October 2025

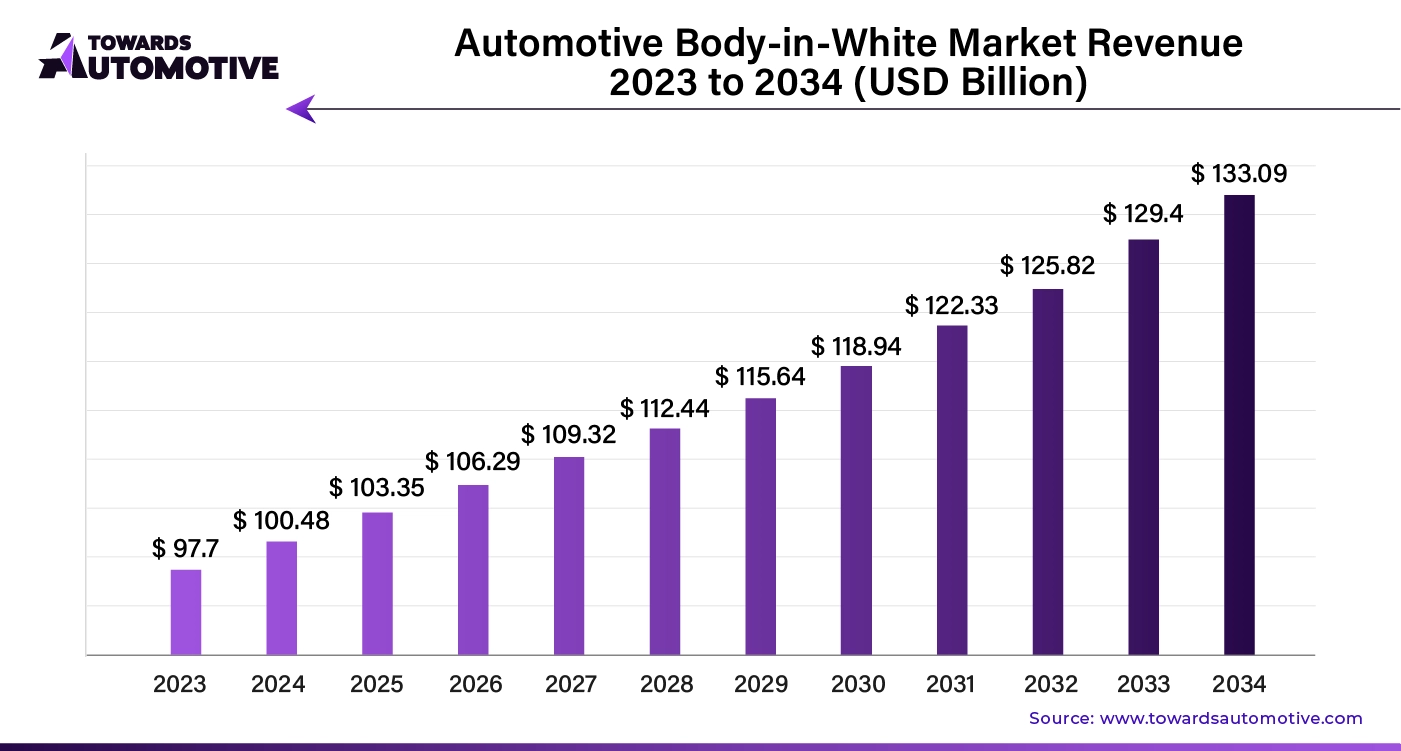

The global automotive body-in-white market size is calculated at USD 100.48 billion in 2024 and is expected to be worth USD 133.09 billion by 2034, expanding at a CAGR of 2.85% from 2024 to 2034.

The automotive body-in-white market represents a critical segment in the automotive industry, focusing on the production of the vehicle's body shell before the installation of any moving parts, such as the engine or interior components. BIW refers to the fully assembled body of a vehicle, including the frame and exterior panels, which serves as the foundational structure for all subsequent assembly processes. This segment is crucial for ensuring vehicle safety, durability, and design integrity.

The market for automotive BIW is driven by factors such as increasing vehicle production volumes, advancements in material technology, and rising demand for lightweight and fuel-efficient vehicles. Manufacturers are increasingly utilizing advanced materials, including high-strength steel, aluminum, and composite materials, to enhance the performance, safety, and fuel efficiency of vehicles. Additionally, the growing focus on electric vehicles (EVs) and autonomous driving technologies is driving demand for innovative BIW solutions that accommodate new design requirements and component integration.

