April 2025

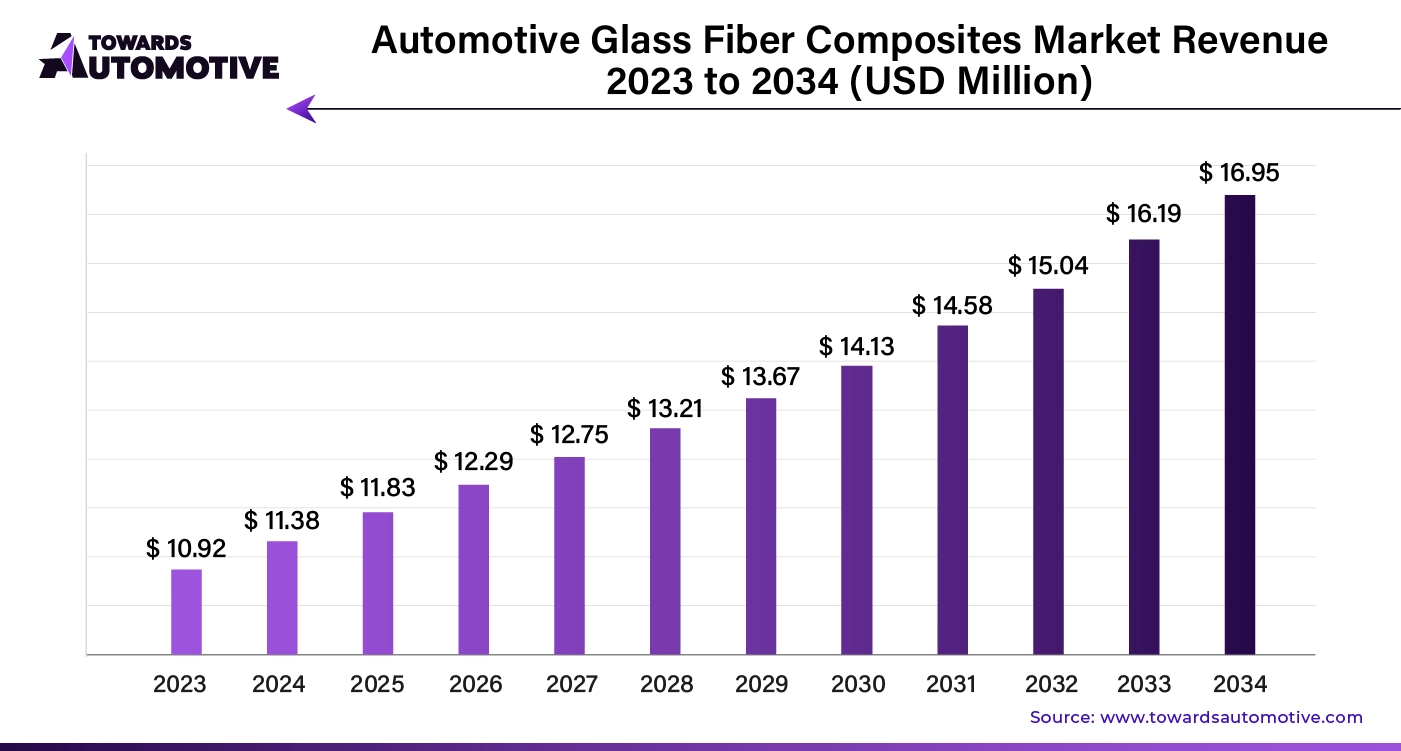

The global automotive glass fiber composites market is anticipated to grow from USD 11.83 billion in 2025 to USD 16.95 billion by 2034, with a compound annual growth rate (CAGR) of 4.65% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Key Takeaways

The automotive glass fiber composites market is experiencing notable growth due to the increasing demand for lightweight, high-strength materials that enhance vehicle performance and fuel efficiency. Glass fiber composites, known for their excellent mechanical properties and corrosion resistance, are increasingly being utilized in various automotive applications, including body panels, interior components, and structural reinforcements. As automakers strive to meet stringent emission regulations and improve overall fuel economy, the adoption of lightweight materials like glass fiber composites becomes essential.

