April 2025

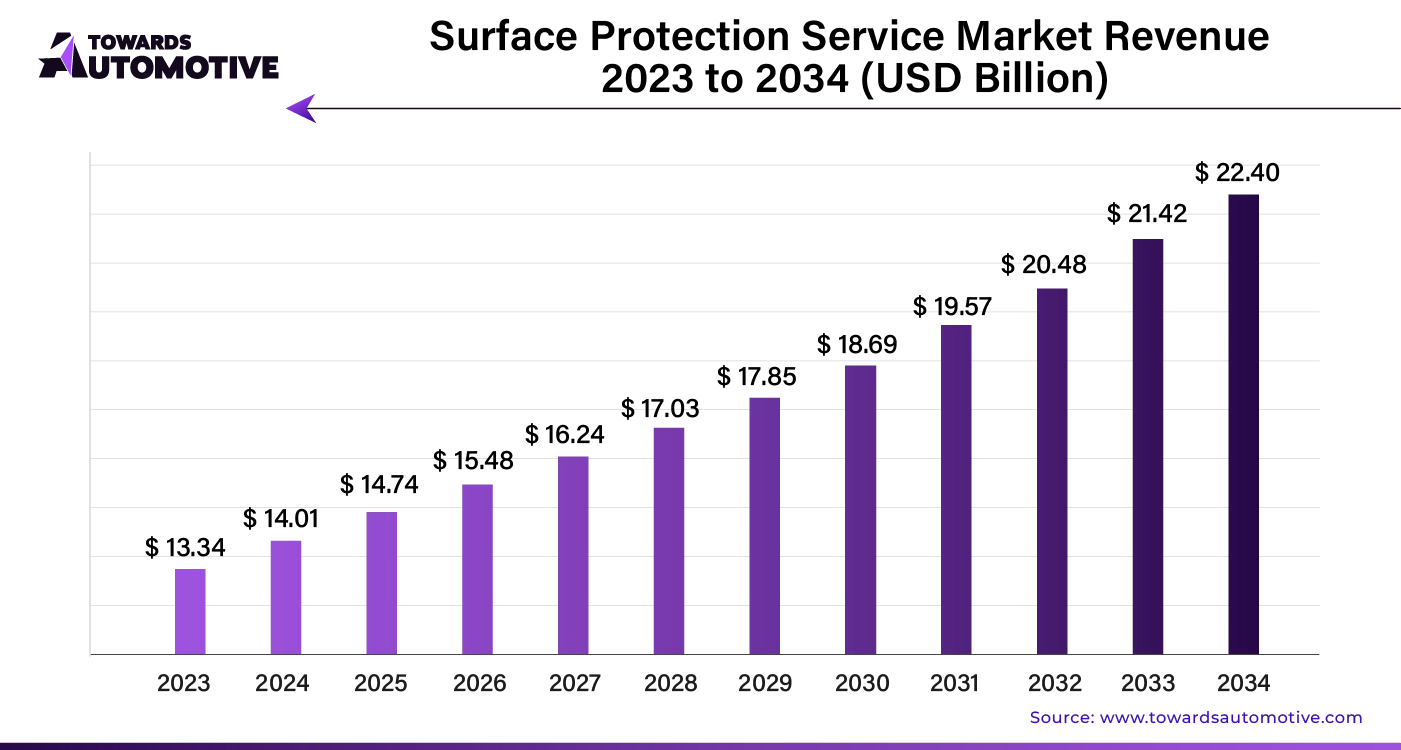

The global surface protection service market size is calculated at USD 14.01 billion in 2024 and is expected to be worth USD 22.40 billion by 2034, expanding at a CAGR of 5.13% from 2023 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The demand for surface protection services is increasing as industries and consumers prioritize preserving surface integrity, especially in high-traffic or harsh environments. Sustainability concerns are also driving the market, with companies seeking eco-friendly solutions that use biodegradable materials, reduce energy consumption, and support responsible disposal practices. These factors are propelling the need for advanced surface protection strategies. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The automotive sector's emphasis on enhancing vehicle aesthetics, durability, and longevity is driving the need for surface protection services. Solutions like paint protection films and ceramic coatings are becoming essential for shielding automotive surfaces from scratches, UV damage, and contaminants.