Technological advancements in manufacturing processes, such as automation and robotics, are also playing a significant role in the BIW market, improving production efficiency and reducing costs. As the automotive industry continues to evolve with trends towards electrification and advanced safety features, the BIW market is expected to experience sustained growth, driven by the need for robust, high-performance vehicle structures that meet modern standards and consumer expectations.

Artificial Intelligence (AI) plays a transformative role in the automotive body-in-white market by enhancing manufacturing efficiency, improving quality control, and optimizing design processes. AI algorithms are employed in the design phase to analyze and optimize the structural integrity and performance of the BIW. AI can simulate various stress and impact scenarios, leading to the development of more robust and lightweight body structures. This results in improved vehicle safety, fuel efficiency, and overall performance.

AI-powered vision systems and machine learning algorithms are used in quality control processes to detect defects and ensure that each BIW meets stringent quality standards. Automated inspection systems can identify even the smallest deviations from specifications, reducing the likelihood of defects and improving the overall quality of the finished vehicle.

AI-driven automation and robotics are increasingly used in BIW production lines to enhance manufacturing efficiency. AI systems optimize the placement and movement of robotic arms, streamline assembly processes, and improve the precision of welds and other critical operations. This leads to increased production rates and reduced manufacturing costs.

AI applications in predictive maintenance analyze data from machinery and equipment to forecast potential failures before they occur. This proactive approach minimizes downtime, reduces maintenance costs, and ensures continuous production flow.

AI helps in managing the complex supply chains involved in BIW production. By analyzing data on material availability, demand, and production schedules, AI systems optimize inventory management and logistics, ensuring that materials are available when needed and reducing delays.

In June 2023, the Toyota Research Institute (TRI) launched generative artificial intelligence. This technology will help designer’s for developing components of vehicles.

