March 2025

Senior Research Analyst

Reviewed By

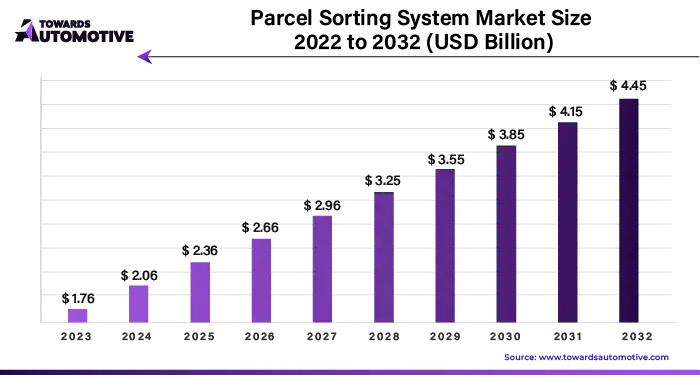

The parcel sorting system market is expected to grow from USD 2.09 billion in 2025 to USD 4.51 billion by 2034, with a CAGR of 8.94% throughout the forecast period from 2025 to 2034.

Parcel sorting systems are essential components of modern logistics and supply chain operations, enabling efficient handling and distribution of parcels across various industries. These systems utilize advanced technologies such as robotics, artificial intelligence (AI), machine learning (ML), and optical scanners to sort and route parcels accurately and quickly. Their integration has become increasingly vital with the rapid growth of e-commerce, which has significantly increased the volume of parcels handled by logistics companies. Automated sorting systems enhance operational efficiency by minimizing manual intervention, reducing errors, and speeding up the sorting process, ensuring timely deliveries and improved customer satisfaction.

The adoption of parcel sorting systems is driven by the demand for same-day and next-day delivery services, especially in urban areas. Retailers and logistics providers are investing in advanced sorting technologies to streamline operations, optimize delivery routes, and reduce costs. Additionally, these systems play a key role in sustainability efforts by improving resource utilization and minimizing energy consumption.

Emerging markets, particularly in Asia Pacific and Latin America, are witnessing a surge in the implementation of parcel sorting systems due to the growing e-commerce industry and expanding logistics networks. As technology evolves, these systems are becoming more sophisticated, paving the way for greater efficiency and innovation in the global supply chain.

Artificial Intelligence (AI) plays a transformative role in enhancing the efficiency and accuracy of parcel sorting systems. By integrating AI algorithms and machine learning models, these systems can process vast amounts of data in real time, enabling intelligent decision-making and automation in sorting operations. AI-powered systems optimize the identification, classification, and routing of parcels based on factors such as size, weight, destination, and delivery timelines, ensuring seamless processing even during peak demand periods.

One of the most significant advantages of AI in parcel sorting is its ability to improve accuracy and reduce errors. Computer vision and AI-powered scanners can identify and read labels, barcodes, and QR codes faster and more precisely than traditional methods. Additionally, predictive analytics powered by AI allows sorting systems to anticipate and adapt to fluctuations in parcel volumes, ensuring efficient resource allocation and minimizing delays.

AI also facilitates real-time tracking and monitoring, enabling logistics providers to offer customers enhanced transparency and visibility into the delivery process. Advanced AI systems can even identify and address potential bottlenecks in the sorting process, streamlining operations and reducing costs. As e-commerce and same-day delivery demands grow, the role of AI in parcel sorting systems will continue to drive innovation, efficiency, and scalability in global logistics.

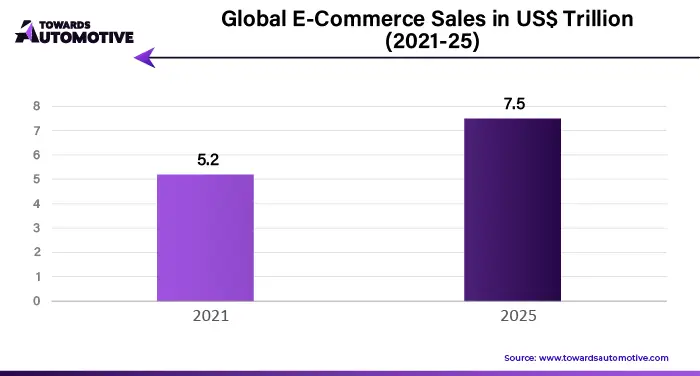

The rising trend of e-commerce is a key driver of growth for the parcel sorting system market, as it has dramatically increased the volume of parcels requiring efficient handling and distribution. With more consumers shifting to online shopping, especially for convenience and accessibility, logistics and supply chain networks are under pressure to process and deliver parcels faster and more accurately. This demand has led to widespread adoption of advanced parcel sorting systems in fulfillment centers, warehouses, and distribution hubs to optimize operations and ensure timely deliveries.

