April 2025

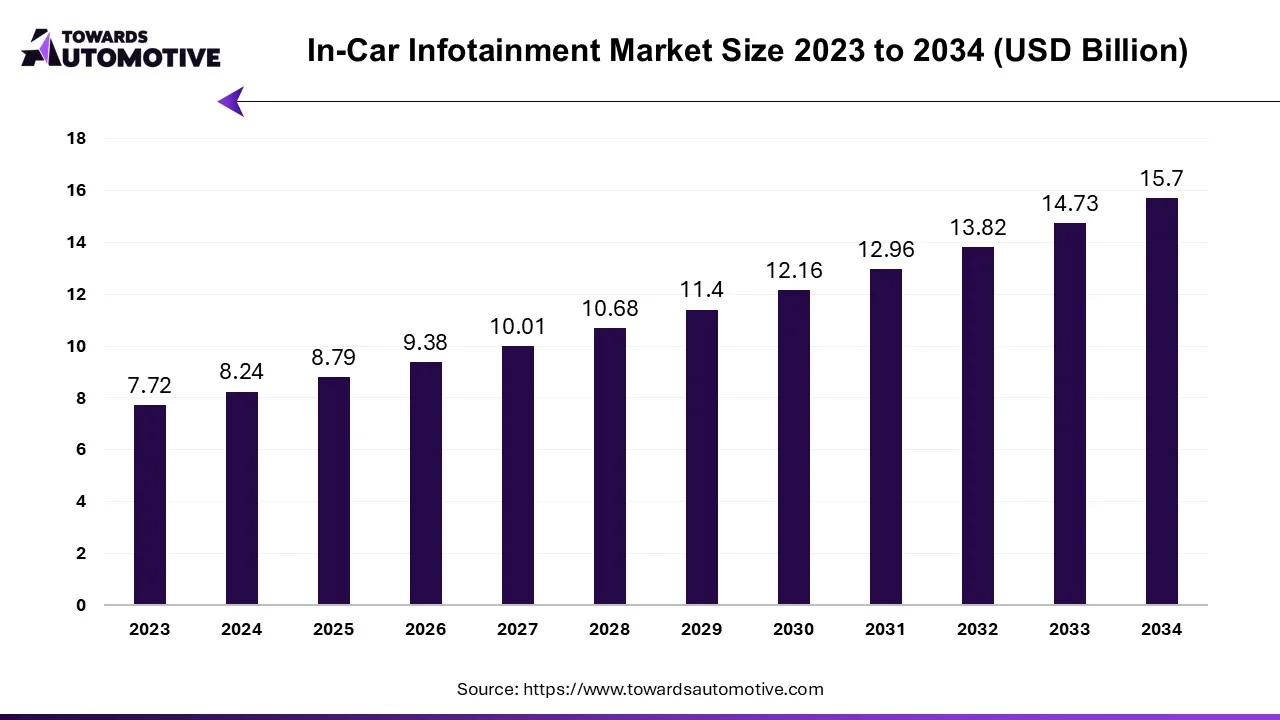

The in-car infotainment market size is expected to grow from USD 8.79 billion in 2025 to USD 15.7 billion by 2034, with a CAGR of 6.74% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