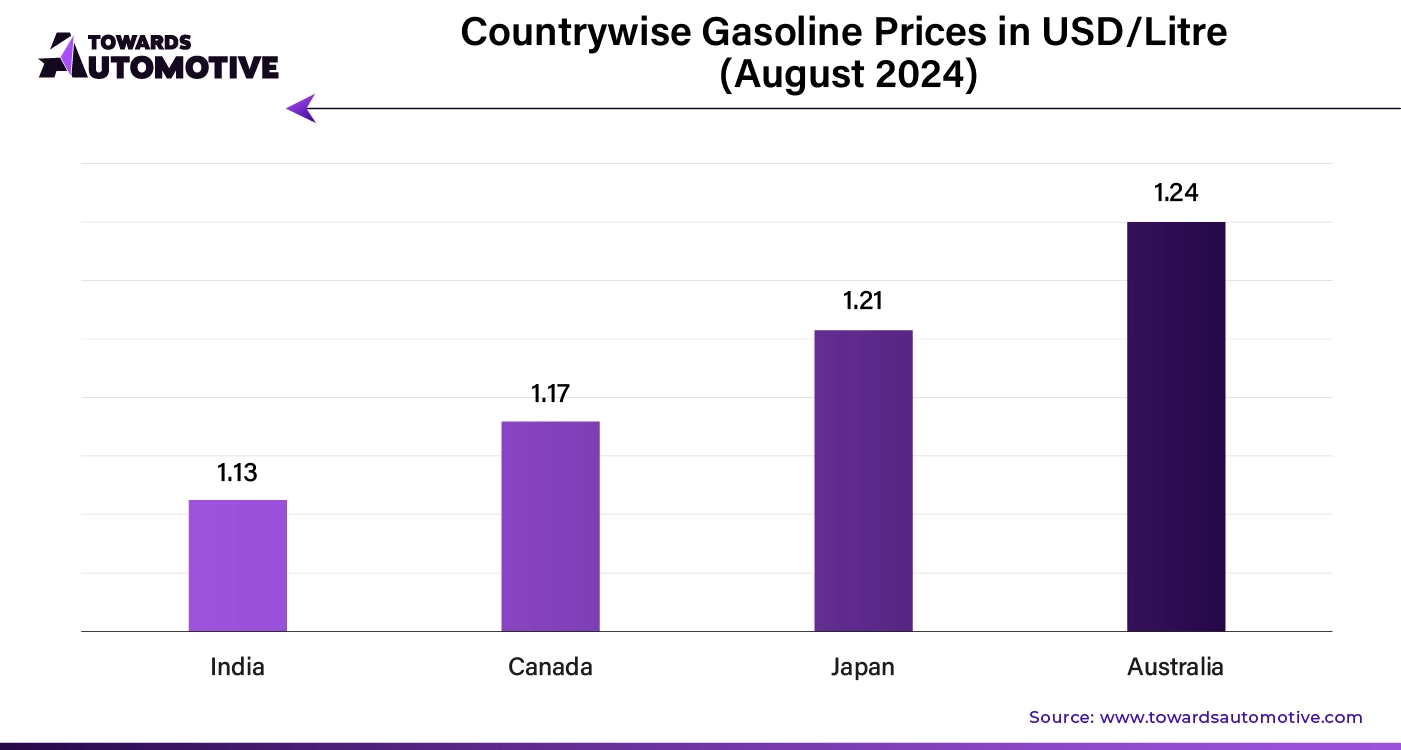

The growing prices of fuel are a significant driver of growth in the automotive body-in-white market as they prompt both consumers and manufacturers to prioritize fuel efficiency and alternative energy solutions. Rising fuel costs create a strong incentive for automakers to develop vehicles that are lighter and more fuel-efficient, which directly impacts BIW design and production. To address these concerns, manufacturers are increasingly investing in advanced materials and innovative design techniques that reduce vehicle weight and improve fuel efficiency.

Lightweight materials such as high-strength steel, aluminum, and composites are being utilized to create more efficient body structures, which help in reducing the overall vehicle weight and enhancing fuel economy. Furthermore, the push for fuel efficiency often leads to a greater emphasis on integrating new technologies and improving aerodynamics, all of which drive demand for advanced BIW solutions. As fuel prices continue to rise, the automotive industry responds by focusing on technologies and materials that support greater fuel economy and reduced emissions.

This shift not only drives innovation in BIW design but also supports market growth as manufacturers seek to align with consumer expectations and regulatory requirements for better fuel efficiency. Thus, the increasing cost of fuel accelerates advancements in BIW technologies, fueling growth in the market.

The automotive body-in-white market faces several restraints that can impact its growth. High production costs associated with advanced materials and manufacturing technologies pose significant challenges for manufacturers, potentially leading to increased vehicle prices. Additionally, the complexity of integrating new technologies and materials can complicate the production process and lead to longer development times. Regulatory compliance and the need to meet stringent safety and environmental standards further add to the complexity and cost. Moreover, fluctuations in raw material prices, such as steel and aluminum, can affect overall production costs and market stability. These factors collectively restrain the growth of the BIW market.

Advancements in 3D printing are creating significant opportunities in the automotive body-in-white market by revolutionizing component manufacturing and design processes. This technology enables the production of complex and intricate BIW components with high precision and reduced lead times. 3D printing facilitates rapid prototyping, allowing designers to quickly test and refine new BIW designs without the need for extensive tooling and molds. This accelerates innovation and shortens development cycles, making it easier for manufacturers to adapt to evolving market demands and regulatory requirements.

Additionally, 3D printing supports the use of advanced materials, such as lightweight composites and metal alloys, which can enhance the performance and efficiency of BIW components. By reducing material waste and enabling on-demand production, 3D printing also contributes to more sustainable manufacturing practices. As the technology continues to advance, its integration into BIW production processes promises increased customization, lower costs, and greater flexibility, ultimately driving growth in the BIW market. The ability to produce high-quality, complex parts on demand aligns with the automotive industry's focus on innovation, efficiency, and sustainability, positioning 3D printing as a key enabler of future developments in BIW technology.

The steel segment held the largest share of the market. The steel segment is a pivotal driver of growth in the automotive body-in-white market due to its critical role in providing structural integrity, safety, and cost-efficiency. Steel remains a fundamental material in BIW construction because of its exceptional strength-to-weight ratio and affordability compared to alternative materials. Advanced high-strength steels (AHSS) and dual-phase steels are increasingly used in BIW applications, offering enhanced crash protection and improved vehicle safety. These advanced steels allow manufacturers to produce lighter vehicle bodies without compromising strength, contributing to better fuel efficiency and lower emissions, which are essential for meeting stringent regulatory standards.