Moreover, advancements in manufacturing technologies, such as automated processes and innovative molding techniques, are making it easier and more cost-effective to produce glass fiber composite components. This has led to greater acceptance of these materials within the automotive industry, as manufacturers seek to enhance the durability and aesthetics of their vehicles while reducing weight.

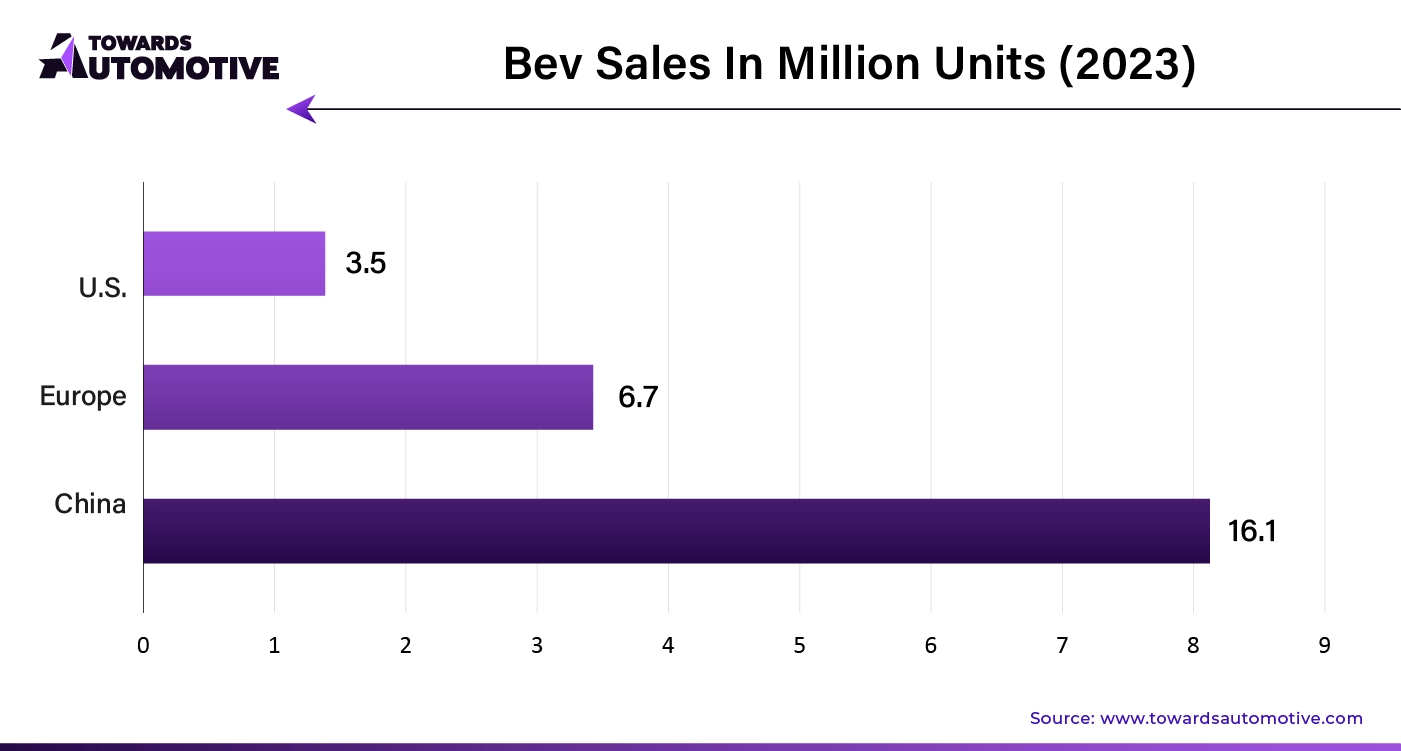

Additionally, the rising trend towards electric vehicles (EVs) is further driving demand for glass fiber composites, as manufacturers aim to optimize battery performance by minimizing overall vehicle weight. With increasing investments in research and development, the automotive glass fiber composites market is positioned for continued expansion, driven by the ongoing shift towards sustainable, high-performance automotive solutions that meet both consumer expectations and regulatory requirements.

