April 2025

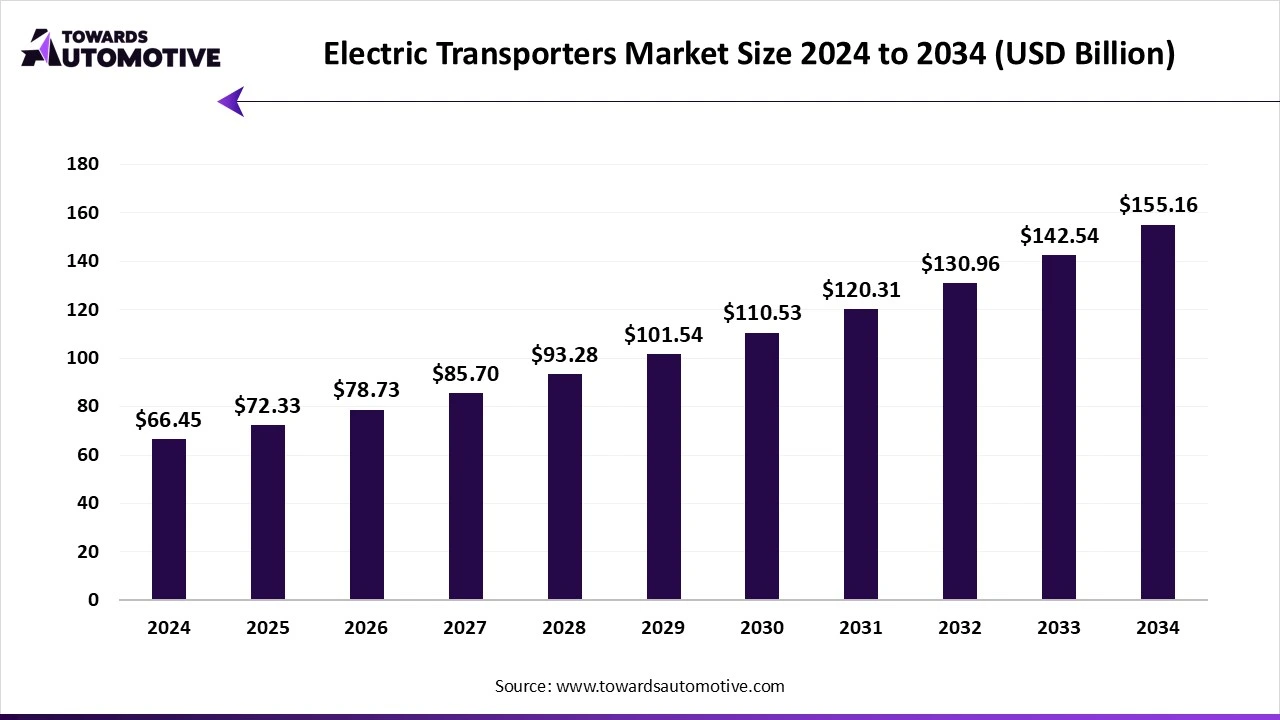

The electric transporters market is predicted to expand from USD 72.33 billion in 2025 to USD 155.16 billion by 2034, growing at a CAGR of 8.85% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The electric transporters market is a significant branch of the automotive industry. This industry deals in manufacturing and distribution of vehicles that run on electricity. There are various types of vehicles developed in this sector consisting of electric trucks, electric buses, electric vans, electric scooters, electric bikes and some others. These vehicles are powered by different types of batteries comprising of lithium-ion, lead-acid, solid-state, nickel hydride and some others. The end-users of this sector includes public transport, freight and logistics, personal use and some others. The growing adoption of electric trucks in different regions of the world has boosted the market expansion. This market is expected to rise significantly with the growth of the EV sector around the globe.

| Metric | Details |

| Market Size in 2024 | USD 66.45 Billion |

| Projected Market Size in 2034 | USD 155.16 Billion |

| CAGR (2025 - 2034) | 8.85% |

| Leading Region | North America |

| Market Segmentation | By Type, By Technology, By Battery Type, By End-Use and By Region |

| Top Key Players | Onewheel, General Motors, Polestar, AllCell Technologies LLC, BMW Motorrad International, BOXX Corporation, Kiwano, Ninebot Inc. |