Additionally, the steel segment benefits from established manufacturing processes and supply chains, which ensure consistent quality and availability at competitive prices. The versatility of steel also supports innovative design approaches, including the integration of complex geometries and features that enhance vehicle performance and safety. As the automotive industry continues to prioritize both performance and cost-effectiveness, steel's ongoing advancements and its ability to meet diverse engineering requirements solidify its position as a key growth driver in the BIW market. These factors collectively drive the demand for steel in BIW applications, supporting the expansion and evolution of the automotive industry.

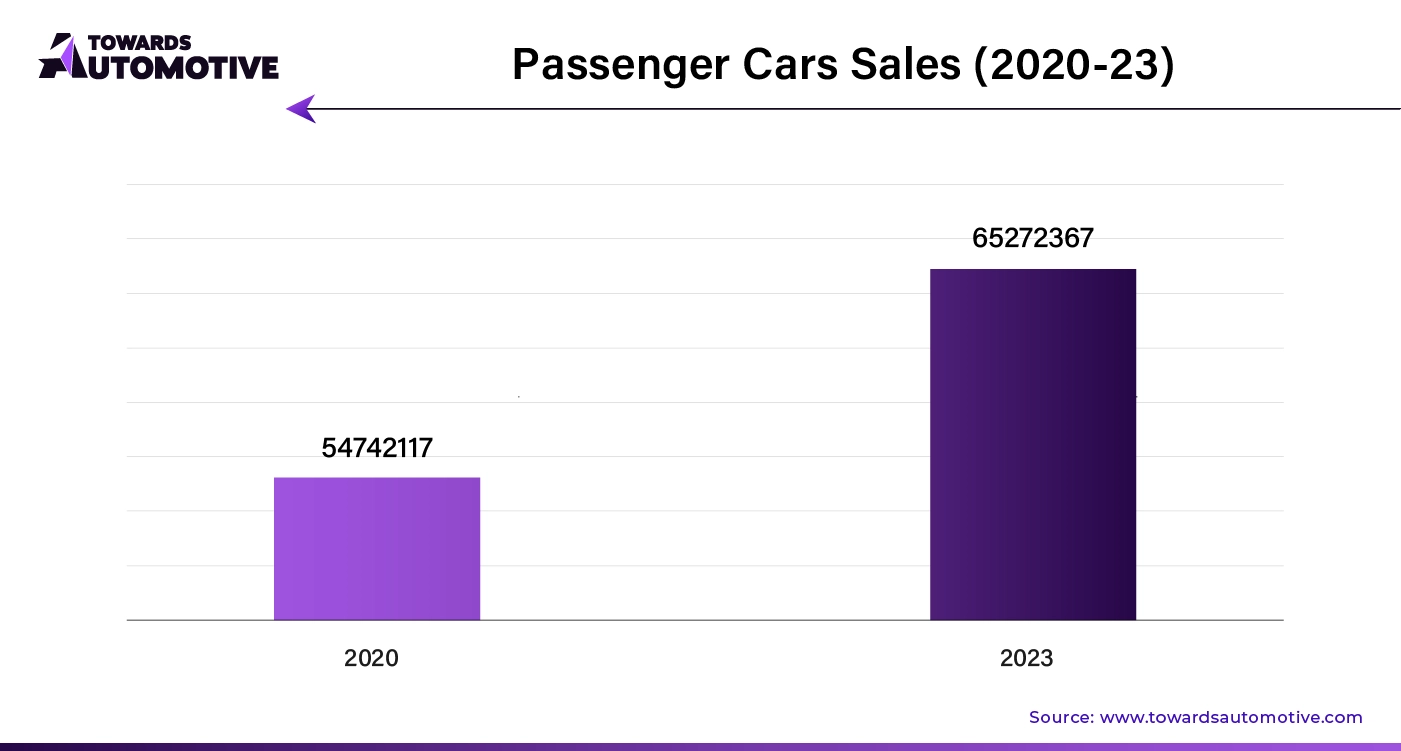

The passenger segment led the market. The passenger car segment is a significant driver of growth in the automotive body-in-white market, primarily due to its substantial share of global vehicle production and the evolving consumer preferences for safety, comfort, and design. As the most common vehicle type on the road, passenger cars generate considerable demand for BIW components, influencing the development of advanced manufacturing technologies and materials. The emphasis on enhancing vehicle safety and performance has led to innovations in BIW designs, such as the use of high-strength materials and sophisticated structural engineering. These advancements aim to meet rigorous safety standards and improve crashworthiness, driving further demand in the passenger car segment.