Artificial Intelligence (AI) plays a transformative role in the automotive glass fiber composites market by enhancing production processes, improving material properties, and optimizing design efficiency. AI algorithms can analyze vast amounts of data related to material performance, manufacturing processes, and environmental factors. This predictive capability helps manufacturers anticipate potential issues in production and product performance, enabling proactive measures to enhance quality and reduce waste.

AI-driven tools facilitate the design of glass fiber composite components by simulating and modeling different configurations and materials. These tools allow engineers to identify the most effective designs that balance strength, weight, and cost, resulting in more efficient product development cycles.

AI systems equipped with machine learning can monitor production processes in real-time, identifying defects and inconsistencies in composite materials. By utilizing computer vision and sensor data, manufacturers can ensure high-quality standards, leading to improved performance and durability of automotive components.

AI can enhance supply chain efficiency by predicting demand fluctuations and optimizing inventory levels. This is particularly important in the automotive industry, where timely access to materials is critical for maintaining production schedules. AI technologies enable manufacturers to offer more customized solutions by analyzing consumer preferences and market trends. This adaptability allows for the creation of tailored glass fiber composite components that meet specific performance or aesthetic requirements.

AI can also help to identify and implement sustainable practices in the production of glass fiber composites, such as optimizing resource use, minimizing waste, and improving recycling processes. This focus on sustainability aligns with the automotive industry's broader goals of reducing environmental impact.

The growing demand for electric vehicles (EVs) is a significant driver of the automotive glass fiber composites market, as manufacturers seek to enhance vehicle performance, reduce weight, and improve energy efficiency. Glass fiber composites offer a compelling solution to the challenges faced in EV design, primarily due to their lightweight and high-strength properties. By replacing traditional materials like steel and aluminum with glass fiber composites, manufacturers can significantly reduce the overall weight of EVs, which directly contributes to improved battery performance and extended driving range.

As consumers increasingly prioritize sustainability and eco-friendliness in their vehicle choices, the automotive industry is responding by adopting advanced materials that align with these values. Glass fiber composites are not only lightweight but also offer durability and resistance to corrosion, making them ideal for various automotive applications, including body panels, structural components, and interior parts.

Furthermore, the shift towards electric vehicles has spurred investments in research and development to innovate and optimize glass fiber composite materials and manufacturing processes. As the EV market continues to expand, the demand for glass fiber composites is expected to rise, positioning them as a vital component in the evolution of modern electric vehicle design and production.

The automotive glass fiber composites market faces several restraints that may hinder its growth. High production costs associated with advanced manufacturing processes can limit widespread adoption among manufacturers, particularly smaller companies with constrained budgets. Additionally, the complexity of integrating glass fiber composites into existing automotive designs poses challenges in terms of compatibility and performance. Concerns regarding recyclability and environmental impact may also deter some manufacturers, as the automotive industry increasingly shifts towards sustainable materials. Finally, competition from alternative materials, such as carbon fiber and traditional metals, can create further challenges for the glass fiber composites market in the automotive sector.

The emergence of hybrid composites presents significant opportunities in the automotive glass fiber composites market by combining the advantageous properties of different materials to create lightweight, high-performance solutions. Hybrid composites, which typically integrate glass fibers with carbon fibers or thermoplastics, leverage the strengths of each material, resulting in improved mechanical properties, such as enhanced strength, stiffness, and durability. This combination allows manufacturers to produce components that meet the increasing demands for fuel efficiency and performance in modern vehicles.

As automakers strive to reduce vehicle weight and enhance overall efficiency, the demand for hybrid composites is expected to grow. These materials can be utilized in various automotive applications, including structural components, body panels, and interior elements, offering versatility and design flexibility. Moreover, hybrid composites can be tailored to meet specific performance requirements, making them suitable for both conventional and electric vehicles.

