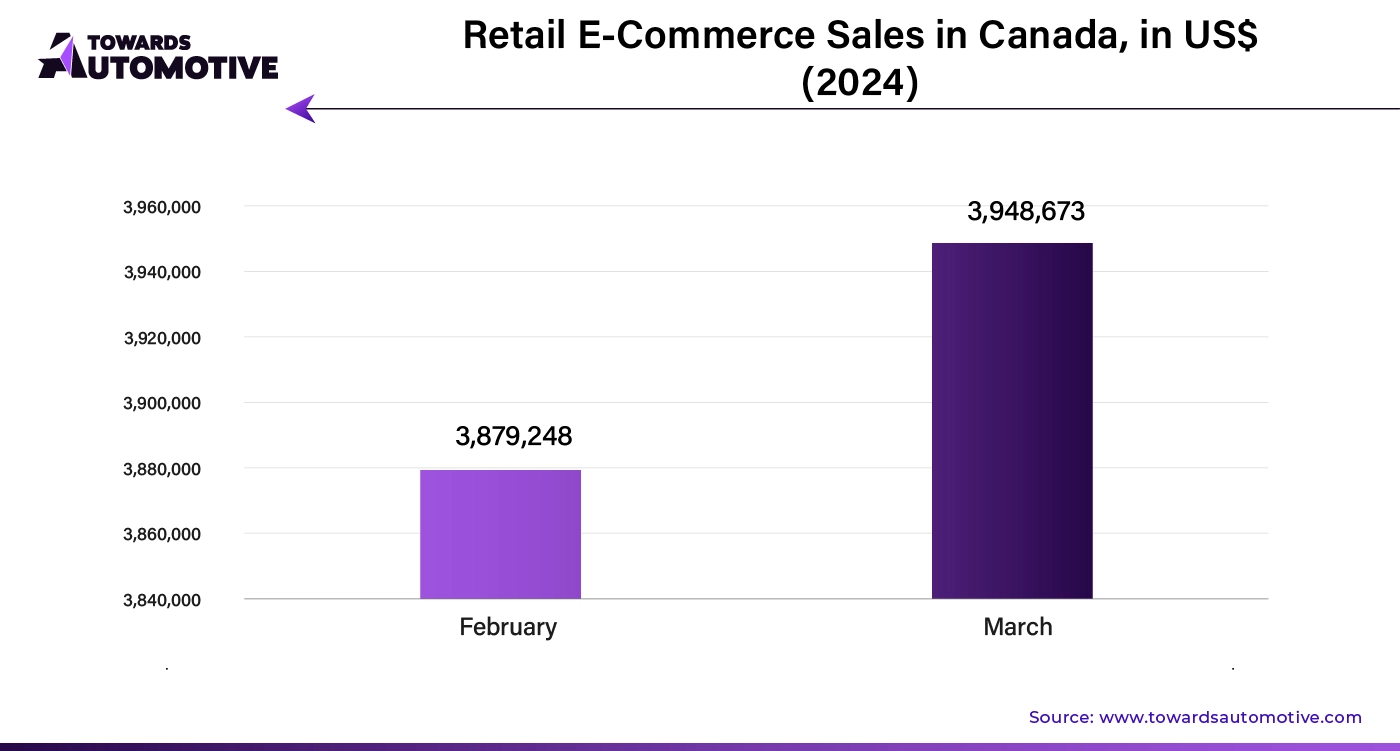

Simultaneously, the growing demand for material handling equipment, such as warehouse machinery, further fuels the market. The rise of e-commerce and increased logistics activities have intensified the need for efficient and durable tires in warehouses and distribution centers. Solid tires provide the necessary durability and low maintenance required for high-traffic environments, ensuring consistent performance and reducing operational interruptions.

The combination of increased industrial and construction activities and the expanding use of material handling equipment in North America generates a strong demand for solid tires. As businesses seek to improve productivity and reduce operational costs, they turn to solid tires for their reliability and long service life. This growing need for high-performance tires is propelling the solid tire market forward, with manufacturers continuously innovating to meet the demands of these dynamic sectors.