Additionally, the growing trend towards lightweighting to enhance fuel efficiency and reduce emissions has spurred investments in BIW solutions that utilize advanced materials like aluminum and composite materials. As consumers increasingly seek vehicles with enhanced features and design aesthetics, automakers are focusing on producing more sophisticated and appealing passenger cars, which drives the need for innovative BIW solutions. The passenger car segment’s dominant role in vehicle production, coupled with evolving safety and design requirements, ensures its continued influence on the growth and advancement of the automotive BIW market.

The electric-powered segment is likely to grow with the fastest growth rate during the forecast period. The electric-powered segment is a significant growth driver in the automotive body-in-white market due to the distinct requirements and innovations associated with electric vehicles (EVs). As the automotive industry shifts towards electrification, EVs necessitate specialized BIW designs to accommodate electric drivetrains and large battery packs, which differ from traditional internal combustion engine (ICE) vehicles. These design changes often involve integrating lightweight materials and advanced structural components to optimize performance, safety, and energy efficiency. The need for robust yet lightweight body structures is crucial for enhancing the range and efficiency of electric vehicles, thus driving demand for innovative BIW solutions.

Additionally, the transition to electric-powered vehicles encourages advancements in material science and manufacturing technologies, as automakers seek to develop more efficient and cost-effective production methods. The increasing focus on sustainability and reducing emissions further accelerates the adoption of electric vehicles, creating a burgeoning market for BIW components tailored to these new vehicle types. The electric-powered segment’s unique requirements and the growing trend toward electrification ensure that it remains a key factor in shaping the future of the automotive BIW market, driving both technological advancements and market expansion.

Asia Pacific dominated the automotive body-in-white market. The automotive body-in-white market in Asia-Pacific is experiencing robust growth due to several key drivers, including the rising production of electric vehicles (EVs), increased automotive manufacturing, and technological advancements. The shift towards EVs is significantly impacting the BIW market as manufacturers invest in specialized body structures to accommodate electric drivetrains and battery packs. These new design requirements necessitate innovative BIW solutions that enhance vehicle performance and safety. Additionally, the surge in automotive production across the region, fueled by strong demand and expanding economies, boosts the need for efficient and high-quality BIW components.

The region's burgeoning automotive industry, with its extensive manufacturing base, drives up production volumes and creates demand for advanced body structures. Technological advancements in manufacturing processes, such as automation, robotics, and AI, are further accelerating market growth. These technologies enhance production efficiency, precision, and material handling, allowing for more complex and lightweight BIW designs. As a result, the integration of these advanced technologies supports the production of more robust and fuel-efficient vehicles, meeting both consumer and regulatory demands. Together, these factors contribute to a dynamic and rapidly evolving BIW market in Asia-Pacific, positioning the region as a critical player in the global automotive industry.

Europe is expected to grow with the highest CAGR during the forecast period. The growth of the automotive body-in-white market in Europe is significantly driven by the region’s strong automotive manufacturing base, rising consumer demand for premium vehicles, and the presence of leading automotive companies. Europe is home to a well-established and extensive automotive production network, with numerous major manufacturers and suppliers contributing to a robust BIW market. This solid manufacturing foundation supports high production volumes and facilitates the development of advanced BIW solutions. Additionally, the increasing demand for premium and luxury vehicles in Europe fuels the need for sophisticated BIW components.

These high-end vehicles often require advanced materials and intricate designs, driving innovation and growth in the BIW sector. The presence of top automotive companies in Europe further amplifies this growth. These industry leaders are at the forefront of automotive technology and design, pushing the envelope in BIW development to meet stringent safety, performance, and efficiency standards. Their ongoing investments in research and development, coupled with a focus on integrating cutting-edge technologies, enhance the capabilities and offerings of BIW solutions. Together, these factors create a dynamic environment for the automotive BIW market, driving advancements and expanding opportunities within the European automotive industry.

By Material

By Manufacturing Process

By Structure

By Vehicle Type

By Propulsion Type

By Region

October 2025

October 2025

October 2025

October 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us