Surface protection services are increasingly adopted in industrial sectors such as aerospace, marine, and machinery. These services are vital for extending equipment lifespan, preventing corrosion, and improving operational efficiency.

As electronic devices proliferate, there's a growing demand for surface protection to safeguard delicate components from moisture, dust, and other contaminants, ensuring their performance and longevity.

Urban areas are facing a rise in graffiti vandalism, leading to higher demand for anti-graffiti surface protection. These services enable easy removal of graffiti without damaging the underlying surfaces.

The packaging industry is adopting more sustainable materials and practices. Surface protection services play a critical role in extending the shelf life of eco-friendly packaging, such as paper-based products, by offering barrier coatings that protect against moisture, oxygen, and UV radiation.

Artificial Intelligence (AI) is revolutionizing the surface protection services market by driving efficiency and precision. Through AI-driven predictive maintenance, companies can anticipate and prevent surface damage, reducing costs and enhancing durability. AI also enables real-time monitoring, allowing for immediate detection of wear and tear, which improves response times and minimizes downtime. Moreover, AI's ability to analyze vast amounts of data helps in customizing protection solutions tailored to specific surfaces, ensuring optimal performance.

These advancements not only increase the lifespan of materials but also align with sustainability goals by reducing waste. As industries increasingly adopt AI-driven technologies, the surface protection services market is poised for significant growth, driven by the promise of enhanced performance, cost savings, and sustainability.

The supply chain in the surface protection services market is centered on efficiency, sustainability, and timely delivery. Raw materials, such as eco-friendly coatings and protective films, are sourced from reliable suppliers who emphasize sustainable practices. These materials are then transported to specialized facilities, where they undergo quality checks before being processed into final products.

Next, these finished products are distributed to service providers who apply them across various industries, including construction, automotive, and aerospace. Logistics play a crucial role, ensuring that products reach their destinations on time, minimizing delays and potential disruptions. Additionally, advancements in tracking technology and data analytics enable real-time monitoring of supply chain activities, further enhancing operational efficiency.

Collaboration among suppliers, manufacturers, and service providers is vital to maintaining a seamless supply chain, ensuring that high-quality surface protection solutions are consistently delivered to end-users. As awareness of surface preservation and eco-friendly solutions grows, the supply chain will increasingly prioritize sustainable practices and innovation, driving the market forward.

The surface protection service market thrives on the contributions of several key components, each playing a crucial role in the ecosystem. Core components include protective films, coatings, and tapes, which are essential for safeguarding surfaces across industries such as construction, automotive, and electronics. These products help extend the lifespan of materials by preventing damage from environmental factors, abrasion, and chemical exposure.

Leading companies like 3M, Dow, and Avery Dennison drive innovation in this market by developing advanced materials and technologies. 3M's expertise in adhesives and films, for example, ensures the reliability and effectiveness of protective solutions. Dow contributes with its high-performance coatings, offering durability and versatility. Avery Dennison, known for its specialty materials, adds value through its customizable solutions tailored to specific industry needs.

These companies not only supply the necessary materials but also provide expertise and technical support, enabling seamless integration into various applications. Their continuous innovation and commitment to sustainability are vital in pushing the surface protection service market forward, meeting the growing demand for eco-friendly and effective solutions.

Corrosion Protective Coating Systems to Capture 63.80% Market Share in 2024

Corrosion protective coating systems are set to dominate the surface protection service market, accounting for 63.80% of the market share in 2024. This growth is fueled by increasing demand from industries such as oil & gas, marine, and automotive. Advancements in coating technologies, including nanocoatings and self-healing coatings, are driving market expansion by offering enhanced protection and durability. End-users are prioritizing these coatings to extend asset lifespan and minimize maintenance costs.