E-commerce platforms, driven by major players like Amazon, Alibaba, and Flipkart, have Fed the need for automated sorting solutions to manage peak demand during events such as flash sales, festivals, and holiday seasons. Automated systems equipped with technologies like artificial intelligence (AI), machine learning (ML), and robotics enable high-speed sorting and reduce errors, helping e-commerce businesses maintain efficiency and customer satisfaction.

Furthermore, the push for same-day and next-day deliveries has highlighted the importance of accurate and fast sorting processes, making automated systems a vital investment. As the e-commerce sector continues to grow, fueled by increasing internet penetration and smartphone usage globally, the adoption of parcel sorting systems is expected to expand, driving market growth significantly.

The parcel sorting system market faces restraints primarily due to high initial investment and maintenance costs, that creates problems for small and medium-sized enterprises (SMEs) from adopting advanced systems. Additionally, the complexity of integrating automated sorting technologies with existing infrastructure can pose challenges, leading to delays and increased costs. Operational disruptions caused by system failures or malfunctions further hinder adoption. Moreover, reliance on skilled labor for system management and the slow pace of technological adoption in developing regions also limit market growth.

Cloud-based parcel sorting systems are creating significant opportunities in the parcel sorting system market by transforming traditional logistics operations into smart, efficient, and scalable processes. These systems leverage cloud computing to provide real-time data analysis, centralized management, and seamless integration with other digital tools. By enabling remote monitoring and control, cloud-based solutions allow logistics providers to optimize their operations from anywhere, enhancing flexibility and adaptability to changing demands.

One key opportunity lies in the scalability offered by cloud-based systems, which can accommodate fluctuating parcel volumes, especially during peak seasons or e-commerce sales events. This scalability ensures cost-effectiveness, as businesses can adjust their usage without investing in extensive hardware upgrades. Additionally, cloud solutions facilitate predictive maintenance by analyzing performance data, helping to reduce downtime and operational disruptions.

These systems also support better decision-making through data-driven insights, such as parcel flow trends, bottlenecks, and efficiency metrics, enabling businesses to streamline workflows. Moreover, the integration of artificial intelligence (AI) and machine learning (ML) with cloud-based platforms enhances parcel tracking and sorting accuracy, improving customer satisfaction.

The loop parcel sorting system segment held the largest share of the market. The loop parcel sorting system segment significantly drives the growth of the parcel sorting system market by offering enhanced efficiency, scalability, and versatility for managing high-volume operations. Loop sorting systems, also known as circular or recirculating systems, are designed to handle large numbers of parcels with varying shapes and sizes in a continuous loop configuration. This layout allows for seamless sorting and redistribution of parcels, minimizing bottlenecks and maximizing throughput, making them an ideal choice for large logistics hubs and e-commerce fulfillment centers.

One of the key advantages of loop parcel sorting systems is their ability to integrate advanced technologies such as barcoding, RFID, and artificial intelligence (AI). These innovations enable precise tracking, faster identification, and error-free sorting of parcels. The systems can adapt to fluctuating parcel volumes, ensuring operational continuity during peak periods, such as holiday seasons or promotional sales.

Moreover, the compact and modular design of loop sorting systems allows for efficient use of warehouse space, reducing the overall footprint without compromising capacity. Their energy-efficient operations and reduced reliance on manual labor also contribute to cost savings and sustainability, aligning with the growing focus on green logistics.

As businesses seek reliable and scalable solutions to meet increasing customer demands, loop parcel sorting systems are becoming a critical driver of market growth, particularly in high-demand sectors like e-commerce and third-party logistics (3PL).

