April 2025

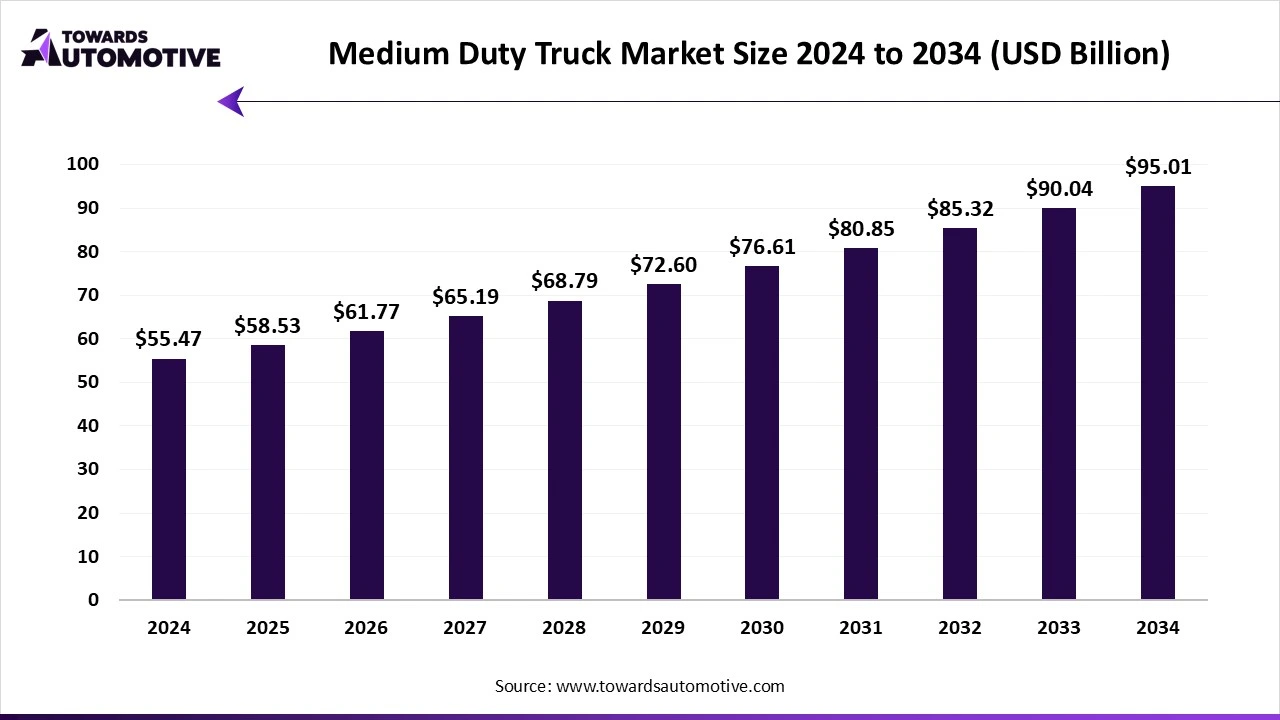

The medium duty truck market is expected to increase from USD 58.53 billion in 2025 to USD 95.01 billion by 2034, growing at a CAGR of 5.53% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The medium duty truck market is a prominent sector of the automotive industry. This industry deals in manufacturing and distribution of medium duty trucks across the world. These trucks are powered by different kinds of fuel consisting of diesel, natural gas, hybrid, electric, gasoline and some others. It finds application in various sectors including construction and mining, freight and logistics, and some others. The rising development in logistics sector has played a crucial role in shaping the industrial landscape. This market is expected to grow significantly with the rise of the electric vehicle industry in different parts of the world.

| Metric | Details |

| Market Size in 2024 | USD 55.47 Billion |

| Projected Market Size in 2034 | USD 95.01 Billion |

| CAGR (2025 - 2034) | 5.53% |

| Leading Region | North America |

| Market Segmentation | By Fuel, By Horsepower, By Battery Type and By Region |

| Top Key Players | BharatBenz, Ford, Ashok Leyland, Eicher Motors Limited, Tata Motors Limited |

The diesel segment held a dominant share of the market. The rising demand for high-performance trucks for operating heavy-duty operations has boosted the market growth. Also, the growing use of diesel-powered trucks due to its enhanced fuel-efficiency and reliability coupled with the surge in demand for medium duty trucks in e-commerce sector is crucial for the industrial expansion. Moreover, rapid investment by automotive companies for developing diesel-powered trucks is anticipated to propel the growth of the medium duty truck market.

The electric segment is predicted to grow with the fastest CAGR during the forecast period. The rising consumer awareness for reducing emission in the environment has boosted the market expansion. Also, numerous government initiatives aimed at strengthening the EV charging infrastructure coupled with technological advancements in battery industry propels the market growth. Moreover, several electric truck companies such as Volvo, BYD, Tata Motors, Isuzu and some others are launching new medium-duty electric trucks, thereby fostering the growth of the medium-duty truck market.