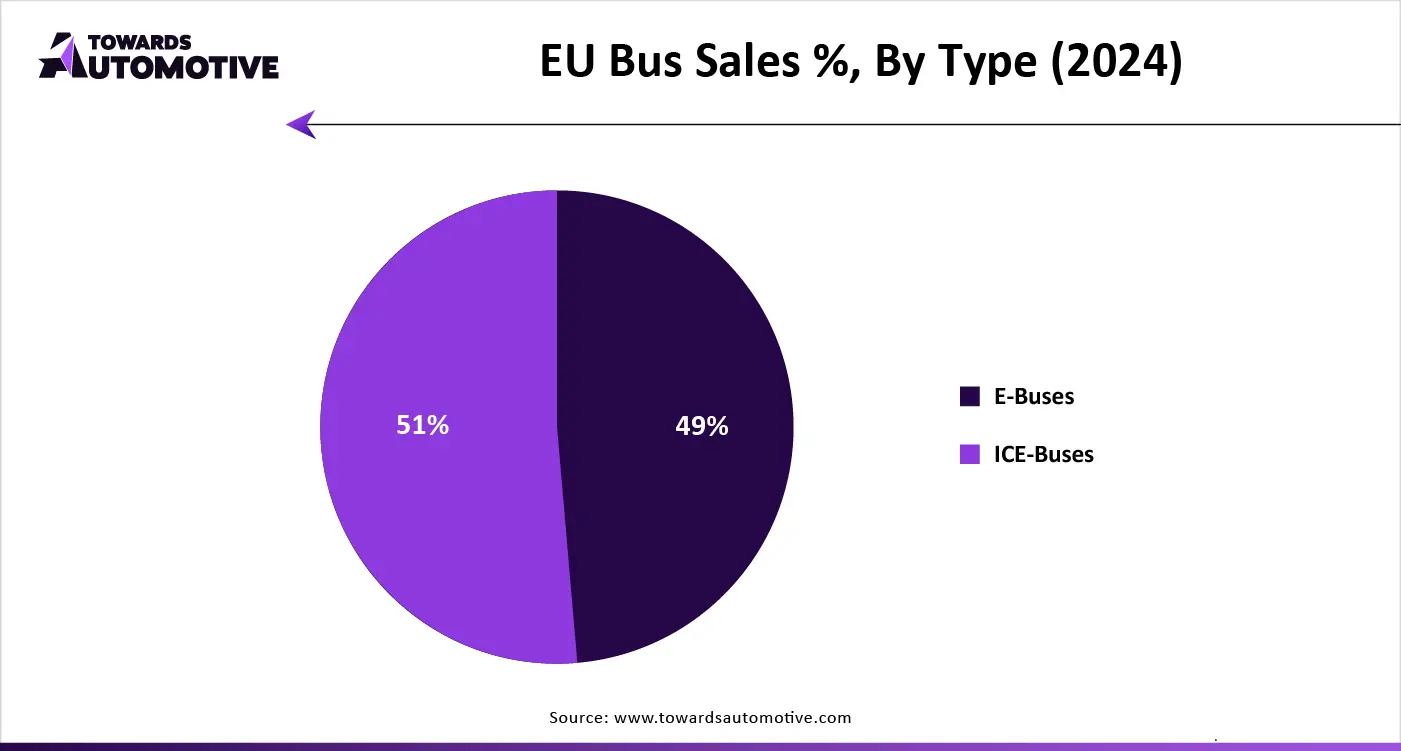

The electric bus segment held a dominant share of the market. The growing adoption of electric buses in airports for shuttle operations has driven the market expansion. Also, government of various countries such as India, EU, U.S. and some others have started integrating e-buses in their fleets to provide eco-friendly transportation to the people, thereby driving the industrial growth. Moreover, the rising investment by EV companies for developing modern E-buses along with launches of e-buses in different regions further propels the market growth.