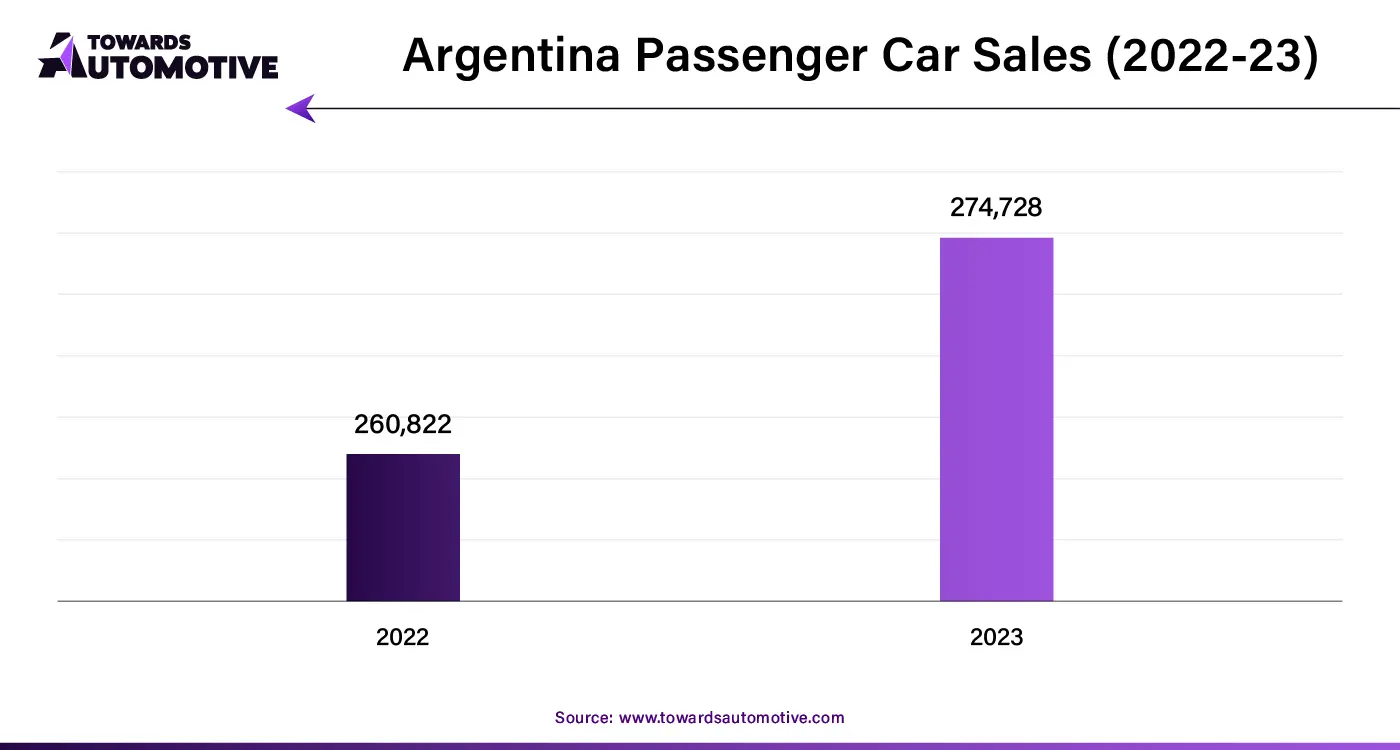

The in-car infotainment market is a crucial segment of the automotive industry. This industry deals in manufacturing and distribution of infotainment systems for automotive sector. The in-car infotainment system is a digital system that provides entertainment and information of any vehicles. There are numerous components of the infotainment systems consisting of hardware and software. The application of these systems includes navigation, media, communication, payment services, telematics and some others. These systems are available in a distribution channel consisting of OEM and aftermarket. The growing sales of passenger cars in different parts of the world has contributed to the industrial expansion. This market is projected to rise significantly with the growth of the automotive aftermarket sector.

In July 2023, Arvin Baalu, the Chief Product Officer of Pioneer Corporation announced that, “"It is a definitive part of our strategy to offer Android-based infotainment systems to OEMs, particularly in India. We will offer Google-certified Android products in the entry-, mid- and premium categories of infotainment devices, it is going to be one of the key focus areas for the Indian R&D team to build these next-generation Android infotainment systems, and that is why we recognize India as a forward-looking technology hub and not just an offshore development center".

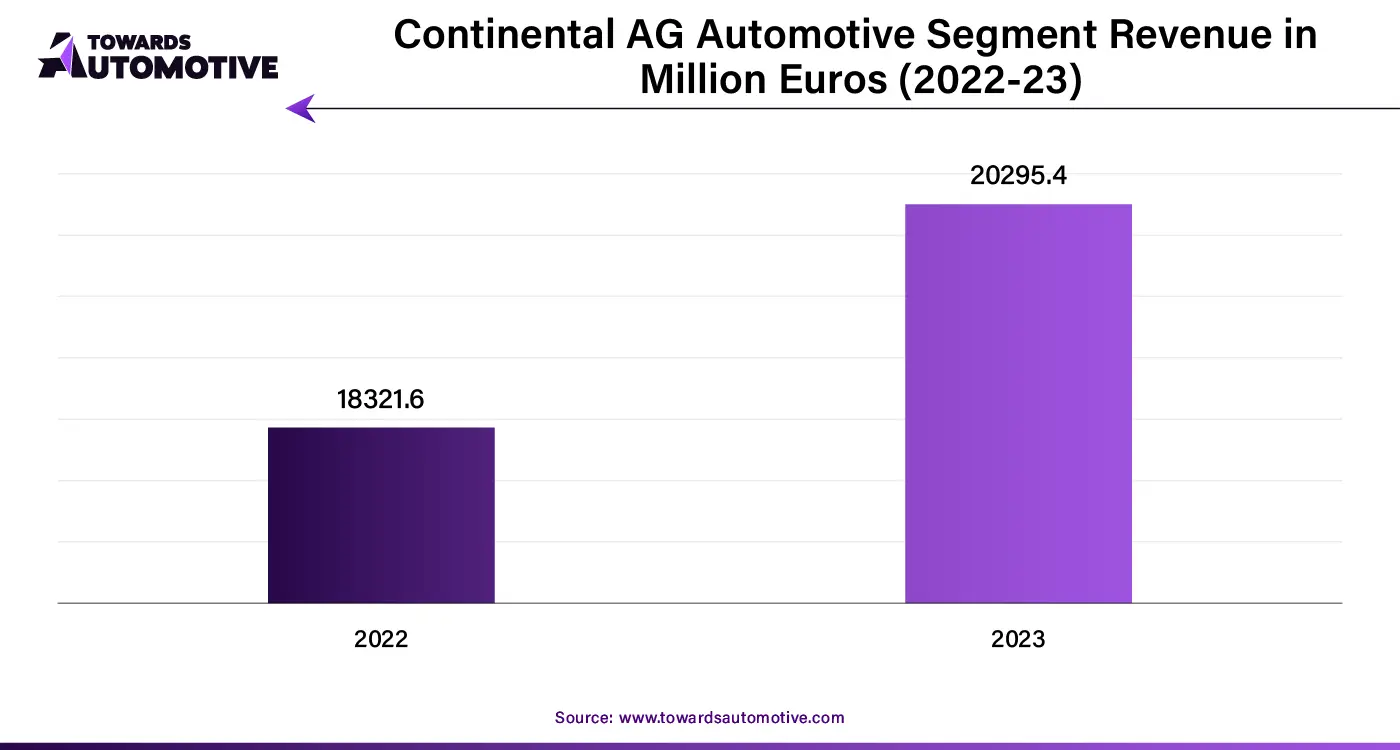

The in-car infotainment market is a fragmented industry with the presence of numerous dominant players. Some of the prominent market players in this industry consists of Denso Corporation, Ford Motors, BMW, Delphi Automotive, Continental AG, Volkswagen Group, Harman International and some others. These market players are constantly engaged in developing advanced in-car infotainment systems and adopting several strategies to maintain their dominant position in the market.

By Components

By Vehicle Type

By Installation

By Regional

April 2025

April 2025

April 2025

April 2025

We offer automotive expertise for market projections and customizable research, adaptable to diverse strategic approaches.

Contact Us