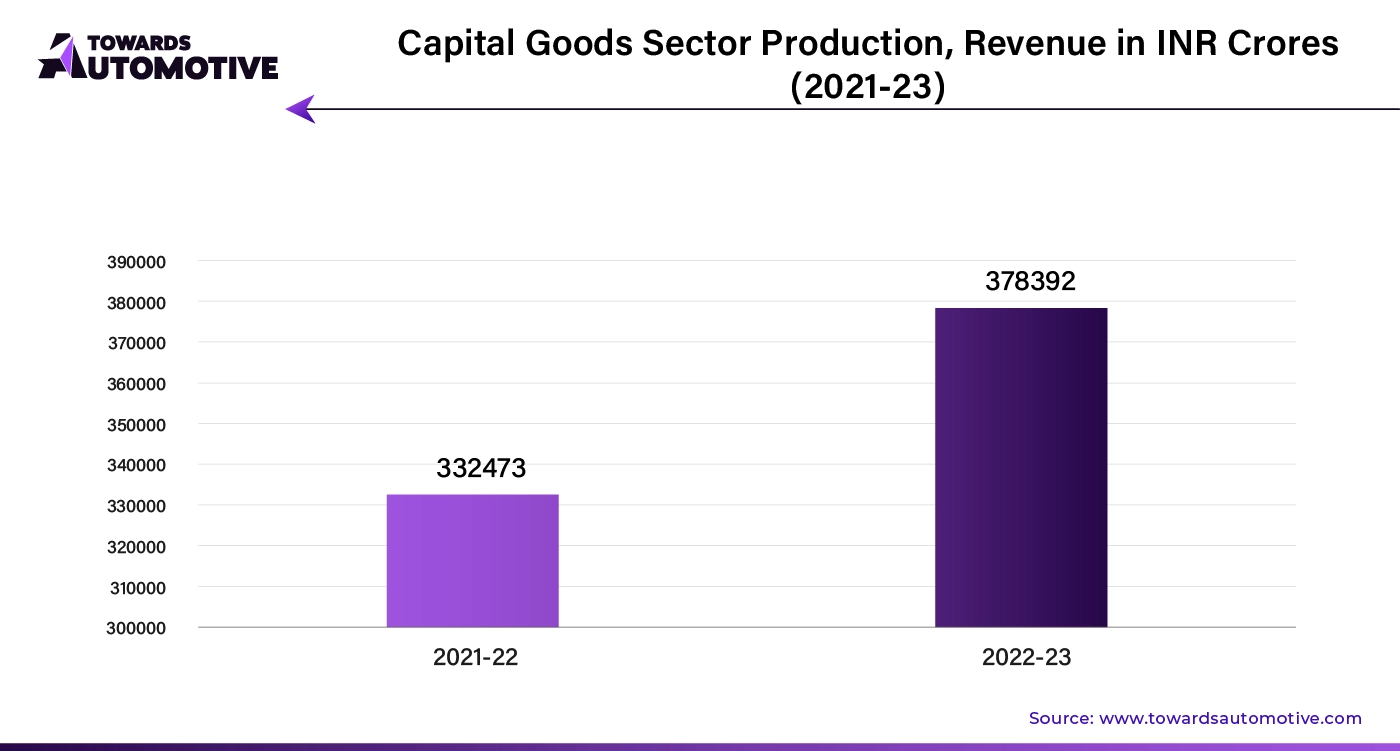

Asia Pacific is expected to grow with a significant CAGR during the forecast period. In Asia Pacific, infrastructure development projects, rapid industrialization and urbanization, and technological advancements are significantly driving the growth of the solid tire market. Large-scale infrastructure projects, such as road construction, urban expansion, and industrial facility development, require robust tires that can endure demanding conditions. Solid tires are known for their durability and resistance to punctures, are increasingly utilized in construction and heavy machinery to enhance performance and minimize maintenance.

Rapid industrialization and urbanization across the region further boost demand for solid tires. As cities grow and industrial activities escalate, the need for reliable, high-performance tires becomes critical. The rise in manufacturing, logistics, and warehousing operations necessitates the use of solid tires in material handling equipment such as forklifts and automated guided vehicles (AGVs). These tires are favored for their ability to handle heavy loads and high-traffic conditions, making them ideal for bustling industrial environments.

Technological advancements also contribute to market growth by improving the design and performance of solid tires. Innovations in tire materials and manufacturing processes enhance durability and efficiency, meeting the evolving needs of various industries. As technology continues to advance, manufacturers develop more resilient and efficient solid tires, driving further adoption in the Asia Pacific region.

By Product Type

By Type

By Construction

By Application

By Vehicle Type

By Rim Size

By Utility

By Region

April 2025

April 2025

April 2025

March 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us