Additionally, advancements in manufacturing processes, such as automated fiber placement and resin transfer molding, are facilitating the production of hybrid composites at scale, reducing costs and improving accessibility for automotive manufacturers. As the industry shifts towards more sustainable and efficient solutions, hybrid composites are poised to play a crucial role in the future of automotive design, enabling innovation and enhancing vehicle performance while addressing environmental concerns.

The exterior segment held the largest share of the market. The exterior segment of the automotive industry plays a pivotal role in driving the growth of the automotive glass fiber composites market due to the increasing demand for lightweight, durable, and aesthetically appealing vehicle components. Glass fiber composites are increasingly being utilized in exterior applications, such as body panels, bumpers, and fenders, thanks to their superior strength-to-weight ratio and resistance to corrosion and environmental stress. These materials help manufacturers reduce the overall weight of vehicles, leading to enhanced fuel efficiency and improved performance, which are critical factors in today’s automotive market.

Additionally, the versatility of glass fiber composites allows for intricate designs and finishes, enabling automakers to meet consumer preferences for sleek and modern aesthetics. The ability to mold these composites into complex shapes without compromising structural integrity provides design flexibility that traditional materials often lack.

As automakers continue to prioritize sustainability and regulatory compliance, the exterior segment's shift toward glass fiber composites further enhances their appeal. With growing consumer awareness about the environmental impact of vehicles, manufacturers are increasingly incorporating these composites into their designs to align with eco-friendly practices. This convergence of design, performance, and sustainability drives the growth of the automotive glass fiber composites market in the exterior segment, making it a critical area of focus for the industry.

The e-glass segment held a dominant share of the market. The e-glass segment significantly drives the growth of the automotive glass fiber composites market due to its unique properties and versatile applications in vehicle manufacturing. E-glass, or electrical glass, is known for its excellent electrical insulation, mechanical strength, and lightweight characteristics, making it an ideal choice for various automotive components. Its integration into glass fiber composites enhances the durability and performance of parts such as body panels, structural elements, and insulation materials. As the automotive industry increasingly focuses on reducing weight and improving fuel efficiency, e-glass composites offer a compelling solution to meet these demands.

Moreover, the e-glass segment supports the growing trend toward electric vehicles (EVs), where weight reduction is crucial for maximizing battery efficiency and extending driving range. The exceptional thermal and chemical resistance of e-glass composites also aligns well with the requirements of modern automotive applications, where exposure to various environmental conditions is common.

Furthermore, advancements in manufacturing techniques and increased availability of e-glass materials have contributed to their wider adoption in the automotive sector. As manufacturers continue to prioritize performance, safety, and sustainability, the e-glass segment is poised to play a vital role in the ongoing evolution of automotive glass fiber composites, driving market growth and innovation in vehicle design.

