April 2025

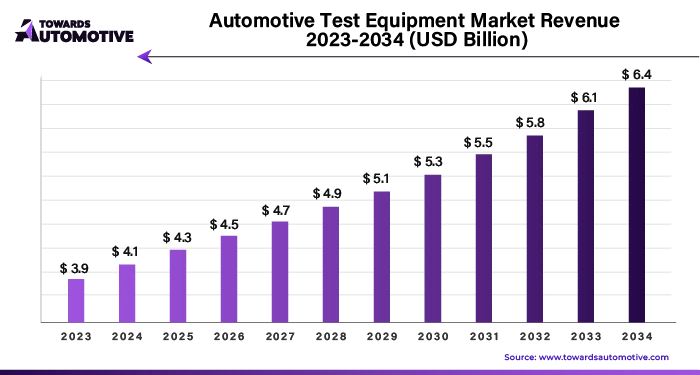

The automotive test equipment market is forecast to grow at a CAGR of 4.8%, from USD 4.3 billion in 2025 to USD 6.4 billion by 2034, over the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

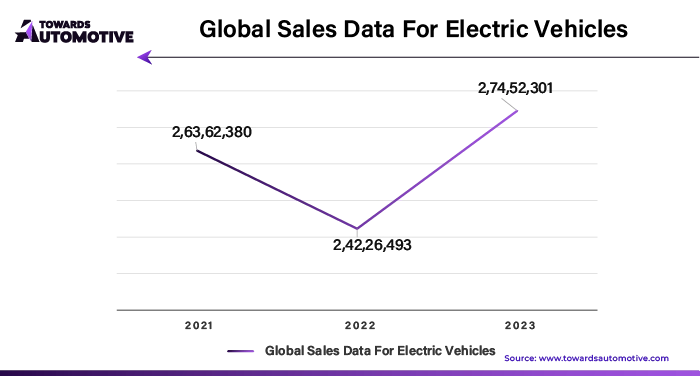

As the automotive industry rapidly evolves with the rise of electric vehicles (EVs) and autonomous driving technologies, there is a growing need for advanced testing equipment. This equipment is crucial for evaluating the performance, efficiency, and safety of a wide range of vehicle components. The development of sophisticated testing solutions is essential to meet the unique challenges posed by these new technologies. The automotive market valued at USD 4,070.19 billion in 2023, is experiencing growth and is projected to surpass USD 6,678.28 billion by 2032, with a significant CAGR of over 5.66%.

The increasing adoption of electric vehicles has led to a surge in demand for specialized testing equipment. This equipment is designed to assess critical components such as batteries, motors, and power electronics. Key areas of focus include:

The development of autonomous vehicles requires highly sophisticated testing equipment to simulate a wide range of driving scenarios. This includes:

The integration of Internet of Things (IoT) connectivity and artificial intelligence (AI) is transforming automotive testing processes. Key developments include:

Safety remains a top priority in automotive testing. This includes:

Automotive manufacturers are increasingly adopting modular and flexible testing solutions. These solutions offer:

The integration of Artificial Intelligence (AI) into the automotive test equipment market is poised to revolutionize the industry by enhancing efficiency, accuracy, and innovation. AI-driven systems can automate complex testing procedures, reducing the time and human error associated with manual processes. This leads to faster development cycles and improved product quality, which are crucial in a highly competitive automotive market.

AI can analyze vast amounts of data from test results to identify patterns and predict potential issues before they occur, enabling proactive maintenance and minimizing costly recalls. The use of AI also allows for more sophisticated simulations and modeling, providing insights that were previously unattainable. As automotive technology continues to evolve, particularly with the rise of electric and autonomous vehicles, the demand for advanced test equipment that can keep pace with these innovations is expected to grow.

AI integration will not only enhance the capabilities of test equipment but also drive market growth by meeting the increasing need for precision and speed in automotive testing processes.

In the automotive test equipment market, the supply chain is a crucial component that ensures the efficient delivery of high-quality products to end users. The supply chain begins with raw material suppliers, who provide essential components such as electronics, sensors, and mechanical parts. These materials are then passed to manufacturers who design and assemble automotive test equipment like dynamometers, emission testing systems, and diagnostic tools.

Once the equipment is produced, it is typically distributed to wholesalers or directly to end-users, which include automotive manufacturers, repair shops, and testing facilities. Distribution channels may also involve logistics providers who manage the transportation, storage, and timely delivery of these products.

To maintain a seamless supply chain, companies often rely on robust demand forecasting and inventory management practices to prevent bottlenecks or shortages. Additionally, collaboration with reliable suppliers and technology partners is essential for meeting industry standards and ensuring the timely rollout of advanced test equipment. As the market evolves with innovations in automotive technology, the supply chain must remain agile, adapting to new demands while minimizing costs and maintaining product quality.