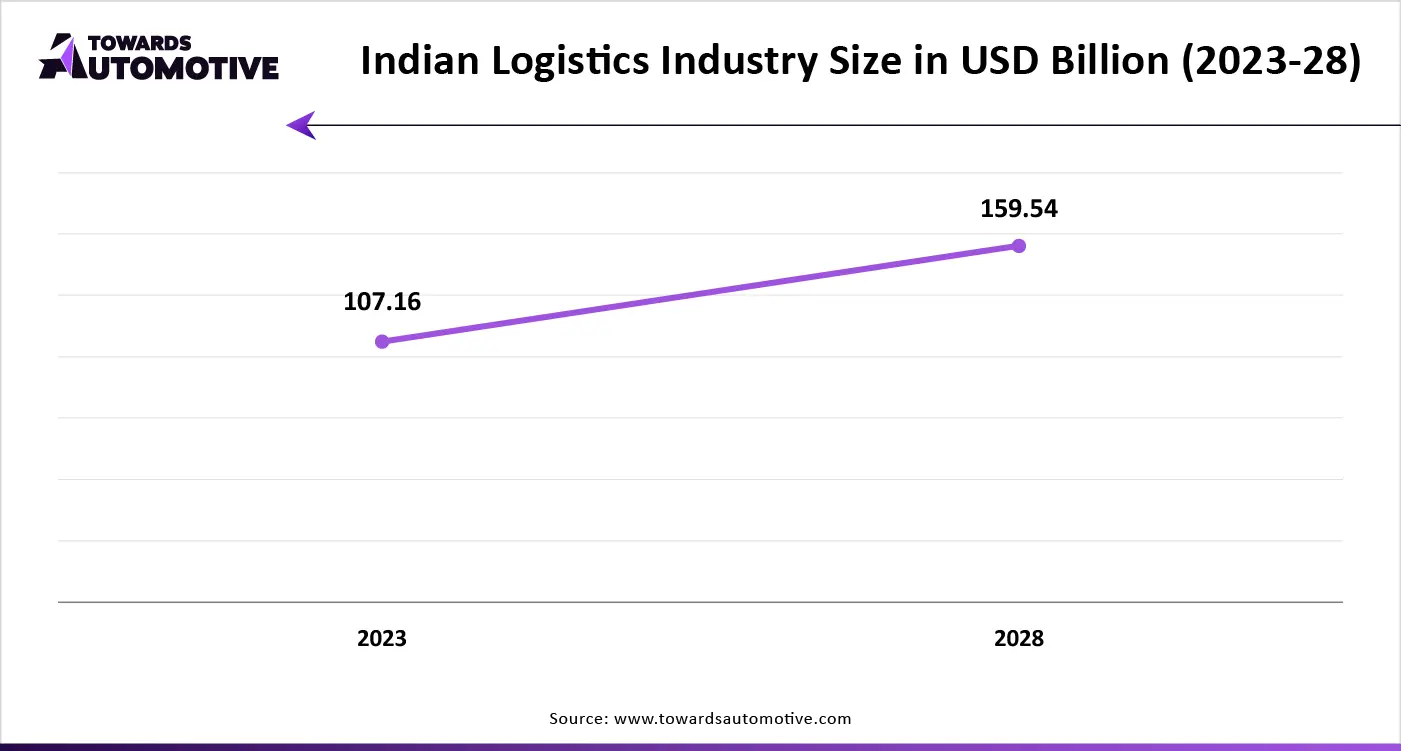

The freight & logistics segment held the lion’s share of the market. The rising application of medium-duty trucks in logistics sector for transporting e-commerce products has boosted the market growth. Also, increasing trend of last-mile delivery in urban centers coupled with rapid investment by government for providing superior logistics services in isolated areas drives the industry in a positive direction. Moreover, the increasing adoption of electric trucks in freight and logistics sector is expected to propel the growth of the medium duty truck market.

The construction & mining segment is likely to grow with the fastest growth rate during the forecast period. The rise in number of residential constructions in different parts of the world has boosted the market expansion. Also, rapid investment by government for strengthening the mining sector is crucial for the industrial growth. Moreover, growing use of autonomous trucks in construction and mining sector is expected to propel the growth of the medium duty truck market.

North America held the highest share of the medium duty truck market. The rising development in the e-commerce sector has increased the demand for superior logistics operations, thereby driving the market expansion. Additionally, the rising government initiatives aimed at strengthening the mining sector coupled with presence of well-established charging infrastructure propels the market growth. Also, rise in number of research and development activities related to hydrogen-fuel cells trucks is contributing significantly to the market development. Furthermore, the presence of several automotive brands along with rapid investment in EV industry by market players is driving the market growth in this region.

The U.S. is the major contributor of this industry. In U.S., the market is generally driven by the increasing development in the online shopping sector along with rise in number of fleet operators propels the market growth. Also, surge in demand for electric trucks coupled with rapid infrastructural development has boosted the market expansion. Moreover, the presence of various market players such as Kenworth, Paccar, Fargo Trucks, Rizon and some others is projected to foster the growth of the medium duty truck market in the U.S.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The rise in number of coal mines and gold mines across countries such as India, China, Japan, South Korea and some others has boosted the market growth. Also, rapid investment by startup companies for developing hybrid trucks to cater the demands of the logistics sector drives the market expansion. Moreover, surge in demand for electric trucks from the municipalities to curb emission further propels the growth of the medium duty truck market in this region.