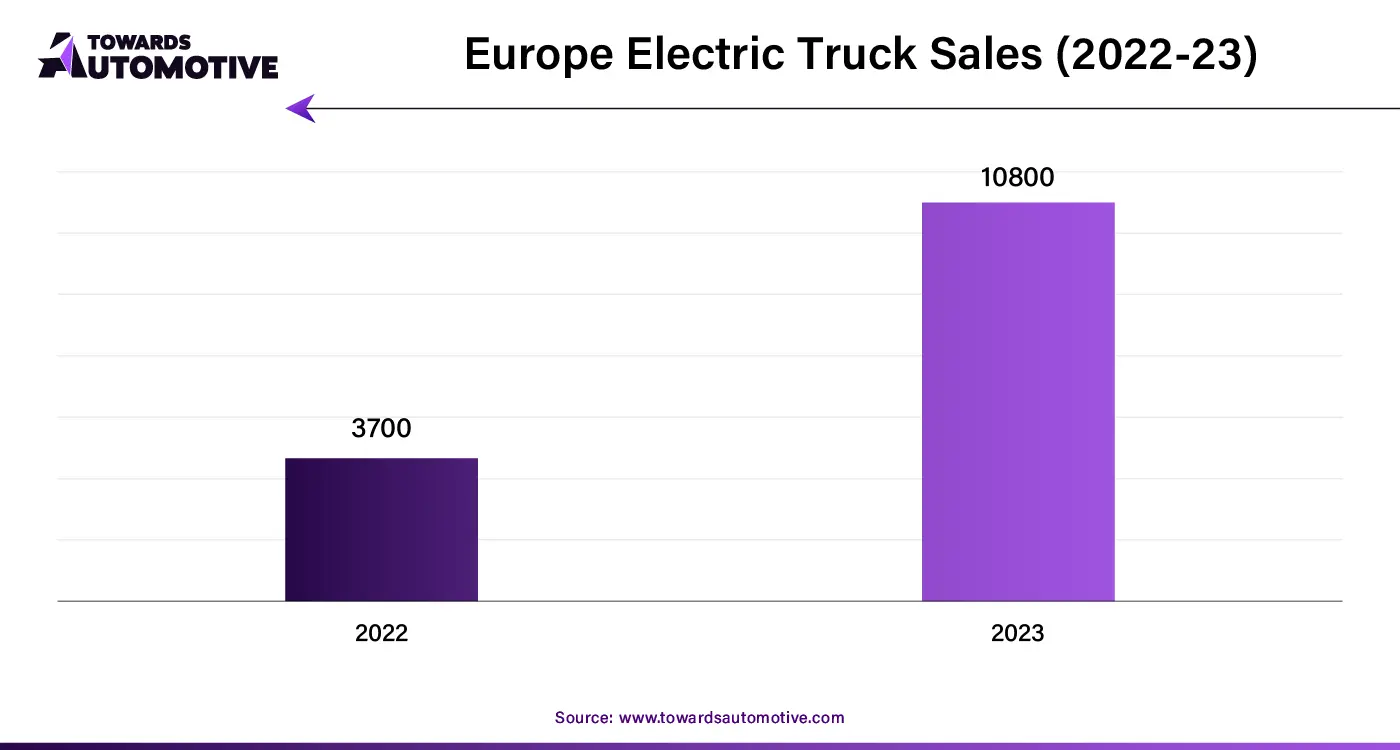

The electric truck segment is predicted to grow with a significant growth rate during the forecast period. The growing adoption of e-trucks by e-commerce brands such as Amazon and Walmart has boosted the market growth. Also, the rising prices of diesel in advanced nations such as the U.S. and UK coupled with advancements in hybrid technology is projected to drive the industrial expansion. Additionally, the market players of electric trucks are developing trucks with advanced technologies to cater the demands of the end-users, thereby fostering the growth of the electric transporters market.

The BEVs segment led the industry. The growing emphasis on reducing CO2 emission along with technological advancements in EV sector propels the market growth. Also, rising government initiatives for strengthening the EV charging infrastructure along with rapid investment by startup companies accelerates the industrial expansion. Moreover, several developments in the battery industry as well as improvements in battery management system is projected to boost the growth of the electric transporters market.