Process Vessels, Equipment & Rigs to Lead the Market with 41.20% Share in 2024

In 2024, process vessels, equipment, and rigs will lead the market with a 41.20% share. This segment’s growth is driven by rising investments in industrial infrastructure, particularly in chemical processing and manufacturing sectors. The oil & gas industry significantly contributes to this demand, focusing on safeguarding offshore platforms, pipelines, and refineries from corrosion and harsh environmental conditions.

United States: Rapid Growth Driven by Infrastructure and Industry

The surface protection service market in the United States is projected to grow at an impressive CAGR of 29.8% through 2034. This growth is fueled by the government’s emphasis on infrastructure development, significantly boosting the demand for surface protection across various sectors. Additionally, the flourishing manufacturing and energy industries drive the need for protective solutions for equipment and facilities. With rising awareness of the risks associated with corrosion and wear, there is an increasing adoption of advanced coating materials and application techniques to ensure effective and efficient protection.

United Kingdom: Aging Infrastructure and Renewable Energy Focus

In the United Kingdom, the surface protection service market is expected to expand at a CAGR of 11.2% through 2034. The need to maintain aging infrastructure, particularly in the transportation and energy sectors, is a primary driver. The country's focus on renewable energy, such as wind farms, also heightens the demand for protective solutions. Strict safety regulations further mandate the use of surface protection across various applications. Technological advancements from global markets are also contributing to the growth of the sector in the UK.

China: Booming Infrastructure and Manufacturing Sectors

China’s surface protection service market is forecasted to grow at a CAGR of 26.3% through 2034, driven by the nation’s ambitious infrastructure development projects. The rapidly expanding manufacturing sector significantly contributes to the demand for protective solutions for industrial equipment. Accelerated urbanization across China also increases the need for protective measures for buildings and infrastructure, while growing awareness of safety and quality standards further supports market expansion.

Japan: High-Tech Industries and Quality Control

Japan’s surface protection service market is set to rise at a CAGR of 12.7% through 2034. The country’s focus on high-tech industries, including automotive and electronics, necessitates the use of advanced protective solutions. The ongoing need to maintain aging infrastructure across various sectors also fuels demand. Japan’s emphasis on quality control ensures a consistent demand for high-performance protection solutions, while its leadership in innovative coating technologies continues to drive market growth. Environmental awareness is further leading to the adoption of eco-friendly solutions.

Germany: Sustainability and Innovation in Manufacturing

Germany’s surface protection service market is anticipated to grow at a 15.8% CAGR through 2034. The country’s robust manufacturing sector, known for its high-quality standards, generates substantial demand for reliable surface protection solutions. Germany’s commitment to sustainability propels the demand for eco-friendly and resource-efficient protection technologies. As a leader in developing innovative protection solutions, Germany continues to advance the effectiveness and efficiency of surface protection services.

The surface protection service industry is witnessing rapid innovation, with companies developing next-generation coatings that offer superior performance, enhanced durability, and environmental benefits. Advances in nanotechnology, self-healing properties, and specialized functionalities are driving the creation of transformative solutions.

The growing emphasis on sustainability is pushing companies to adopt eco-friendly practices. Businesses are focusing on creating environmentally conscious formulations, reducing waste, and exploring circular economy models to lessen their environmental impact and meet the demands of eco-conscious clients.

Strategic mergers and acquisitions are allowing industry leaders to broaden their service offerings and expand their global presence. Companies are also collaborating with research institutions, startups, and even competitors to tackle complex challenges and deliver innovative solutions.

Focusing on specialized niches, businesses are offering tailored solutions for specific needs, such as concrete protection, high-temperature environments, or temporary protection during construction. This approach fosters innovation and addresses diverse client requirements. Additionally, regional players are adapting to local regulations and challenges, delivering culturally relevant solutions and strengthening relationships with local clients to enhance their competitive advantage.

By Product Type

By Application

By Region

April 2025

April 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us