The logistics segment led the industry. The logistics segment is a significant driver of growth for the parcel sorting system market, as it serves as the backbone for handling the increasing volumes of parcels generated by e-commerce, retail, and industrial supply chains. Efficient parcel sorting is essential for logistics companies to meet the rising demand for fast and accurate deliveries, particularly with the surge in same-day and next-day delivery services. Automated sorting systems allow logistics providers to streamline operations, minimize errors, and process high volumes of parcels efficiently, enabling them to meet tight delivery deadlines and improve customer satisfaction.

Technological advancements within the logistics sector, such as the adoption of artificial intelligence (AI), robotics, and machine learning (ML), have further enhanced the capabilities of parcel sorting systems. These innovations enable real-time parcel tracking, dynamic routing, and predictive analytics, allowing logistics providers to optimize delivery networks and reduce operational costs. Additionally, automation in sorting systems helps reduce reliance on manual labor, addressing labor shortages while improving speed and accuracy.

The expansion of global trade and cross-border e-commerce has also increased the demand for advanced parcel sorting systems in logistics hubs and distribution centers. As the logistics sector continues to prioritize efficiency and scalability, the integration of cutting-edge sorting technologies remains critical, driving the growth of the parcel sorting system market.

Asia Pacific dominated the parcel sorting system market. The parcel sorting system market in Asia Pacific is witnessing robust growth, driven by a combination of economic expansion, technological advancements, and the rapid proliferation of e-commerce. The region's booming e-commerce sector, led by countries such as China, India, Japan, and South Korea, is a significant growth factor. Increasing online retail activities have resulted in surging parcel volumes, creating a critical need for efficient and automated sorting systems to manage large-scale operations and ensure timely deliveries.

The adoption of advanced technologies, such as artificial intelligence (AI), robotics, and machine learning (ML), is also driving the market. These innovations enable faster, more accurate sorting, optimize workflows, and reduce dependency on manual labor, catering to the region’s increasing demand for same-day and next-day delivery services. Moreover, governments across Asia Pacific are heavily investing in smart logistics and infrastructure development, further boosting the demand for sophisticated parcel sorting systems in warehouses and distribution centers.

Additionally, the rapid urbanization and rise in disposable incomes in emerging economies like India and Southeast Asian nations have led to increased consumer spending on online platforms, further driving parcel volumes. This has prompted logistics providers to adopt automated sorting technologies to enhance operational efficiency and customer satisfaction.

The growing focus on sustainability in logistics is another key factor. Automated parcel sorting systems help reduce energy consumption and waste, aligning with green logistics initiatives. With a dynamic mix of technological progress, economic growth, and e-commerce expansion, the parcel sorting system market in Asia Pacific is poised for sustained growth in the coming years.

North America is expected to grow with a significant CAGR during the forecast period. The parcel sorting system market in North America is experiencing significant growth, driven by various factors. The rapid expansion of e-commerce is a primary growth driver, with major players like Amazon, Walmart, and Shopify increasing the demand for efficient and automated sorting solutions to handle rising parcel volumes. The region’s well-established logistics and supply chain infrastructure further supports the adoption of advanced parcel sorting systems to optimize operations and meet customer expectations for faster deliveries, including same-day and next-day services.

Technological advancements in automation and robotics also play a critical role in propelling market growth. North American logistics providers are increasingly deploying AI-powered and machine learning-enabled sorting systems to enhance accuracy, speed, and efficiency. These systems reduce manual labor requirements, minimize errors, and enable real-time tracking, aligning with the industry's focus on operational excellence and customer satisfaction.

The growing emphasis on sustainability in logistics is another key factor. Automated parcel sorting systems help reduce energy consumption and optimize resource utilization, supporting the shift toward environmentally friendly practices. Furthermore, the rise of omnichannel retailing, where businesses integrate online and offline sales channels, has created a need for flexible and scalable sorting solutions to manage diverse parcel flows efficiently.

Additionally, government initiatives and investments in advanced infrastructure, coupled with the increasing adoption of smart warehouses, are boosting the demand for sophisticated parcel sorting systems across the region. As e-commerce and logistics continue to grow, the North American parcel sorting system market is set to expand further, driven by innovation and the evolving needs of the industry.

By Offering

By Type

By Industry Vertical

By Region

March 2025

March 2025

March 2025

March 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us