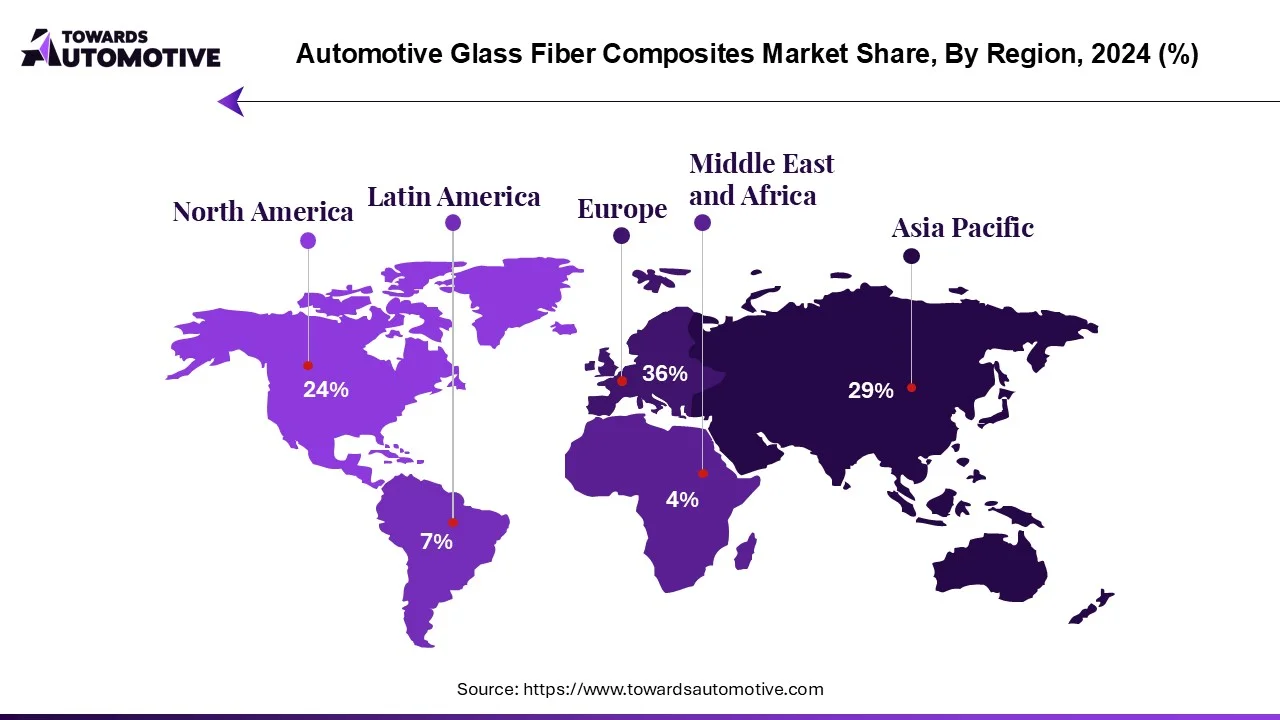

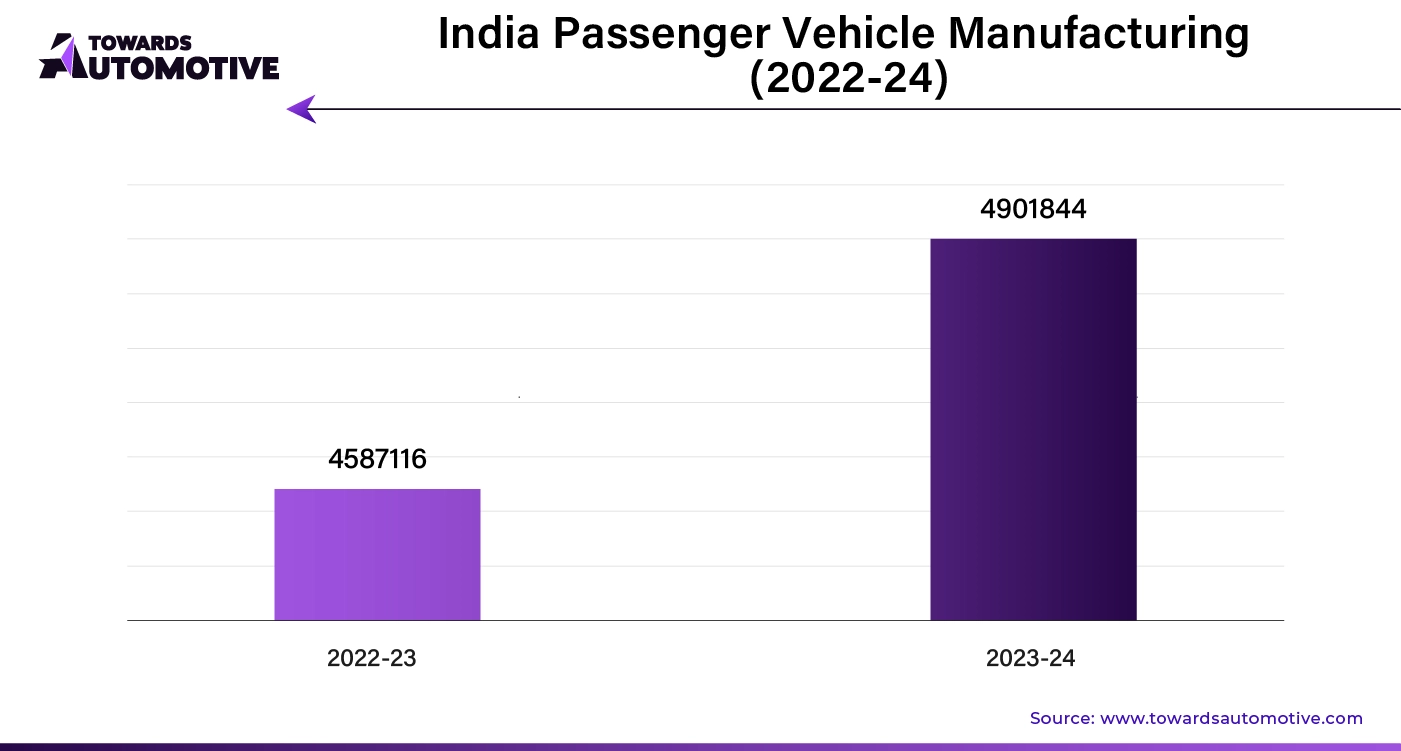

Asia Pacific dominated the automotive glass fiber composites market. Rising vehicle production, shifting consumer preferences, and increased investment in research and development (R&D) are pivotal drivers of the automotive glass fiber composites market in Asia Pacific. The region's robust automotive manufacturing sector, led by countries like China, Japan, and South Korea, has seen a consistent increase in vehicle production to meet the burgeoning demand for personal and commercial transportation. This growth necessitates the use of lightweight materials like glass fiber composites, which enhance fuel efficiency and overall vehicle performance.

Simultaneously, consumer preferences are evolving towards more sustainable and eco-friendly vehicles, prompting manufacturers to seek materials that not only reduce weight but also align with environmental goals. Glass fiber composites, known for their durability and recyclability, fit this bill, appealing to environmentally conscious consumers.

Moreover, significant investments in R&D are driving innovation in the development of advanced glass fiber composite materials, leading to improvements in their mechanical properties and manufacturing processes. These advancements make composites more accessible and cost-effective for automotive applications, further fueling their adoption in the industry. Together, these factors contribute to a dynamic landscape in the automotive glass fiber composites market, positioning it for substantial growth in the Asia Pacific region.

North America is expected to grow with a significant CAGR during the forecast period. Sustainability initiatives, urbanization, and technological advancements are key factors driving the growth of the automotive glass fiber composites market in North America. As environmental concerns become increasingly pressing, automotive manufacturers are prioritizing sustainability by adopting materials that reduce their ecological footprint. Glass fiber composites align perfectly with these initiatives, offering lightweight and recyclable options that help improve fuel efficiency and lower emissions. The automotive sector is actively seeking to replace traditional materials with composites that not only meet performance standards but also contribute to greener manufacturing processes.