The automotive test equipment market is a critical segment of the automotive industry, comprising various specialized tools and systems designed to ensure vehicle performance, safety, and compliance with regulatory standards. Key components of this market include engine dynamometers, chassis dynamometers, vehicle emission test systems, and tire testing equipment, among others. These components are essential for assessing the mechanical and electronic functionality of vehicles, ensuring they meet required safety and environmental standards.

Various companies contribute to the ecosystem by offering innovative solutions that cater to different aspects of vehicle testing. Major automotive manufacturers often collaborate with specialized test equipment providers to develop custom solutions tailored to specific vehicle models. Companies like Bosch, ABB, and Horiba are prominent players, offering advanced testing systems that incorporate cutting-edge technologies such as AI and IoT for real-time data analysis and diagnostics.

Additionally, software providers enhance the functionality of testing equipment by integrating sophisticated data management and analysis tools, ensuring comprehensive evaluation and reporting. Together, these contributors create a dynamic ecosystem that supports the continuous advancement of automotive technology and ensures the production of safe, reliable vehicles.

Growing Environmental Testing Demands: As environmental concerns mount, there is an increasing need for automotive test equipment that evaluates the environmental impact of vehicles. This includes equipment for emissions testing to ensure compliance with regulatory standards and environmental performance testing to assess the sustainability of vehicle components. The push for greener technologies and stricter environmental regulations is driving the demand for advanced testing solutions that can accurately measure and report environmental impacts.

Integration of Industry 4.0 Enhances Automotive Testing: The automotive sector is rapidly adopting Industry 4.0 principles, which integrate automation, data exchange, and smart technologies into testing processes. This includes the use of digital twins, which create virtual models of physical systems for real-time monitoring and analysis, predictive analytics for anticipating potential issues before they arise, and cloud-based testing platforms that offer flexibility and scalability. These advancements are aimed at boosting efficiency, productivity, and the overall effectiveness of testing procedures.

Emphasis on Cost-Effectiveness and Efficiency Drives Innovation: Automotive manufacturers are increasingly focused on finding cost-effective and efficient testing solutions that can reduce both time-to-market and overall testing expenses. This trend has led to the development of innovative testing methodologies and technologies designed to streamline the testing process without sacrificing quality. Solutions that enhance efficiency and lower costs are highly sought after as manufacturers strive to remain competitive in a rapidly evolving market.

High Initial Investment Challenges: A significant challenge in the automotive test equipment market is the high initial investment required for acquiring advanced testing technologies, particularly for specialized applications such as electric vehicle (EV) components or autonomous vehicle systems. This substantial cost can be a barrier for smaller automotive companies or those operating in emerging markets, limiting their ability to invest in the latest testing equipment.

Compliance with Stringent Testing Standards: The automotive industry is subject to stringent testing standards and regulations that vary across different regions. Ensuring compliance with these standards requires sophisticated testing equipment and specialized expertise. This complexity and the associated costs add an additional layer of challenge to the testing process, as manufacturers must navigate diverse regulatory environments and maintain high standards of quality and safety.

The United States stands as a dominant force in the global automotive industry, characterized by a robust presence of major manufacturers, suppliers, and advanced testing facilities. This prominence is supported by several key factors:

India is expected to grow at fastest rate over the forecast period as India’s robust economic growth has risen disposable income and increased the purchasing power of automobile. India is currently experiencing growth in the middle class population which is significant consumer base for automobile, contributing to growth in vehicle ownership. There is rapid technology advancement in India with innovation and launch of the hybrid and electric vehicles, with improved manufacturing processes id driving the growth of the automotive test equipment market in the India.

The key players operating in the India market focused on adopting inorganic growth strategies like collaboration to develop automotive software solutions for testing vehicles which is estimated to drive the growth of the automotive test equipment market over the forecast period.

For instance,

China is spearheading the global transition to electric and new energy vehicles (NEVs), driven by government policies and substantial investments in EV technology and infrastructure:

The automotive industry in the United Kingdom is at the forefront of technological innovation, with significant developments in automotive testing equipment:

Engine dynamometers play a crucial role in the automotive industry, offering engineers a sophisticated means to measure and optimize engine performance. These devices are indispensable for a range of applications including performance tuning, durability testing, emissions testing, and the development of engine control systems.