The HEVs segment is anticipated to rise with the highest growth rate during the forecast period. The growing demand for fuel-efficient vehicles in different parts of the world has boosted the market growth. Also, advancements in hybrid technology along with rapid investment by truck manufacturers for developing hybrid powertrains is crucial for the industrial expansion. Moreover, the rising adoption of PHEVs by fleet operators for reducing emission fosters the growth of the electric transporters market.

The lithium-ion segment held the lion’s share of the market. The growing use of li-ion batteries in EVs due to its superior life and high energy density drives the market expansion. Also, government of several countries such as the U.S. and UK have started li-ion battery recycling programs to reduce emission, thereby shaping the industry in a positive direction. Additionally, rapid investment in battery industry coupled with technological advancement in lithium mining sector has boosted the market growth.

The lead-acid segment is anticipated to register a considerable growth rate during the forecast period. The rising adoption of lead-acid batteries in short-range EVs has driven the market growth. Also, the growing investment by battery companies for opening new manufacturing plants along with rise in research and developments activities related to lead-acid batteries further boosts the industrial expansion. Moreover, the increasing demand for these batteries due to its cost-effectiveness, temperature resistance, reliability and some others is predicted to drive the growth of the electric transporters market.

The freight and logistics segment dominated the industry. The growing adoption of electric trucks by logistics sector for transporting goods in different parts of the world has fostered the industrial expansion. Also, the rising emphasis of freight providers on adopting sustainable transportation along with rapid investment in logistics industry is driving the market growth. Additionally, numerous logistics brands are partnering with EV companies for deploying e-trucks in their daily operations is likely to boost the growth of the electric transporters market.

The personal use segment is likely to rise with a notable CAGR during the forecast period. The rising awareness of C02 emission among individuals has driven the market expansion. Additionally, subsidies and tax-benefits provided by government for adopting electric vehicles is shaping the industry in a positive direction. Moreover, the growing popularity of electric skateboards and electric ROVs among youths is boosting the growth of the electric transporters market.

North America held the highest share of the electric transporters market. The rising demand for EVs among the people of the U.S. and Canada to mitigate CO2 emission propels the market growth. Also, the rising investment by government for strengthening the EV charging infrastructure coupled with presence of several EV brands drives the market expansion in this region.

The U.S. is a major contributor of this region. In U.S., this industry is generally driven by the surge in demand for sustainable transportation coupled with rapid investment in EV battery manufacturing sector. Also, the rising adoption of electric buses in schools and government offices along with presence of well-established charging infrastructure is driving the market growth.

Europe is expected to grow with a significant CAGR during the forecast period. The growing adoption of eco-friendly transportation solution in countries such as UK, Germany, France, Italy and some others has bolstered the market growth. Also, technological advancements in wireless EV charging infrastructure coupled with rapid investment in EV manufacturing by large and small companies helps the industry to grow significantly.

UK and Germany are the prominent countries that contributes significantly to the market. In UK, the market is generally driven by the rising adoption of electric trucks in various sector such as mining, e-commerce, construction and some others. In Germany, the presence of several EV brands such as BMW, Mercedes, Audi and some others propels the market expansion.

The electric transporters market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of BYD, Onewheel, General Motors, Polestar, AllCell Technologies LLC, BMW Motorrad International, BOXX Corporation, Kiwano, Ninebot Inc., Razor USA LLC and some others. These companies are constantly engaged in developing electric transporters and adopting numerous strategies such as product launches, collaborations, joint venture, partnerships, business expansion, acquisition, and some others to maintain their dominant position in this industry. For instance, in July 2024, Onewheel launched Onewheel GT-S Series Rally Edition. GT-S is a range of self-balancing electric skateboard that is integrated with a 6-inch hub motor and superior performance tire. Also, in July 2024, Ninebot launched a range of e-bikes consisting of E300SE, E125S and E110S. These e-bikes are designed for the urban people of Australia.

By Type

By Technology

By Battery Type

By End-Use

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us