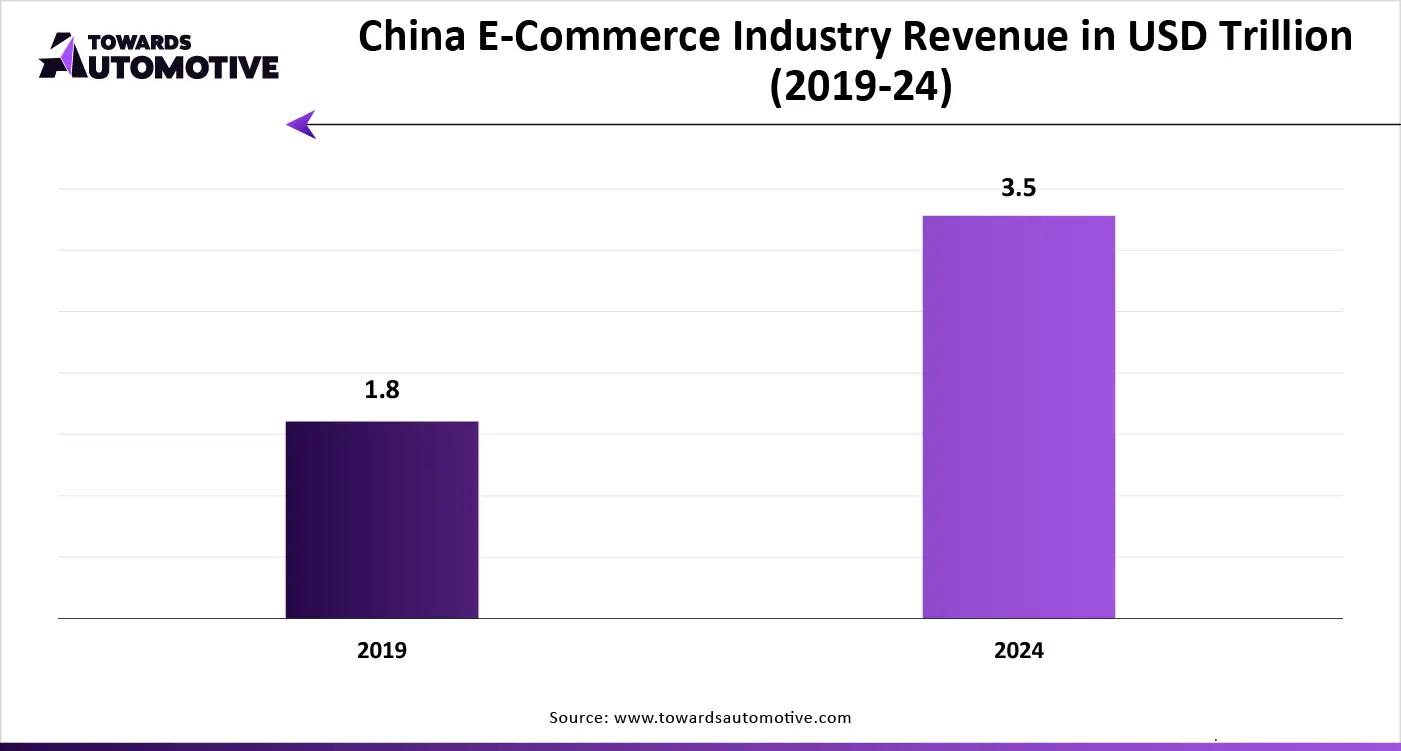

China held the largest market share in this region. In China, the rising sales of electric trucks along with growing e-commerce sales through platforms such as Alibaba, Pinduoduo, Little Red Book and some others has boosted the market expansion. Additionally, the presence of numerous truck companies such as Sinotruk, Dongfeng, FAW Jiefang and some others drives the industrial in a positive direction. Moreover, the increasing disposable income coupled with availability of raw materials at low prices is projected to boost the market growth.

The medium duty market is a highly competitive industry with the presence of several dominating players. Some of the prominent companies in this industry consists of Hino Motors, BharatBenz, Ford, Ashok Leyland, Eicher Motors Limited, Tata Motors Limited, Daimler Trucks, Isuzu Motors, Navistar, Freightliner and some others. These companies are constantly engaged in developing electric transporters and adopting numerous strategies such as collaborations, joint venture, product launches, partnerships, business expansion, acquisition, and some others to maintain their dominant position in this industry. For instance, in May 2024, Isuzu North America Corp launched an EV-based medium-duty truck. This truck is integrated with acclera powertrain to reduce emission in the environment. Also, in March 2023, Hino Motors launched M- and L- Series medium duty trucks. These medium-duty trucks are integrated with SEA Electric's SEA-Drive power system.

By Fuel

By Horsepower

By Battery Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us