Engine dynamometers are used to evaluate several key parameters of engine performance, such as power output, fuel efficiency, and reliability under different conditions. They enable engineers to:

The engine dynamometer market is expected to grow significantly through 2034, driven by several trends and advancements:

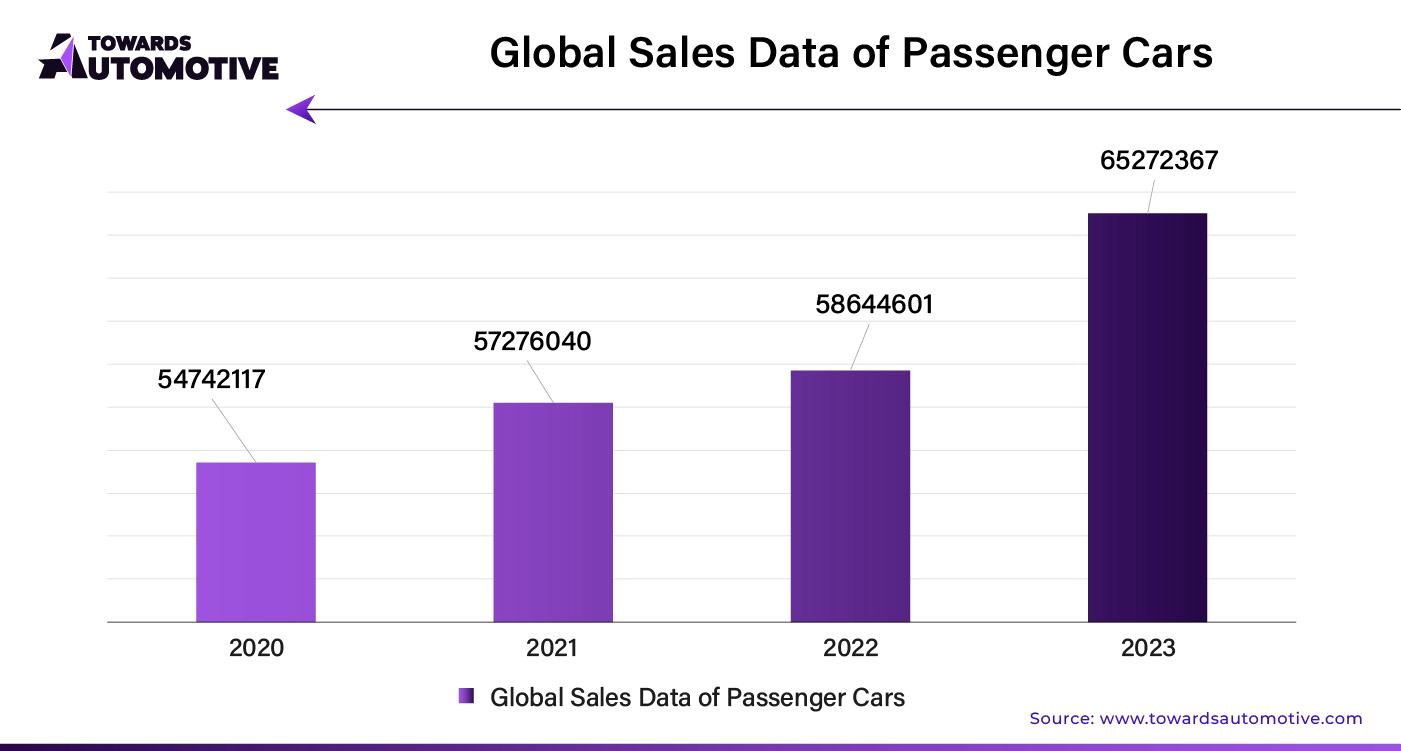

In the passenger car segment, the demand for automotive test equipment is driven by the need for high performance and reliability. Key factors include:

Furthermore, increase in sales of passenger vehicle has risen the demand for the automotive test equipment which is estimated to drive the growth of the segment over the forecast period.

For instance,

Key players in the market are making substantial investments in research and development to drive innovation and improve performance. Their focus is on developing advanced technologies with better tolerance and efficiency across various applications. This includes enhancing equipment materials, refining design techniques, and optimizing manufacturing processes.

To stay ahead of the competition, these companies are forming strategic partnerships with start-ups and technology providers. These collaborations enable them to explore new markets, share expertise, and co-develop innovative solutions. By prioritizing regulatory compliance and obtaining necessary certifications, they ensure their products meet industry standards for reliability and durability.

Additionally, companies are placing a strong emphasis on customer support. They offer tailored solutions, comprehensive training, and technical assistance to address specific customer needs effectively. By staying at the forefront of technological advancements and engaging in strategic partnerships with research institutions and technology providers, these companies foster knowledge sharing, access to new markets, and joint research initiatives. This approach helps them develop competitive products that cater to the evolving needs of various applications.

By continuously innovating and adapting to market demands, key players are positioning themselves as leaders in their respective fields, driving progress and shaping the future of technology and industry standards.

By Product Type

By Vehicle Type

By Technology

By Application

By Region

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us