Simultaneously, rapid urbanization in North America is fueling the demand for new vehicles, necessitating innovations in design and materials. As cities expand and populations grow, there is an increased need for efficient, high-performing vehicles that can navigate urban environments while minimizing their impact on resources.

Technological advancements in manufacturing processes, such as automated fiber placement and improved resin formulations, have further enhanced the properties of glass fiber composites, making them more accessible and cost-effective for automotive applications. These innovations allow for the production of lighter, stronger components that meet the demands of modern vehicle design. Together, these elements foster a conducive environment for the automotive glass fiber composites market, driving its expansion and integration into future vehicle designs.

By Product

By Application

By Vehicle Type

By Region

April 2025

April 2025

April 2025

April 2025

Dr. Arjun Patel is a distinguished expert in the automotive industry, holding advanced degrees in Automotive Engineering and Mechanical Engineering. His expertise spans automotive market dynamics, technological advancements, and sustainable practices. Dr. Patel excels in conducting in depth research and analysis on market trends, consumer preferences, and the economic implications within the automotive sector. He is renowned for his insightful publications on topics such as electric vehicles, autonomous driving technologies, and the evolution of sustainable transportation solutions. Dr. Patels research contributions have significantly advanced understanding in the field, earning him recognition as a leading authority in automotive research and analysis.

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us